After Strong Rally in 2023, Cocoa Prices Have Already Doubled in 2024

Global chocolate manufacturers are reeling due to the record spikes in cocoa and sugar prices

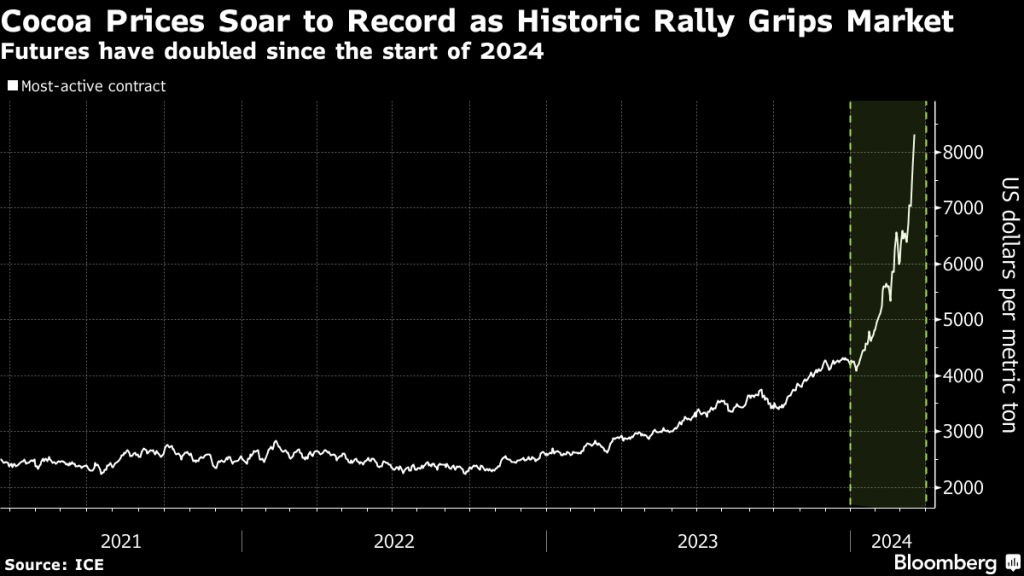

- After a strong bull run in 2023, cocoa prices have already doubled in 2024, and are currently trading at record highs.

- The sharp rise in prices is attributable to weaker than expected cocoa bean production, which has been linked to adverse weather conditions created by El Niño.

- Global chocolate makers are facing intense financial pressure due to the skyrocketing price of a key raw material in the industry.

Within the dynamic landscape of the global commodity markets, there’s typically one sector that steals the spotlight, and 2024 has been no exception.

During the first 2 1/2 months of trading in 2024, the meteoric surge in cocoa prices has been nothing short of remarkable. So far this year, cocoa prices have already doubled. However, the true magnitude of the cocoa rally is even more astounding when viewed through a wider lens.

As recently as 2022, cocoa was trading for about $2,200/ton, but today the price is closer to $9,000/ton, which means this particular commodity has rallied by more than 300% in less than two years. To understand why this market caught fire, it’s critical to understand the broader dynamics in the cocoa industry.

The term “cocoa” is often used interchangeably with “cacao,” but technically, cacao refers to the tree (Theobroma cacao) and its beans, while cocoa typically refers to the processed products derived from the beans, such as cocoa powder, cocoa butter and chocolate.

Optimal growth of cacao trees is only possible in certain parts of the world—typically about 20 degrees north and south of the equator.

For this reason, there’s only a handful of countries that produce the bulk of the world’s annual supply. These include Cote d’Ivoire (Ivory Coast), Ghana and Indonesia, which together account for about 60% of the world’s annual output.

Several factors contribute to the prominence of these countries in cocoa production. At the top of the list is their climatic suitability, because cacao trees thrive in warm, humid climates with well-drained soil. Each of the aforementioned countries feature an equatorial climate that’s characterized by ample rainfall and consistent temperatures, which theoretically contributes to optimized production of healthy beans.

Unfortunately, the concentration of cocoa production in a handful of countries leaves the industry vulnerable to geopolitical complications that occur in these regions.

For example, adverse weather conditions, disease outbreaks, and socio-political instability can weigh heavily on output. And as demonstrated by the recent surge in cocoa prices, significant disruptions can also have profound implications for global cocoa supplies, and associated prices.

