Here We Go Again—Trading the 2nd 2020 Stock Market Correction

Back in December of 2019, almost nobody predicted that the stock market would crash in 2020. Fewer still were calling for two corrections this year—although that is precisely what has come to pass.

After experiencing a correction of 34% percent during Q1 of 2020, the S&P 500 has now corrected for a second time in 2020, albeit to a lesser degree.

The second correction occurred on September 21 when the S&P 500 made an intraday low of 3,229, a decline of 10% from its all-time intraday high of 3,588 on September 2. It should be noted this was an intraday correction of 10%, as the closing prices on those days (3,580 and 3,281, respectively) equated to a pullback of only 8.3%.

The “official” second correction of 2020, involving a 10% pullback of closing highs and lows (instead of intraday), could materialize soon.

Before running down an “old-timer” for more information about the last trading year with a double correction, investors and traders should note the last occurrence was actually in 2018. Two years ago, the stock market experienced two 10%+ corrections, one early in the year, and another in fall.

Interesting, the two corrections in 2020 have followed that same pattern, except the correction in Q1 2020 was a lot more severe than the correction observed in Q1 2018.

To find the next historical occurrence of a double correction in the same calendar year, one has to go all the way back to the end of World War II. In 1946, the stock market experienced two deep corrections in February and May.

However, when looking at 12-month periods spanning two calendar years, there are several additional historical instances in which two corrections occurred during a single 12-month window. But with only a handful of total instances since WWII, that means a double correction in such a short period is rare—a reality that helps underscore the outlying nature of market volatility this year.

And on top of this double correction information, there are additional statistics related to past market corrections that cast the 2020 trading year in even stranger terms.

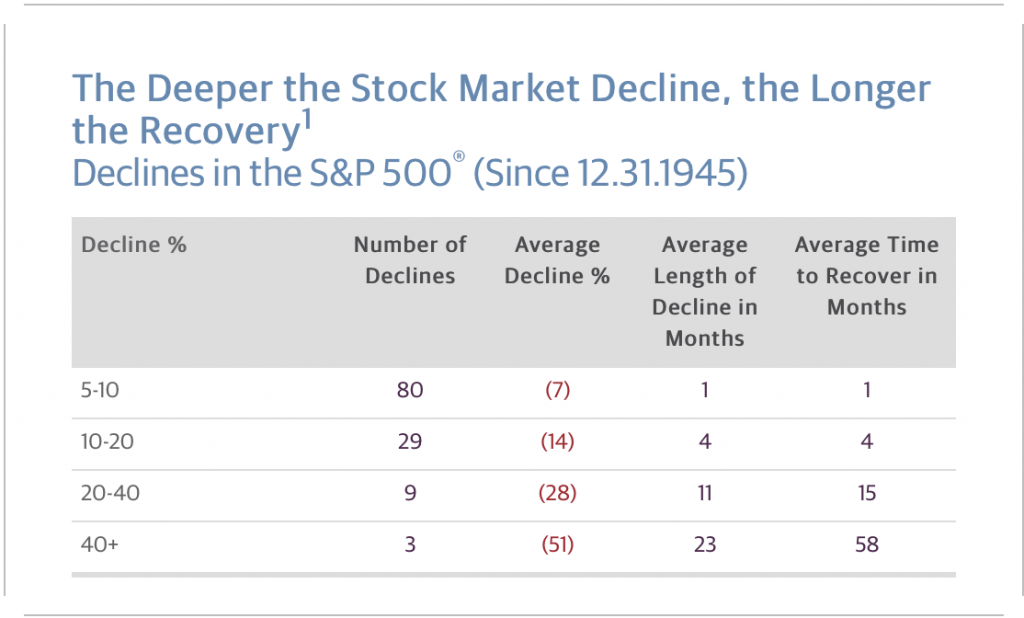

Based on an analysis of 121 previous market corrections going back to 1945, trading data reveals that the severity of those corrections tended to be directly correlated to the timeline until recovery. For example, pullbacks of 5-10% during that span (80 instances) required only one month for the market to recover.

On the other hand, severe pullbacks of between 20-40% (9 instances) required on average 15 months for the market to recover. Somewhat strangely, after a decline of 34% in Q1, the S&P 500 recovered all of those losses, and more, in less than 5 months.

The 2020 stock market has therefore “bucked” several historical trends—and it isn’t yet over.

If the stock market falls further in the fall/winter of 2020, the complexion of the entire trading year could take on a completely different hue. Since WWII, there’s never been a trading year that contained two separate stock market corrections of more than 20%.

However, if the second wave of COVID-19 resembles anything like the second wave of the 1918 Spanish flu, it’s difficult to imagine the stock market avoiding another serious correction in the coming months.

For context, getting to 20% down would require the S&P 500 to drop back to 2,850, based on the closing high of 3,562 from September 2. That level of 2,850 would still be well above the year-to-date low in the S&P 500 of 2,191.

If the second wave of the coronavirus fails to materialize, or Congress gets their act together and passes another comprehensive relief package, one could see how a second correction of 20% (or more) might be avoided.To follow all the daily action in the financial markets, readers are encouraged to tune into TASTYTRADE LIVE, weekdays from 7am to 3pm central time.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of luckbox, tastytrade or any affiliated companies. Readers can direct questions about any of the topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.