The Fed is Far From Egg-Static About the Recent Price Rise in This Commodity

As a result of reduced production, egg prices are up roughly 46% since the start of the new year and that may affect the Fed's rate hike actions

- Egg futures hit record highs in 2022, but moderated in 2023 amidst the Fed’s campaign to tame inflation, as well as a decline in avian flu infections.

- After a fresh wave of “bird flu,” egg producers have been forced to cull their flocks, which has resulted in reduced egg production.

- As a result of reduced production, egg prices have been rising in 2024, and are up roughly 46% since the start of the new year.

Based on recent developments, anyone pinning their hopes on a March rate cut by the Federal Reserve may need to adjust their expectations. The chances for a March rate cut took a serious hit in early February when the U.S. Labor Department announced that hiring remains strong in the economy, and that the U.S. unemployment rate hasn’t budged from record lows.

On top of the robust labor market, another February report from the government indicated that problematic levels of inflation haven’t yet been completely tamed. On Feb. 13, the Bureau of Labor Statistics revealed that inflation was higher than expected during the month of January, with the Consumer Price Index (CPI) rising to 3.1%. That was above the expected 2.9%, and more importantly, well above the Fed’s target of 2%.

In addition to those big picture trends, another key development has emerged that will undoubtedly catch the attention of leaders at the Fed—the rising price of eggs. As most American consumers likely recall, skyrocketing egg prices made headlines back in 2022 when the rapid growth in prices pushed U.S. inflation to multiyear highs.

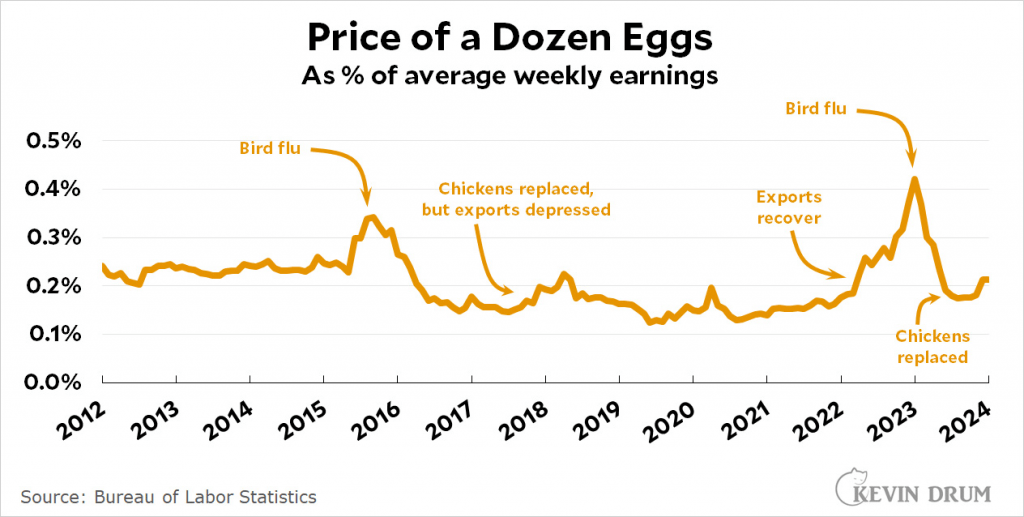

After bottoming at around $1.35/dozen during the first year of the COVID-19 pandemic, egg prices continued to climb during 2021 and 2022, eventually peaking at about $5.30/dozen. However, in response to Fed’s aggressive fight against inflation, egg prices retraced all the way back down to about $2.00/dozen by autumn of last year, as illustrated below.

Unfortunately, egg prices rebounded at the end of 2023, and have been steadily climbing again in early 2024.

Year-to-date, egg futures are up about 46%, climbing to $3.20/dozen as of Feb. 20. It should be noted, however, that recent action in the egg market hasn’t necessarily been driven by strengthening demand. Instead, it’s the supply side of the egg market that’s been under pressure, as outlined in the next section.

Avian Flu outbreak threatens U.S. egg production

Over the last decade, one of the biggest complications for U.S. egg producers has been the Avian Flu (H5N1), which is a viral infection that primarily affects birds, particularly poultry such as chickens, ducks, and turkeys.