Continuing supply crunch triggers strong price gains in the cocoa market

The cocoa industry is experiencing unprecedented upheaval as adverse weather conditions wreak havoc on cocoa-producing regions, particularly in Ghana and Ivory Coast.

In December, heavy rains inundated West Africa, resulting in widespread flooding that inflicted significant damage on cacao groves in Ghana and Ivory Coast. This deluge not only caused immediate crop loss but also facilitated the spread of black pod disease, which often devastates the bean pods on cacao trees.

Speaking to the disastrous rainfall observed at the end of last year, Siaka Sylla—the president of a trade cooperative in the Ivory Coast—observed, “In 20 years, I have never seen a harvest like this, the rain has spoiled our crops.”

As if that wasn’t enough, an extreme heat wave has exacerbated the situation. So far in 2024, West Africa has already dealt with several periods in which temperatures were above 40 degrees celsius.

That means cacao groves have transitioned from excessive rainfall to drought-like conditions, which has severely disrupted cocoa bean development, and in turn derailed expectations for the 2023-2024 harvest.

Ghana, for example, recently slashed its cocoa production forecast, dropping it from 850,000 to 650,000 tons for the current growing season. Ivory Coast, facing similar challenges, is also ratcheting back expectations for the forthcoming harvest.

Globally, Just Food anticipates that net cocoa output will drop to around 4.5 million tons during the 2023-2024 growing season, which is roughly 350,000 tons lower than the total harvest from 2022-2023.

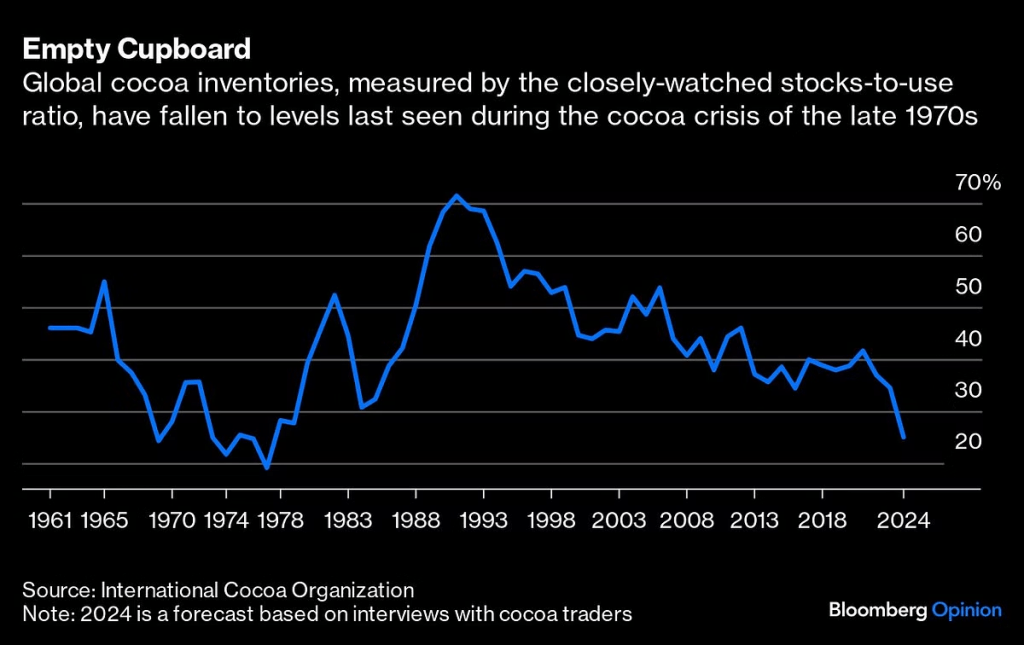

And not surprisingly, weaker than expected harvests have pushed global cocoa inventories down to critical levels, as illustrated below.

Chocolate producers grapple with soaring cocoa prices

According to data from the International Cocoa Organization (ICCO), approximately 70% of the world’s cocoa production is used in the chocolate industry.

Cocoa butter, obtained by grinding processed cocoa beans, is a key ingredient in chocolate—approximately one-fifth of an average chocolate candy bar consists of cocoa butter.

As a result of skyrocketing cocoa prices, the world’s chocolate producers are being forced to swallow a bitter truth. The cost of their primary ingredient has been steadily rising for more than 18 months, which has led to significant challenges in their business operations. As such, the surge in cocoa prices has profound implications, not only for chocolate producers, but also for worldwide consumers of chocolate.

