Yen Trends as Fed Eyes Rate Hikes

This writer has argued in the past two issues of Luckbox that structural factors beyond “base effects” of the COVID-19 slump in 2020 were likely to make this year’s inflation pick-up stickier than the “transitory” rise envisioned by the Federal Reserve.

The Fed seemed to revise its stance accordingly at June’s momentous Federal Open Market Committee meeting. Officials said they were shifting the timeline for an upcoming interest rate hike because price growth had surpassed expectations.

Having previously anticipated keeping rates flat through 2023, Fed officials now pencil in two rate hikes that year. The priced-in market view implied in Fed Funds futures following the announcement is more aggressive still, envisioning one hike in 2022 and two more in the following year.

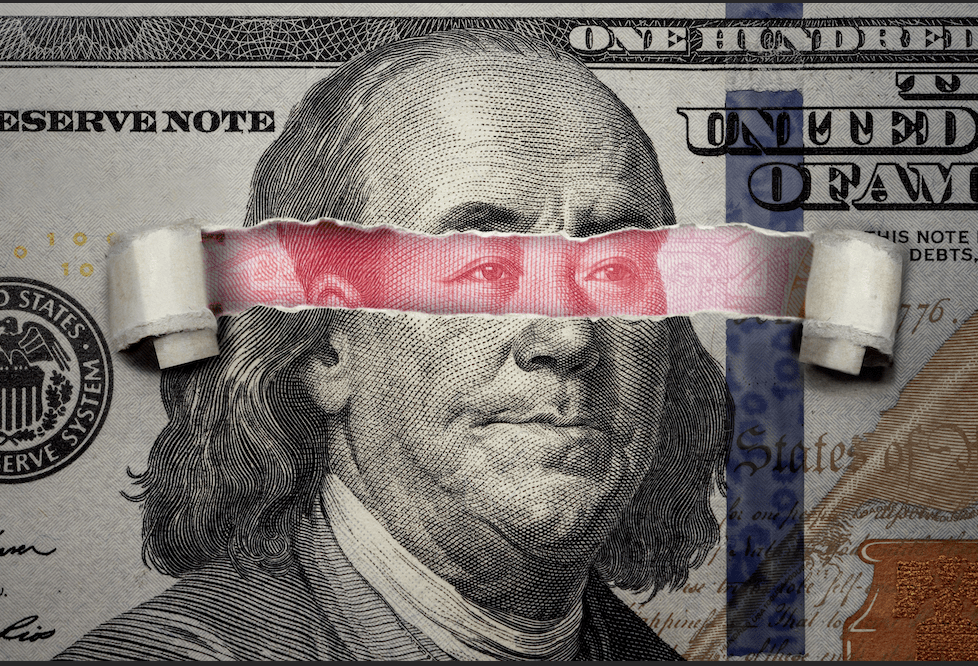

It’s not surprising that this pivot drove up near-term borrowing costs and sent the dollar sharply higher against other major currencies.

The rising yen

A near-parallel rise in the Japanese yen is perhaps a bit more surprising. The Bank of Japan has maintained an ultra-dovish policy stance for the better part of 30 years amid an epic—and mostly fruitless—struggle to bring price growth up to the target of 2%.

A rise in borrowing costs worldwide led by the Federal Reserve, which usually sets the overall trend because of the dollar’s ubiquity as the global medium of exchange, may have been seen as yen-negative.

That’s because the yen serves as investors’ go-to “funding currency” of choice. Because rates in Japan have been so low, traders popularized a “carry trade” strategy of borrowing cheaply in yen to buy higher-yielding assets and thereby extracting the differential as an income stream.

That approach works best when interest rates are on the rise globally, growing the yield disparities available to exploit. A more hawkish Fed portends just that.

The difference this time seems to be that global policy rates have converged on Japan—moving toward zero and sometimes beyond it into negative territory—collapsing yield spreads.

Recovering from these depths in most places is expected to come together with reflation.

Indeed, as the Fed has made apparent, that’s the driver of the latest outlook change. However, that does not mean that the structural forces holding down prices in Japan for decades have evaporated.

