Google’s Got Game

Video game companies derive more than 70% of their revenue from console-based games. here comes the cloud.

Two years ago, games like Fortnite and PlayerUnknown’s Battlegrounds shook up the game industry, delivering an easily accessible platform that connected them to dozens of players around the world from multiple devices. Players flocked to the new games with an almost cult-like voracity, catching established game makers off guard. Two years later, a company not synonymous with gaming is looking to make an even bigger splash.

The Google (GOOGL) announcement of its cloud-based gaming service called Stadia looks to disrupt an industry that has been surprisingly static until recently. Since the inception of Nintendo (NTDOY) 30 years ago, gamers have been buying cartridges and disks to plug in to their clunky gaming consoles. While newer consoles can download the game to the console directly, users are still confined to the console and the storage limitations that come with it. Google looks to trash the console-based gaming industry, enabling users to stream games from multiple devices, much like Netflix (NFLX) or Hulu.

While games have evolved tremendously over the years into beautiful and massively scaled masterpieces, little else has changed in the way players purchase and use video games. Bringing players online to play together and against each other was arguably the only major paradigm shift the industry has seen. Video game and console makers have been stuck in a rut of simply improving the foundations that are already there, instead of finding a new way to consume content. Stadia looks to take advantage of that complacency.

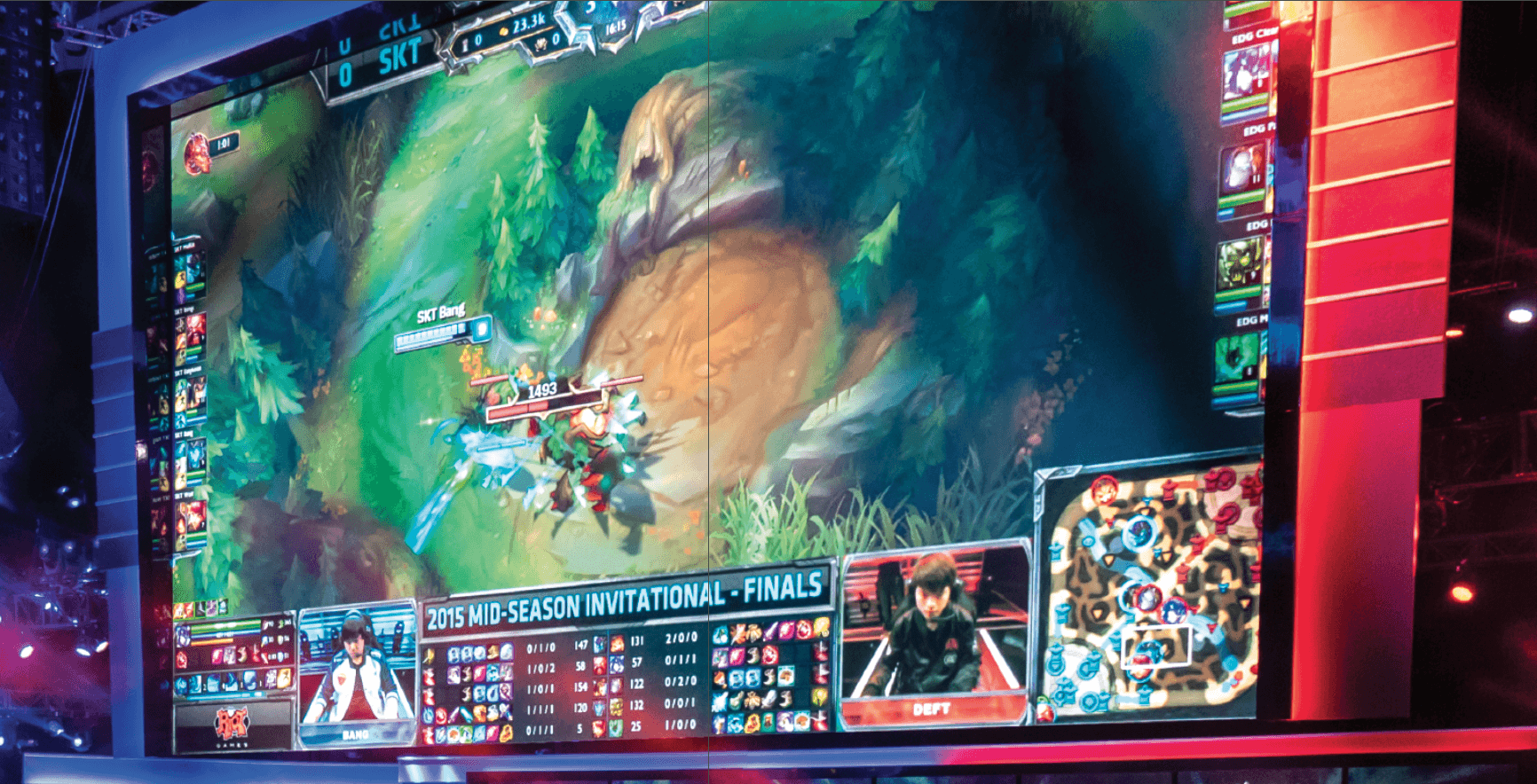

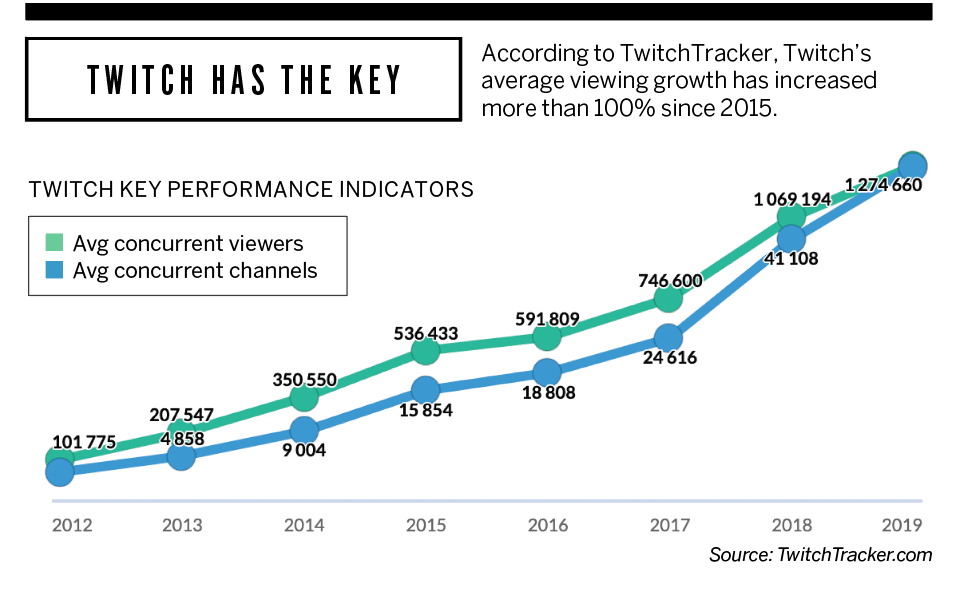

Stadia not only releases gamers from the confines of gaming consoles, but also integrates services such as Twitch. According to TwitchTracker, Twitch’s average viewing growth has increased more than 100% since 2015 (See “Twitch has the key,” below).

Stadia aims to integrate those who watch video games with those who play them, even enabling those watching to join the game in certain cases. With YouTube in their holster, one can imagine this integration would be seamless.

Video game companies such as Electronic Arts (EA) derive more than 70% of their revenue from console-based games, according to their fourth-quarter earnings report, with more than half of that revenue coming from service-based fees and charges. That includes in-game purchases, subscriptions and add-on content. It’s impossible to deny that the business model is changing to more service and subscriptions, instead of just direct-game sales.

