Q1 Earnings: Corporate Gains, Consumer Pains

Q1 earnings have been better than expected, but inflation continues to weigh heavily on downtrodden consumers

- The blended average growth rate for Q1 earnings has been about 5.7%, surpassing the pre-earnings estimate of 3.4%.

- However, revenue data from Q1 has been less encouraging, with only 60% of companies reporting actual revenues above consensus estimates, falling short of the five-year average of 69%.

- While corporations continue to achieve robust profits, new data indicates that consumer confidence is declining, due to the ongoing impact of inflation.

Two key trends are shaping the Q1 2024 earnings. First, the U.S. public companies exceeded profit expectations for the quarter. Second, businesses have passed a significant part of inflation to consumers, who are now showing signs of inflation fatigue.

The blended average growth rate for corporate earnings in the S&P 500 during the first quarter was approximately 5.7%, according to FactSet. That figure reflects 93% of the companies in the S&P 500 that had reported earnings as of May 17.

Leading up to Q1 earnings, consensus expectations indicated that the growth rate would be closer to 3.4%, which means Q1 earnings season has been better than expected. Assuming that the final growth rate is in-line with 5.7% (after the last 7% of companies in the S&P 500 report earnings), then Q1 of 2024 would be the best earnings season since Q2 of 2022, when the growth rate was 5.8%.

The number of companies beating consensus earnings expectations was also robust by historical standards. Of the companies in the S&P 500 that have already announced Q1 earnings, 78% of them have reported higher-than-expected earnings per share (EPS). According to FactSet, that’s a higher percentage than the five-year and 10-year averages, which are 77% and 74%, respectively.

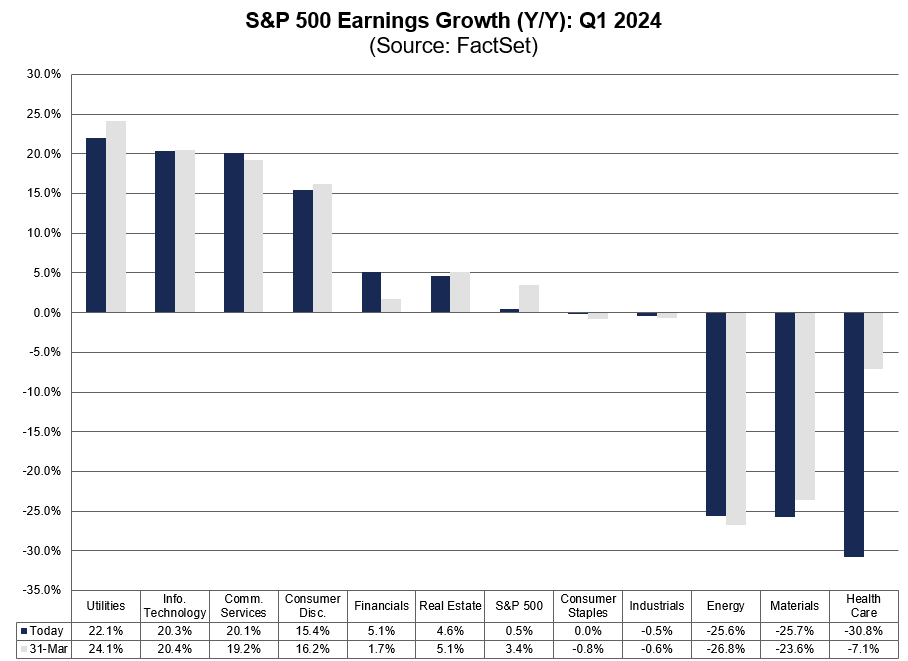

Sector analysis

On a sector basis, Q1 earnings have also distinguished a clear set of winners and losers. As of mid-May, the sectors announcing the most significant earnings beats (on average) have included communications, consumer discretionary, information technology and utilities. The weakest sectors have been energy, health care and materials, as illustrated below.

Importantly, the earnings outperformance in Q1 is just the beginning. Current analyst estimates for the remainder of 2024 suggest that each of the next three quarters will show even stronger earnings growth. For instance, FactSet predicts growth rates of 9.2%, 8.2%, and 17.4% for the next three quarters, respectively.

Here’s the catch

As illustrated in the previous section, corporate earnings have been better than expected in Q1 of 2024. And based on current estimates, experts expect corporate profits to strengthen further during the remainder of 2024.

But one aspect of Q1 earnings season provides a reason for caution. Many companies have issued downward revisions for forward earnings guidance in Q2. Per FactSet, 91 total companies have issued guidance for Q2, and of that number, 59% issued negative guidance. Companies are not required to provide forward guidance, and some elect not to do so.

