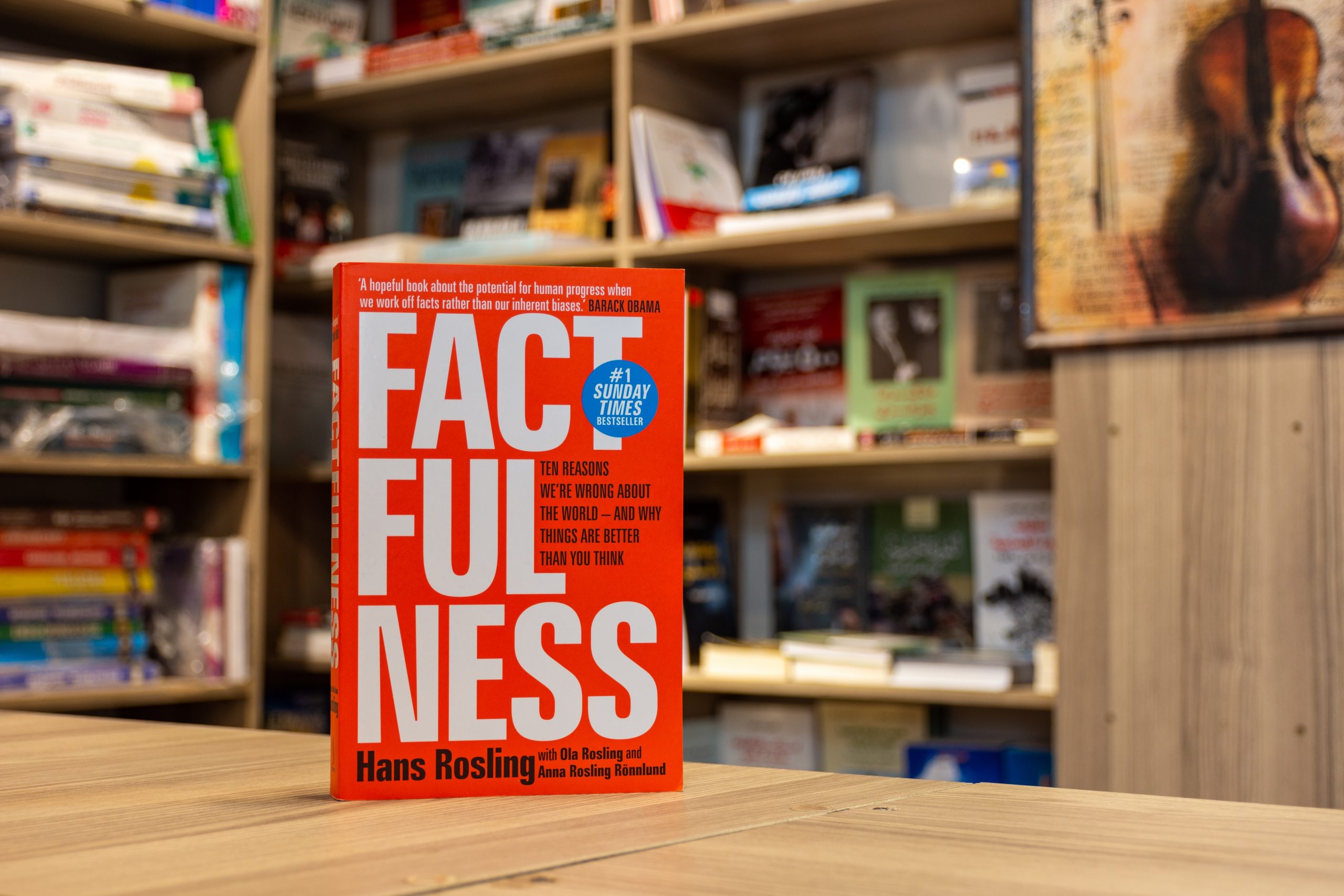

Can These Two Trading Strategies Really Predict a Stock’s Direction?

Momentum and insider activity are anomalies that defy the efficient market hypothesis—a theory that says you can’t win big

The efficient market hypothesis (EMH) holds that stock prices reflect absolutely every bit of public information, leaving zero room for investors to make additional profits—let alone beat the market.

If that’s true, hedge funds should shut down, active equity managers should quit, and everyone should either passively purchase index funds or trade options the tastylive way. But even though some academics may buy into the EMH, traders aren’t about to stop trading. The fact is that active investors are always looking for identifiable and sustainable advantages to guide their trading.

After all, the price/earnings (P/E) ratio indicates companies trading at lower P/E multiples often generate higher returns. Plus, the neglected firm...