Fed ‘Pivot’: What to Expect in the Stock Market

In May, the Federal Reserve is expected to raise benchmark interest rates by another quarter-percentage point, while also announcing a potential pivot away from the current rate-hiking cycle.

The financial markets have been hyper-focused on interest rates and inflation since March 2022, when the U.S. Federal Reserve first started raising benchmark rates to combat record-high inflation.

But the Fed is expected to step away from its hawkish approach soon, potentially ending the current rate-hike cycle. That would represent a major shift and would likely reverberate through international financial markets.

The Fed’s next meeting is scheduled for May 2-3, at which point leaders at the U.S. central bank are expected to raise rates by another quarter-percentage point, bringing the federal funds rate target to 5.00%-5.25%.

Many analysts and traders project this could be the final interest rate hike of 2023. Interest rates futures markets currently project that the Fed will hike rates at the meeting in May, and then potentially cut interest rates two or three times before the start of 2024.

However, that’s only one of the many possible scenarios that could play out. It’s also possible that after meeting in May, the Fed could be forced to raise rates further in June or July—especially if economic data continues to reflect persistently high inflation.

The Fed is walking a fine line. They’re trying to cool inflation, but only to a certain degree. The Fed certainly doesn’t want to overshoot on rates and trigger a fresh bout of deflation—the latter of which is characteristic of recessions and depressions.

Stock market performance after previous Fed pivots

While the exact date of the Fed pivot isn’t clear, consensus opinion suggests the Fed will pivot at some point in early summer.

As such, it’s reasonable to question how the stock market has historically performed after previous shifts in U.S. central bank policy.

First, it’s important to define a Fed pivot. In this context, a Fed pivot refers to a shift in interest rate policy, which is one of the primary tools the Fed uses to guide monetary policy in the U.S.

When the economy is floundering, the U.S. central bank has historically cut benchmark interest rates to help stimulate increased borrowing, which in turn promotes economic growth. However, when the economy overheats—as observed in the wake of the COVID-19 pandemic—the Fed typically raises benchmark rates to disincentivize borrowing.

The most recent Fed pivot occurred in early 2022 when the Federal Reserve hiked rates to combat inflation. Prior to that, the Fed pivoted in 2020, when it cut rates dramatically to prop up the economy at the onset of the COVID-19 pandemic.

Looking at that small sample size, the stock market reacted definitively in both cases. Back in 2020, the stock market rallied in sharp fashion after the Fed provided extensive monetary accommodation (i.e. near-zero interest rates) to the underlying economy.

