Betting Against the Political Polls

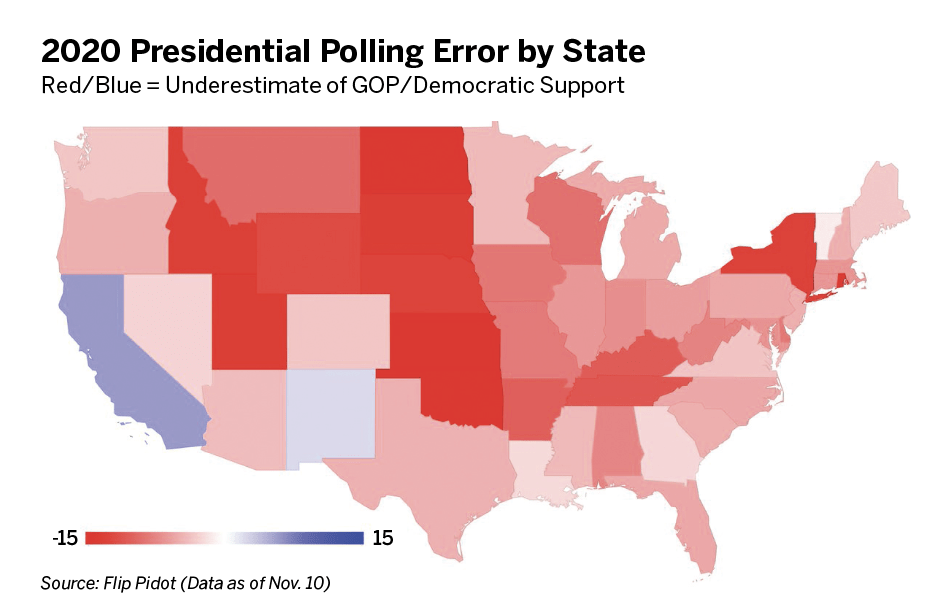

Pollsters fared badly in the 2020 elections, especially down-ballot. Were prediction markets a better bet?

Forecasters are a shifty bunch, adept at concocting preemptive excuses and post hoc narratives for why their projections are right, no matter what happens.

They eagerly point out the stupidity of betting markets, such as political prediction market PredictIt.org, yet are reluctant to subject themselves to the markets’ scrutiny. They cite a bizarro ethical code, contractual obligations, conflicts of interest and whatever else allows them to talk a big game while sitting on the sidelines.

As Mike McDermott told Joey Knish in Rounders, “You see all the angles. You never have the stones to play one.”

We saw it in 2016, when FiveThirtyEight’s 28% win probability for Donald Trump was heralded as yet another success story. Had Hillary Clinton won, their 72% forecast for her would have also been a success.

It happened again in 2020. Before the election, statisticians at The Economist, who gave Biden a 95% chance to win, clarified that their model predicted “voter sentiment,” not the election outcome. Nate Silver of FiveThirtyEight published, “I’m here to remind you that Trump can still win: A 10 percent chance isn’t zero.”

So, let’s get this straight. If Joe Biden wins, they called it. If he doesn’t, they warned us. Heads they win, tails they win.

It may be that 72% for Clinton was right in 2016, and that 89% for Biden was right in 2020. But with all the hedging and excuses, how would we ever know?

A week before the election, Silver tweeted, “political betting markets are basically just a competition over what types of people suffer more from the Dunning–Kruger effect.”

For context, the Dunning-Kruger effect is a psychological bias that causes people to overestimate their ability to perform a task—in this case, forecast the election. Silver was alluding to the fact that betting markets gave Biden just a 60% to 70% chance to win, far lower than the polls and his model suggested.

So, were the markets as irrational as Nate Silver claimed and full of overzealous “MAGA money” as many PredictIt traders contend, or were they pricing in extra information that skewed their probabilities toward Trump?

The graphic below shows that the polls were skewed in Biden’s favor, as predicted by the betting markets. This lends some support for the markets’ shading toward Trump, but Biden won anyway. And still there are plenty of reasons why political betting markets might be less efficient than other markets.

“Were the markets as irrational as Nate Silver claimed and full of overzealous ‘MAGA money’ as many PredictIt traders contend?”

PredictIt, in particular, suffers from a number of structural limitations and sources of price distortion: a 5,000 trader maximum per contract, an $850 maximum exposure per contract, the limitation to U.S. participants and longshot biases. In addition, many market participants are blinded by their own political biases. So, if any market is beatable, it should be PredictIt.

As of Nov. 16, using FiveThirtyEight’s forecasts to bet on each state in the Electoral College would have resulted in a profit of about 4.6% before fees. Not bad at first glance, but after accounting for fees, 4.6% looks more like -0.8%.

A losing effort—after all that ranting and raving.

Diving deeper, most of the profits come from the 40 or so races with well-documented price distortions. In every election there are 40 or so states for which the winner can be predicted with high certainty—states such as Alabama, Wyoming and North Dakota for Trump as well as New York, California and Illinois for Biden—but these markets tend to top out in the 90¢-95¢ range as a consequence of PredictIt’s asymmetric commissions and high fees. For example, Biden to win California sold at 94¢ on the morning of the election.

Zeroing in on nine of the closest races reported by FiveThirtyEight (Arizona, Nevada, Texas, Florida, Georgia, North Carolina, Pennsylvania, Ohio and Iowa), a trader would lose 9.1% before fees, or 13.9% after fees. Ouch.

OK, but adding the states of Michigan and Wisconsin ends up at a 3.3% profit before fees, yet a 2.0% loss after fees. Still a loser, no matter how it’s sliced.

If losing 1%-2% doesn’t sound so bad, consider that the house edge at craps is about 0.42% per roll. So you’d be better off rolling the dice than tailing FiveThirtyEight in the betting markets.Remind me again about that Dunning-Kruger effect.

Some contrarians will argue it’s not fair to include fees, but the fees cut both ways—they make it harder to profit but also cause market distortions that traders can be exploit.

Besides, if you can’t beat the rake, you’re not a winner. Still, they’ll insist they could beat the markets, if only they had the time or were allowed to bet—the old “I would if I could, but I can’t” alibi.

I don’t doubt for a minute that the betting markets are beatable, very beatable. It’s just that the major forecasting outlets don’t beat them, though they sure talk like they do.

The real beauty of markets is that we don’t need to argue about this. If the markets really are so dumb, then go make some money. Until then, remember what Mikey McD told Knish.

Harry Crane is the co-founder of Researchers.One and an associate

professor of statistics at Rutgers University. Listen to an extended interview with Crane on The Political Trade further detailing his research and its conclusions.