This level of downward revision isn’t high by historical standards. But considering the sky-high expectations for the remainder of 2024, that certainly seems like a suboptimal development.

On top of the above, revenue data from Q1 wasn’t as rosy as bottom-line earnings figures. While 78% of the companies in the S&P reported better than expected earnings, only 60% reported actual revenues that were above expectations. Not only was that a surprise, but it was well below the five-year average of 69%, according to FactSet.

The above figures don’t paint an extremely bullish picture for Q2 earnings. And they look even more ominous considering recent signals from the economy, especially as it relates to the American consumer.

Leading economic indicators soften, along with consumer confidence

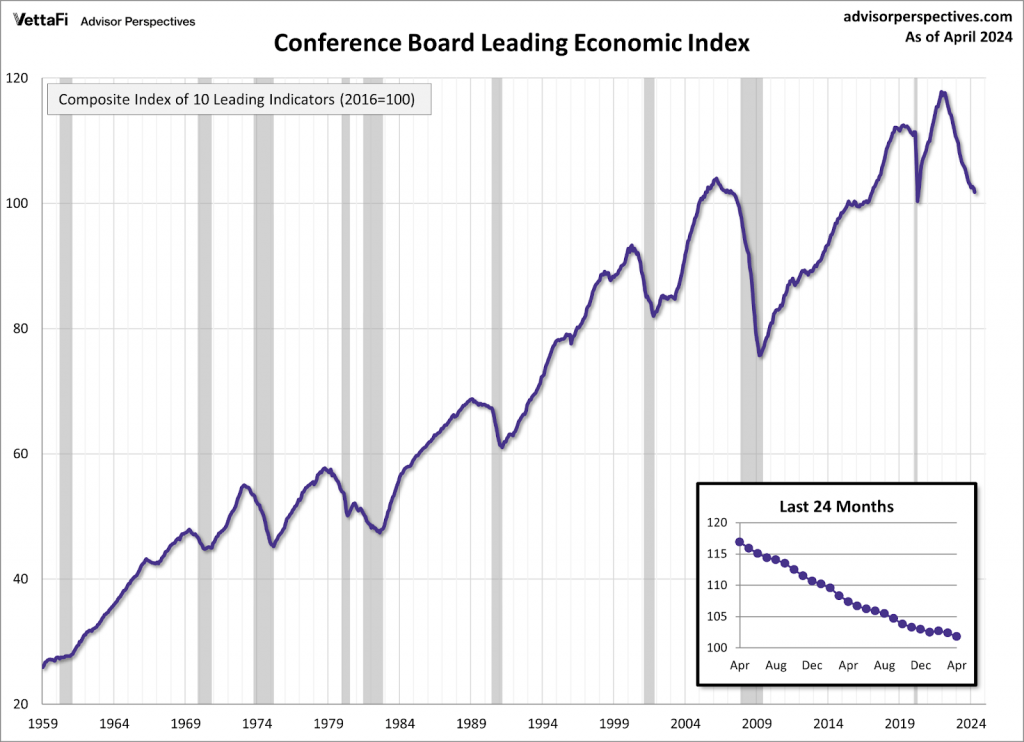

The Conference Board Leading Economic Index (LEI) is a composite of ten economic indicators that together provide a forward-looking gauge of activity in the U.S. economy. The Conference Board selects those indicators due to their ability to shift direction before the overall economy, thereby offering early insight into forthcoming trends.

Over the last six months, the Conference Board index declined by about 1.9%. And as illustrated in the graphic below, the index is nearing levels last observed during the COVID-19 recession, but still well above the depths observed during the 2008-2009 “Great Recession.”

Speaking to recent economic trends, Justyna Zabinska-La Monica, a senior manager at the Conference Board, recently said: “Another decline in the U.S. LEI confirms that softer economic conditions lay ahead.” However, Zabinska-La Monica qualified that assessment with a reminder that it’s still hard to accurately predict whether the U.S. economy is headed for a technical recession.

Amazingly, however, many Americans already believe the U.S. economy is in recession. According to The Guardian, a recent Harris poll revealed that 56% of respondents believe the U.S. economy is already in a recession. Even more shocking is the fact that 49% of respondents believe unemployment in the United States is at a 50-year high. In fact it’s the opposite, unemployment in the U.S. is at a 54-year low.

The results of that Harris poll dovetail well with the recent pullback in consumer confidence. Recent surveys conducted by the University of Michigan showed that consumer sentiment in the United States fell to a six-month low in May. Many Americans continue to feel the negative effects of inflation.

