Fed’s Next Decision on Interest Rates Could Hinge on Housing Starts

New housing starts in the United States remain above historical averages, explaining why the Federal Reserve is still raising benchmark interest rates.

In the wake of the recent decision by the Federal Reserve to hike interest rates by another quarter-percentage point, investors and traders need to keep a close eye on monthly housing starts.

Historically, a sustained contraction in housing starts has been one of the most accurate predictors of a recession, in addition to an inverted spread between short-term and long-term Treasury yields.

The term “housing start” hails from the realm of economics, and refers to the point at which a shovel physically enters the ground to build a new housing unit. Housing starts are a key leading economic indicator because they tend to be closely correlated with strength in the underlying economy.

As the economy expands, so too do housing starts—and vice versa.

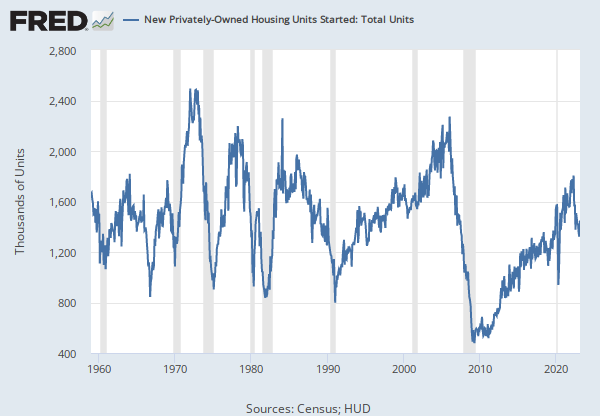

Currently, new housing starts in the United States are roughly 18% lower than they were a year ago. That’s a clear reflection of slumping economic conditions between then and now. But last year, housing starts were at the higher end of the historical range—meaning the current downdraft has brought them back in line with historical averages, as illustrated in the tweet below.

Housing starts are a leading indicator for the real estate cycle, so watching this will confirm whether the next leg down commences in the fall or turns back up. pic.twitter.com/Jwox7VY8CZ

— The Economic LongWave (@TheELongWave) March 29, 2023

Interestingly, housing starts saw a surprise uptick from January to February of this year, which may help explain why the U.S. Federal Reserve stayed the course in its recent decision to raise interest rates on March 22.

From January to February of this year, housing starts increased by about 10%. Last month, the U.S. government reported that roughly 1.50 million privately-owned housing units started their initial phase of construction.

During the last 20 years, monthly housing starts have ranged between roughly 475k and 2.2 million, which means the current level of housing starts is still above the 20-year average.

Clocking in at 1.50 million in February, housing starts are also well ahead of the levels observed during the heart of the 2008-2009 Financial Crisis. Housing starts bottomed out at roughly 475k in April of 2009, which was the lowest monthly total observed in the 21st century, as illustrated below.

The big question is where housing starts are headed from here. Prior to the upside surprise in February, housing starts in the U.S. had dropped for five straight months.

The next report on housing starts is due in mid-April, which will provide important insight into building activity during the month of March. If housing starts slowed significantly in March, that could be a signal that the economy has finally cooled, which could provide the basis for a so-called “Fed pivot.”

On the other hand, another upside surprise in housing starts could compel the Fed to bear down on additional rate hikes.

The next report on housing starts is due on April 18 at 8:30 a.m. EST, while the next report on inflation is due on April 12 at 8.30 a.m. EST. That data will be closely analyzed by leaders at the Federal Reserve. The next Fed meeting on interest rates is scheduled for May 2-3.

To track and trade the U.S. housing market, readers can add the following symbols to their watchlists:

- D.R. Horton, Inc. (DHI)

- Home Depot, Inc. (HD)

- iShares Residential Multisector Real Estate ETF (REZ)

- iShares Core U.S. REIT ETF (USRT)

- KB Home (KBH)

- Lennar Corporation (LEN)

- LGI Homes, Inc. (LGIH)

- Lowe’s Companies, Inc. (LOW)

- NVR, Inc. (NVR)

- PulteGroup, Inc. (PHM)

- Real Estate Select Sector SPDR Fund (XLRE)

- Redfin Corporation (RDFN)

- Schwab US REIT ETF (SCHH)

- SPDR S&P Homebuilders ETF (XHB)

- Toll Brothers, Inc. (TOL)

- Vanguard Real Estate ETF (VNQ)

To follow everything moving the markets, tune into tastylive, weekdays from 7 a.m. to 4 p.m. CDT.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastylive or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.