This is No Amazon Delivery

Trading crude oil presents daunting challenges when its price falls into negative numbers and the owner must take delivery. Here’s a look at the high cost of free oil.

The COVID-19 pandemic’s major disruptions to the global economy have trickled down to the global stock markets and caused massive spikes in volatility.

For reference, the U.S. stock market plunged roughly 34% in less than a month and then proceeded to make back half of its losses in the following month.

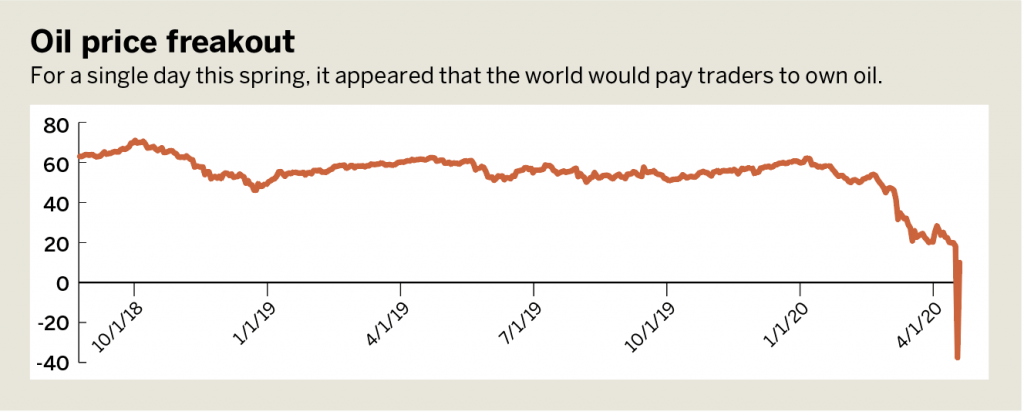

If that didn’t instill enough fear among individual investors, what came next could be described as the single craziest moment in commodities markets history: negative oil prices. Essentially, getting paid to buy oil.

But don’t immediately log into a brokerage account to place an order to buy crude oil and expect to receive thousands of dollars for doing so. First, traders should understand why oil became “free” in the first place.

To understand how the main U.S. crude oil benchmark works, take a trip to Cushing, Okla. That’s where traders pick up oil when they buy a contract and hold it through expiration. The one catch is that storage and transportation of oil is NOT included with the free oil. That means the recipient has to pay to store or transport the oil. To further complicate matters, a “barrel” of oil does not come in one of those fancy 55-gallon drums pictured here. The trader is paying only for the liquid oil itself.

This means anyone who takes possession of the oil has to transport and store it immediately. It’s not OK simply to collect thousands of dollars for buying the oil and then pour it into the streets, rivers or lakes and then go forth and call it a profitable day.

So, why not find a place to store it and a way of getting it there? Storage and transportation, like oil, are commodities, meaning that their price is determined by supply and demand.

When the COVID-19 pandemic broke out, the demand for oil dropped by so much that oil producers did not have time to adjust their output in the short term. That caused demand for oil storage and transportation to skyrocket, while the supply of storage and transportation is more or less fixed, especially in the short term.

The result? A massive increase in the price of storing or transporting oil means that even taking into account the money received from buying the oil, the associated costs rose a lot.

So, what does this mean to the individual investor? If things seem too good to be true, they probably are. Looking at oil and saying, “I should buy it because it can’t go below zero,” isn’t an option because the market has demonstrated that negative prices can occur.

Anyone looking to trade oil for its high levels of volatility may consider spreading off risk via options or back-month contracts. Better yet, investors who don’t fully understand how the contract trades should stay away completely.

Many other energy products aren’t as volatile, are still liquid and settle to stock instead of physical crude oil. Some examples are energy exchange-traded funds (ETFs), such as Energy Select Sector SPDR Fund (XLE), SPDR S&P Oil & Gas Exploration and Production ETF (XOP), and VanEck Vectors/Oil Services ETF (OIH). Each of these energy ETFs carries decently high implied volatility and maintains a somewhat strong correlation to crude oil.

Anton Kulikov is a trader, data scientist and research analyst at tastytrade. @antonkulikov97