Trading the Bidding War for U.S. Steel

U.S. Steel’s days as an independent company appear to be numbered as several companies are currently jockeying to buy out the storied company

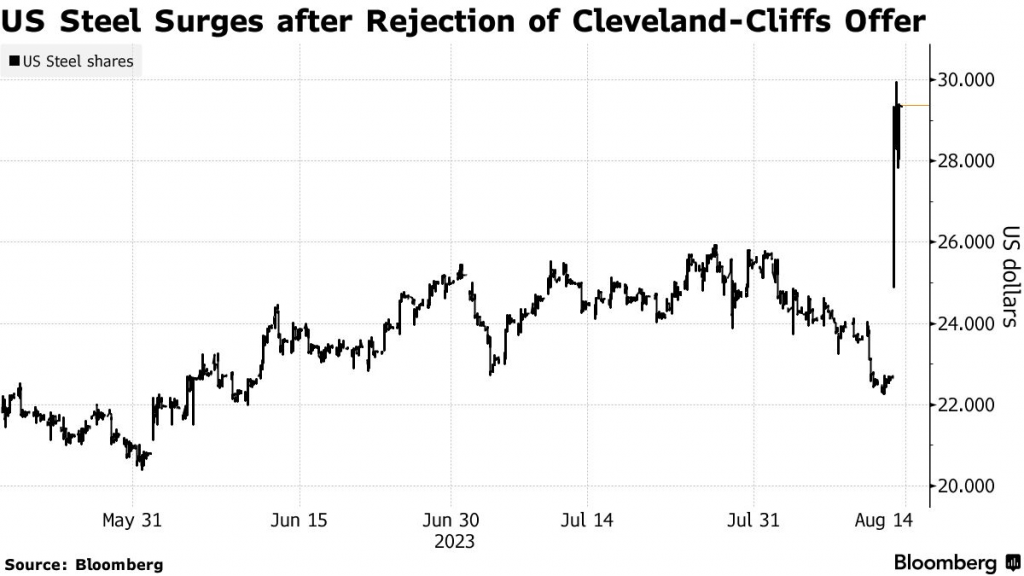

- On Aug. 13, U.S. Steel (X) revealed it was exploring strategic alternatives.

- Thus far, Cleveland-Cliffs (CLF) and privately held Esmark have submitted formal, takeover bids for the iconic American steelmaker.

- As a result of the bidding war, U.S. Steel’s stock price has rallied by roughly 25% year-to-date.

U.S. Steel has a storied history, and for many years was a symbol of the manufacturing might of the United States.

These days, however, the company’s struggles are more illustrative of the tough realities associated with global outsourcing.

Due to the rise of low-cost foreign manufacturers, the steel industry in the United States has become a shell of its former self. So instead of braving new frontiers, the modern U.S. steel industry is far more defensive in nature, and inward-looking.

That posture may help explain why U.S. Steel finds itself at the center of a domestic bidding war, with companies such as Cleveland-Cliffs (CLF), Esmark and ArcelorMittal (MT) seeking to acquire U.S. Steel in hopes of taking a key competitor off the board, while simultaneously gaining valuable market share in an increasingly competitive global market.

The bidding war for U.S. Steel broke out on Aug. 13 when U.S. Steel confirmed that it had invited its competitor Cleveland-Cliffs to participate in its previously announced strategic review process.

Shortly thereafter, the company confirmed it had rejected Cleveland-Cliffs’ initial offer of $7.3 billion, which represented a 42% premium over U.S. Steel’s closing price on July 28, when private talks between the two companies first started.

Since that time, U.S. Steel has received a competing offer from the private firm Esmark, which bid $7.8 billion for the iconic brand. Esmark’s offer is a pure cash bid of $35/share, while Cleveland-Cliffs offered a mix of cash and stock.

According to a recent report, ArcelorMittal (MT)—one of the largest steel makers in the U.S.—is also considering a formal bid, which could be in the neighborhood of $39/share. Esmark has indicated it could raise its offer as well, possibly as high as $10 billion.

Shares in U.S. steel started 2023 trading around $25/share, but have rallied roughly 27% due to the ongoing bidding war. U.S. Steel closed trading on August 24 at $30.45/share, with a market capitalization of $6.8 billion.