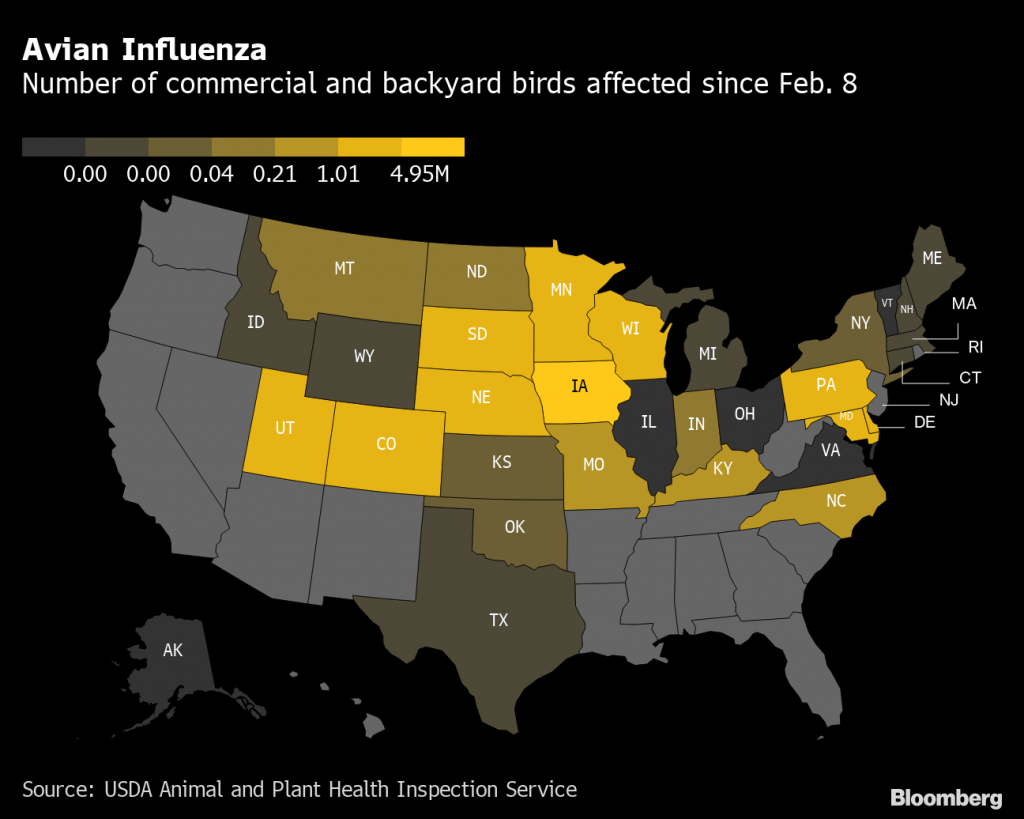

The avian flu is highly contagious, making it easily transmissible, especially among the closely flocked chicken herds of many U.S. egg producers. And the current strain is often fatal. That means any outbreak must be met with swift and decisive action, typically by culling the infected and at-risk birds from the flock.

Last year, a decline in bird flu cases in the United States no doubt contributed to the weakening in egg prices. But cases started rising again in autumn of last year, ultimately leading to a nation-wide outbreak.

The U.S. Department of Agriculture estimates that some 80 million birds were culled in the last two years in response to the bird flu. That includes around 20 million during the last three months of 2023 alone.

Due to the severe impact of these bird flu outbreaks—particularly over the last several years—annual egg production in the United States has been on the decline. Prior to the COVID-19 pandemic, the U.S. produced about 9.4 billion eggs in 2019.

But last year, that figure was down to around 9.1 billion. As is often the case in commodities markets, those supply constraints have been bullish for prices, which is a key reason that eggs got so expensive in 2022.

All told, that means the current surge in prices may not be linked to a second bout of inflation, but rather to the current outbreak of avian flu. But most consumers won’t care about the exact reason for the spike in prices, instead, they’ll focus on the fact that prices are rising.

And unfortunately, food inflation remains stubbornly high, despite the broader decline in overall inflation. For example, food inflation rose by 0.4% last month, while total CPI increased by 0.3%. But those statistics only provide a partial picture. Restaurant prices continue to climb at a worrisome rate, rising at an annualized rate of 5.1%, which is well above the CPI rate of 3.1%.

Food prices and the economy

For most American consumers, food prices are one of the most visible parts of the economy, so when prices start rising, most Americans take notice.

As a result, it’s almost assured that the Fed will note that egg prices have spiked during early 2024, and that could factor significantly into the upcoming rate decision.

Not surprisingly, the aforementioned employment and inflation data has also affected ongoing market expectations for the first rate cut in 2024. Several months ago, most expected the Fed to cut rates by a quarter percentage point during its March meeting. But as of now, those expectations have shifted—the interest rates futures market now indicates that benchmark rates will remain at current levels until mid-June.

That means the Fed will likely stand fast at its next two meetings, which are scheduled for March 19-20 and April 30-May 1. But if egg prices continue to climb, or other pockets of the economy start to experience faster-than-expected price growth, then expectations could shift again—pushing out the first rate cut even further.

Amid a major election year, that means volatility could increase during the next several months, as investors and traders wrestle with the potential impact of “higher rates for longer” on the underlying economy.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.