Unity’s 30% Surge: Are Investors Finally Catching On?

After growing from indie hero to tech titan, the company’s next chapter could be its best

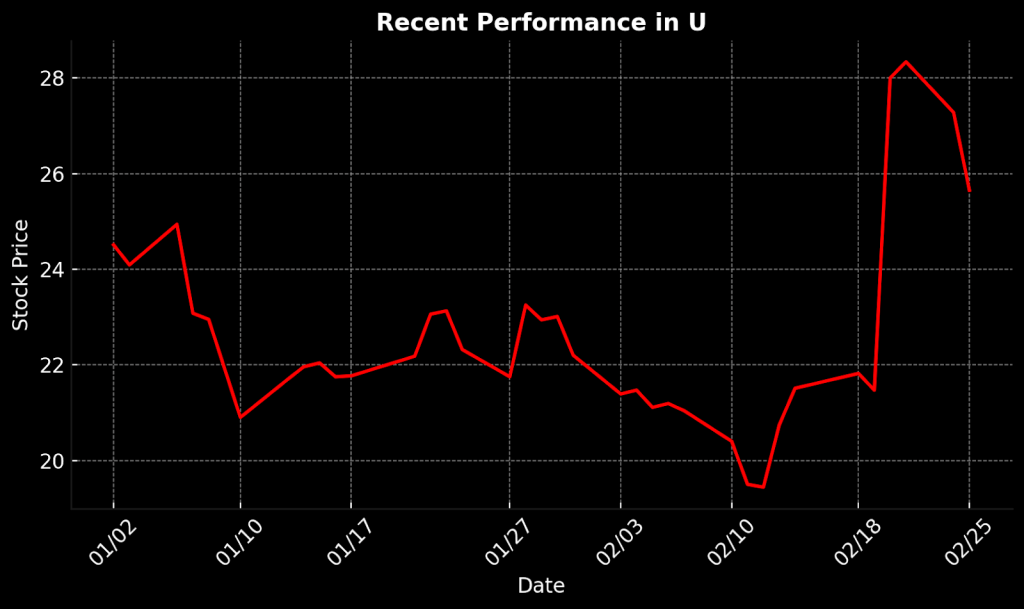

- Unity’s stock surged 30% after a strong Q4 earnings report.

- With promising developments ahead, the company’s valuation suggests there’s room for further upside.

- AppLovin’s failed $20 billion bid highlights Unity’s hidden potential, casting a bullish outlook on the company’s current $10.5 billion market cap.

Unity Software (U) has transformed itself from an indie developer’s favorite into a powerhouse in interactive 3D content creation, and its latest earnings report cements that status. Unity, the engine behind global hits like Fortnite and Pokemon GO, is no longer just a gaming tool—it’s becoming a pivotal player in industries ranging from automaking to film productiond. It’s even becoming important in the rapidly evolving realms of augmented and virtual reality. The company’s growing influence is impossible to ignore.

After a 30% surge in stock price following a stellar Q4 report, market sentiment has been overwhelmingly bullish. Unity is still in the early stages of its journey but has bold expansion plans. Plus there’s the looming possibility of another acquisition bid and a commanding market presence. So here’s the burning question: Does the market fully appreciate the company’s true potential? Today, we dig into its meteoric rise and show why this could be a stock worth watching (and perhaps owning).

From indie darling to industry leader

Unity Software, founded in 2004 and headquartered in San Francisco, has emerged as a leading platform in interactive 3D content creation. The company is best known for its Unity engine, which enables developers to create games, simulations and a wide variety of interactive experiences. Initially popular among indie developers, Unity has grown into a powerful tool for professionals in the gaming, architecture, automotive and entertainment industries. By providing a user-friendly platform for rapid prototyping, development and deployment across different devices, the company is helping to transform how interactive content is created.

Unity’s prominence in the gaming industry cannot be overstated. Its engine powers many of the world’s most popular games. Beyond gaming, it’s making inroads into other sectors, like Hollywood movies. Film companies are . using the company’s tools to create realistic 3D set. The growing adoption of its software across a wide range of industries is a testament to Unity’s flexibility and robust capabilities.

The company also operates in the rapidly expanding realms of augmented reality (AR), virtual reality (VR) and the metaverse—areas that have gained serious momentum in recent years. This makes Unity an intriguing play for investors interested in the intersection of gaming and interactive media.

The company’s position as an innovator has made it a prime target for acquisition. This was underscored in 2022 when AppLovin (APP) made an attempt to purchase the company. The deal fell through, but the fact that a close competitor saw such value in Unity speaks volumes about its potential. Its stock price has experienced high volatility, especially during the lead-up and aftermath of AppLovin’s takeover attempt. And the volatility has carried through the last 52-weeks of trading. However, after an encouraging Q4 earnings report, sentiment has been decidedly bullish.