Speaking to that reality, Jacob Sprague—a systems engineer from Nevada—recently told The New York Times, “I’m paying more on taxes and more on groceries and more on housing and more on fuel. So that doesn’t feel good.” The findings from the Harris poll reinforce Sprague’s perspective. The poll found that 72% of Americans believe inflation is still rising in 2024.

Arguably, corporate profits come at the expense of consumers

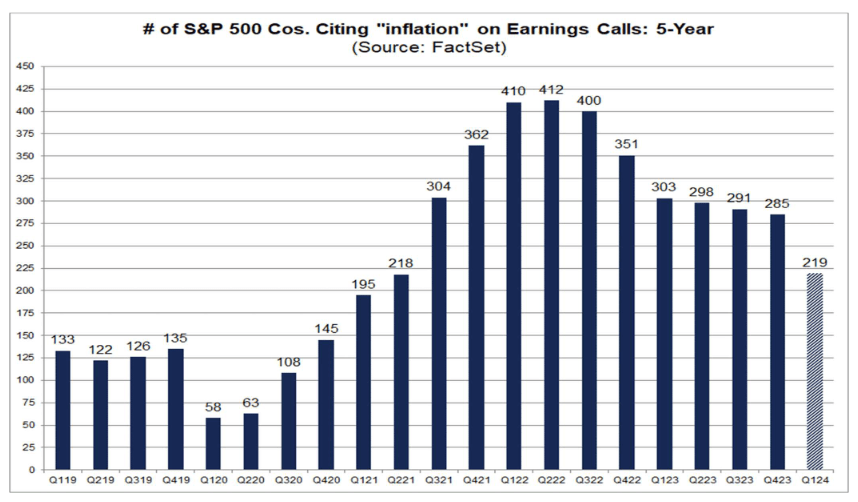

Consumers continue to feel the negative effects on inflation. But in the corporate world, inflation concerns are abating.

According to FactSet research, 219 companies referenced inflation during their Q1 2024 conference calls, which was the lowest absolute number since Q2 of 2021, when 218 companies mentioned the negative impact of inflation (illustrated below).

This incongruence suggests that consumers could finally see relief from inflation soon. Or, that the corporate sector is due for a reckoning, in terms of slowing demand for goods and services. Because it’s difficult to imagine how embattled consumers could drive a surge in demand during the remainder of 2024.

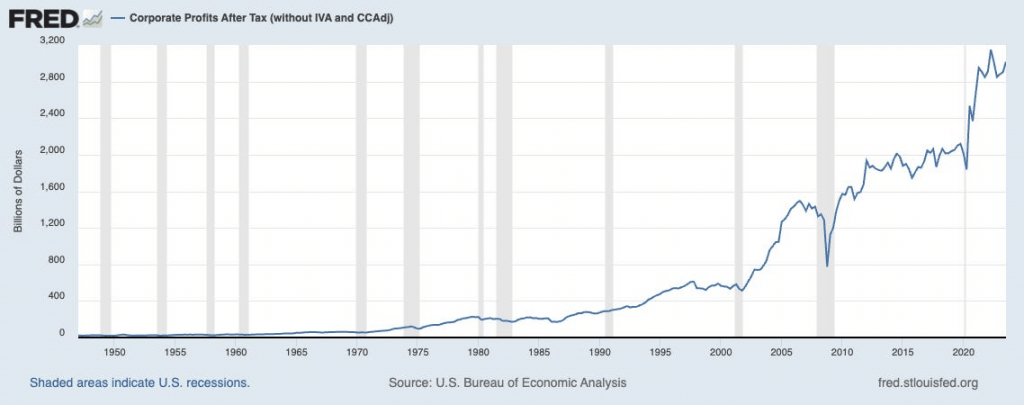

The striking difference between the outlook of the corporate sector, versus the outlook of American consumers, has arisen because the latter has shouldered the bulk of the negative effects stemming from record inflation. Researchers at the Institute for Public Policy Research (IPPR) asserted last year that the “excess profits” reported by the corporate sector have been paid by consumers.

Research from the Groundwork Collaborative, a progressive think tank, reinforces that perspective. According to this group’s findings, 53% of the inflation absorbed by American consumers during Q2 and Q3 of 2023 translated directly to corporate profits. That’s especially interesting when one considers that corporate profits are hovering near record highs.

Something must give. Either the effects of inflation will abate, and newly emboldened American consumers will drive increased activity in the U.S. economy. Or, the current trends will persist, and downtrodden American consumers will pull back further into their shells. If the latter scenario unfolds in 2024, it’s almost certain that corporate earnings forecasts for the second half of the year will need to be adjusted lower.

For more insight into the ramifications of Q1 earnings season, readers can check out this recent installment of Options Jive on the tastylive financial network.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.