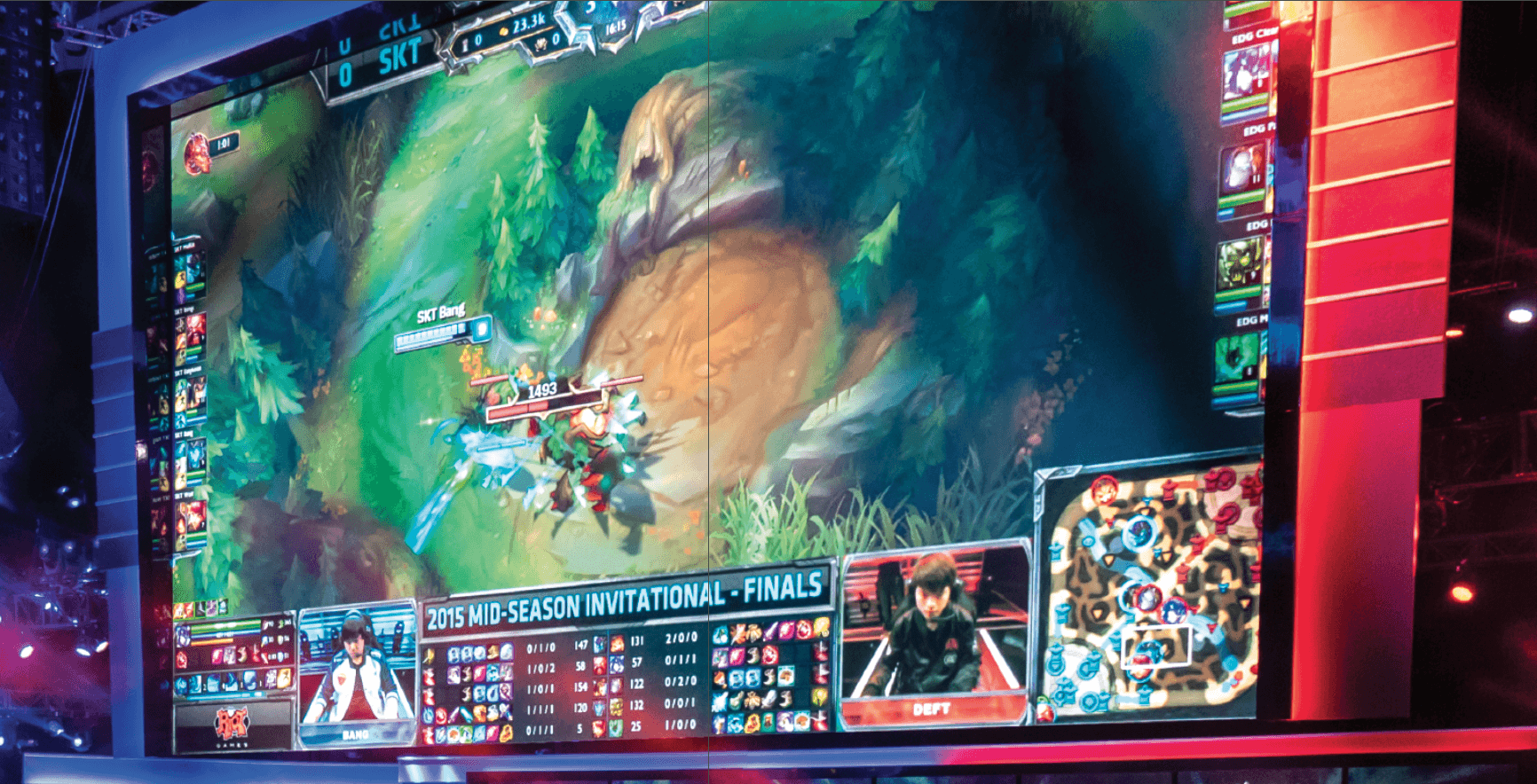

Glu Mobile: Boom and Bust Cycle Continues

Electronic gaming stocks appear likely to remain highly volatile. here’s how to capitalize on trading opportunities likely to arise with one of the sector’s high flyers

In the summer of 2014, Glu Mobile (GLUU) was riding high. Hit games that included Deer Hunter, Dino Hunter

But the glow soon faded. Follow-up games flopped, expenses piled up and the stock—which had topped out above $7 per share—fell to $2 in 2016.

