Trends

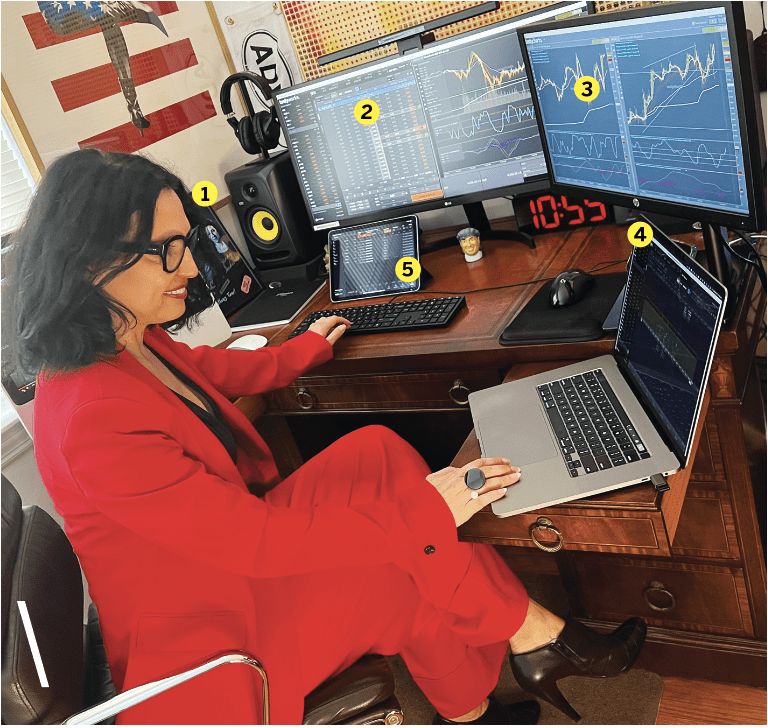

Meet Aneta Genova

By Yesi D

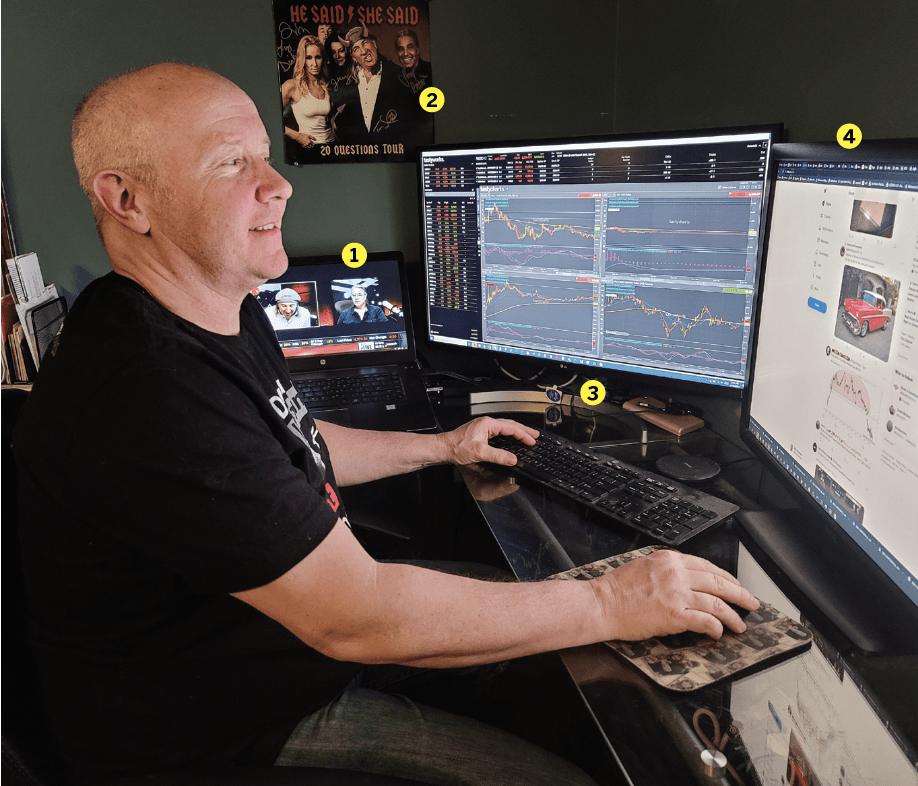

butterfly setup; 3. Price charts with various time frames; 4. IRA account; 5. The tastyworks app on iPad

Home/Office location

New York City

Years trading

12

How did you start trading?

