Death, Taxes … Healthcare Inflation

Customer lifetime value in the health insurance sector has a hidden advantage

Healthcare. It’s the ultimate “cradle to grave” industry. This sector covers all stages of the mortal coil, from the moment Americans are born to their final breath.

As a necessity, it enjoys nearly continuous demand and thus has a high customer lifetime value (CLV). That helps to propel strong cash flow, low customer acquisition costs and dynamic pricing. But it’s not just the strong demand that favors healthcare investors.

It’s also powered by soaring prices. Demographic and policy shifts in the last two decades have caused increasing healthcare price inflation. That has boosted profits while driving consolidation.

Let’s explore the role of CLV in the healthcare sector and note one critical metric investors should consider when evaluating two terrific companies.

CLV in healthcare

Customer lifetime value estimates the total expected revenue from a customer relationship.

The figure helps companies make strategic decisions. It’s used in marketing, customer acquisition, retention and more. Consider these healthcare CLV questions:

- Where should companies build hospitals?

- What factors influence manufacturing in the sector?

- Which drugs should biotech giants acquire to diversify and amplify their portfolios?

While some critics may question the line between ethics and profitability in healthcare, the metric remains one of the most important mechanisms for expanding sector’s products and services. In addition, the focus on CLV has drastically improved customer experiences and helped the industry communicate and serve individuals.

Take health insurance for example. Healthcare insurers use many methods of measuring CLV. They use data analytics to study policyholder data, including premiums, claims and renewals. They also use customer segmentation to identify the CLV of demographic groups.

Finally, predictive modeling incorporates machine learning and analytics to forecast future behavior and revenue based on historical data.

Health insurers’ CLV

To calculate CLV, health insurers employ a three-part multiplication process.

The first calculation is the average premium per policy period (APP), which measures the premiums the policyholder pays per period. Next, we calculate the customer retention rate (CRR), which is the percentage of policyholders who renew their policies. Finally, we measure the average policyholder lifespan (APL), which is the average time a policyholder stays with the insurance company.

Multiply the three and you get a rough calculation of the CLV for a company like UnitedHealth Group (UNG) or Cigna (CI). Consider an insurance company with an APP of $8,500, an 80% retention rate and an APL of 10 years.

Multiplying all three figures in the CLV formula, policyholders generate $68,000 in revenue on average over their lifetimes. However, this estimate is much lower than industry standards. According to CustomerGage, the average insurance company’s CLV is $321,000, while the average healthcare consultancy’s CLV is $330,000, according to 2023 numbers.

Such a large figure underscores the importance of retaining long-term customers.

Naturally, these are estimates. But how does a company in this sector boost its overall CLV? Companies use CLV to optimize customer acquisition, focusing on high-value segments. They improve retention rates by personalizing services and providing loyalty programs.

They also tailor product offerings to these high-value customers. For instance, a health insurance company might find family plans provide a higher CLV than individual plans.

The company may alter its business model to include new family policies that provide greater benefits, such as wellness programs and preventive care, which can boost revenue. In addition, a company may expand into new markets where more American families are moving, and heads of households are working.

The goal is to boost retention rates and increase CLV.

A closer look at Cigna

Health insurance giant Cigna illustrates the “cradle to grave” business model.

Cigna is a global health services company known best for its insurance products, such as health, dental, disability, life and accident insurance. The company operates in more than 30 countries (many with single-payer healthcare).

Cigna’s business model is designed to engage customers throughout their lives—it is the embodiment of “cradle to grave.”

The company offers health insurance for newborns and pediatric care. It also offers full insurance and wellness programs for adults and their families. It provides Medicare Advantage plans and senior care for the elderly.

It also offers access to medical support in over 200 markets and territories, including a global network of more than 1.5 million hospitals and clinics.

The streamlining of these various segments helps promote a high Customer Lifetime Value.

The concept of CLV isn’t limited to a company’s profitability. Cigna has looked outside the business lines to determine the optimal ways to boost CLV through research. It has engaged in traditional customer research, like surveys and focus groups, as well as data mining and analytics.

This has enabled the company to personalize customer services, determine additional benefits they would enjoy, and discover the optimal way to communicate with patients (over the phone, email, for example).