These days, Glu’s situation looks similar to its position in 2014—just replace the names of the 2014 games with today’s Design Home, Covet Fashion and Tap Sports: Baseball. Despite recent growth, the business still has no clear path to sustained growth or profitability.

Faux business model

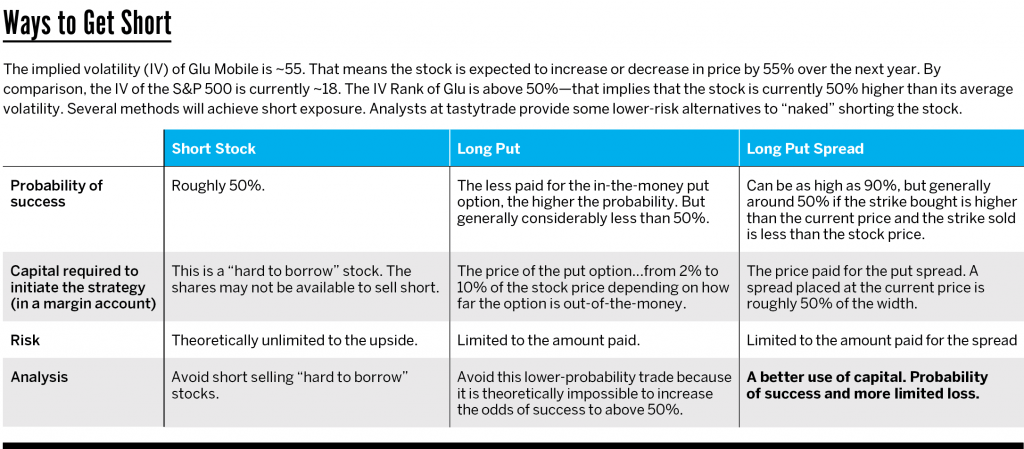

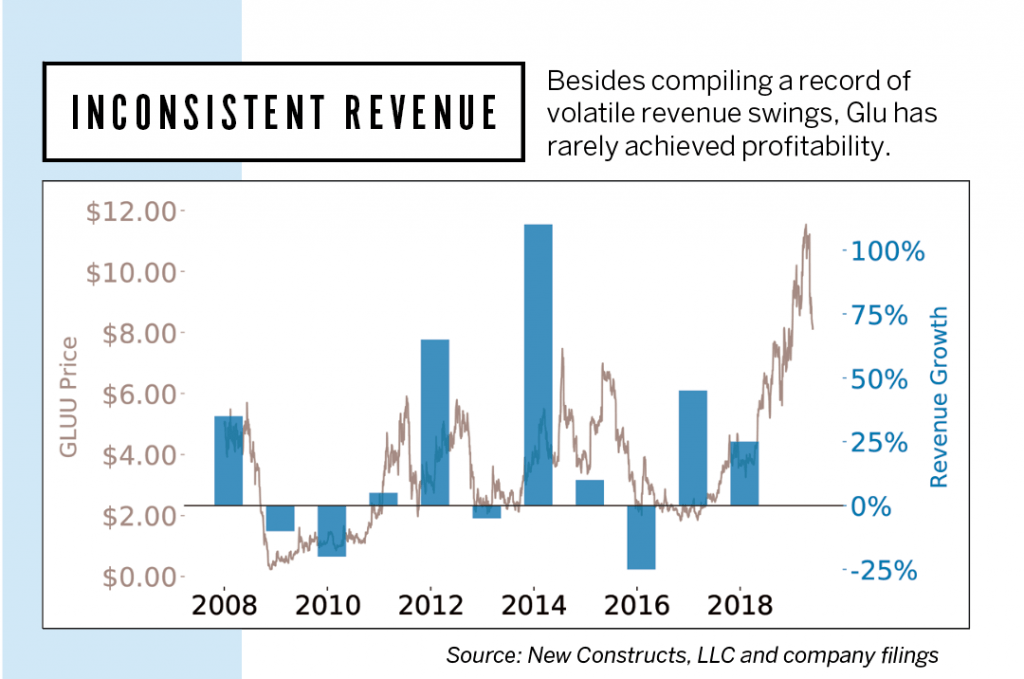

The problem with valuing game developers is that their revenues can be irregular. One hit game can overshadow longer-term downtrends. In its 11 years as a public company, Glu has experienced several cycles of growth and decline, as shown in “Ways to get short” (below).

Glu’s Annual Revenue Growth Since 2008

Besides compiling a record of volatile revenue swings, Glu has rarely achieved profitability. In 2014, the only year when Glu earned an operating profit, the company managed a return on invested capital of only 3%.

Over the past five years, Glu’s average annual free cash flow has been -$66 million (5% of market cap). To finance that negative cash flow, Glu has diluted the holdings of existing shareholders by selling more stock. Since March 1, 2015, Glu’s share count has increased by 35%.

An unworkable business model?

Bulls will argue that investors should expect Glu’s losses and volatile revenues because the company’s still in the early stages of building a profitable mobile gaming platform. New Constructs believes Glu will remain stuck in this cycle indefinitely. Successful content creators, such as Disney (DIS), or successful console game developers, like Activision Blizzard (ATVI), enjoy competitive advantages that a purely mobile gaming company lacks, including:

Branding: Consumers feel loyal to movie studios. They go see a Pixar movie just because it’s Pixar. There’s no evidence to suggest that mobile game developers build that sort of brand loyalty. Glu has tried to piggyback on established brands like Kim Kardashian and Major League Baseball, but that strategy requires paying royalties and sacrificing margins.

Sequels and Franchising: Sequels frequently do well at the box office. ATVI generates reliable cash flow year after year from franchises like Call of Duty. Hit mobile games, however, are almost always one hit wonders that rarely have a popular sequel.