Cleveland-Cliffs has asserted that the combination of the two companies would rank the newly created entity among the top ten largest steel companies in the world, which would unlock the economies of scale necessary to compete in the current environment.

Why the United Steelworkers Union Could Ultimately Decide Which Bidder Prevails

Back in 1901, the well-known American industrialist—J.P. Morgan—built U.S. Steel into the largest company in the world by financing a merger between Carnegie Steel, Federal Steel and National Steel. That entity went on to become the world’s largest company, and the first with a valuation in excess of $1 billion.

At its peak in the middle of the 20th century, U.S. Steel employed around 340,000 people, and pumped out upwards of 36 million tons of steel. In comparison, the company produced roughly 11 million tons of steel in 2022, while employing about 15,000 people.

As is usually the case, U.S. Steel lost its dominant position in the market as a result of emerging steelmaking technologies, which allowed for cheaper and faster production. Especially in countries that could leverage lower labor costs, such as China and India.

One of the more recent trends in steelmaking involves so-called “minimills,” which utilize modern electric arc furnaces. Minimills use scrap steel as the primary input, which means they don’t have the same overhead as legacy steelmakers that rely on cumbersome blast furnaces to produce steel from raw materials such iron ore, limestone and coking coal.

Today, the largest American steelmaker—Nucor (NUE)—built itself into a major player in the industry by exclusively leveraging minimills.

While foreign buyers are no doubt interested in joining the bidding war, none have yet emerged—most likely because any deal involving a foreign buyer would almost certainly be blocked by the U.S. government for national security reasons.

Alluding to the potential complexity of that situation, a U.S. Senator from Ohio—J.D. Vance—recently voiced his preference that U.S. steel remain an American-owned entity because of its “strategic national importance.”

Another important angle to this ongoing saga involves the employees at U.S. Steel, and more specifically those affiliated with the United Steelworkers union.

What Happens Next for Potential Buyers?

According to a recent report by Axios, the current union contract requires “any buyer to come to terms on a new labor contract before a transaction closes.” That means the union could theoretically hold out against any buyers it views as undesirable.

It’s believed that the United Steelworkers currently favor the Cleveland-Cliffs bid, but that could change if ArcelorMittal—or any other domestic steel manufacturers—officially enter the fray.

ArcelorMittal previously sold a large chunk of its U.S.-based steelmaking operations to Cleveland-Cliffs, so a bid for U.S. Steel would represent a bit of a 180 for the company. ArcelorMittal does still have a presence in the Canadian market, so it may theoretically view the U.S. Steel assets as strategically attractive for growing that enterprise.

Regardless of which company ultimately prevails—if one does—the impact of the bidding war has pushed U.S. Steel’s valuation closer in line with its rivals.

Before rumors started swirling about a potential transaction, U.S. steel was trading at only 3.6 times its projected 12-month earnings. That was on the lower end of the spectrum in the steel industry, with Cleveland-Cliffs, Nucor and Steel Dynamics (STLD) trading at 5.0, 6.9 and 5.8, respectively, according to data compiled by Refinitiv.

On Aug. 23, multiple sources reported that Esmark was likely rescinding its bid for U.S. Steel because of the union’s decision to back the Cleveland-Cliffs overture.

However, the situation remains fluid, and Esmark could easily step back into the ring, just as another yet unnamed player could still emerge.

As highlighted below, Cleveland-Cliffs has actually been a laggard in the industry so far in 2023, with some of the other major players in the steel industry already booking double-digit returns year-to-date:

- POSCO (PKX), +95%

- Worthington Industries (WOR), +47%

- Reliance Steel and Aluminum (RS), +36%

- Nucor Corporation (NUE), +27%

- US Steel (X), +25%

- VanEck Vectors Steel ETF (SLX), +16%

- Commercial Metals Company (CMC), +14%

- Steel Dynamics (STLD), +8%

- Tenaris (TS), -2%

- ArcelorMittal (MT), -1%

- Gerdau (GGB), -1%

- Cleveland-Cliffs (CLF), -10%

The above indicates that while the United Steelworkers may prefer the Cleveland–Cliffs, shareholders at U.S. Steel may be less eager to tie their fortunes to CLF, which has been one of the weakest performers in the sector so far in 2023.

To follow all the latest updates in the financial markets—including those involving the steel industry—readers can also tune into tastylive, weekdays from 7 a.m. to 4 p.m. CDT.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox Magazine.