From Teacher to Trading: Meet Ross Young

He’s the latest active investor profiled in tastylive's Rising Stars series

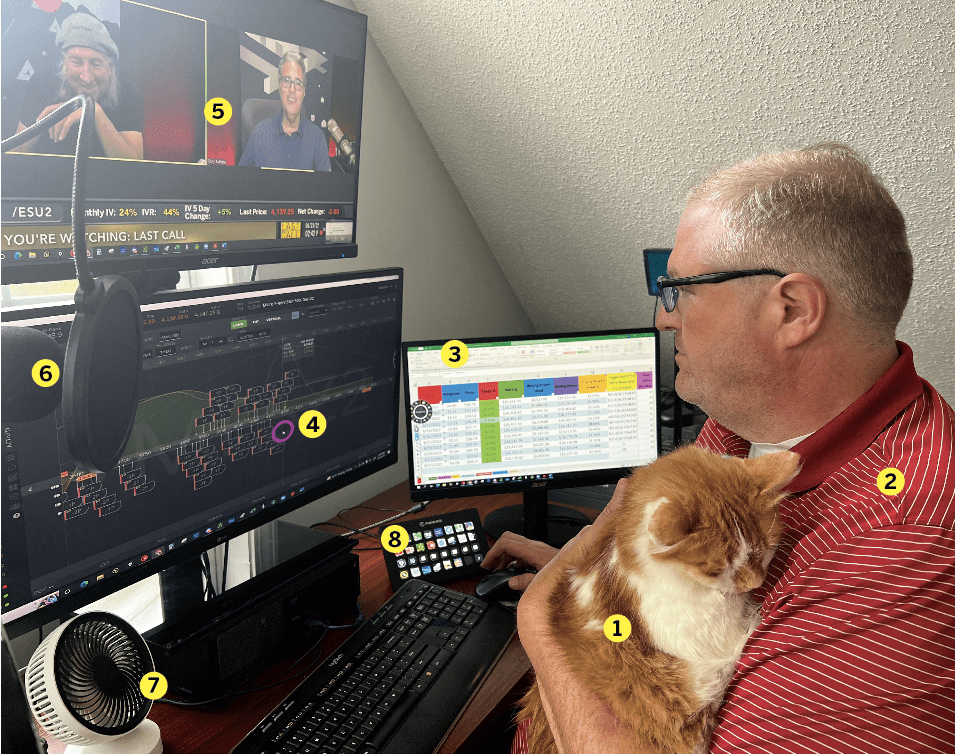

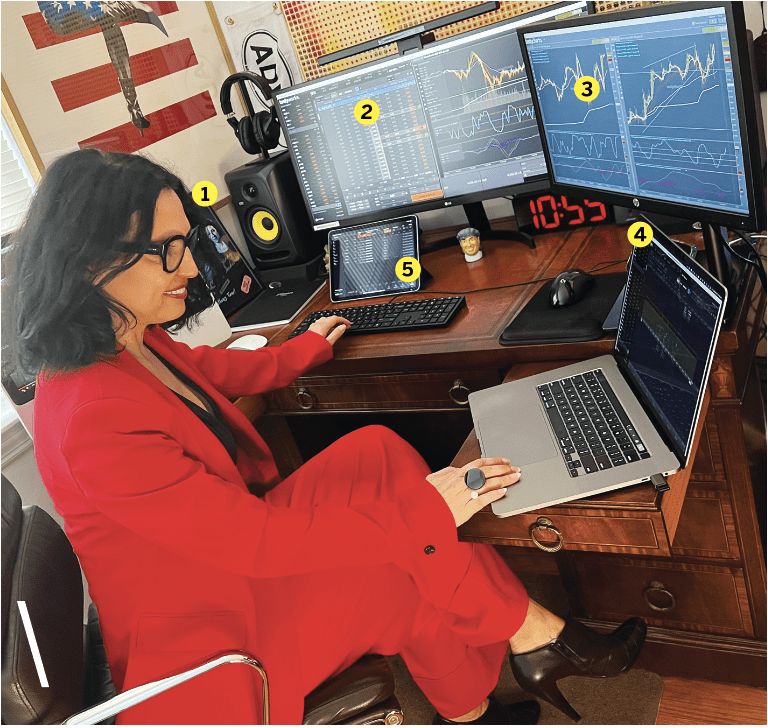

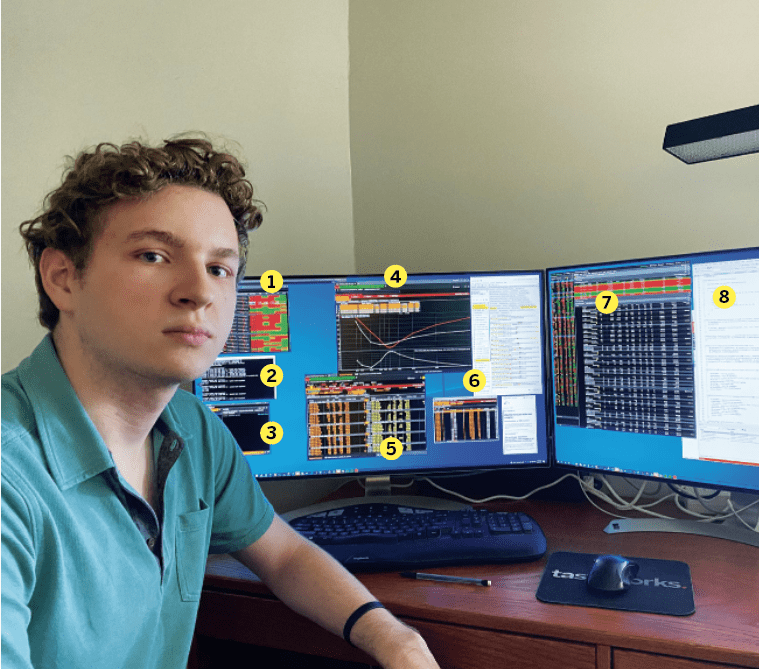

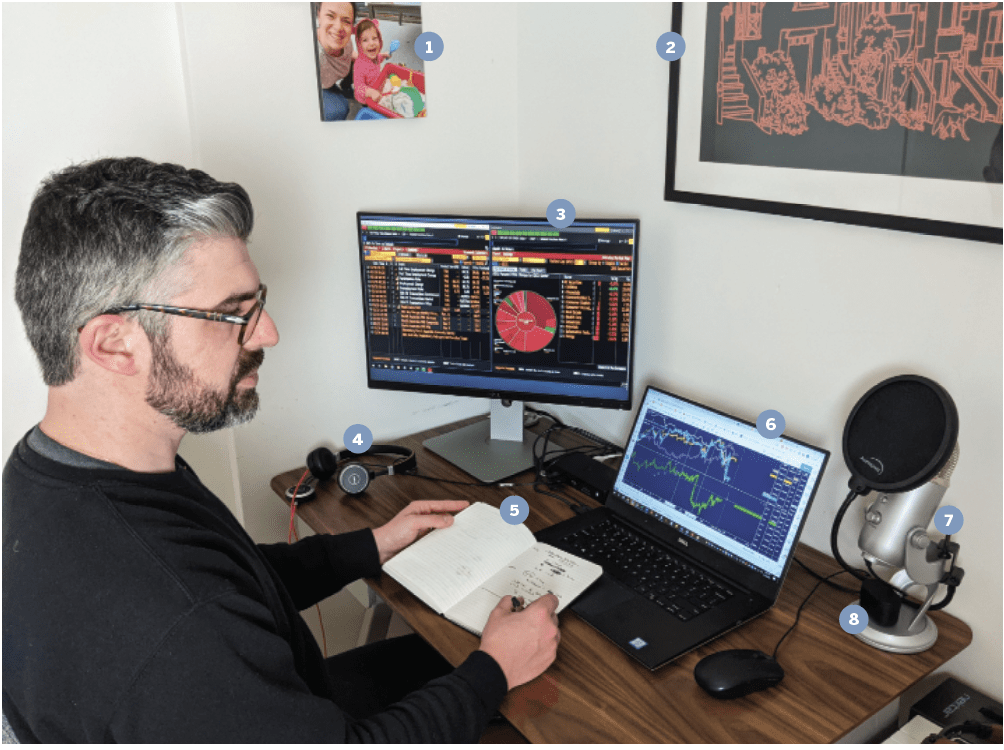

Ross Young, 53

New Hampshire

years trading: 10

Ross Young used to teach at a private boarding school, but he knows the value of learning outside the classroom. “The most important things I’ve learned,” he said, “have been things I’ve done on my own—like with finance.”

Young began by investing modest amounts monthly and credits his financial success to his philosophy of consistency, patient capital-building and disciplined trading strategies. His experience can serve as an example to anyone hoping to balancing a career and pursuit of financial goals.

But everything changes. In September, Young plans to cut back on his duties at school and in the community. He’ll be staying involved but limiting his activities to the ones he really treasures.

He sat down with Luckbox to share the lessons he’s learned from his trading journey and to describe how options trading has reshaped his financial future.

How did you start trading?

