Correction Playbook: Leveraging Indices & ETFs When Volatility Strikes

The stock market has experienced a rare second correction in the same calendar year, and as a result, volatility has spiked.

The VIX is currently trading about 30, which is well below the all-time high set on March 16, but also well above the metric’s long-term historical average of about 19.

With uncertainty rising, volatility traders are undoubtedly preparing to deploy a fresh round of short options. However, before jumping into this fresh wave of volatility, market participants may first may to first ensure their appetite for risk matches the positions under consideration.

For example, research conducted by tastytrade suggests that when volatility is elevated, the risk-reward value proposition shifts in favor of index and ETF options, as opposed to options of single stocks.

The reasoning behind this tactical adjustment is rooted in a concept called “idiosyncratic risk,” also referred to as company-specific risk. Essentially, this speaks to the potential for individual companies to make gap moves on highly impacting negative or positive news.

Short volatility traders typically suffer outsized pain when exposed to extreme forms of idiosyncratic risk in single stocks.

Indices and ETFs, on the other hand, are far more diversified, and can therefore insulate investors and traders from company-specific risk. For example, if a single company in the S&P 500 goes bankrupt, the S&P 500 won’t wouldn’t suffer to the same degree as the shares of that single stock.

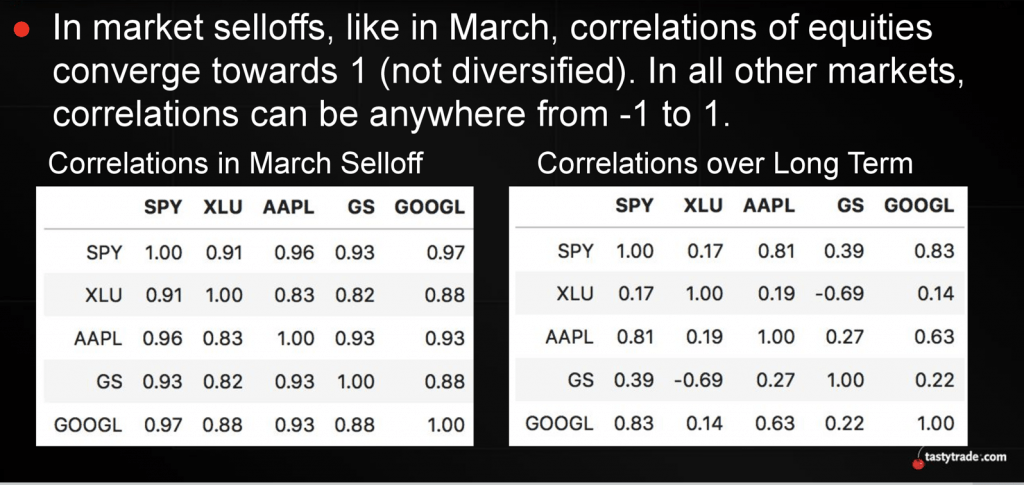

Circling back to high volatility environments, reams of evidence show that when uncertainty is rising, correlations increase. That means asset prices in the financial markets demonstrate less independence in movement, and begin to move more with each other.

tastytrade has conducted extensive research on the relative performance of short volatility positions in indices, ETFs, and single-stocks amidst high-VIX trading environments and the results of this research support a bias toward indices and ETFs during tumultuous, high-correlation periods in the market.

For example, if the economy is deteriorating, and the stock market is whipping around, would a market participant rather be exposed to a single company, or to a basket of diversified companies? Most prefer the latter, especially when the potential “reward” for each (i.e. implied volatility) is elevated.

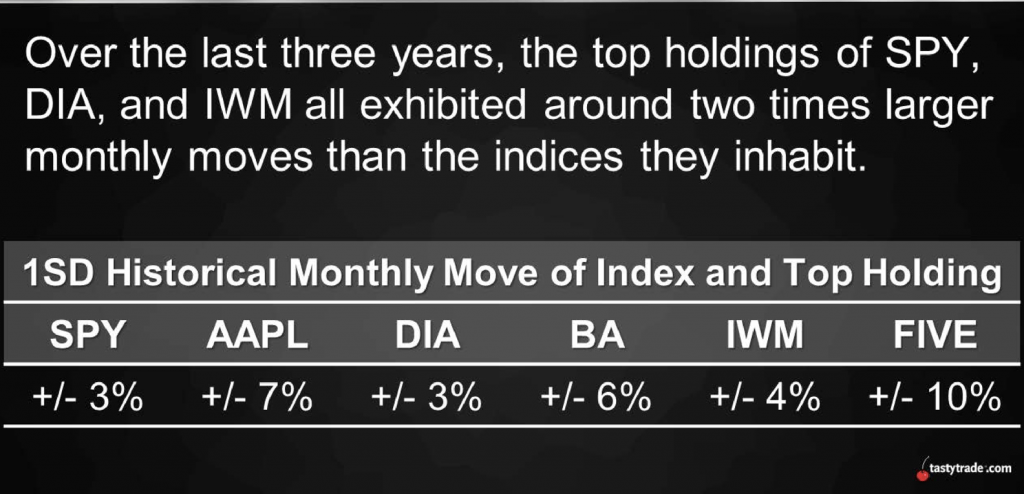

Some market participants might believe they can minimize idiosyncratic risk in single stocks by targeting only companies with larger market capitalizations. Theoretically, mega-caps are better insulated to withstand challenges to a single business line because other segments of the organization can help mask the issue(s).

However, tastytrade research has shown that even large-cap single stocks exhibit significantly larger monthly moves (i.e. more volatility) than the indices they inhabit. As highlighted in the graphic below, the largest single stocks (AAPL, BA, FIVE) have all experienced about two times larger moves as compared to the indices themselves (SPY, DIA, IWM) during the last three years.

Of course there are exceptions to every rule, and there may be instances in which a trader/investor simply can’t pass up an opportunity in a single stock. In those cases, traders may want to be especially disciplined when it comes to risk management, and follow some of these rules of thumb:

- Ensure adequate liquidity in both stock and options

- Trade fewer contracts

- Be less aggressive when selecting strikes

- Consider defining risk through spreads and wings

To learn more about the different risk-reward value propositions offered by single stocks as compared to indices/ETFs, readers are encouraged to review a previous installment of Options Jive when scheduling allows. A new installment of Tasty Extras focusing on the behavior of market correlations in high-volatility environments is also recommended.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of luckbox, tastytrade or any affiliated companies. Readers can direct questions about any of the topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.