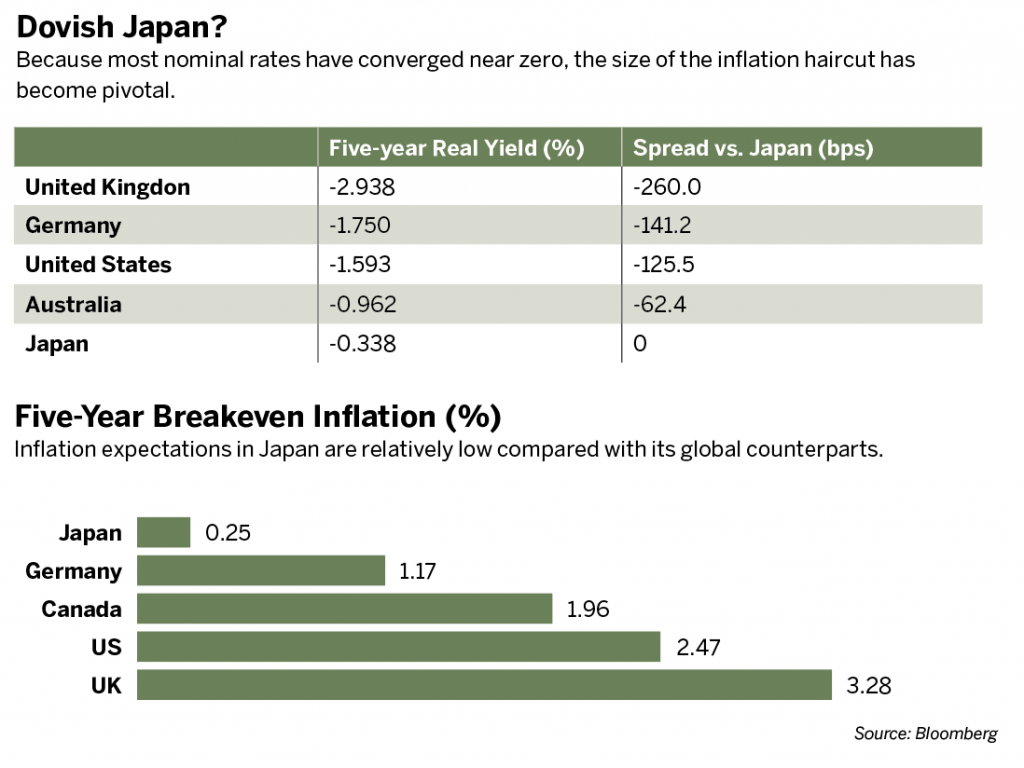

So, real interest rates, the nominal yields discounted by the rate of inflation, have turned out to be higher in Japan than most major economies.

Because most nominal rates have converged near zero, the size of the inflation haircut has become pivotal. It’s inherently small in Japan relative to global counterparts, so the inflation-adjusted yield to be had on yen-denominated holdings has emerged as more attractive. It’s the old “carry trade” upside down.

Rising borrowing costs

Dovish action from the Bank of Japan (BOJ) is an obvious counter to this narrative. Governor Haruhiko Kuroda and company already run a yield curve control regime by committing to buy Japanese government bonds in whatever amount is needed to keep the 10-year rate pinned at no more than 0%. If that could continue to work, it might erode the yen’s baseline nominal—and thereby real—yield advantage.

However, that policy seems fragile. The BOJ’s asset purchase effort, one of the pillars of its long-running stimulus program to overcome structural disinflationary barriers, has already gathered nearly half of the country’s bond issuance.

The ability to do more seems limited because critics could accuse the central bank and the government itself of outright debt monetization, an international taboo.

In fact, abandoning this element of the policy mix in the face of mounting external pressure that’s pushing rates higher may become a potent accelerant for any yen gains encouraged against this backdrop.

It brings to mind the Swiss National Bank’s unceremonious abandonment of the 1.20 floor on the euro/Swiss franc exchange rate in 2015 and the utter chaos triggered by the subsequent Swiss franc surge.

Surveying the major currencies, the yen’s most pronounced advantage in this sense seems to be against the British pound. Here, Japan enjoys a real-rate premium of 257 basis points on five-year paper.

While the nominal five-year rate in Japan is -0.102% and the equivalent in the UK is 0.378%, the former country has an expected breakeven inflation rate of just 0.25% at the same tenor (that is, five years). For the latter, this is a whopping 3.3%.

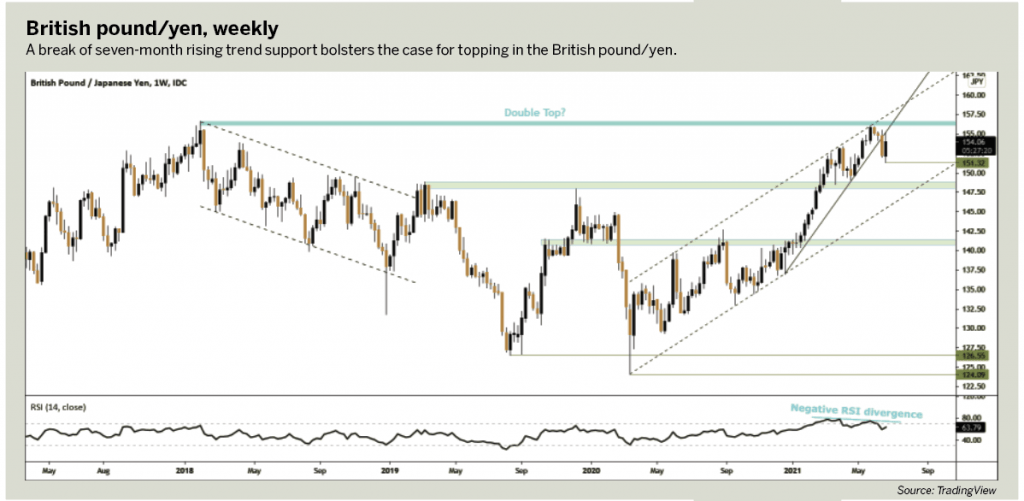

The technical picture appears to support the case for the British pound/Japanese yen currency pair’s downturn. Negative RSI divergence points to ebbing upside momentum as prices test resistance near the January 2018 high.

A break of seven-month rising trend support bolsters the case for topping in the GBP/JPY. Pushing past immediate swing low support at 151.32 may expose a critical juncture in the 148-149 zone. A further breakthrough might also take out the uptrend from March 2020.

Ilya Spivak is head strategist for Asia-Pacific markets at DailyFX, the research and analysis arm of retail trading platform IG. @ilyaspivak