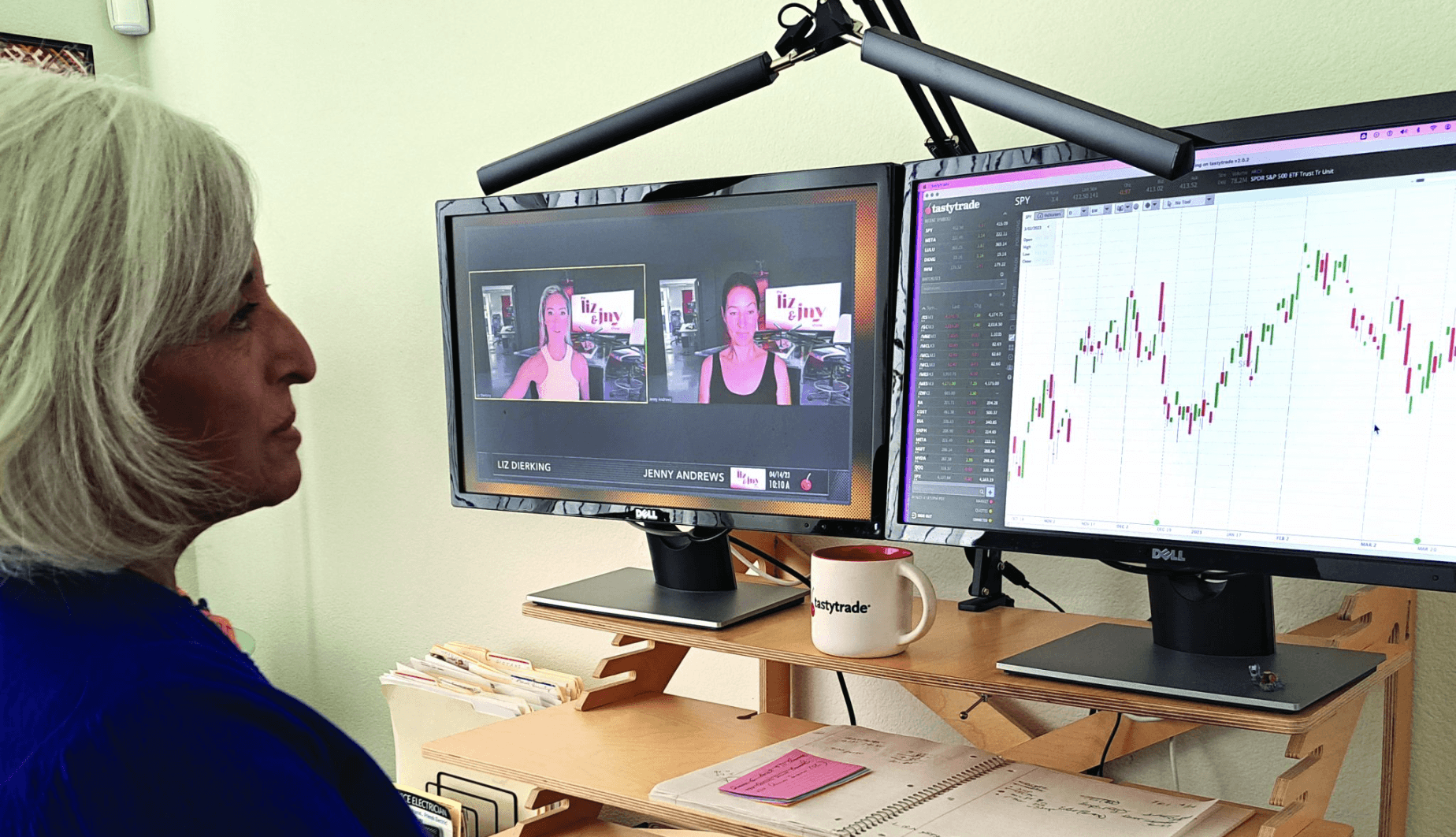

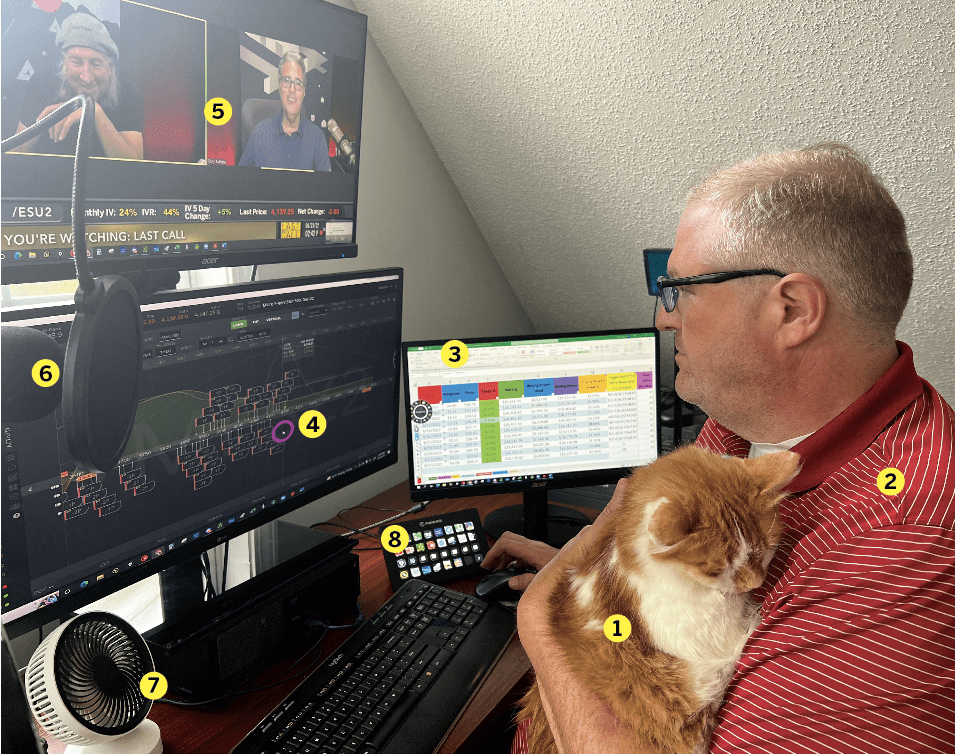

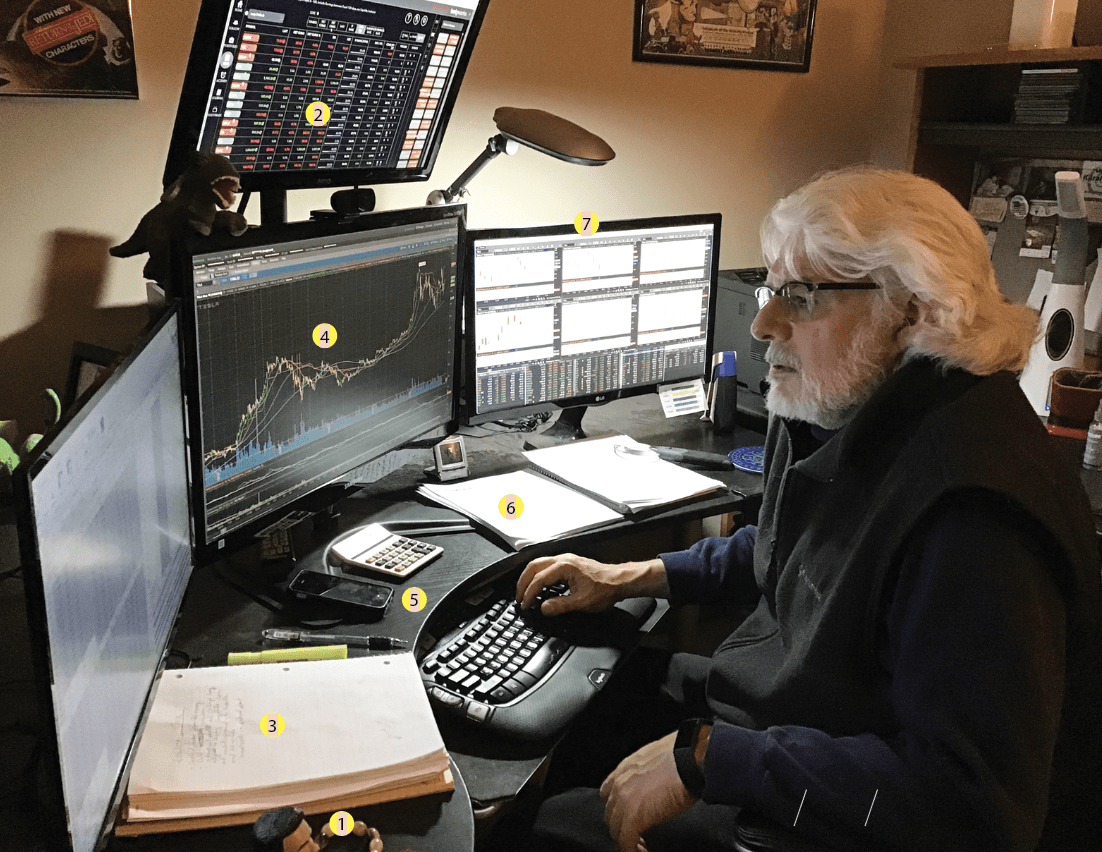

Meet the Trader: Caulin T. Struyk

Meet the trader Caulin T. Struyk in a Q&A about his trading experience.

How did you start trading?

I started trading in 2014 with dividend stocks and just collected the dividend. Then I started trying equity derivatives in 2016 by just buying options. This was obviously unsuccessful because I was long premium. I lost money with time and had a very low probability of profit compared with selling options. So, I tried a new method in 2020. I finally implemented the tastytrade mechanics and started only selling premium. This is when I really started to make money. The shift from buying premium to selling premium and volatility was the real key to my success. Right now, I maintain a short delta portfolio and use mainly short strangles.

2. I’m looking at position delta, overall portfolio delta, portfolio theta and expiration time. I always roll before 21 DTE and don’t go longer than 60 DTE.

Location:Denver

Age:33

Years Trading:Eight

Favorite trading strategy?

My favorite strategy is the short strangle. I implement this with about 22 to 30 delta on each side. I try to stay close to zero delta on each position. I never go lower than 18 delta on either side. I don’t think the risk is justified with delta that low. I also use the iron condor (short strikes the same delta). I don’t like the iron condor because it makes rolling difficult with the clunky long options. I occasionally do butterflies and jade lizards and reverse jade lizards. I will do an SPX put fly when /VX is up $1 or more and /ES is down 2% or more.

Average number of trades per day?

I average about four to five new trades per day. In earnings season I can make seven to eight trades a day.

What percentage of your outcomes do you attribute to luck?

I attribute 0% of outcomes to luck. Everything in options is a probability. With the tasty mechanics, one has a mathematical advantage. I use the law of large numbers and a high number of occurrences to win without luck, as I was never lucky.

Worst trading moment?

I lost 100k in the pandemic crash of 2020. I found out that to be short premium and long delta was a serious problem on an outlier down move. This is why I keep my portfolio delta short to offset outlier down moves