Return to Value

Savvy bargain hunters search for underpriced stocks

Value investing may seem like a thing of the past in an era of high-frequency trading, special-purpose acquisition companies (SPACs) and meme stock mania. But that doesn’t have to be the case. Value investing is making a comeback in a year characterized by rising interest rates, heightened uncertainty and resets in the valuations of many companies.

It’s an investment strategy based on picking companies trading below fair value. It works because the market tends to overreact to news, resulting in large price movements that aren’t necessarily representative of the long-term performance of a stock. Investing is like shopping, and value investors are savvy shoppers who look for a sale.

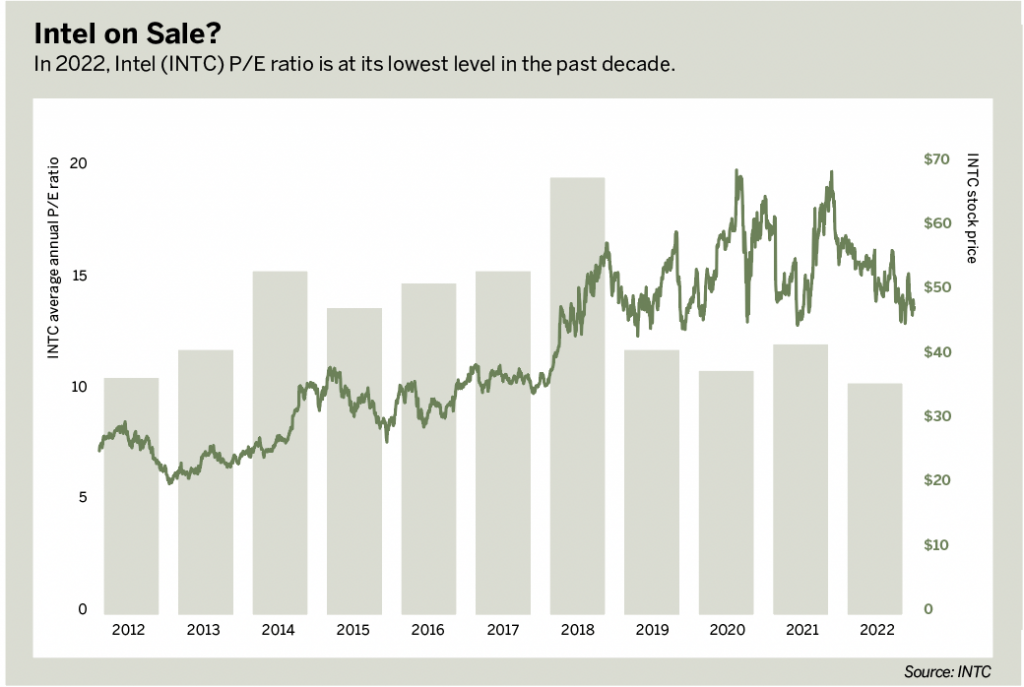

The price-to-earnings ratio, or P/E ratio, helps investors find stocks that are “on sale.” To calculate the P/E ratio, divide the current stock price by the company’s earnings per share. The resulting P/E ratio tells investors how much they will pay per share for $1 of a company’s earnings. That provides insight into the valuation of a stock and expectations for growth.

Price may be a big factor in how newer investors view a company’s valuation. Suppose company A is $20 a share and company B is $50 a share. At first glance, company A may seem like the more attractive investment. However, price alone can’t paint the full picture, and that’s why investors should use P/E ratios to analyze the companies.

Here’s an example: Let’s say company A has earnings of $1 per share, and company B has earnings of $10 per share. That means company A has a P/E ratio of 20 and company B has a P/E ratio of five. Simply put, $1 of earnings in company A would cost $20, while $1 of earnings would cost $5 for company B. Why pay more for less?

When using a P/E ratio to assess a stock’s value, compare it with other stocks in the same industry because every industry has a different range of P/E ratios. A high P/E ratio is not always problematic because the market may be pricing in greater growth in future years. However, if the P/E ratio is much higher than comparable companies, investors may end up paying more for every dollar of earnings.

Value investors search for companies with lower-than-average P/E ratios hoping earnings will increase and lead to a higher stock price. A negative P/E ratio indicates the company has not reported profits, a common occurrence for new firms. If a negative P/E ratio persists for years, it may become a concern.

Eddie Rajcevic, a member of the tastytrade research team, serves as co-host of the network’s Crypto Corner and Crypto Concepts programs. @erajcevic11