Such personalization can dramatically boost the probability that customers will extend their relationship with the insurer. These processes are not just limited to selling but also to continuous engagement with their clientele.

The hidden factor in healthcare

The increase in consumer engagement to boost retention isn’t a healthcare-specific focus. However, one additional metric will boost their CLV. Companies should add it—price inflation.

Over the last 40 years, the demand for healthcare services has been relentless and growing. Prices have skyrocketed. An aging population and chronic diseases drove prices higher, but so did advances in medical technology and growing awareness of health and wellness.

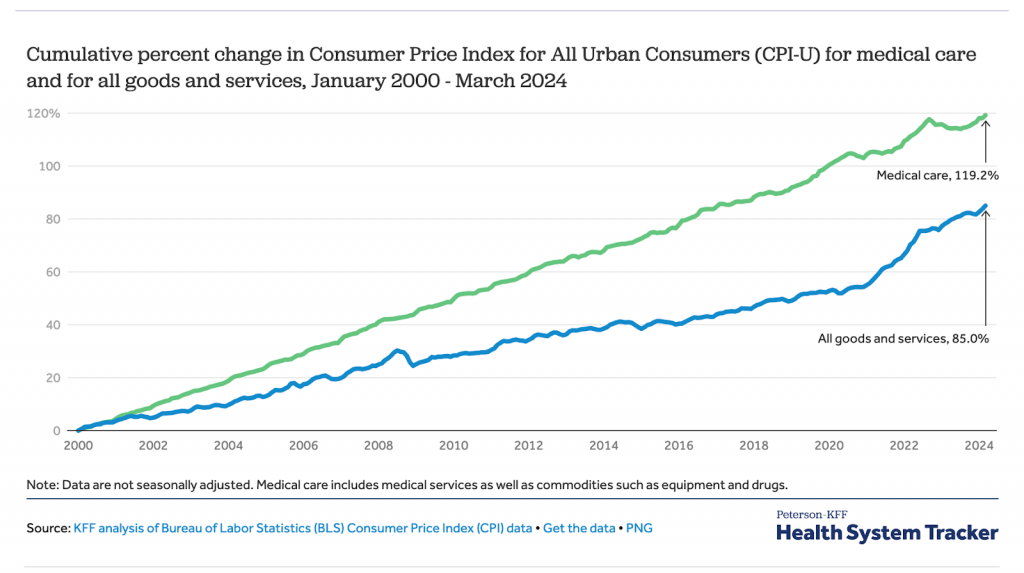

Over the last 24 years, medical care inflation has drastically outpaced inflation of all goods and services in the United States. Between January 2000 and March 2024, medical care inflation increased by 119.2%, compared to a broader 85% increase in gross domestic product (GDP).

While healthcare price inflation has been outpacing total U.S. total ever since the Census began tracking figures in 1978, we have witnessed two significant trends act as rocket fuel for the sector since the great financial crisis of 2007-2008.

From June 2009 to March 2024, the cost of medical care services increased by 53.4%, outpacing total consumer price index (CPI) gains of 45.1%. In addition, health services PPI registered at 39.6%, and healthcare services PCE at 31.8%, according to Peterson KKF’s Health System Tracker.

What’s driving this inflation? The simple answer is that it’s the same factor that’s driven most inflationary practices over the last three days: Inflation targeting (started in 1993) that accelerated under quantitative easing beginning in 2009.

Another factor was introduced in early 2010 was the passage of the Affordable Care Act (ACA), commonly known as Obamacare, which profoundly changed healthcare costs.

The ACA has drastically increased the number of insured individuals because of subsidies, banned companies from rejecting patients with preexisting conditions, and stressed providers and insurers.

Naturally, costs rose, and so did revenue and profits for insurance companies.

While the decision to alter rules around pre-existing conditions and subsidize more insurance coverage granted access to healthcare for more Americans, it also propelled a massive jump in premiums. Between 2010 and 2020, the average annual premium for employer-provided family coverage surged by nearly 55% from roughly $13,770 to $21,342, according to the Kaiser Family Foundation (KFF). That growth represented a 4.5% jump annually during that period.

