Big Moves in Small Bonds

Talking heads were so taken with the price appreciation of bitcoin that they missed the impressive move in interest rates

Experts often disparage bonds as a second-rate asset class because they’re not as relatable as Apple (AAPL) or as flashy as bitcoin. But bonds have recently presented some opportunities and may continue to make waves as the public worries about inflation and the Fed becomes more active. Last year’s price action alone may be enough to warrant adding them to a watchlist for investors and traders alike.

While most people hear bond and think of the associated interest rate, these products have traditionally been traded in terms of their price. Yet, converting the 30-year bond price of 160 to a 30-year yield of 2% is no easy math. Add in the fact that bonds and yields move inversely, and it starts to become clear why so many traders have stayed away from this market.

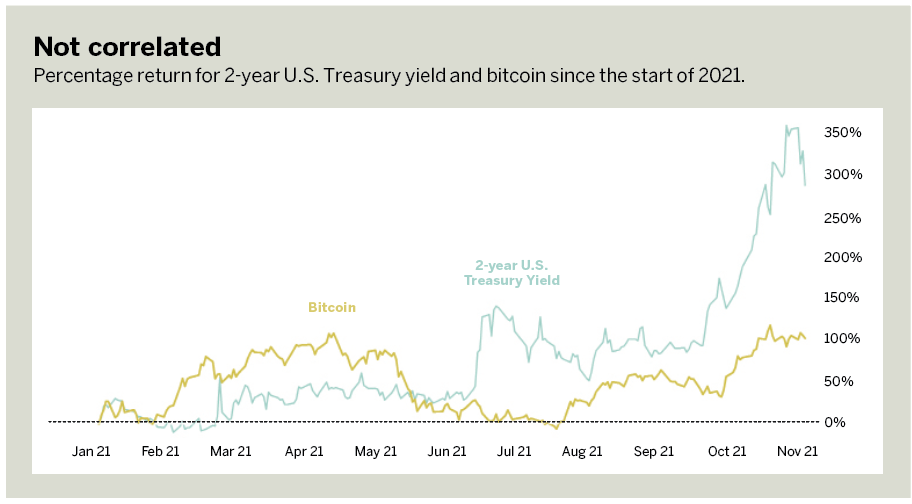

Jargon aside, a confluence of factors has prompted interest rates to creep up from unprecedented lows to levels not seen since before the start of the COVID-19 pandemic. Since the beginning of 2021, for example, two-year U.S. Treasury yields have increased from 10 basis points to more than 50 basis points. Remember that one basis point represents 0.01%, thus 100 basis points equal 1%.

That’s an increase of 400% for interest rates, much greater than the 100% increase in the price of bitcoin over the same period. With extraordinary moves in such a critical asset class, why is there so much hesitation to trade treasury yields?

Part of the hesitancy to try rates is that for the longest time the products were designed for institutional participants. Outside of a few floor traders in Chicago, these instruments were reserved for large portfolio managers and bulge bracket banks because of their humongous size and obscure quoting conventions.

Just this year, however, the Small Exchange introduced a suite of interest rate futures products for the do-it-yourself investor. The small interest rate suite includes two-year, 10-year and 30-year rate futures that look and feel like stocks while providing pure-play exposure to these critical benchmarks.

For day traders and investors alike, these smaller contracts afford manageable size and pure-play access to some of the most pertinent rate benchmarks. To trade the previously mentioned two-year interest rate with the Small Exchange futures contract requires just $88 in margin.

While that 400% increase over a 10-month period may seem daunting, the profit for an investor who bought on the first day of January and sold on the last day of September would have been just $163, an amount appropriate for accounts of varying sizes.

This small sizing makes rates an interesting new product for investors and swing traders, but also a neat scalping vehicle for the day trader who wants to try futures.

With affordable margins, manageable daily moves and unique market exposure, these smaller-sized interest rate futures fit nicely in a wide range of portfolios. Investors can take a long-term position on the direction of rates across the short, medium and long term, while day traders can scalp around binary events such as Federal Open Market Committee meetings in an asset class completely distinct from stocks.

Michael Gough enjoys retail trading and writing code. He works in business and product development at the Small Exchange, building index-based futures and professional partnerships. @small_exchange