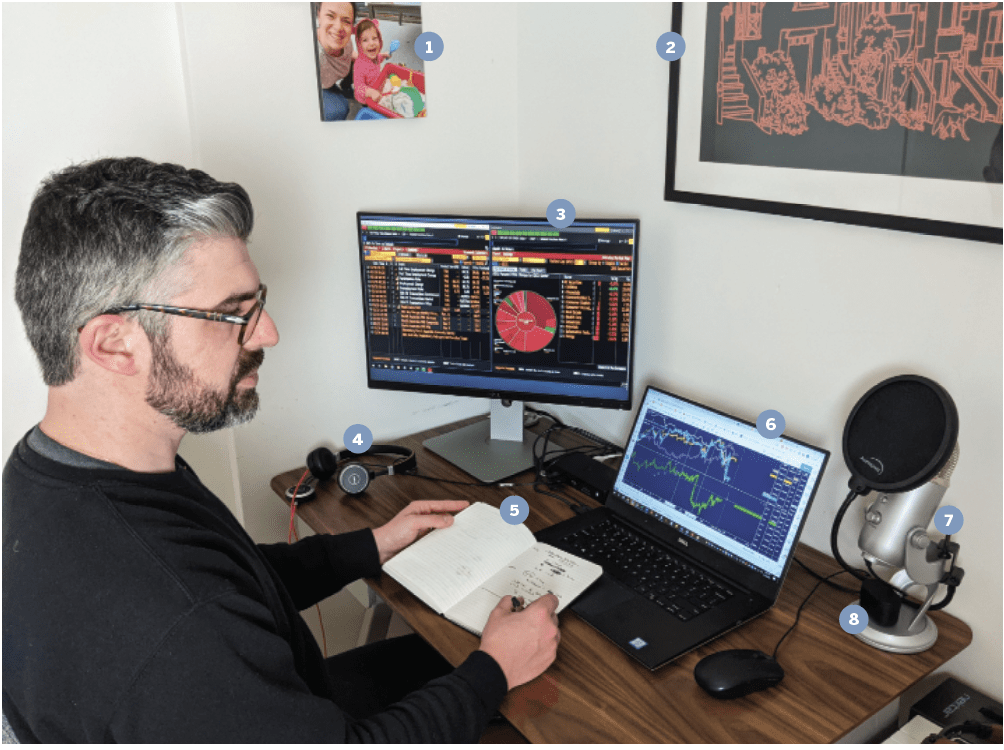

Meet Ilya Spivak

Ilya Spivak, Head Asian-Pacific Strategist at DailyFX

Home/Office location San Francisco

Age 38

Years trading 15

How did you start trading?

I graduated with dual undergraduate degrees in economics and international relations, wanting to pursue some sort of hands-on macro research or analysis. I was also stubbornly dead set on staying in San Francisco. After almost a year of going to interviews for places I really didn’t want to work, I came across an ad for an entry-level sales job at the new San Francisco branch of a Wall Street FX broker. It opened with something like, “Do you love to talk about international events, markets and politics?” That was definitely me. I figured I’d try to get my foot in the door through sales and see if I could find my way to the analytical side of things from there. At the interview, I was handed an article from The Economist that I was supposed to read and answer questions about on the spot. As it happened, I’d already read it because I subscribed to the magazine, and said as much. That seemed to go over well, and after a bit of deliberation they hired me. I fell in love with trading in the first few months on that sales desk. The ability to practically participate in everything I’d studied in school and was passionate about was almost instantly appealing.

Favorite trading strategy for what you trade most?

I trade from a global macro perspective. I follow global events closely and try to think about what is likely to happen economically and geopolitically from a broad, big-picture perspective in the coming six to 12 months or so. Then I attempt to figure out how the major markets might respond to various permutations of what I think might occur. Usually, I see most benchmark assets—G10 currencies, bonds and stock indexes, as well as key commodities like gold and crude oil—telling the same macro story through their own lens. Then, I study the charts to gauge how the macro backdrop I envision might look in the context of current trend development. I am looking for price action to suggest that one of the macro scenarios I’ve considered is playing out, and then use technical analysis to find where a trading opportunity with attractive risk and reward parameters could be.

Average number of trades per day?

I might have as many as five or six trades on at a given time, or none at all. I tend to hold positions for weeks and months at a time, so there is no true daily average. I am not necessarily looking to trade on any given day, whether it be to open or close a position.

What percentage of your outcomes do you attribute to luck?

Everything I have learned over the years suggests it’s critical to get the influence of luck in trading outcomes as close to 0% as possible, for both winning and losing bets. In my experience, successful traders follow a well-defined system where they can clearly explain what their entry and exit parameters are and thereby demonstrate why they took a given trade, whether it made them money or lost it. That doesn’t mean I can foretell what will happen all of the time, not by a long shot. Rather, I try to define rules that say, “If price does X or goes to Y level for whatever reason, this is what my response should be.” This way, even my losses are hopefully within the strategy’s parameters. That makes learning from my mistakes and adjusting the approach accordingly much easier. There might be some pure luck here and there—like getting a good trade fill in difficult market conditions—but this should not impact performance in a meaningful way.

Favorite trading moment?

I was just getting started on the research side of the forex markets after moving from sales in early 2008. A lot of the talk at that time was about “de-coupling,” which meant that the United States would go off and have its mortgage crisis and recession while the rest of the world would continue growing. The U.S. dollar got absolutely shredded and euro/U.S. dollar (EUR/USD) currency pairs poked above 1.60 for the first time. I was convinced that this idea was wrong and searched all over the place for evidence of global contagion. One day it dawned on me that if there were spillover, it might strike Canada relatively early because of its proximity to the United States and sensitivity to its business cycle. Once I figured out that I needed to strip away crude oil exports—which looked as though they were surging because the price of a barrel of crude had skyrocketed thanks to the weak greenback—I giddily found precisely what I was looking for. That convinced me that USD was cheap because the crisis would not be contained, and that it had not been truly priced in. I entered short EUR/USD near 1.5550 in early August and covered below 1.30 toward year-end, almost tripling my account.