I was running my own business for small leather goods about 17 years ago, and when I started being profitable, my accountant advised me to go to Fidelity and invest my money with them. I bought some mutual funds based on their advice, and nothing much happened for what felt like a very long time. I didn’t like the feeling of being so passive and detached. I wanted a lot more engagement than mutual funds offered. I like to make my own decisions and...

Trader

-

Straightforwardly Successful

By Yesi D

|The idea that volatility is often overpriced and fear is inflated gave me the edge I needed -

Trading in Harmony

By Yesi D

|A couple trades together, but separately, with different returns. Somehow, it works. This is the tale of the very first couple's Rising Stars on the tastylive network. -

Meet Luckbox’s Trader of the Month: Brian Chung

By Yesi D

|This young meme stock trader has had his ups and downs -

Meet the Trader: Fauzia Timberlake

By Yesi D

|The tastylive network converted this former financial planner to active investing -

Meet the Trader: Caulin T. Struyk

By Yesi D

|Meet the trader Caulin T. Struyk in a Q&A about his trading experience. -

Meet Stephen Bigalow

By Luckbox

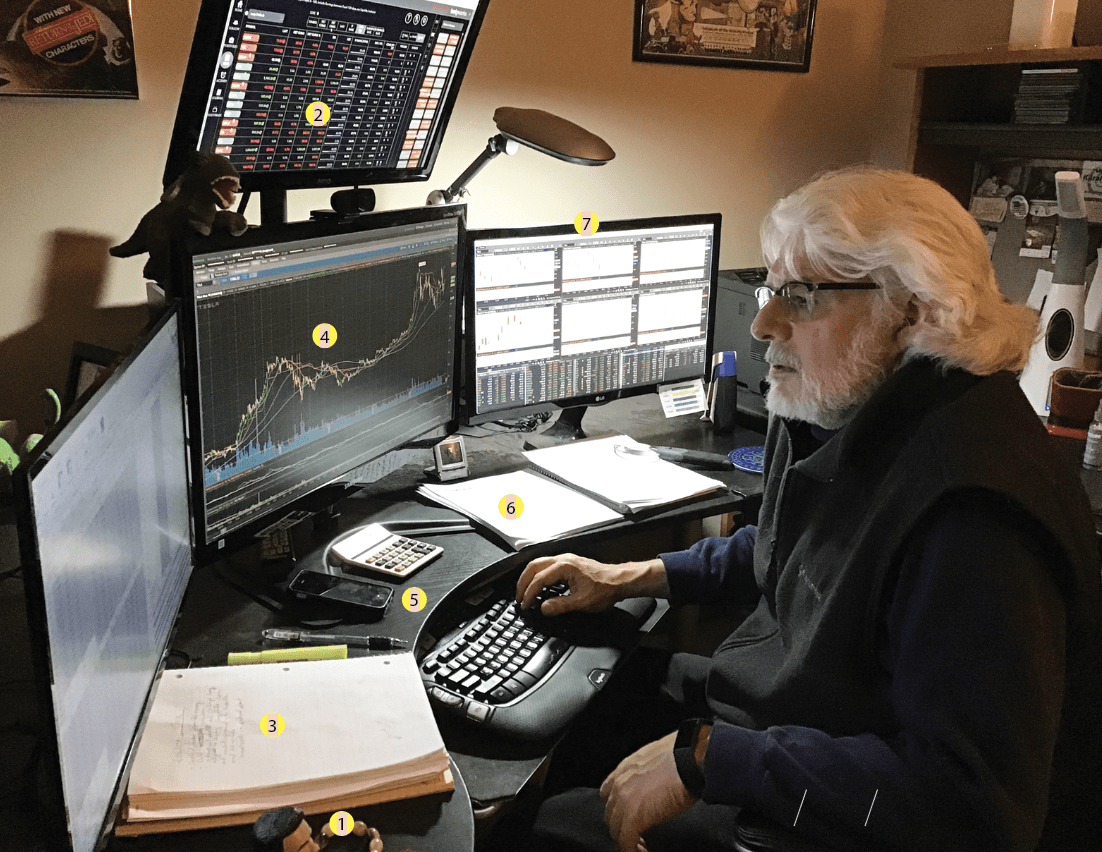

|Office location Houston Age 69 Years trading 48 How did you start trading? When I was 8 years old, my dad bought me one share of Eazor Express [a trucking… -

