Q2 Earnings: Expectations Run High, But Headwinds Are Building

Big banks lead off earnings season, as investors look for clues as to whether the bull run will continue

- Q2 earnings season takes flight tomorrow when some of the nation’s largest financial institutions are scheduled to release their results.

- The financial industry as a whole is expected to report modest gains in Q2 of 2024, but earnings growth from the banking sector could be more anemic because of continuing challenges in the commercial real estate sector.

- Overall, earnings in the S&P 500 are expected to climb by nearly 9%, compared to the same quarter last year. But to gauge the health of the corporate sector, we should analyze the entire spectrum of American companies—big and small.

As Q2 earnings season approaches, all eyes are tomorow, when some of the nation’s most prominent financial institutions are scheduled to unveil their quarterly results. This earnings period is a crucial barometer for active investors after the remarkable rally on Wall Street in the first half of the year.

This earnings quarter is particularly significant, as investors await the results to determine whether corporate profits can remain strong after Wall Street’s steady rally in the first half of the year.

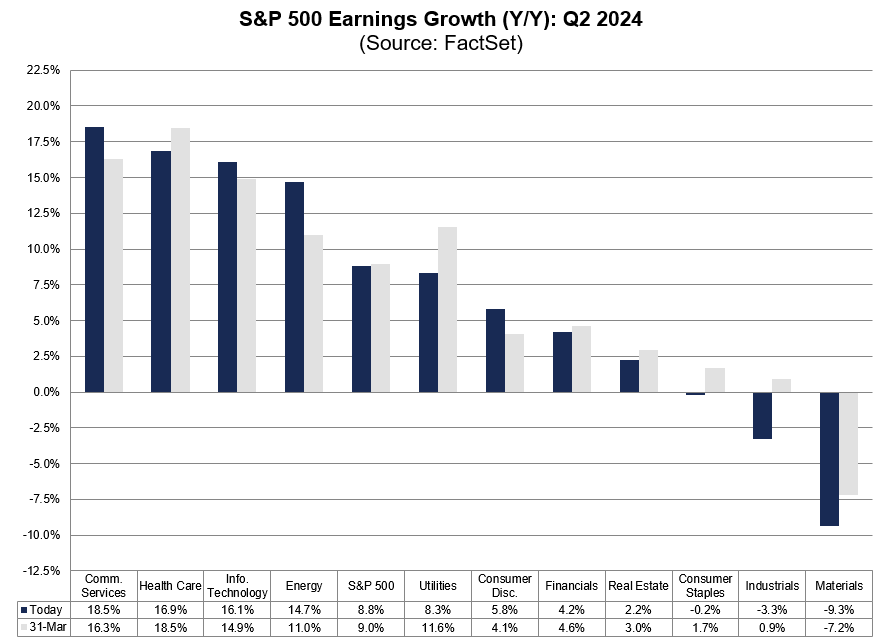

FactSet, a financial data and software company, projects that S&P 500 earnings will rise by 8.8% in Q2, compared to the same period last year. If this prediction holds true, it would mark the strongest growth in corporate earnings since the first quarter of 2022.

In recent months, analysts have pared back expectations for Q2 earnings, but FactSet researcht indicates these revisions have been minimal. Over the past decade, the average quarterly decline in bottom-up earnings per share (EPS) estimates has been 3.3%. However, for Q2 2024, the reduction was only 0.5%, highlighting analysts’ confidence in their projections.

Strength in corporate earnings is becoming increasingly conspicuous, considering both the manufacturing and services sectors have reflected slowing activity of late. A corresponding dip in consumer confidence is another sign corporate earnings may eventually start to weaken, even if Q2 results clock in as expected.

Also note that Q1 results weren’t as rosy as they appeared on the surface. While profits for S&P 500 companies were relatively strong, earnings growth for the broader corporate universe was actually negative on a quarter-over-quarter basis.

The financial sector will set the early tone for Q2 earnings season

The financial sector will be responsible for nearly 40% of the earnings releases reported by the S&P 500 during the first couple weeks of Q2 earnings season. So, this sector will set the early tone for the quarter.

The sector’s earnings are expected to grow by about 4.2%, compared to the same quarter last year (sector breakdown illustrated below). However, FactSet noted that if the results from the insurance and capital markets subsectors were excluded, then earnings from the sector would look significantly weaker. In that theoretical scenario, earnings in the financial sector would be expected to decline by roughly 6.4%.

The weakest subsector in the financial industry is expected to be the banks, which are projected to have experienced a 10% decline in earnings during Q2 2024, compared to Q2 2023. Excluding the banks, however, the financial sector would have shown robust growth in Q2, with earnings increasing by roughly 14%.