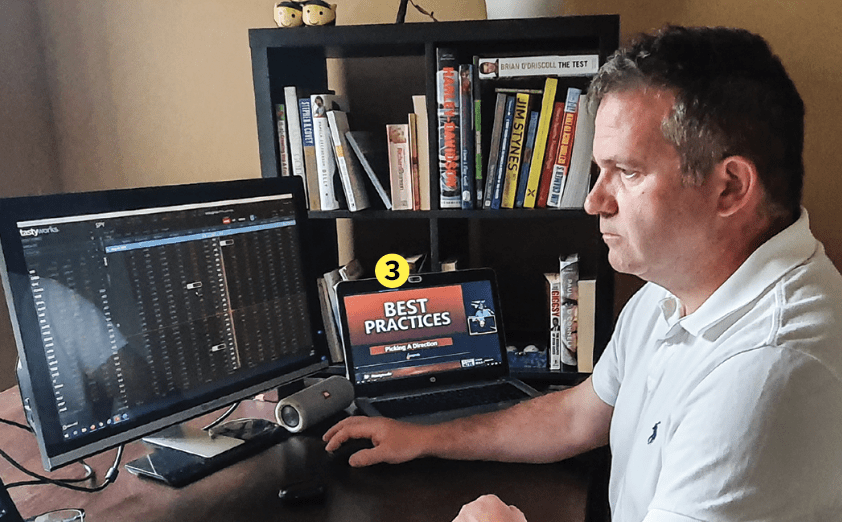

I once coached for a season with a guy who was a full-time retail trader. He did a lot of technical analysis and he got me thinking about leverage, but of course it was from the long side so it only lasted until the market went the “wrong way.” Around 2014, I was reading some investing stuff from The Motley Fool and it was talking about options. It was the first time that I read about trading from the short side and it made sense. Soon after that I found tastytrade and the introduction to trading segments it ran with Dr. Jim Schultz WDIS and Britney Shereyk. I’ve been hooked since then.

Favorite trading strategy?

Tough to say. I probably sell more naked puts than anything else, but I really like strategies that have more going on like lizards or ratio spreads. I also sell covered calls on any of my stock holdings and let those become wheel of fortune trades.

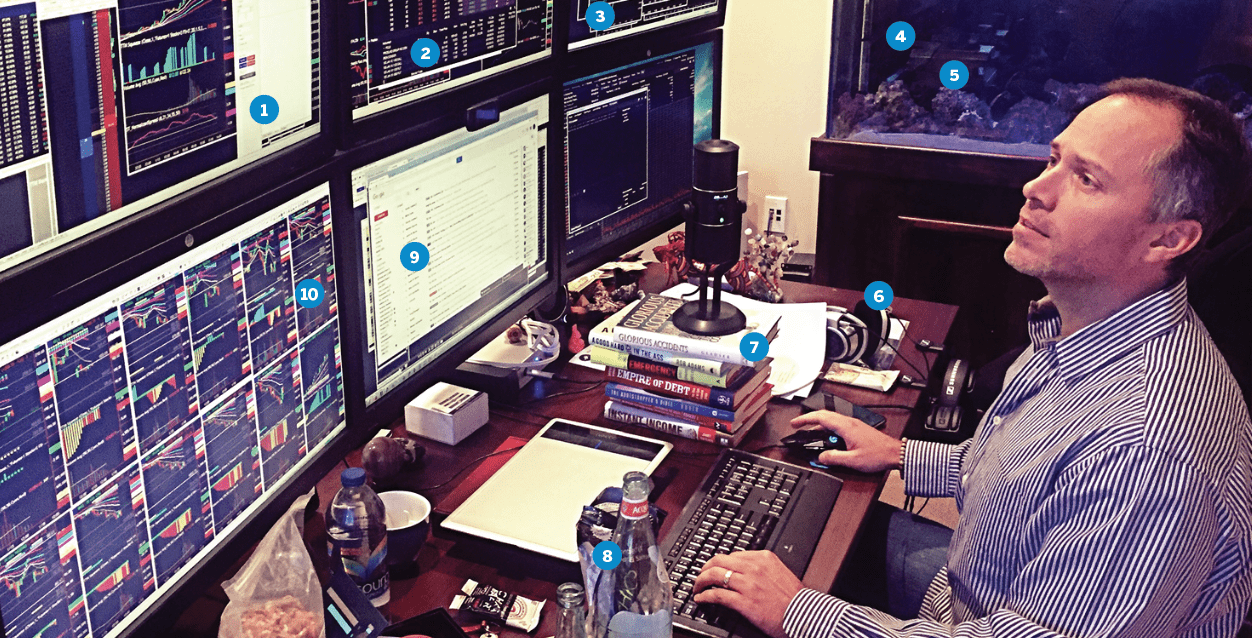

Which financial instruments do you most frequently trade?

I mostly trade equities options. Sometimes I’ll trade futures options. I hold stocks, but those could be just long-term holdings or part of a wheel of fortune type trade.

Tell us about your success as an active investor.

Base hits are really the best. “Trade small and trade often” works. Swinging for the fences is where it gets dangerous. My base trades are ones that I’m able to repeat over and over again for small wins that pile up over time. I love comparing my trades in a stock to what would have happened if I had just bought the stock like a regular bullish passive investor. With very few exceptions, I’ve done better trading because I can reduce basis and increase my probability of profit.

What was your worst trading moment?

All my worst moments come from when I thought I knew something. They are usually around a stock that I read about and where I was really bullish. Thankfully, I try to stay small, so those aren’t usually as bad as they could be. One notable loss was during COVID with Teladoc Health (TDOC). I thought I knew something. I still hold some shares to keep hope alive, but it’s ugly and I’ll probably have to leave them to my son when I die.

Yesenia Duran—not an alien, not a zombie; just an editor.