Trading the SPAC Crash

Special purpose acquisition companies (SPACs) enjoyed a revival during 2020 and 2021, but shares in these “blank check” companies have come back to earth recently, with many SPACs now down 50% or more from their highs.

During 2020 and 2021, a pandemic-induced trading frenzy sparked interest in the emerging meme stock and special purpose acquisition company, or SPAC, niches of the financial markets.

But a bout of intense market volatility during the first month of trading in 2022 has laid bare the outsized degree of risk that is often associated with “fast money” corners of the stock market.

For example, the 58% drop in GameStop (GME) since late November 2021 provides a fairly clear indication of current sentiment in the meme stock niche. And the 67% drop in AMC Entertainment (AMC) over that same period only serves to underscore that negativity.

The correction in the SPAC sector has been equally riveting.

Since February of last year, the CNBC SPAC Post Deal Index (.spacpost) is down more than 62% (highlighted below). This index is comprised of so-called “blank check” companies that have already completed a merger with a “target company.”

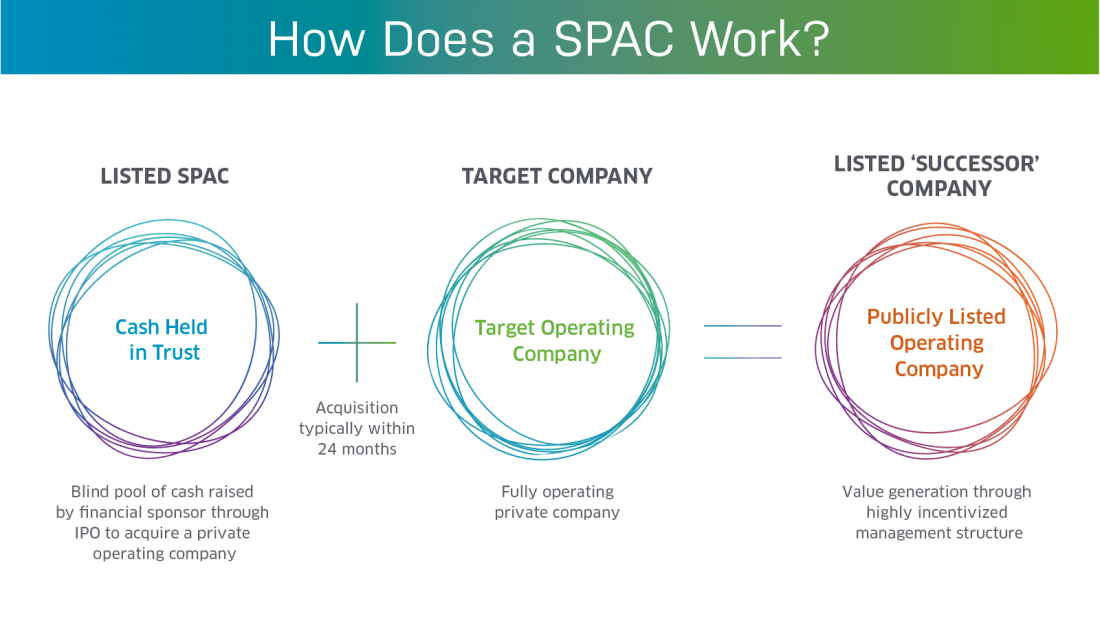

As a reminder, SPACs actually live up fairly well to their names—the “special purpose” part of the acronym refers to the fact that SPACs are shell companies created with the intent of merging with, or acquiring, another company.

SPACs therefore represent a non-traditional method of raising capital because the funding comes first and the business idea comes second. That’s counterintuitive to the traditional IPO approach, which involves growing a successful business, and using that momentum to attract new investors—eventually through an initial public offering (IPO).

Seemingly putting the cart before the horse, SPAC founders (referred to as sponsors) pull together a group of investors that agree, according to the U.S. Securities and Exchange Commission definition, “to pool funds in order to finance a merger or acquisition opportunity within a set timeframe.”

The ultimate success of a SPAC often resides in the reputation of the sponsors and their ability to generate interest in the entity. SPACs are frequently founded by subject matter experts (SMEs) that possess key experience in a business field that in all likelihood will be the focus in a future acquisition or merger.

Source: Nasdaq

SPAC Landscape Then and Now

SPAC mania kicked off in earnest during 2020—likely as a result of all the extra liquidity sloshing around in the U.S. financial system due to the government’s aggressive response to the COVID-19 pandemic.

From 2019 to 2020, the total number of new SPAC listings in the U.S. financial markets grew by more than 300%. The year 2020 actually set records in terms of the number of new SPAC deals and total capital involved—248 and $80 billion, respectively.

Unbelievably, SPAC deal-making was even more frenzied in 2021. Last year, it’s estimated that 613 new SPACs went public, representing over $160 billion in capital—basically doubling up on 2020 records.

That said, hindsight may ultimately prove that SPAC mania peaked last fall when Digital World Acquisition Corp. (DWAC) merged with a digital media company affiliated with former U.S. President Donald Trump.

Last October, former President Trump announced he founded a company called the Trump Media & Technology Group (TMTG) that was building a social media platform intended to compete with the likes of Facebook (FB) and Twitter (TWTR).

At that same time, Trump revealed that TMTG would be merging with DWAC, which is why the latter stock was suddenly thrust into the spotlight.

On Oct. 20, 2021, DWAC closed trading at $9.96/share. But only two trading days later—in the wake of the news it would merge with TMTG—it closed trading at $94.20/share, spiking by a jaw-dropping 845%.

But data shows that even amid the DWAC frenzy, overall performance in the SPAC sector was starting to falter.

At the end of last year, Renaissance Financial estimates that 70% of the SPACs that IPO’d in 2021 were trading below their $10/share offer price ($10/share is the standard IPO price for a SPAC).

And the pullback in the SPAC sector has only intensified in 2022, as evidenced by recent performance in the aforementioned CNBC SPAC Post Deal Index, as well as the Defiance Next Gen SPAC Derived ETF (SPAK)—the latter of which is down 40% in the last 12 months.

Some other well-known SPACs that have seen their stock prices lose 50% (or more) include DraftKings (DKNG), Embark (EMBK), Heliogen (HLGN), Lordstown Motors (RIDE), Matterport (MTTR) and QuantumScape (QS).

Looking beyond the numbers, qualitative data also suggests the SPAC craze may be losing steam.

Withdrawals of new SPAC listings were in the double digits (20) during January 2022, which was considerably higher than previous quarters. Withdrawals occur when the sponsor of a SPAC decides to pull the plug on the project—due to lack of investor interest, or another reason.

For more context on the current bout of market volatility, readers may want to review this new episode of Engineering the Trade on the tastytrade financial network.

To track everything moving the financial markets, readers can also tune into TASTYTRADE LIVE—weekdays from 7 a.m. to 4 p.m. CST—at their convenience.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.