Today’s Esports Team Valuations = NBA Teams in the 1980s

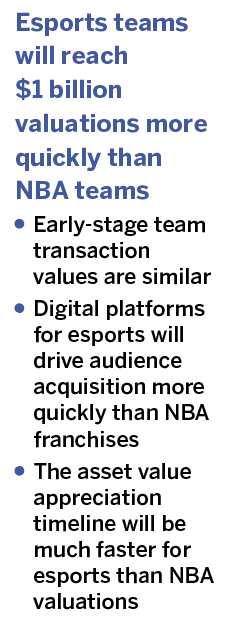

Today, every NBA team is worth more than $1 billion. Esports teams could reach similar heights, perhaps even more, in the near future. History is repeating itself, but more quickly this time

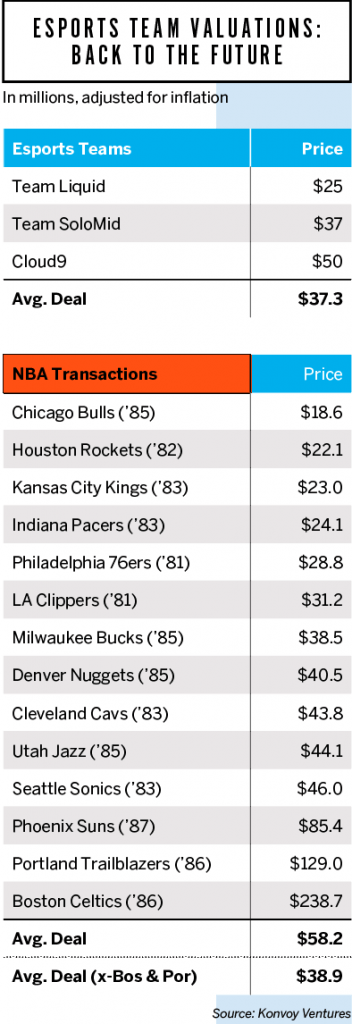

Esports teams are attracting investments of about the same size as NBA teams of the 1980s. Examples include Cloud9 raising $50 million, TSM raising $37 million, and Team Liquid raising $25 million.

In the 1980s, 15 NBA teams were purchased in whole or in part ranging from $9.8 million for the Houston Rockets in 1982 to $120 million for the Boston Celtics in 1986. Those figures are similar to the $37M average for top esports organizations today.

Two significant outliers occurred among the 1980s NBA transactions: Portland and Boston. They alone increase the average by nearly 50%. Adjust for inflation and remove those two from the table, the average NBA franchise investments were within 5% of the three most notable recent investments in esports organizations.

When those NBA transactions were completed, teams were valued from $10 million to $120 million, and today every NBA team is worth more than $1 billion. Most of the value appreciation can be attributed to technological advances that have brought wider viewership, which in turn has created lucrative media rights deals for the NBA and its teams. That’s important because esports franchises already have the viewership, and today’s digital distribution platforms will enable rapid audience acquisition and adoption. With more viewership comes more rich media deals.

The esports audience

Esports team franchises appear inherently lucrative because of their global digital audience. The NBA audiences in the 1980s were predominantly based in the United States and the teams couldn’t develop widespread, loyal fan bases abroad.

Global potential should help esports franchises appreciate in value at a materially faster rate than the NBA franchises from the 1980s. They have comparable audiences; considering the Overwatch League’s 10.8 million viewers today versus the NBA’s 13.2 million viewers in the 80s.

Another reason for esports teams to appreciate in value is the age of their fans. The average NBA viewer is 42 years old, but according to Nielsen, the average age of esports viewers is 31 and 61% of viewers are millennials.

These factors should drive the appreciation of valuations because those viewers have grown up not only watching esports, but also continue playing as they get older. With traditional sports, the majority of the viewers are just fans—even if they played the sport when they were younger they probably are not playing regularly years later.

Millennials have a lasting affinity for the video games they grew up playing (and still play today) because they enjoy the exact same game at a high level of competitiveness. This dynamic is going to keep them engaged for years. It’s similar to golf, which players continue to enjoy for a long time. The same will be true for the younger Gen X and Gen Z demographics.

History is repeating itself… but faster. Esports could do in five to 10 years what took the NBA over 30 years to achieve.

Josh Chapman is managing partner at Konvoy Ventures, a Denver-based venture-capital fund specializing in esports and video gaming. @joshchapmn