Meet Micheal Antzas

By Luckbox

|Home/Office location Tulsa, Oklahoma Age 63 Years trading 25 How did you start trading? The company I worked for 27 years ago offered a 401(k), and on the weekends I… -

The Apprentice: A Mathematical Edge

|As he learns trading, a teenager is already stockpiling financial wisdom—and cash In the case of 18-year-old Jacob Intrator, youth isn’t wasted on the young. While learning to trade equities,… -

The Master Trader & Educator

|“Those who can’t do, teach” is a truncation of a line from Man and Superman, a 1905 George Bernard Shaw play. It’s a maxim that’s often true in the world… -

THE JOURNEYMAN: THE PATH TO A 153,000% RETURN

By Ed McKinley

|Son Dao has made a fortune in almost no time by bucking the market’s bearishness. He turned $1,600 into $2.5 million in 17 months. Yes, Luckbox verified the numbers. Twenty-eight-year-old… -

Meet Stefanie Kammerman

By Yesi D

|Home/Office location Las Vegas Age 52 Years trading 28 How did you start trading? Happy hour! I got lucky and got offered a job as a trader’s assistant working in… -

Meet Bobby Gaines

By Yesi D

|Home/Office location Bowdon, GA Age 52 Years trading 11 How did you start trading? I was installing a Roku box on my television and found tastytrade! Initially, I wondered about… -

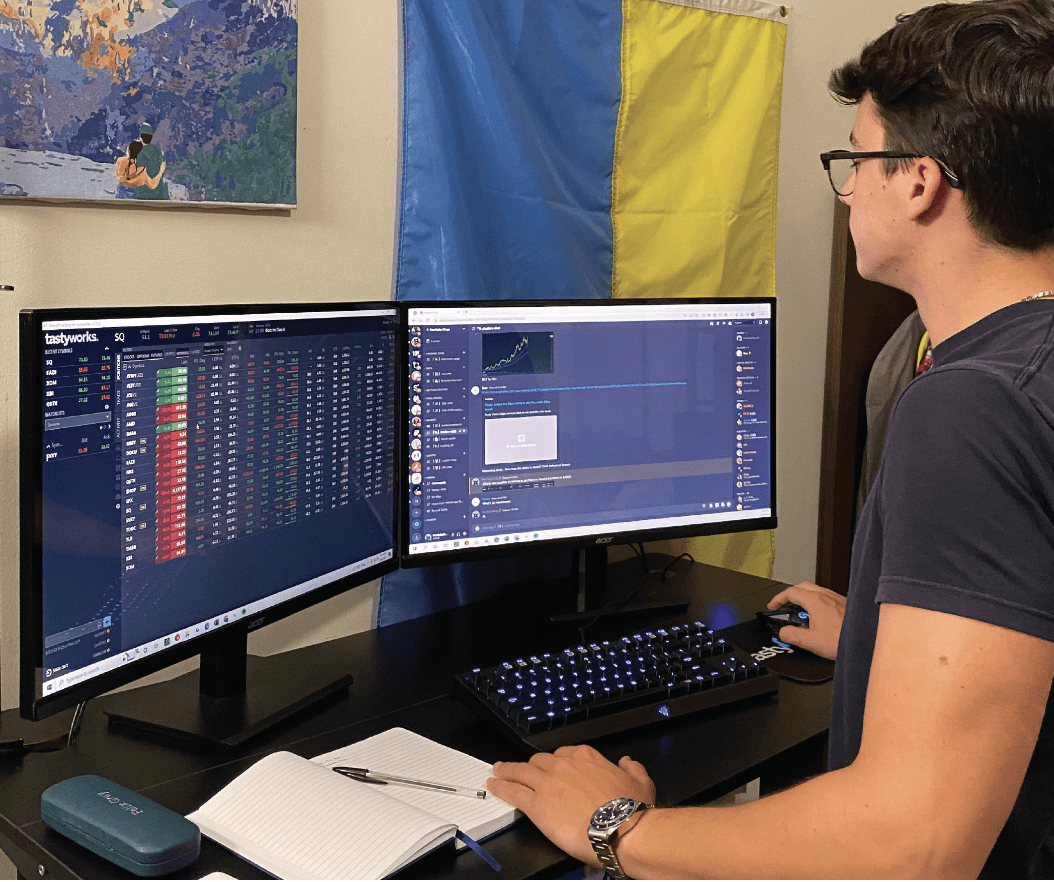

Meet Ivan Fediv

By Yesi D

|Home/Office location: Chicago Age: 20 Years trading: 3 How did you start trading? In high school, I ran a high-end streetwear and sneaker reselling business, which taught me how to… -

