Trading in Harmony

A couple trades together, but separately, with different returns. Somehow, it works. This is the tale of the very first couple's Rising Stars on the tastylive network.

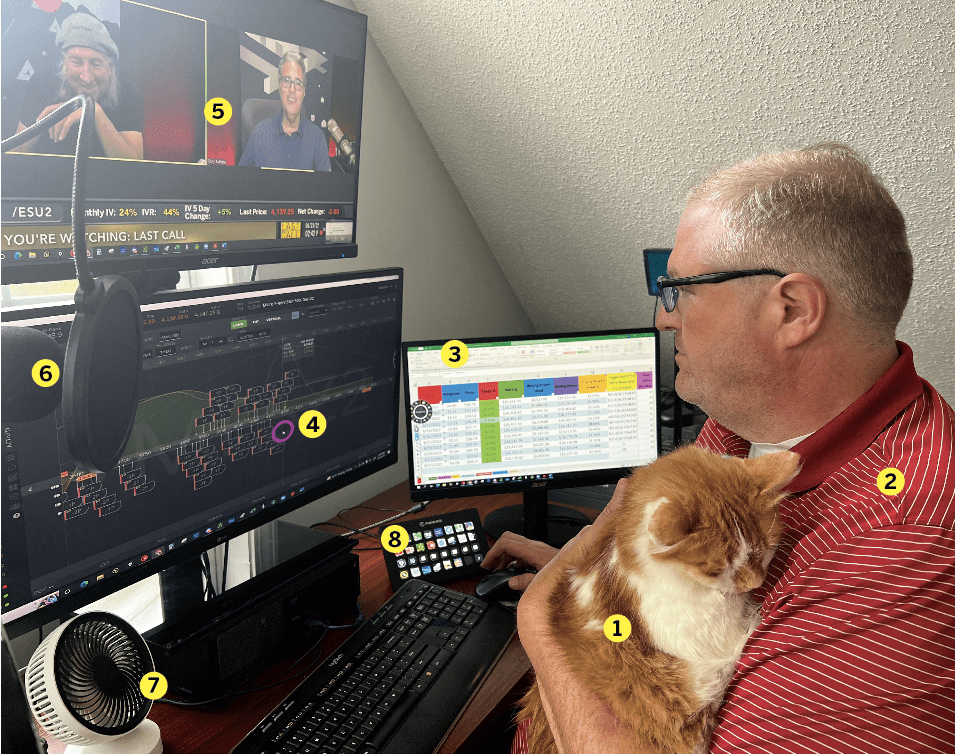