Michele Buck, the president and CEO of the Hershey Company, emphasized the significance of historically high cocoa prices, highlighting an 11.5% drop in net income during Q4 of 2023.

If prices continue to climb, consumers can expect to see a significant hike in chocolate prices, adding to the strain of rising inflation. Last year, retail chocolate prices in the United States rose by an estimated 10%.

In response to the changing landscape, chocolate manufacturers have been forced to adopt strategic measures to mitigate the impact on their bottom lines.

For example, Hershey’s recently announced that it would lay off as much as 5% of its workforce, due to its weakening financial position.

Beyond trimming operational costs, chocolate companies are also trying to maintain existing revenues by promoting new products that feature less chocolate, and by re-engineering the size and packaging of some chocolate products. Mars Inc., for instance, made adjustments to its Galaxy chocolate bar by reducing the size by 10 grams and offering it at the same price point.

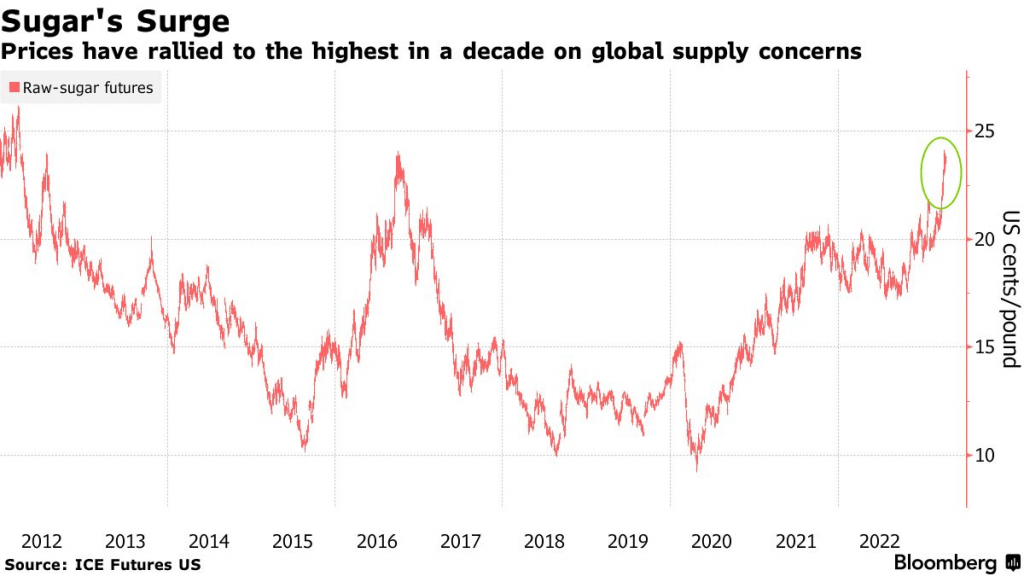

Other manufacturers have responded by incorporating additional ingredients—such as caramel, nuts and fruits—in an effort to substitute other indulgences in favor of increasingly expensive cocoa butter. Unfortunately, another key ingredient in chocolate making has also surged in value during the last several years—sugar.

Speaking to these industry-wide hardships, Billy Roberts, senior food and beverage economist for CoBank, recently told Food Engineering Magazine, “The cocoa issues come at a particularly challenging time for manufacturers, considering the increase in sugar prices they’ve been coping with over the past three years.”

The current challenges are expected to persist, mostly because the cocoa and sugar markets aren’t expected to cool anytime soon.

At present, many analysts expect the cocoa market to remain imbalanced throughout 2024, and potentially into 2025. That’s because the El Niño weather pattern—which is viewed as largely responsible for adverse weather conditions in West Africa—is also here to stay.

All told, that means chocolate producers likely won’t see relief anytime soon. Notably, a recent study of consumer sentiment conducted by NIQ found that chocolate buyers are expected to retrench if any further price hikes materialize.

Those findings indicate that the delicate balance between profitability and consumer expectations continues to narrow, and will weigh on chocolate producers for the foreseeable future.

Alarmingly, cocoa prices jumped another 8% on March 25, settling above $9,600/ton. To track and trade this unique niche of the global markets, investors and traders can add cocoa futures (CC1:COM) to their watchlists.

Additionally, some of the best-known publicly traded chocolate companies include Chocoladefabriken Lindt & Sprüngli AG (CHLSY), Hershey (HSY), Mondelez International (MDLZ) and Nestle (NSRGY).

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.