4 Crypto Criteria

Choose a crypto by analyzing market cap, volatility, correlation and utility

With hundreds of cryptocurrencies widely available, it’s challenging to choose the “right” one. Is bitcoin the best long-term investment? Does ether have more potential now that it’s switching to proof of stake? What’s the next dogecoin?

Investors ask these questions and more. But instead of relying on somebody else’s opinion, they can do some simple research to determine which crypto may provide the best fit.

Begin by considering the crypto’s market cap, which is the current market price multiplied by the circulating supply. The larger the market cap, the safer the crypto. Examples of large-cap cryptos include Bitcoin, Ethereum and Cardano.

Mid-cap cryptos are more volatile than their large-cap counterparts but theoretically have more growth potential. Examples include Chainlink, Aave and Enjin.

Small-cap cryptos are the most volatile, meaning they can go up 50% to down 50% in a matter of hours or days. Examples include Basic Attention Token and Compound.

By determining their tolerance for risk and desire for growth, investors can use market cap to narrow the choices of crypto.

The next factor to consider when choosing a crypto is volatility. For many investors, crypto holdings will make up only a small fraction of their investment account. But even then, a volatile asset can cause unsavory profit/loss swings.

Market cap and volatility have a strong relationship, so a crypto with a large market cap tends to be less volatile. Bitcoin and ether tend to be the least volatile, whereas Shiba Inu and Stellar Lumens are the most volatile.

But as long as investors keep their position size small (less than 5%), the differences in volatility should not have a large impact on the day-to-day volatility of a portfolio.

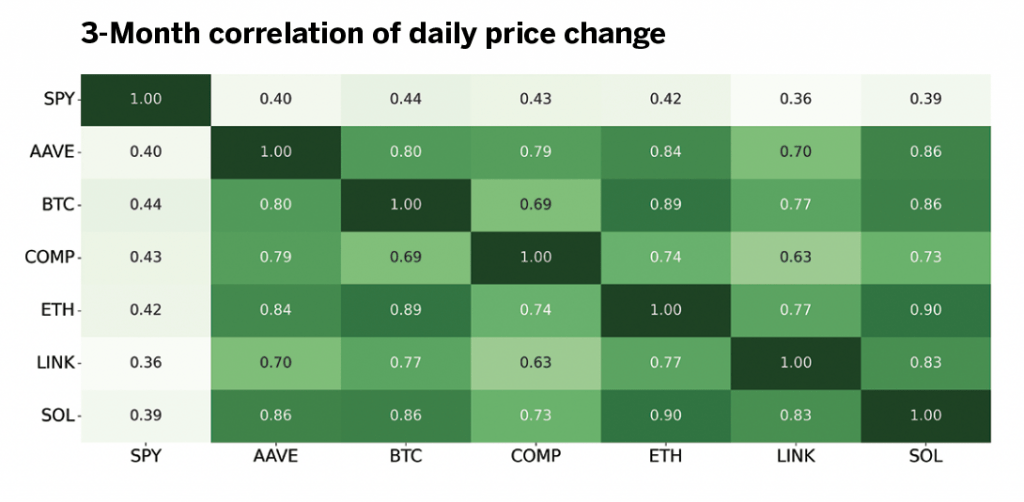

Because crypto is likely to be an addition to a traditional equities portfolio, it’s important to consider the strength of the relationship between a crypto and stocks. When the prices of two entities move up or down together, they’re said to be correlated.

The correlation of the aforementioned cryptos to the broad market index, the S&P 500, was much lower at press time than at the start of 2022. The correlation is 0.4 on average, indicating a weak positive relationship between cryptos and equities, which helps when looking to diversify.

The last thing investors should consider when choosing a crypto is its utility. When crypto was introduced, it was primarily a store of value and a means of transacting. Nowadays, a variety of cryptos represent a blockchain’s utility.

This utility can come in the form of lending and borrowing platforms, decentralized exchanges, NFT marketplaces and more.

For example, Aave and Compound are lending platforms that enable investors to earn a yield on assets that would otherwise be sitting idle in their accounts. The corresponding cryptos for these platforms, Aave and Compound, provide a way for investors to gain exposure to current and future utility.

Choosing a crypto isn’t too different from choosing a stock. By analyzing a crypto’s market cap, volatility, correlation, and utility or use case, investors can make well-educated decisions.

Eddie Rajcevic, a member of the tastytrade research team, serves as co-host of the network’s Crypto Corner and Crypto Concepts. @erajcevic11

Eddie Rajcevic, a member of the tastytrade research team, serves as co-host of the network’s Crypto Corner and Crypto Concepts. @erajcevic11