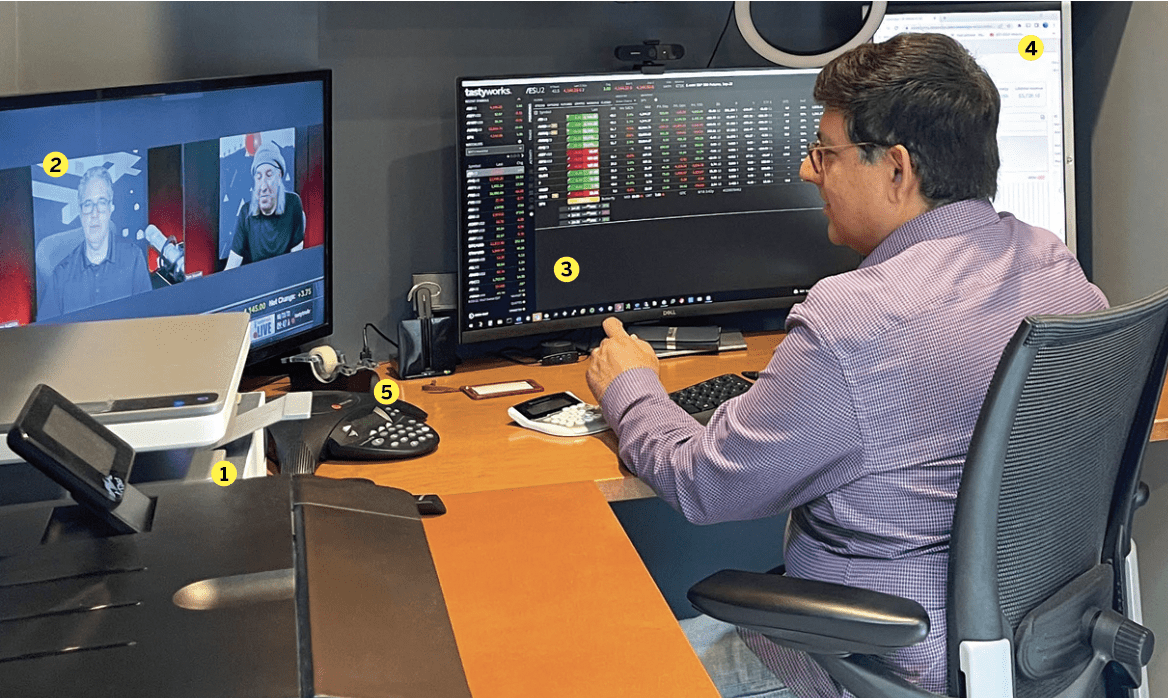

Meet Sanjeev Malhotra

By Yesi D

|Home/Office location East Brunswick, New Jersey Age 51 Years trading 22 How did you start trading? I began trading during the stock market’s great bull run in 1992 and made… -

