The Latest Shift in the U.S. Yield Curve is Worrying Some Economists

The U.S. yield curve has been inverted since autumn of 2022, but the latest shift in the real yield curve suggests that the risk of a recession remains high in the American economy

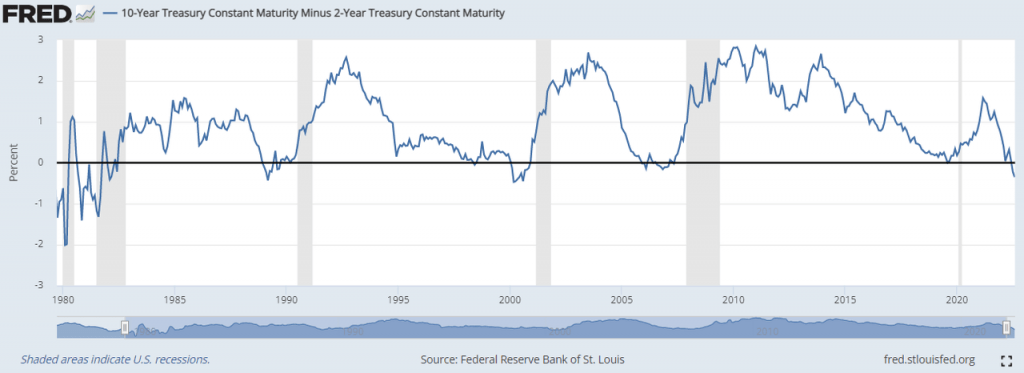

- The nominal yield curve in the U.S. has been inverted since autumn of 2022, but has moderated from the extreme levels observed in 2023.

- The real yield curve—which accounts for inflation expectations—recently inverted, as well.

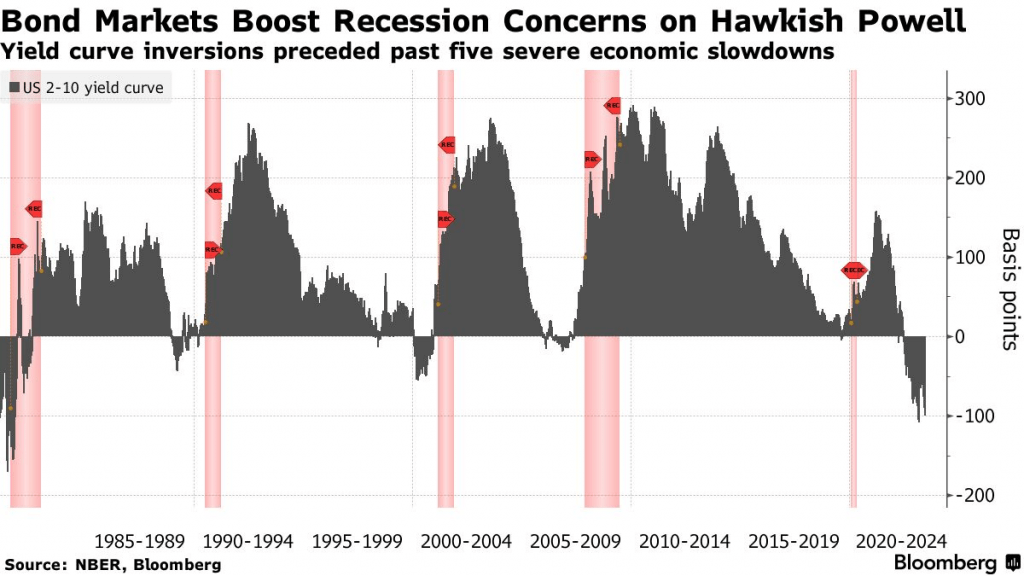

- Yield curve inversions have historically preceded contractions in the U.S. economy, which is why many economists maintain a cautious outlook, despite continued strength in the labor market.

A U.S. economic recession has been on the table for over a year now, but one hasn’t developed yet. However, a recent shift in the yield curve suggests that the risk of a recession remains high, and may be intensifying.

