Managing Directional Risk with Beta and Theta

When things get weird in the financial markets, as they have in 2020, seasoned investors and traders like to tighten up their adherence to disciplined risk management—particularly as it relates to directional exposure.

Reviewing some of the odd occurrences so far this year, the all-time high achieved in the VIX would likely be at the top of the list. However, one of the speediest corrections and ensuing rebounds in market history would be a close second.

As if all that weren’t enough, the stock market has also been grossly overvalued according to the well-known Price/Earnings Ratio (P/E) ratio. Back on Sept. 1, when the S&P 500 was trading above 3,500, the P/E ratio for the S&P 500 was above 30.

The historical average in the P/E ratio of the S&P 500 is closer to 15, which makes the current investment landscape more than a little confusing. Indexes such as the S&P 500 are exhibiting extremely high valuations, while the underlying economy and business environment appear to be languishing.

Investors and traders who felt the rally was over-extended, and reduced long exposure in August, were rewarded when the stock market pulled back in early September. However, it’s not always so easy to accurately predict which direction the stock market might move, and when.

For this reason, many investors and traders utilize a variety of risk management tactics to hedge directional risk. For example, when P/E ratios in the broad-market indexes (Nasdaq 100, Russell 2000, S&P 500) hit extremes, an investor might have decided to reduce long exposure, or add long exposure, accordingly.

Options traders who are managing more complex derivatives portfolios also have several choices available to them to assist with the management of directional risk. Three of the best-known approaches include:

- Delta-neutral trading

- Beta-weighted hedging

- Theta ratio hedging

The first two tactics listed above, delta-neutral trading and beta-weighted hedging, have been covered extensively by the tastytrade financial network.

Trading delta-neutral involves hedging a given options position “flat delta” using the underlying stock. Traders who embrace delta-neutral philosophy are typically seeking to reduce directional exposure in the portfolio while attempting to isolate the true intent of volatility trading—mean reversion.

Beta-weighted portfolio hedging, on the other hand, allows traders to approximate delta risk across multiple positions (i.e. the entire portfolio), and then estimate an appropriate hedge that reduces undesired directional exposure using an index—preferably one that is highly correlated to the underlying positions in question.

For example, if a portfolio was net long 500 deltas (according to beta-weighting), then 500 short SPY deltas might theoretically be deployed to reduce that directional risk.

Beta-weighted hedging gets its name because “beta” itself measures the systematic risk of a given underlying or portfolio. “Beta-weighting” therefore represents an attempt to quantify this risk, while “hedging” is the action/tactic used to minimize it.

Because underlying prices in the portfolio are constantly on the move, the beta risk of the portfolio must be continuously monitored in case adjustments are needed. This is similar to trading delta-neutral, which also requires ongoing adjustments.

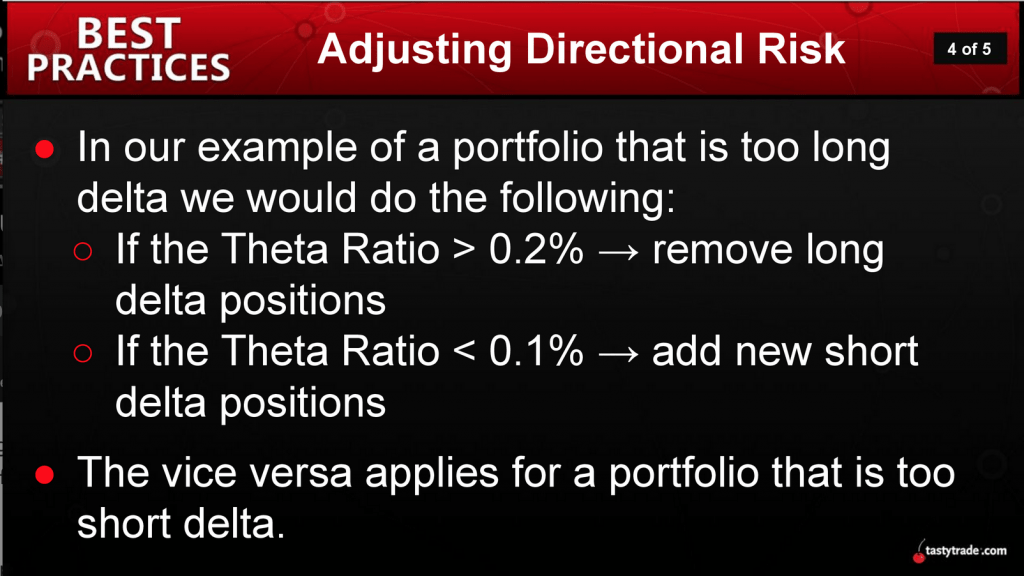

A third approach that traders can use to manage directional risk is the theta ratio. Under this philosophy, market participants use the theta ratio as a guide for potential portfolio hedging actions, as illustrated below.

To learn more about using the theta ratio when hedging directional risk, readers are encouraged to review a recent installment of Best Practices on the tastytrade financial network.

Additional information on delta-neutral trading, as well as beta-weighted hedging, can be found using the following links:

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of luckbox, tastytrade or any affiliated companies. Readers can direct questions about any of the topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.