Q4 earnings report exceeds expectations

On Feb. 20, Unity delivered a standout Q4 report that immediately captured the market’s attention, driving its stock up by over 30%. And over the last six months, the stock is up closer to 60%. This impressive performance reflects excitement among investors, not only for its improving financial position but also for significant progress in key areas of its business. It’s solidifying Unity’s position as a rising tech powerhouse.

Unity’s Q4 revenue reached $442 million, a 4% year-over-year increase that exceeded guidance by $15 million. The growth was largely fueled by Unity’s core business segments—Create Solutions, which grew 9% year-over-year, and Growth Solutions, which saw a more modest 2% increase. One driver behind the success of Create Solutions was the launch of Unity 6, which spurred 38% of active users to migrate to the new version. This shift not only boosted user adoption but also contributed to increased subscription revenue.

Adjusted EBITDA came in at $106 million, surpassing expectations by 26%, with a solid 23% margin. This performance reflects progress in managing costs while still investing in long-term growth initiatives. Free cash flow also impressed, rising 74% year-over-year to $106 million, showing the company’s ability to generate cash despite ongoing transitions. Its cash position, with $1.5 billion in reserves, along with its continued focus on debt reduction, assured investors of the company’s financial health and good strategic direction.

While the earnings report was largely positive, Unity did temper some expectations for Q1 2025, primarily because of the ongoing transition to its AI-driven ad platform, Unity Vector. This shift, which is necessary for long-term growth, will take time, and the company warned of possible short-term disruptions in its advertising business. However, the company remains bullish on Unity Vector’s potential, improving return on investment (ROI) for customers and expanding the company’s reach in the mobile and gaming industries. The first stage of Unity Vector’s rollout is set to be complete by the end of Q2 2025, with continued incremental improvements thereafter.

Meanwhile, Unity is expanding its commitment to mixed reality and diversifying its revenue streams beyond gaming. The company recently announced a strategic partnership with Google to co-develop the Android XR platform, which strengthens Unity’s position at the forefront of interactive content creation. This move highlights its growing influence in industries like automaking and retailing, where its 3D visualization tools are increasingly in demand.

Unity’s valuation suggests upside

Unity Software’s valuation places it in a nuanced position in the broader tech sector. The company’s P/E ratio (non-GAAP trailing 12 months) of roughly 26 is just slightly above the sector median of 24, suggesting it’s priced at a mild premium. That signals investors aren’t overly inflating expectations for the company’s earnings growth. But they are clearly factoring in upside potential driven by strategic investments, particularly in gaming and the rapidly growing extended reality market.

Unity’s price-to-sales (P/S) ratio, currently around 6, is above the sector median of 3. But that’s typical for a high-growth company. Given its expansion into multiple industries, the higher P/S ratio is understandable—provided the company maintains strong revenue growth. Likewise, Unity’s price-to-book (P/B) ratio of 3.4 aligns closely with the sector median, indicating the market is valuing the company fairly in relation to its book value.

Of the 29 analysts covering Unity, 15 rate the shares a “buy” or “overweight,” while only one analyst gives it a “sell” or “underweight” rating. The average price target stands at approximately $28 per share, slightly above the current stock price of $26 per share. The numbers suggest the stock is close to being fairly valued. And that’s largely attributable to the post-earnings rally that’s brought the stock closer to its intrinsic value.

Looking beyond the valuation metrics, AppLovin’s attempted $20 billion acquisition of Unity is a key consideration. Unity’s current market cap of around $10.5 billion is significantly lower than the bid, suggesting the market may be undervaluing the company’s true potential. While AppLovin’s bid probably factored in expected synergies from a merger, the high-dollar bid arguably establishes a floor for Unity’s stock, particularly if the company continues to deliver on its growth prospects. Taken as a whole, this dynamic suggests untapped value in Unity’s stock, which the market has yet to recognize.

With Unity’s recent earnings exceeding expectations and its ongoing strategic initiatives gaining traction, the stock now stands in a more compelling light. The company’s improving growth trajectory—and the possibility that AppLovin or another competitor could rekindle acquisition talks—suggest the stock could easily trade higher. In short, while Unity’s stock might be fairly priced today, its long-term outlook—bolstered by both organic growth and potential M&A interest—could easily justify a higher premium in the near future.

Investment takeaways

Unity’s recent surge stems from its bold vision, innovative products and strategic initiatives. However, the true excitement lies in Unity’s ability to navigate the Unity Vector migration, a shift that has the potential to transform its advertising model and enhance its competitive position. As the company expands into automotive, retailing, and extended reality, the key question will be whether these ventures can deliver sustained growth and expanded margins.

What truly sets Unity apart is the attention it has garnered from competitors. AppLovin’s failed $20 billion bid underscores how highly others value Unity’s potential, raising an intriguing question: Could the market still be undervaluing the company? With strong earnings and a growing market presence, Unity’s stock may offer more upside than implied by its valuation metrics alone. Analyst sentiment remains positive, and with the potential for acquisition offers, Unity shares look well-positioned for further gains.

Andrew Prochnow, Luckbox analyst-at-large, has traded the global financial markets for more than 15 years, including 10 years as a professional options trader.