At least that’s the opinion of Campbell Harvey, one of the world’s leading authorities on interest rates. Harvey has been studying interest rates for decades, and his research provides the basis for how interest rates are analyzed today, especially with regards to the yield curve.

The yield curve illustrates how interest rates vary across different maturities in time. Changes in the yield curve are often used like tea leaves to project potential implications for the underlying economy.

A normal yield curve is usually characterized by a gradually rising line going from left to right on the chart—meaning interest rates rise as one goes further out in time. But a so-called inversion of the yield curve occurs when short term rates climb higher than longer-term rates.

The yield curve first inverted in autumn of 2022, when the yield on the 10-year U.S. Treasury bond first dipped below that of the 2-year U.S. Treasury bond. Harvey, a Canadian economist and researcher at Duke University, is widely credited with discovering that inversions in the yield curve have often preceded economic downturns.

Generally speaking, longer-term interest rates reflect future expectations for short-term interest rates. So when long-term rates drop below short-term rates, that generally means that future expectations for the underlying economy are deteriorating. It implies that the Federal Reserve will eventually be forced to lower benchmark rates in response to a slumping economy.

As highlighted below, inversions of the yield curve have preceded the last five U.S. economic recessions.

Considering the aforementioned information, it’s no great surprise that Harvey’s perspective on the yield curve carries added weight. In Harvey’s opinion, economic growth in the U.S. will deteriorate at some point in 2024. Recently appearing on the Forward Guidance podcast, Harvey told host Jack Farley, “Given the circumstances, I think it is likely we do see much slower growth in 2024.”

Notable shift in the real yield curve

What’s especially interesting about the timing of Harvey’s warning is that the real yield curve recently inverted, as well. The real yield curve is very similar to the regular yield curve, but is adjusted for inflation.

As such, the real yield curve is typically viewed as a more accurate predictor of the actual yields that investors will receive from a fixed income investment because real yields account for the expected rate of inflation. The real yield is calculated by subtracting the expected inflation rate from the nominal yield, whereas the regular yield curve is based on nominal yields themselves.

Unlike the regular yield curve, the real yield curve hadn’t yet been inverted—at least not until recently. According to Steven Blitz at TS Lombard, the real yield curve finally inverted last month. Based on that development, Blitz appears to share the same outlook as Harvey—that the U.S. economy could finally start to slow in 2024.

In Blitz’s opinion higher rates eventually lead to a slowdown because lenders and investors are disincentivized from taking on unnecessary risks in such environments. When benchmark interest rates trend toward multiyear highs—as they did last year—fixed-income investments become increasingly attractive, which reduces investments in other parts of the economy.

Despite the sentiments of Harvey and Blitz, there’s no guarantee that a recession will materialize in the near future, because history doesn’t necessarily always repeat itself. There’s also one small problem—the real yield curve historically inverts before the nominal yield curve. This time around, it has been the opposite.

It’s possible that the unique post-pandemic circumstances in the economy have produced some false signals, and that the yield curve will normalize in the coming months, without the onset of a recession. At this time, the inversion between the 2-year and 10-year Treasury bonds is far less extreme than it was last year. Currently, the inversion is about 37 basis points, as compared to 100+ basis points at its worst point last year.

For his part, Blitz isn’t expecting an immediate drop-off in the U.S. economy. His forecast calls for a recession to develop 7 to 12 months down the road, which feels like a lifetime from now, especially during a presidential election year.

Active market participants would be well-advised to continue tracking the leading indicators in the economy extremely closely, as well as the relative strength of corporate earnings. If one or more of those gauges starts to weaken, it may be a sign to adopt a more defensive posture in the markets.

Along those lines, it should be noted that retail sales came in weaker than expected in January. Considering that the U.S. economy is heavily reliant on consumer consumption, another month of weaker than expected retail sales would represent an incremental negative, and potentially indicate that risks in the economy are intensifying.

Lastly, investors and traders should also recognize that the emergence of a significant financial or geopolitical disturbance—such as the reemergence of the regional banking crisis—could serve as a critical tipping point, and push an already beleaguered economy into recession.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.