Don’t Fear Volatility: Reap It!

Modern Halloween traditions are steeped in “fear,” which unofficially makes the holiday a celebration of volatility.

That’s because most traditional financial media outlets usually talk about the appearance of volatility in the financial markets as if they were reporting a recent sighting of Halloween’s Michael Myers in Haddonfield.

“Oh no, the market is moving—it’s time to panic!”

Hardly.

The truth is that the appearance of volatility in the financial markets is typically synonymous with a trading environment proliferating with opportunity, especially for those who keep a level head when everyone else is losing theirs.

The reason volatility often gets misrepresented is because journalists—or, rather TV personalities—on traditional financial media outlets are typically just that: career journalists, not career traders. Would you rather take cooking lessons from a journalist who’s written about cooking, or an actual chef?

When TV personalities are expounding on their market opinions, or worse, specific trade ideas, the best thing to do is hit the “mute” button on the remote. Most savvy traders use traditional financial media feeds for breaking news, possibly quotes, and not much more.

And just as lifelong, passionate traders know that TV personalities rarely provide valuable insight on the markets, they also inherently know that spiking volatility is a cue to clear the calendar. The famine is over, it’s time to feast!

Fast-moving markets, for traders, is a lot like going trick-or-treating on a block that’s only giving out “full size” candy bars. There’s only one rule: hit as many houses as humanly possible. It’s similar for experienced traders in volatile markets. Opportunity abounds, and it’s a great time to open up your bag to let the goodies flow in.

For example, an environment such as this is almost guaranteed to present opportunities in which attractive holdings get oversold. For directional traders, this can be a great time to establish a new position or add to an existing one.

And for volatility traders, an uptick in the speed of the financial markets is like that famous bell used on Pavlov’s dogs—cue the salivation. Except in this case, it’s more like a gong than a bell.

The one wrinkle is that when a metric like the VIX is climbing higher, some of the best emerging opportunities tend to be on the short side of the volatility coin. And just like jumping off a steep cliff while tied to a bungee cord, the initial paralysis during a market correction can sometimes feel insurmountable. This can represent a considerable hurdle for traders who are trying to simply execute their intended strategy.

So when fear has a stranglehold on the market, how can traders quell their nerves, tune out the talking heads and simply execute on their ideas?

A great starting point is to familiarize yourself with the historical performance of short volatility strategies in high VIX trading environments—especially as compared to relatively stagnant periods in the market. With this type of data in mind, traders can rely on systematic, fact-based decision making, instead of knee-jerk emotional reactions.