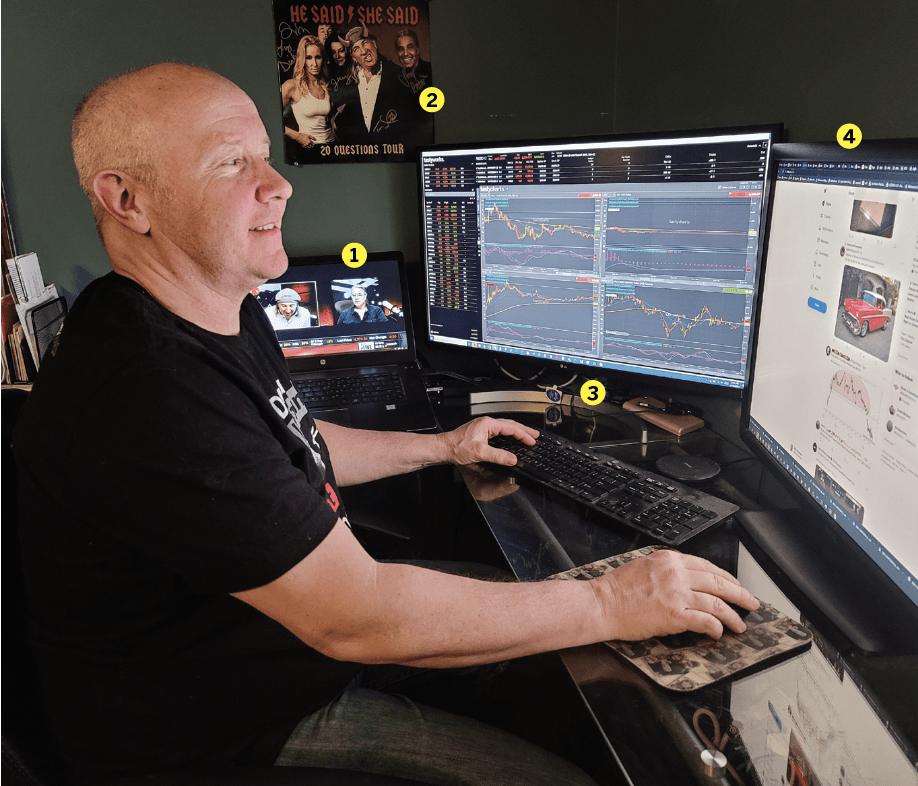

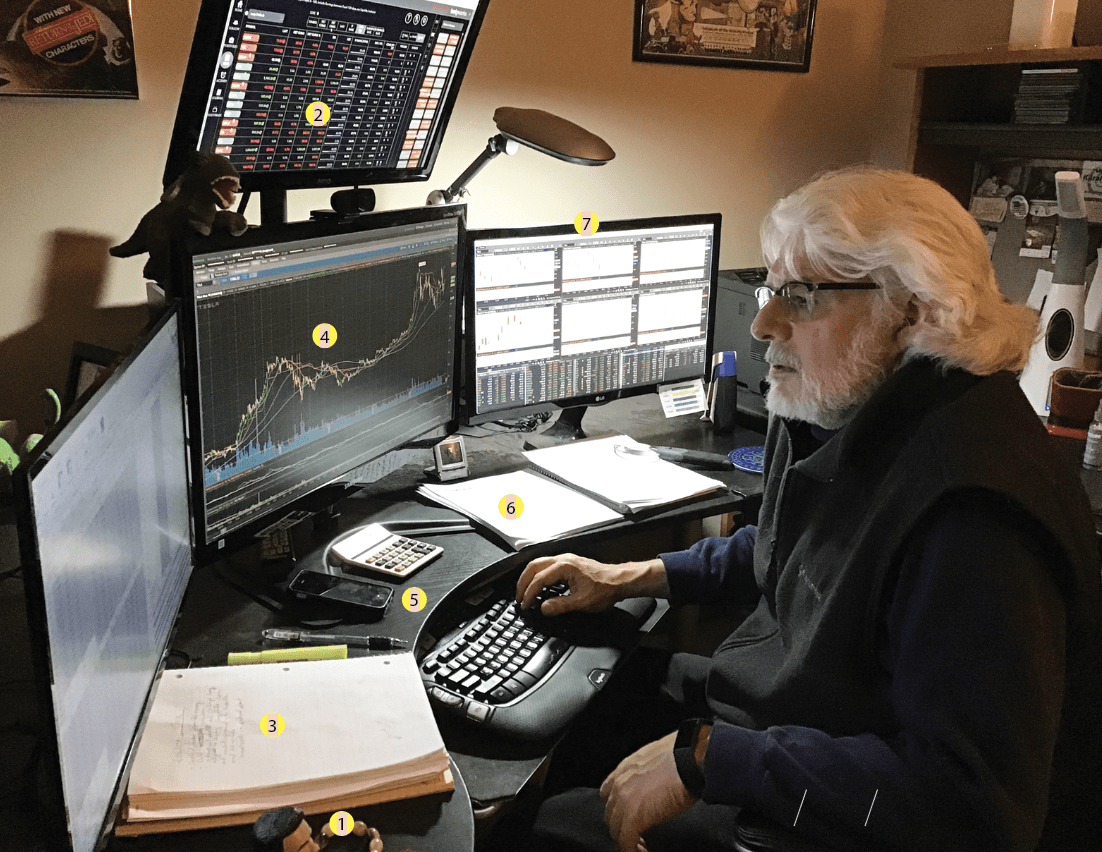

Mark Dunham, 68, trading for five years

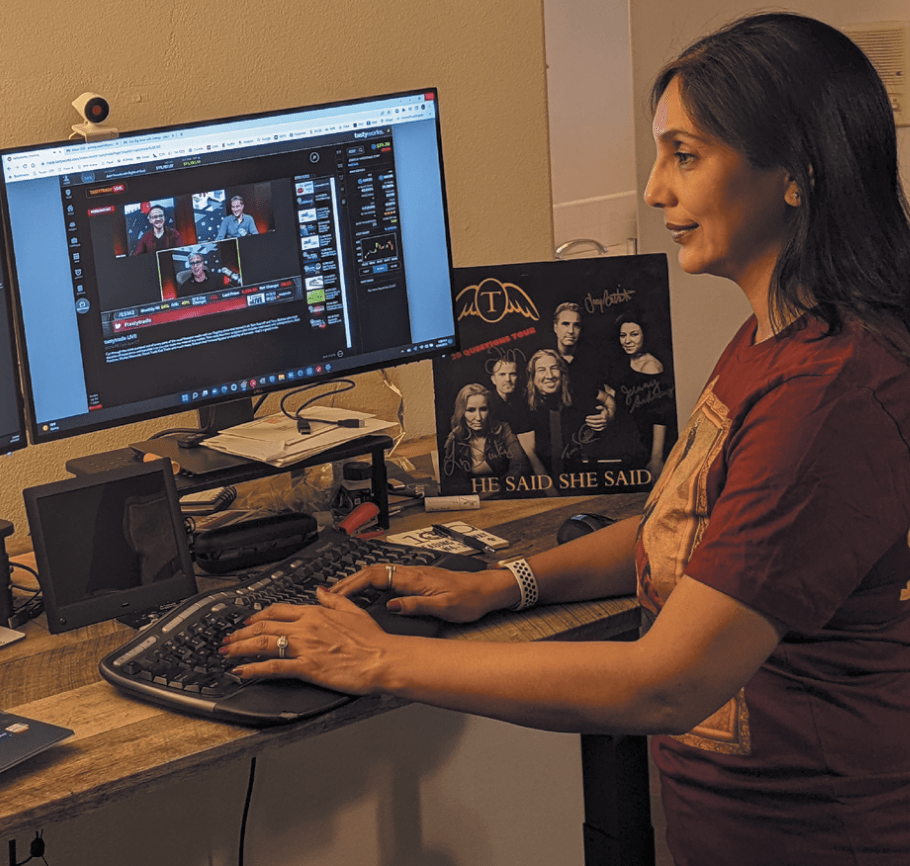

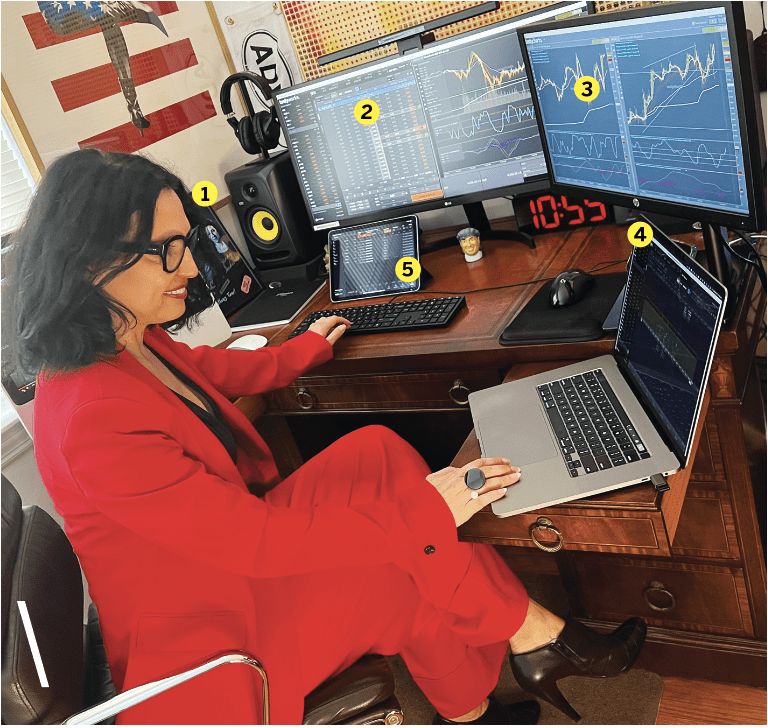

Lucia Kung, 63, trading for five years

“We talk every morning about trading,” says Mark Dunham. “In fact, my wife works in Pacific time, and I work in Eastern time. I wake up first and when she wakes up, her first question to me is, “How’s the market?'”

Luckbox: How did you start trading?

