Big Moves are Price Predictors

Big news about big moves—when a stock moves up or down by 2% or more, the probability of subsequent big move increases.

Regular readers of the Tactics section know Luckbox avoids market forecasting in terms of direction. However, recent groundbreaking research by the tastytrade in-house research team shows some predictability in the magnitude of outsized moves (+/- 2% or more) when the first move of such magnitude occurs.

For the most part, market moves are independent of each other in terms of direction. In other words, if the market has an up day today, the chance of an up day tomorrow is roughly 50%. However, the magnitude of the move is not as independent as once thought.

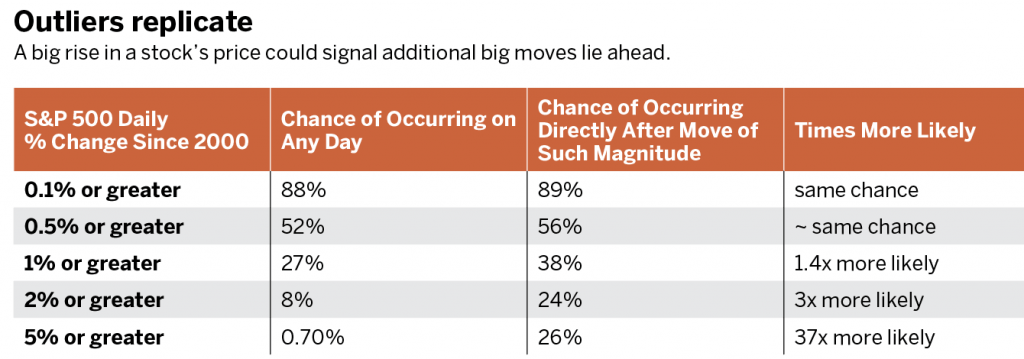

Looking at the probabilities of certain percent moves (up or down) in the S&P 500 since 2000, one sees that a move +/- 1% or less has the same chance of occurring on any randomly selected day as it does after a move of +/- 1% or less. In other words, if a stock has a small move today, that doesn’t change the chance of another small move tomorrow. It’s similar to the game of roulette, where if the ball lands on black, the chance it will land on black on the next spin doesn’t change.

However, with outlier moves (+/- 2% or greater) the probabilities are no longer the same for the first move as they are for additional moves. The row in the table above called “5% or greater” shows that the chance of seeing a 5% move on any randomly selected day in the last

20 years is 0.7%.

But if that move happens, then the chance of seeing another move of 5% or greater (up or down) is 26%—an increase of 37-fold. Going back to the roulette example, if these moves were all independent, and if the ball lands on green (less than 3% chance of happening), then the chance of the ball landing on green again right after that remains 3%.

With large market moves, however, the chance of another large move is not independent of the first one. So, if there’s a large move today, the chance of another large move tomorrow is much greater than seeing that first large move. In fact, with a 5% move today, the chance of another 5% move in the next 30 days is 91%.

How can traders use this phenomenon to their advantage? The main takeaway is to adjust expectations to anticipate more large moves after seeing one. If traders stay small with options positions before a first large move, they can capitalize on subsequent large moves because they know there’s a higher probability of seeing them.

Anton Kulikov is a trader, data scientist and research analyst at tastytrade. @antonkulikov97