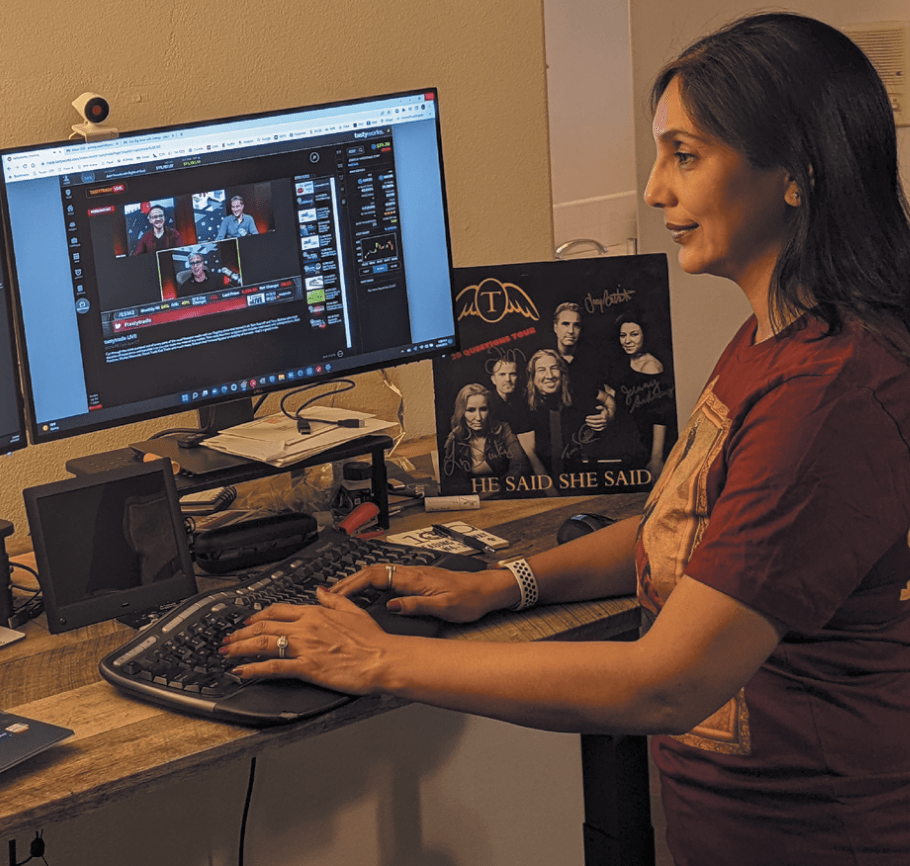

Meet Payal Swami

By Yesi D

|Home/Office location Tustin, California Age 45 Years trading Seven How did you start trading? My sister introduced me to options trading. I had just walked away from a 20-year career… -

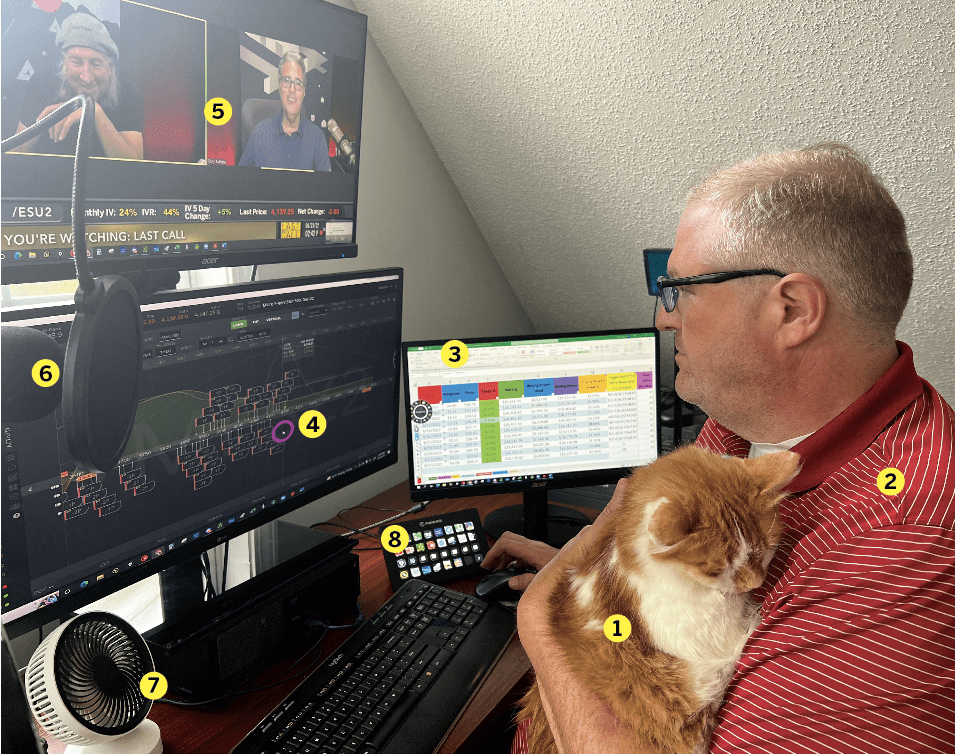

Meet Mike Niemotka

By Yesi D

|Home/Office location Round Lake, Illinois Age 54 Years trading 20 How did you start trading? My father introduced me to investing around the age of 13, but it was more… -

Meet Kimberly Jane

By Yesi D

|@mommavestor Home/Office location Washington Years trading Three How did you start trading? I have been engaged in the stock market for most of my adult life, but at first I… -

Meet Dino Karahalios

By Yesi D

|Home/Office location: Wauconda, Illinois Age: 68 Years trading: 16 How did you start trading? I attended a presentation by Tom Sosnoff, who was then CEO of thinkorswim. He spent a… -

Meet Joseph Barbuto

By Yesi D

|Home/Office location Long Island, NY Age 59 Years trading 25 How did you start trading? Around 1987, I was working for a small electronics company that Bear Sterns took public.…