Fortnite was a wakeup call that supplied the kind of content the video game world lacks. In addition to high-end blockbuster games such as Call of Duty and Madden, demand is high for simpler games with little or no initial cost. Those games capture their audience’s time with the addictive gameplay opportunity to engage with dozens of human-controlled characters, and capture audience dollars by offering low-cost additions, upgrades and extra content that serve as a recurring revenue stream instead of just a onetime purchase. Cloud streaming can thrive with that type of game design and an intuitive connection among watching, playing and interacting with others in a platform.

While it may have been hard for them to create the grand-spectacle masterpieces made famous by established companies, they appear likely to have a much easier time focusing on the shareable experience games provide.

Stadia and other ambitious cloud-streaming gaming platforms’ success will likely come down to content, like the Netflix (NFLX) stranglehold on the video streaming business. If Google can acquire or engineer games that pull more users from console-based gaming to the cloud, they could position themselves the way Netflix did in the beginning of the video-streaming boom.

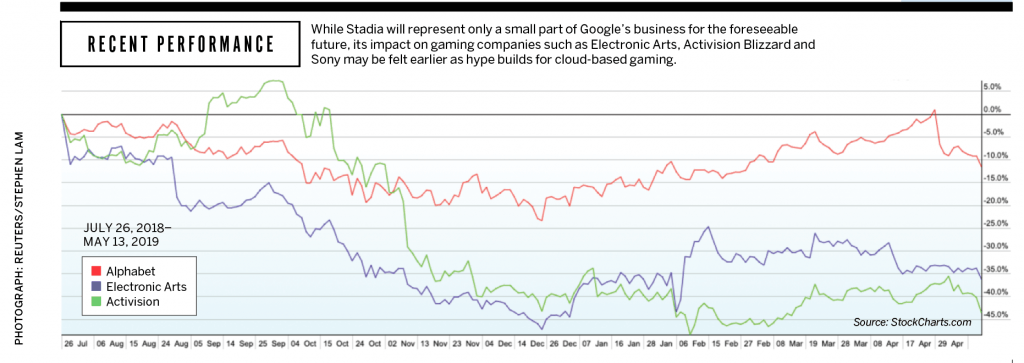

Google will have to beat competitors like Microsoft (MSFT), Amazon (AMZN) and possibly Apple, (AAPL), though it seems they’re first on the scene. While Stadia will represent only a small part of Google’s business for the foreseeable future, its impact on gaming companies such as Electronic Arts, Activision Blizzard (ATVI), and Sony (SNE) may be felt earlier as hype builds for cloud-based gaming. It’s not clear yet where and if Google will turn a profit in this venture, but with the cash hoard Google has at its disposable it seems they’re willing to do what it takes to earn market share. With the price rumored to be free initially, Google can undercut the market until it gains its followers, much like the Amazon model of the last 20 years.

If Stadia delivers exclusive content that draws eyes from competitors, console-based gaming companies could find themselves on the wrong end of a gaming revolution. For investors who are considering a gaming play for the long term, it’s possible buying Google and selling companies like Electronic Arts and Activision Blizzard offers a compelling pairs trade.

If gaming continues to take off in popularity, Google seems likely to execute its plan with some success. That could be the positive catalyst many are waiting for from the company. If not, it will be sheltered from the secular trend away from gaming, while gaming companies will feel the full brunt. Adding the third scenario of Google taking significant market share from the established companies, being long Google and short Electronic Arts could prove a winning strategy.

Ryan Shaw, a futures and derivatives trader, specializes in option spreads and pairs trading at NinjaTrader, analyzing order execution, charting and automated strategies.