Barriers to entry: Mobile games have much lower development costs than console games and enjoy easily accessible distribution platforms through the various app stores. Mobile game developers also compete with thousands of individuals and indie game developers to reach consumers.

Those barriers to entry highlight another big issue for mobile game developers: No one really knows what makes a game succeed. When Glu launched Design Home, its current top-earning game, management expected the title to make a “minimal contribution” to revenue. If the company’s leadership couldn’t see that hit coming, what makes investors confident the company will follow it up with additional successful games?

Irrational exuberance colors stock price

Even though Glu has celebrated booms and weathered busts many times, investors seem to be betting that this time it’s different.

To justify its current valuation of ~$8/share, Glu must achieve after-tax operating profit margins of 16% (current margins are 0%) and grow revenue by 15% compounded annually for the next eight years. Having 16% NOPAT margins is comparable to ATVI in recent years. Because Glu lacks many of the aforementioned competitive advantages that enable ATVI to earn those margins, it seems unlikely it would achieve that level of profitability.

If Glu grows revenue at the same rate but earns just 8% margins, the stock is worth just $3 per share today, according to New Constructs modeling.

Insider selling should alarm investors

In the last year, Glu Mobile insiders have sold 2.9 million shares, or about 10% of the shares they hold. Again, this is reminiscent of 2014, when insiders also cashed out after the stock first spiked. Glu’s management can see that history is repeating itself, and investors should follow their lead.

David Trainer is CEO of New Constructs, an independent equity research firm that uses machine learning and natural language processing to parse corporate filings and to model economic earnings. Sam McBride is an investment analyst at New Constructs. @newconstructs