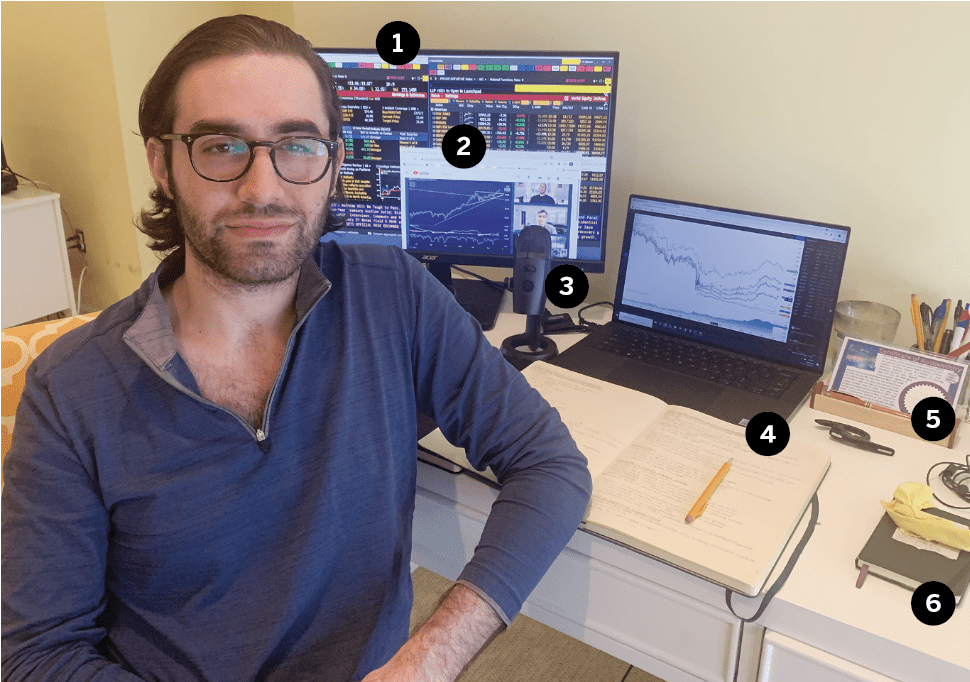

Meet Christopher Vecchio

1 Bloomberg terminal; 2 Editing latest “The Macro Setup” with Guy Adami & Dan Nathan; 3 Blue Yeti microphone; 4 Moleskine classic hard cover (notes on macro research and trading strategies dating back to 2013); 5 Wooden pen made from old Shea Stadium home dugout benches; 6 Moleskine notebook (planner & trading diary)

Title Senior currency strategist, DailyFX

Home/Office location Lower Manhattan & Westhampton, New York

Age 32

Years trading 17

How did you start trading? I was 14 years old and I wanted my first cell phone, so my mother told me that if I invested some money, I could earn it. She’s a trust and estates attorney and does some angel investing, so she’s always had a sharp eye for the markets. She gave me some money and some choices, and I invested in Baxter International, a biotech company. When it went up enough in price, I sold to cover the cost of the phone.

Favorite trading strategy for what you trade most? I don’t have the temperament to sit around day-trading tight ranges. My academic background is degrees in political science and economics, as well as earning the CFA (Chartered Financial Analyst)Charter by passing an exam that tests the fundamentals of investment tools, valuing assets, portfolio management and wealth planning. That gears me toward longer-term perspectives. So, I’m either looking for significant turning points in markets for long-term value plays or finding a trend I have faith will continue for several weeks or months. While I use spot forex in the currency space, my activity in equities and commodities is explicitly vis-à-vis options, such as call and put spreads, straddles/strangles and, when I’m very confident, long-dated on-the-money calls/puts.

Average number of trades per day? Approximately 20 per month, so fewer than one per day. I usually trade in batches and then sit around for days at a time.

What percentage of your outcomes do you attribute to luck? I typically outline my strategy and expected returns ahead of time for each trade, going so far as to backtest the strategy using factor models to create an expected distribution of outcomes. If I find myself in a position where the realized outcome is in excess of three standard deviations of my average expectation (common practice for identifying outliers in Gaussian distributions), I attribute that to luck. There have only been two instances when that’s happened to me.

Favorite trading moment? My favorite trading moment came when the Bank of Japan intervened in the yen on Aug. 4, 2011, sending the U.S. dollar/Japanese yen currency pair from ~77 to ~79 in a few minutes. I was fresh out of college and doing things by the book. And I recalled a professor in college just months earlier telling me about his experiences around White Wednesday, or Sept. 16, 1992, when the Bank of England’s peg broke and they exited the European Exchange Rate Mechanism, which is why the U.K. doesn’t use the euro. He noted that he had orders laddered among different British pound-crosses that day, and he basically made his year in one afternoon. On a hunch, I laddered in long U.S. dollar/yen orders and, sure enough, I hit it lucky. That single trading event confirmed to me that studying market history would be beneficial in the long term.

Worst trading moment? On Sept. 6, 2011, I was short the euro/Swiss franc currency pair. When I arrived at my desk at 4:31 a.m., the Swiss National Bank had raised the floor to 1.2000. This was my first margin call. It was a hard but tough lesson, and I haven’t run the risk of ruin since. It was formative in understanding risk management early in my career.

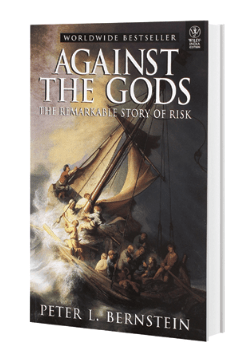

Favorite trading book

Against the Gods: The Remarkable Story of Risk

by Peter L. Bernstein Wiley (1998) Paperback, 400 pages