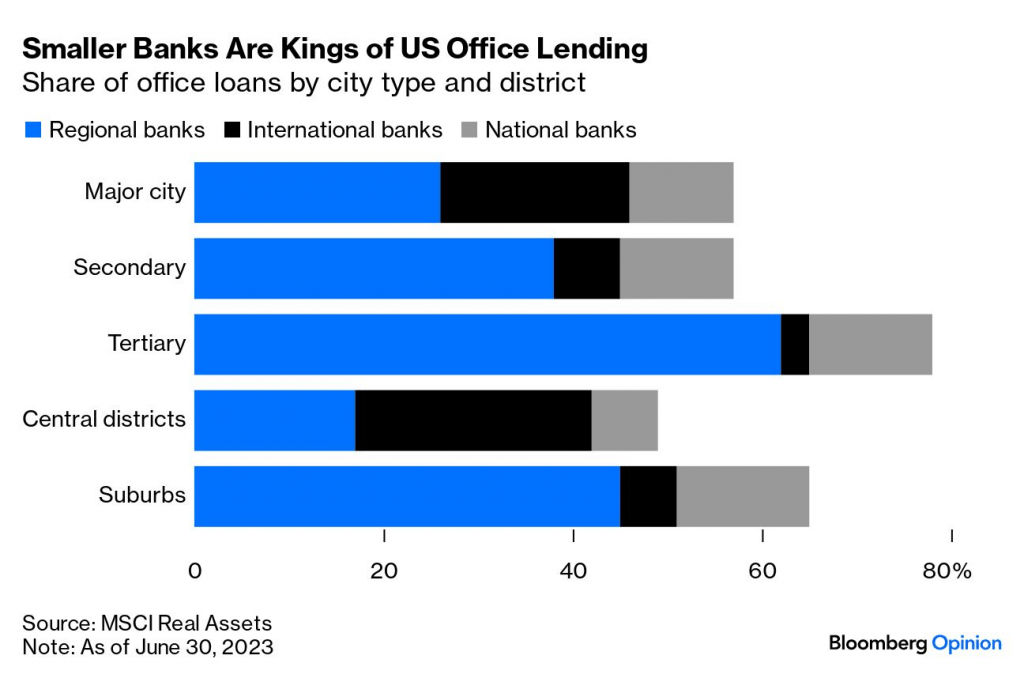

Delving into specifics, the weakest performers in the financial sector are expected to be the regional banks, as well as the so-called “diversified banks,” which respectively are expected to report earnings declines of 26% and 9%, according to FactSet.

Regional banks are still battling a slowdown in the commercial real estate sector. The latter has seen reduced occupancy in the wake of the pandemic—especially the embattled office niche—which has weighed negatively on associated cash flows and valuations. This has in turn pressured the banks holding the loans on those properties, many of which are regional.

History says the bull rally could continue in H2 2024

Trading years that include presidential elections have historically been more volatile than others, but in 2024 that hasn’t been the case. At least, so far.

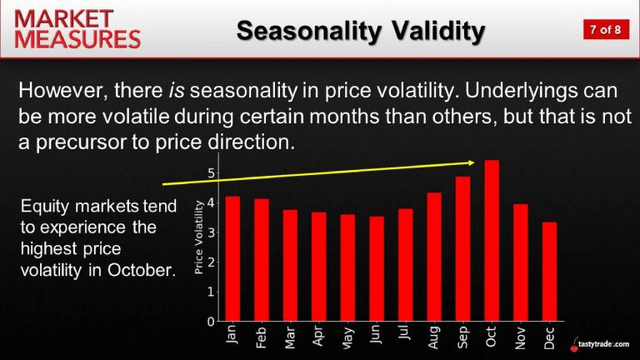

The fact that the stock market performed well under both candidates—President Joe Biden and former President Donald Trump—is probably a key reason that complacency has reigned in the financial markets. But replacing Biden on the ticket could disrupt the risk paradigm on Wall Street, potentially triggering increased market volatility during the second half of 2024. That volatility could become especially strong in September and October, which tend to be the most volatile months on the calendar.

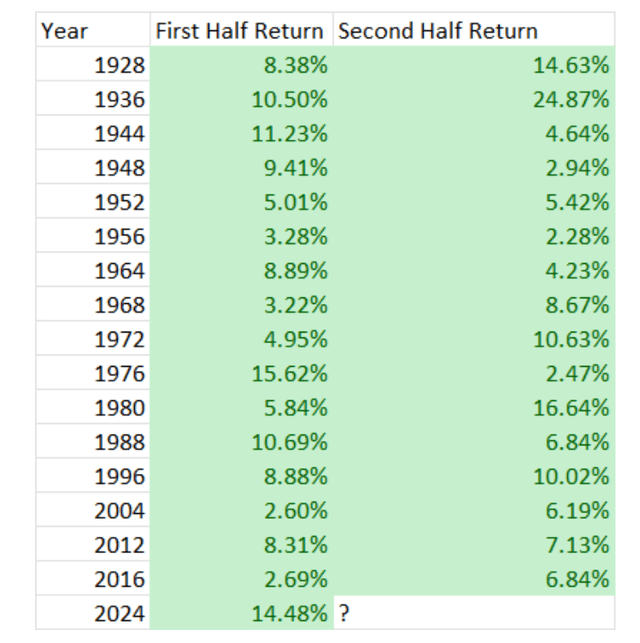

Importantly, historical data suggests that when the stock market performs well in the first half of a presidential election year, it often continues to outperform during the second half. It’s happened 16 times, as highlighted below.

Based on the aforementioned data, and current expectations for robust corporate earnings growth in Q2, it’s hard to bet against further upside in the major equity indices during the second half of the year.

However, keep in mind that the stock market rarely goes straight up, even if it does end the year higher. In previous election years when the S&P 500 rallied in the first half and continued to climb in the second half, the stock market always experienced a significant pullback at some point in between. The smallest pullback was 3.55% in 1964, while the largest was 12.83% in 1948, according to McElroy.

This data serves as an important reminder that active investors may want to keep some “powder dry,” and build up cash reserves to use on a pullback. Moreover, note that past performance is no guarantee of future results—meaning 2024 could easily become the exception to the previous “rule” if the S&P 500 fails to advance during the second half of the 2024 trading year.

To learn more about trading corporate earnings season, readers can check out this installment of Options Trading Concepts Live on the tastylive financial network.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.