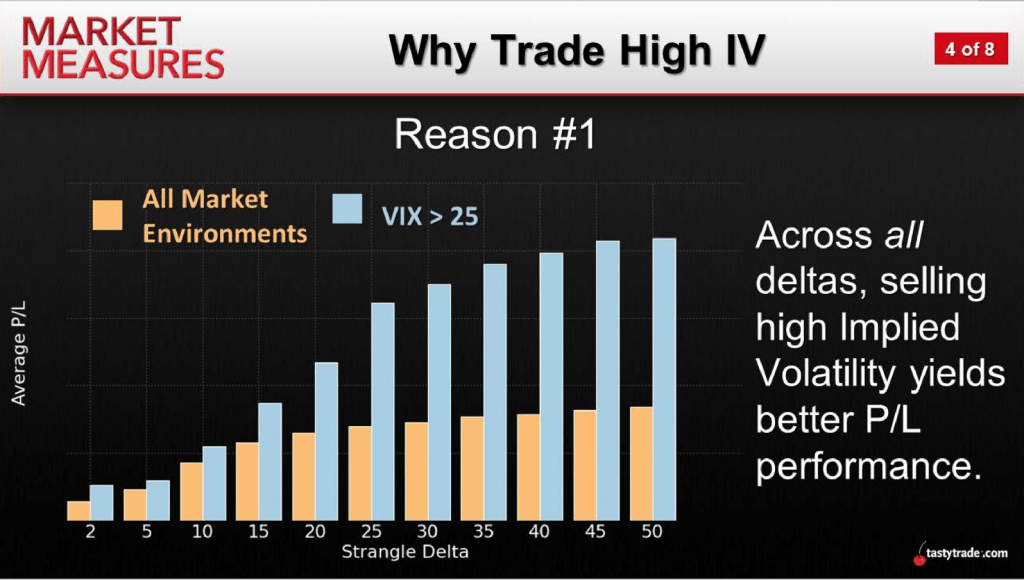

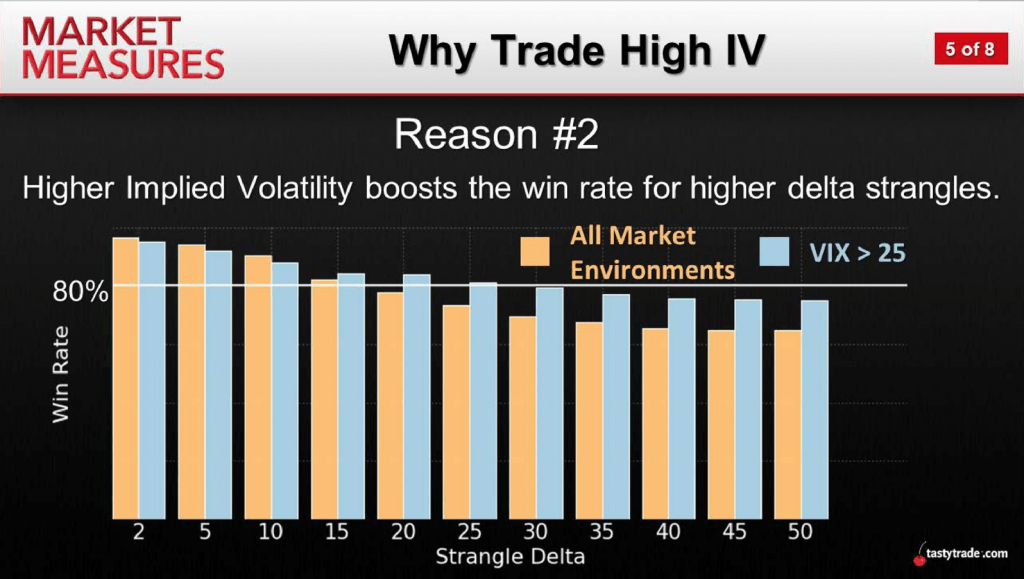

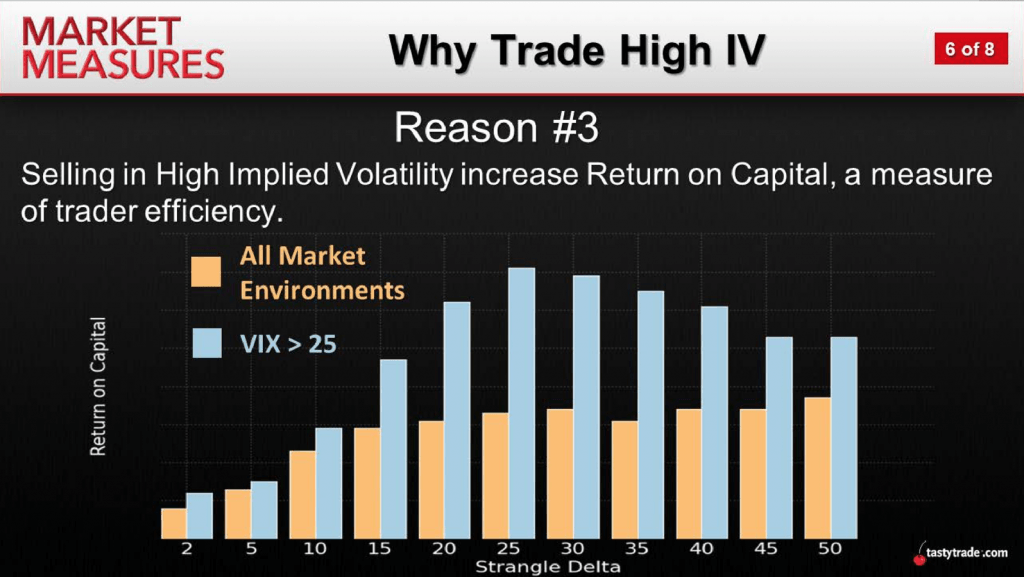

Fortunately, a recent episode of Market Measures on the tastytrade financial network focuses on this subject. The heart of the show anchors on a new tastytrade study that helps illustrate how short strangles have performed in “all environments” as compared to a trading environment characterized by high levels of volatility.

In this examination, a high volatility environment is defined as one in which the VIX is higher than 25. Given the historical mean in the VIX is roughly 18, the choice of 25 clearly demarcates periods in which the speed of the market is more volatile than “usual.”

Cutting straight to the chase, the findings from this research provide several hard-hitting takeaways, which are clearly illustrated in a series of 3 charts presented on the show.

This data, depicted below, helps reinforce why fortune truly does favor the bold when it comes to selling heightened levels of implied volatility:

As one can see in the above graphics, historical market data helps establish why rising volatility can be such a boon for traders, especially those embracing the mean reversion philosophy.

So the next time the “fear index” (i.e. VIX) rises above 25, there’s no need to look under your bed for Michael Myers or Jason Voorhees. Instead, traders can simply execute their intended strategic approach while keeping in mind that market volatility isn’t an aberration from the norm, it’s a part of it.

For a detailed breakdown of this research, a complete review of Market Measures is recommended when scheduling allows. More information is also available in the tastytrade LEARN CENTER.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of luckbox, tastytrade or any affiliated companies. Readers can direct questions about topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.