Predictions for 2023

After learning to live with the totally unexpected in 2022, Luckbox Magazine makes its annual outlier forecasts for another wild ride

FINANCIAL MARKETS AND THE ECONOMY

Janet Yellen steps down as treasury secretary as inflation remains stubbornly elevated. Concerns arise that the Federal Reserve may need to tolerate 4% to 5% inflation in the coming years. The U.S. runs a massive deficit again. Inflation sits north of 4%. The dollar remains one of the top-performing assets.

Tensions between the superpowers escalate because of the Biden administration’s decision to restrict China from importing advanced U.S. semiconductors. China moves on Taiwan.

Russia and Ukraine strike a peace deal. Russia annexes Crimea, and Kyiv declares neutrality while renouncing ambitions to join NATO.

The Fed hikes interest rates to 5.5% to crush aggregate demand, resulting in another leg down in the market. The markets find a bottom in 2023—likely in the first half of the year.

As the financial markets form a bottom, community banks trading for well under their liquidation value become a favored position of retail investors looking to capitalize on deal flow.

After being hammered by the Fed’s rate hikes in 2022, Palantir Technologies (PLTR) turns around to become one of the top-performing stocks of 2023, thanks to increases in defense and cybersecurity spending.

Crude oil’s bottom: $75 in a demand-driven crush. Oil’s top: $155 thanks to supply shortages.

The investment trend of the 2020s emerges: energy, weaponry, lithium, uranium and land. Billionaires continue to gobble up commodity resources in farming, water and even rare earth metals.

SPORTS

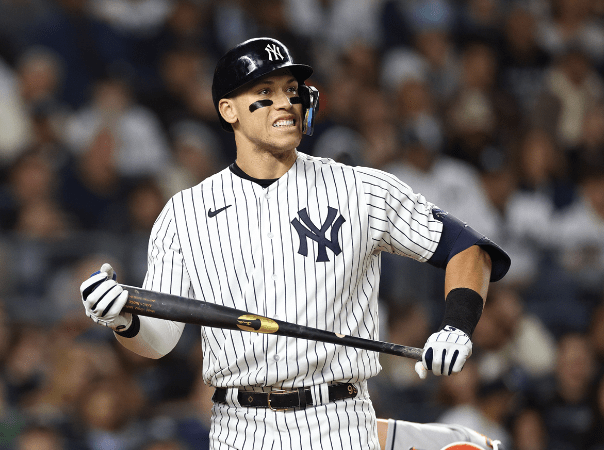

Aaron Judge shatters the record for a Major League Baseball contract, inking an eight-year deal averaging more than $40 million per year … with the San Francisco Giants. He never hits more than 50 home runs in one season again.

The road to the Super Bowl runs through Buffalo and Philadelphia, but neither team makes it there. The Kansas City Chiefs win LVII, but most people spend the next day talking about the “Rihanna halftime show controversy.”

Despite losing to Tennessee in 2022, the Alabama Crimson Tide wins the SEC West, defeats Georgia to win the SEC championship and bests Ohio State to win the national title. Doesn’t this feel inevitable?

In horse racing, Americans meet Cave Rock, a Bob Baffert horse that’s the son of the great Arrogate. If permitted to race, Cave Rock wins two of the three legs of the Triple Crown.

The New York Rangers frustrate fans with a loss in the Eastern Conference Finals for the second consecutive year. The Calgary Flames lift the Stanley Cup in a convincing series win over the Carolina Hurricanes. Colorado Avalanches’ center Nathan MacKinnon wins the Conn Smythe trophy.

POLITICS

Following months of diesel and heating oil supply shortages, Congress introduces a bill to create strategic reserves of finished petroleum goods. It’s a move that resembles the way Europe manages its emergency fuel supplies. The bill passes the House but stalls in the Senate, thanks to lobbyist intervention.

The cost of complying with Securities and Exchange Commission restrictions on emissions causes another bust on Wall Street for initial public offerings. The technology IPO market is worse than during the Great Recession of 2007-2008.

At the end of 2023, prediction market traders at PredictIt.org rank Ron DeSantis as the top contender for the 2024 Republican presidential nomination and Kamala Harris as the lead candidate for the Democratic presidential nomination.

TECHNOLOGY & SOCIAL MEDIA

Companies deploy artificial intelligence to track work-from-home employee productivity. Mistrust increases dramatically as companies attempt to bring workers back to the office.

The metaverse finds its mojo around gaming, porn, live entertainment and travel. Mark Zuckerberg steps aside and Meta (META) names a new CEO.

Institutional investors petition the SEC and other financial agencies to alter the rules for initial public offerings.

They complain that the Snap (SNAP) IPO in 2016 gave virtually all of the stockholder voting power to the co-founders. It happened because the terms of the IPO made it impossible for any institution to own enough shares to provide guidance or press for changes at the public company. Yet investors were forced to hold the stock through Index funds. Snap’s stock moved down 90%, and the petitioners don’t want to be caught up in that type of drop again.

Roughly 10% of reading glasses connect with the internet, creating a new device susceptible to hacking.

The Kanye-Parler deal fails to go through.

Bitcoin finds its low at $16,000 in 2023 but finishes the year at $24,000. Ethereum outperforms its rival, pushing back to the $2,500 level or higher, based on the Fed’s policies.

Twitter creates multiple tiers of screens similar to Google Search to filter out bots, racism and extreme speech—the same way Google filters out pornography. But Elon Musk’s true intentions become apparent as Twitter becomes a crypto-embracing payment platform. Revenues exceed $7 billion by 2024.