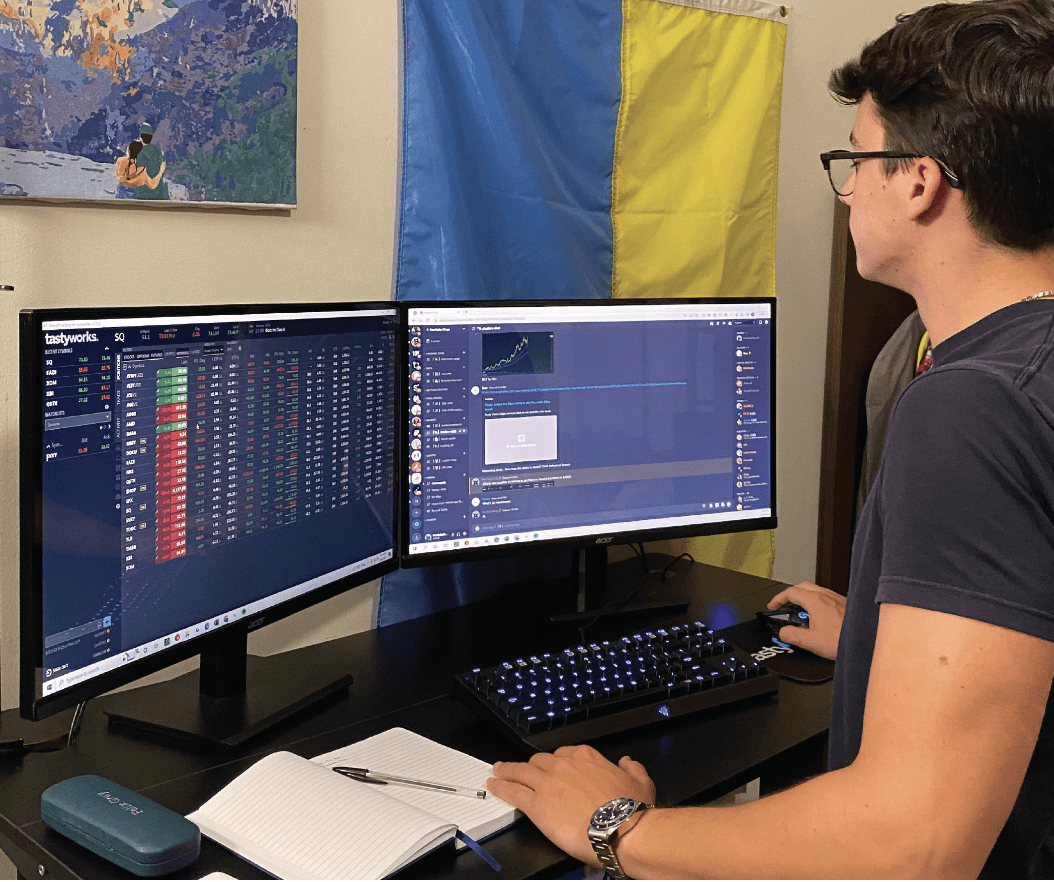

Meet Luckbox’s Trader of the Month: Brian Chung

This young meme stock trader has had his ups and downs

How did you start trading?

I began in 2019 when a friend introduced me to wallstreetbets and options trading. He turned $1,000 into almost $50,000 on Investco QQQ exchange-traded fund calls before blowing up. Personally, I did the reverse by turning $50,000 into $1,000 before still blowing up. But I’ve always believed that if someone can do it, anyone can do it. It helps that I don’t think anyone is smarter than anyone else or that there’s some hidden secret baked into their personality.

Favorite trading strategy?

I love a good merger arb (arbitrage) with naked call options on X (formerly Twitter). The risk is always perfectly defined, and nothing is more interesting than a good lawsuit. If I were not a trader, I would’ve been a lawyer.

Average number of trades per day?

It’s 0.25. It used to be much higher, but I’ve worked really hard to take trades only when I have a defined edge. When I’m not in school, this number tends to go way up. During market turmoil I might take 10 setups a day, whereas on a slow day I might just watch the market in class and play around with $100 on illiquid SPACs (special purpose acquisition companies).

What percentage of your outcomes do you attribute to luck?

It looks like a graph that goes from 100% to 45%. When I started trading, I really had no understanding of what moved markets. I would short Tesla (TSLA) for a week because I saw a graphic saying it was worth more than the top ten car companies combined. Eventually, I started to get some idea of what edge looked like and how to accumulate data and information early. Still, no setup is perfect, and the market can even be “wrong” for longer than I can be solvent. I could flip a weighted coin 100 times and still only get heads. You have to play the game to win. You can’t get lucky if you don’t put yourself in a position to get lucky. So, is it still luck?

Favorite trading moment?

Trading meme stocks in 2021. There’s still nothing like the feeling of texting all your friends that Cathie Wood bought more Palantir Technologies (PLTR) and everyone is celebrating and making money. It really felt like a tipping point even though many people proceeded to return all their gains to the market. I’m still rooting for everyone to make it, and for a brief moment in time it felt like it was possible.