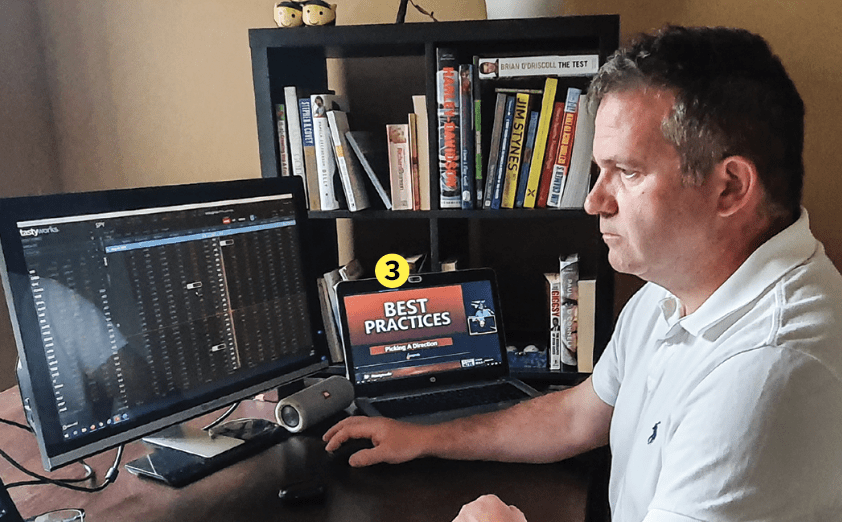

Kung: While learning how to best manage investments for a company I had begun working for. At the same time, I was thinking about how we can manage our financial future. The fees for personal finance services—with their lack of responsibility for your account profit or loss—caused me to learn how the market worked.

Dunham: The fetching Lucia became interested in trading. She decided to attend a seminar regarding learning to become a retail trader, and she stated very clearly, she was going to go whether I went or not! Wanting to maintain my good husband status, I agreed to go. It did take some time, but I realized that trading could be a missing piece in our retirement puzzle and the process of learning began.

Favorite trading strategy?

Kung: Cash-secured put using the wheel strategy. Discount on buying stock, then selling covered calls against my stock positions. Also, using credit spreads and iron condors to collect premiums.

Dunham: Generally speaking, I most often use some type of credit spreads. Short puts, call spreads/put spreads, iron condors, iron flies in the SPX 0DTE trades, short strangles, etc. Depending on market conditions, I will sometimes employ a debit trade.

Average number of trades per day?

Kung: One.

Dunham: For me it’s five to 10. I am the plant manager of our little ranch, meaning I take care of the plants and I have more time to spend trading! She will trade as often as she sees opportunity with her style, which is longer term, more investment.

What percentage of your outcomes do you attribute to luck?

Kung and Dunham: 5%

Dunham: This one is very interesting. We both believe that we make our own luck through our behavior. Putting that aside, luck as we see it in trading occurs when, for example, you intend to sell a call (covered or otherwise) and you hit the wrong button and buy a call by mistake. You notice this later after the stock price has gone up noticeably and realize you own a long call and can close for a profit. We have done this in the past and consider this to be luck.

Otherwise, all of our trades are probabilities and carefully checked before we hit send. I always use statistics (because of tasty) to analyze before placing a trade. Sometimes stuff happens.

Now that I think of it, I might attribute big losing trades to “bad luck.” Maybe.

Favorite trading moment?

Kung: After having seen an occasional mistake pay off, it was even better to learn and use probabilities and have them pay off even better.

Dunham: I guess it would be an ADBE short put that was assigned @ $340. I began selling calls against it and reduced my cost to $319 and sold to close @ $400. Looking back through the corrective lens of time, I should have kept the stock … oh, well.

Worst trading moment?

Kung: Thinking I knew something and realizing it was not true, losing based on my feelings.

Dunham: Without a doubt my worst day was early in my learning process and doing 0DTE SPX trades when there were only M,W,F options. I was selling call and put credit spreads for a few weeks with success! Getting paid three times a week was very cool. Then the SPX turned against me by going down very big at the end of the day; my put credit spread was in the money. So, I confidently thought I would open another put spread below to reclaim some money—after all it won’t keep tanking. The SPX dropped further and put my new spread in the money, and using the same logic I did the same thing again. At the close I had lost $16,000 in a day trading in the SPX. A very good lesson.

Favorite trading book?

Both: The Unlucky Investor’s Guide to Options Trading by Julia Spina

Dunham: I have only read two trading books: Trading in the Zone by Mark Douglas, and Julia Spina’s The Unlucky Investors Guide To Options Trading. Both are good, but Julia’s book has more relevance to options trading in my opinion.

Kung: Being a CFO, I am very interested in the math behind trading.