KFF says that between 2020 and 2023, premiums jumped another 22%, bringing total coverage to $23,968 for family coverage.

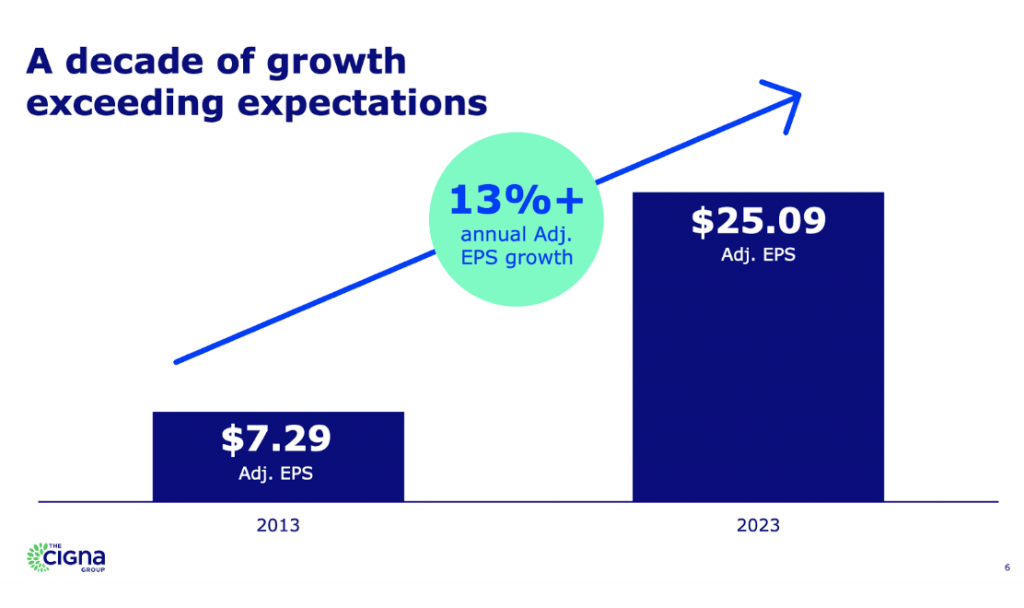

Is it any wonder that since the ACA began in April 2010, shares of Cigna have surged more than 800%, compared to the S&P 500’s return of 342%?

From 2013 to 2023, the company reported an annualized adjusted earnings per share (EPS) growth of 13%. This took adjusted annualized EPS from $7.29 per share to roughly $25.09 per share. It’s good to be in business with the federal government.

Cigna isn’t the only beneficiary of this surge. Shares of rival UnitedHealth Group (UNH) are up more than 1,460% since April 2010, according to Finviz, a stock screener and research site.

What else helped propel price inflation? The ACA also imposed new taxes and fees on healthcare providers, including new fees on insurers and medical-device makers.

Companies pass these costs along to consumers, which has fueled higher premiums and out-of-pocket expenses. However, these device makers haven’t benefited as much as health insurance companies.

Medtronic (MDT) stock, for example, has been up only about 77% since the passage of Obamacare.

The wrap-up

Healthcare inflation can act as rocket fuel for a customer’s lifetime value on a nominal basis. Inflation hurts consumers, yet it can benefit healthcare company shareholders.

Inflation fuels higher prices for goods, increasing revenue for healthcare companies as the prices for medical treatments, drugs, and healthcare services rise. Should the pace of prices outpace the increase in corporate costs, this can boost profit margins and increase the CLV.

In addition, customers tend to prioritize spending on essentials during periods of inflation, including healthcare. Because of the non-discretionary nature of these expenses, this can help propel longer retention periods. In addition, customers may choose longer-term healthcare plans or subscriptions to lock in prices, guaranteeing revenue.

The last decade has proven that healthcare remains a source of perpetual growth and demand. With the government continuing to fuel price inflation through quantitative easing, support, and substantial amounts of subsidization, the sector remains a terrific source of strong margins and customer lifetime value.

Garrett Baldwin, a commodity and trade economist, serves as Luckbox editor-at-large. He is the author of Postcards from the Florida Republic on Substack, which focuses on insider buying and momentum trading.