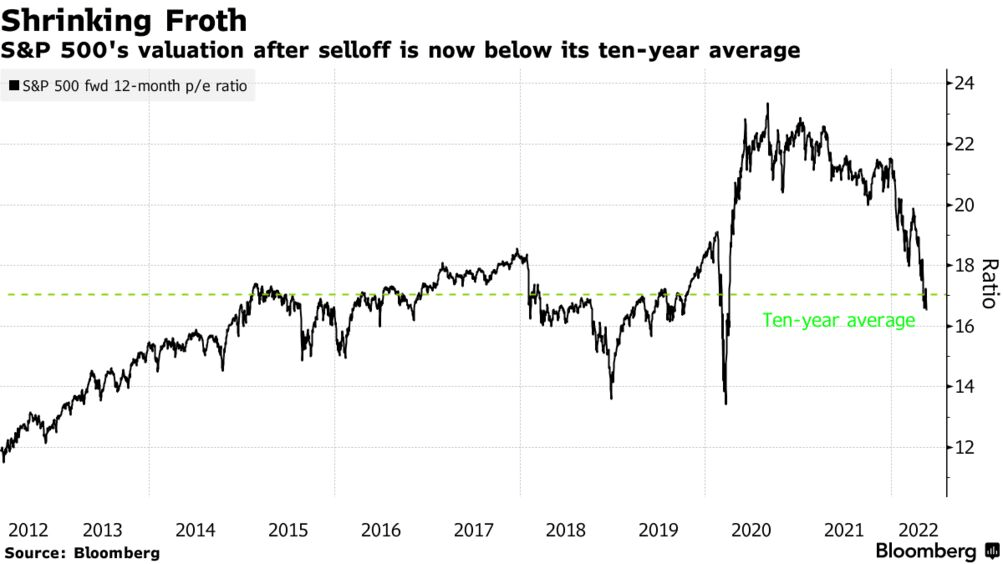

Then, in 2022, when the Fed pivoted toward higher rates, the stock market suffered. Last year, the annual return in the S&P 500 was negative 20%, while the annual return in the Nasdaq Composite was negative 33%.

Notably, the last two Fed pivots were dramatic in nature. In 2020, the Fed dropped rates to zero in a matter of months, and in 2022, the Fed made it clear they’d raise rates significantly.

For the upcoming Fed pivot, leaders at the central bank have suggested interest rates could remain elevated for some time. That indicates that the upcoming Fed pivot will be far less dramatic—the Fed will ostensibly stop raising rates, but the current environment of elevated rates will persist.

For this reason, the impact on the stock market could be much more tempered as compared to the last two shifts in Fed policy.

Looking further back in history, performance in the S&P 500 shows that previous Fed pivots have been a bit of a mixed bag. When the Fed pivoted away from rate-hiking cycles in 2000 and 2007, the stock market experienced sharp selloffs in 2001 and 2008, as illustrated below.

However, the Fed pivot in the mid-to-late 1990s didn’t have the same bearish impact on the stock market.

From March 1994 to June 1995, the Fed raised benchmark rates from roughly 3.25% to 6.00%, before pivoting away from that hawkish approach in early 1996. In the wake of that pivot, the stock market continued to chug higher for nearly four years.

What’s notable about the mid-to-late 1990s is that interest rates remained persistently high, and that a recession never materialized.

The effective federal funds rate climbed above 5% in November 1994 and remained there until November 1998. The economy didn’t enter recession until well after that, in March 2001.

Why a potential 2023 recession is still the key X-factor

A potential recession in 2023 could influence market sentiment and direction to a greater degree than a 2023 pivot by the Fed. Because the last three times the Fed pivoted away from a rate-hike cycle, the market corrected only when the pivot occurred immediately ahead of a recession—in 2000 and 2007.

In the mid-to-late 1990s, the Fed pivot wasn’t followed by a recession and the stock market never corrected.

Considering all of the above, the onset of a recession—or the avoidance of one—may actually play a greater role in dictating market sentiment during 2023 than the much-ballyhooed Fed pivot.

Interestingly, leaders at the Fed recently noted they expect a mild recession to develop in the U.S. economy at some point later this year.

Moreover, recent data released by the Conference Board Leading Economic Index (LEI) also indicates that the U.S. economy is still contracting and likely headed toward a recession.

A leading economic indicator is a measurable set of data that’s used to help forecast future economic activity. Economists monitor a wide spectrum of leading economic indicators to try and predict changes in the economy before the economy actually shifts in one direction or the other.

In March, the LEI dropped another 1.2% and fell to 108. That marked the 12th consecutive monthly drop in the LEI, and the sharpest month-over-month drop since April 2020.

Adding further context to the data, the Conference Board that produces the LEI published a memorandum on April 12 that stated, “The Conference Board forecasts that economic weakness will intensify and spread more widely throughout the U.S. economy over the coming months, leading to a recession starting in mid-2023.”

So, bullish investors and traders may not want to completely pin their hopes on a 2023 Fed pivot, because a slight shift in the Fed’s policy stance—from hawkish to neutral—may not trigger the uber-bullish shift in market sentiment that many are expecting.

If recessionary forces intensify in the coming weeks and months, the Fed pivot could actually result in a bearish move in the stock market—much like what was observed in 2001 and 2008.

To follow everything moving the markets during Q1 earnings season, tune into tastylive, weekdays from 7 a.m. to 4 p.m. CDT.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastylive or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.