Short Side of the Moon

Feeling bearish? Options and futures can beat short-selling. Here’s how.

There’s something suave about shorting the market, whether it’s fading an earnings pop, selling a pandemic rally or jumping into a long squeeze. It’s risky, contrarian and sometimes highly profitable.

As the adage goes, markets take the stairs up and the elevator down. While short-selling provides an obvious and direct way to profit from a decrease in a market’s price, it’s not the most capital-efficient or strategic approach. So, before short-selling the next moon stock, consider alternative bearish strategies with futures or options.

Short-selling often comes with sneaky costs. Unlike long stock positions, short-selling exposes traders to unlimited risk, as the price could theoretically rise to infinity. That potential risk prompts many brokerage firms to require a margin account and substantial initial capital outlay to enter the short.

Some firms, for example, charge as much as 150% of the size of the short. In other words, they require traders to post $150 to short $100 worth of stock. Then, when the market becomes more volatile—or, more interesting—the broker can declare it hard-to-borrow and either limit further short-selling or increase the capital required to trade it.

Capital is a trader’s most valuable asset, and these costs can really add up. But futures contracts can serve as a lower-cost alternative to gain short market exposure.

Say it with futures

Futures, like options, are derivatives contracts, and they enable traders to express a market opinion much more easily and cheaply than they can with stocks. Because futures are contracts, there is no borrowing and it’s just as easy to go long a market as it is to go short.

Plus, futures have no hard-to-borrow designation that can stop trades when things get interesting. Not only is there no borrowing cost, but for an equivalent amount of exposure, futures require just a fraction of the amount stocks or ETFs would require because of their efficient margining methodology, which calculates gains and losses that could occur.

One drawback of shorting with futures is the lack of choice. While there are stock index futures, there aren’t futures for single stocks. Thus, traders who want to short a moon stock like Tesla (TSLA) would have to sell an index future that contains Tesla stock, like the Small Stocks 75. For both capital efficiency and direct exposure, traders might consider options contracts.

The options option

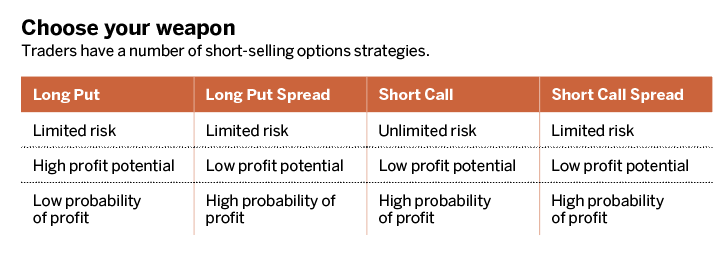

Options bring pure exposure and an element of strategy to trading that’s inaccessible through stocks and futures. Traders can use options to short a market in many ways, but the simplest is to buy a put option.

Another way to get short with options is to sell a call, which has a similar risk profile to shorting stock but a higher probability of profit because of positive time decay.

Combining the two types of options, traders can also construct bear put spreads (put debit spreads) or bear call spreads (call credit spreads), which have defined profit and loss amounts, high probabilities of profit, and low capital requirements.

Thinking beyond stocks affords traders more flexibility when deciding to get short. Don’t miss out on the next big short because of the hard-to-borrow restrictions of prohibitive capital requirements. Instead, consider more capital-efficient or strategic choices with futures and options.

Michael Gough enjoys retail trading and writing code. He works in business and product development at the Small Exchange, building index-based futures and professional partnerships. @small_exchange