The Low Spark of High-Yield Stocks

With a little knowledge and hard work, traders can beat the return on high-dividend stocks and avoid the trap of inadvertent risk

Alexander Pope got it right in 1711 when he wrote that “a little learning is a dangerous thing.” His words still ring true for one of the simplest and most-promoted approaches to investing – buying high-yielding stocks. It’s one of the first strategies new investors learn and, unfortunately, it’s sometimes all they learn.

Admittedly, high-dividend stocks can seem appealing. They hold the allure of earning 6% or 8% a year via cash flow, and Wall Street touts them as a sound way to build wealth. But buying high-yield stocks doesn’t always lead to success, and a slight modification of the strategy can increase returns.

Historically, investing for dividends has been stable, often with 25% to 50% less risk than investing in stocks that don’t pay dividends. The idea is simple — investing in companies that pay dividends can accomplish two things. First, the income stream makes the stock position similar to a bond (without the guarantee of principal). Second, there’s the potential to make money on the growth of the stock price, which would be a capital gain. Dividend investing is popular among retirees because the income stream provides positive cash flow every quarter. Plus, growth in the stock price can help a portfolio keep pace with inflation.

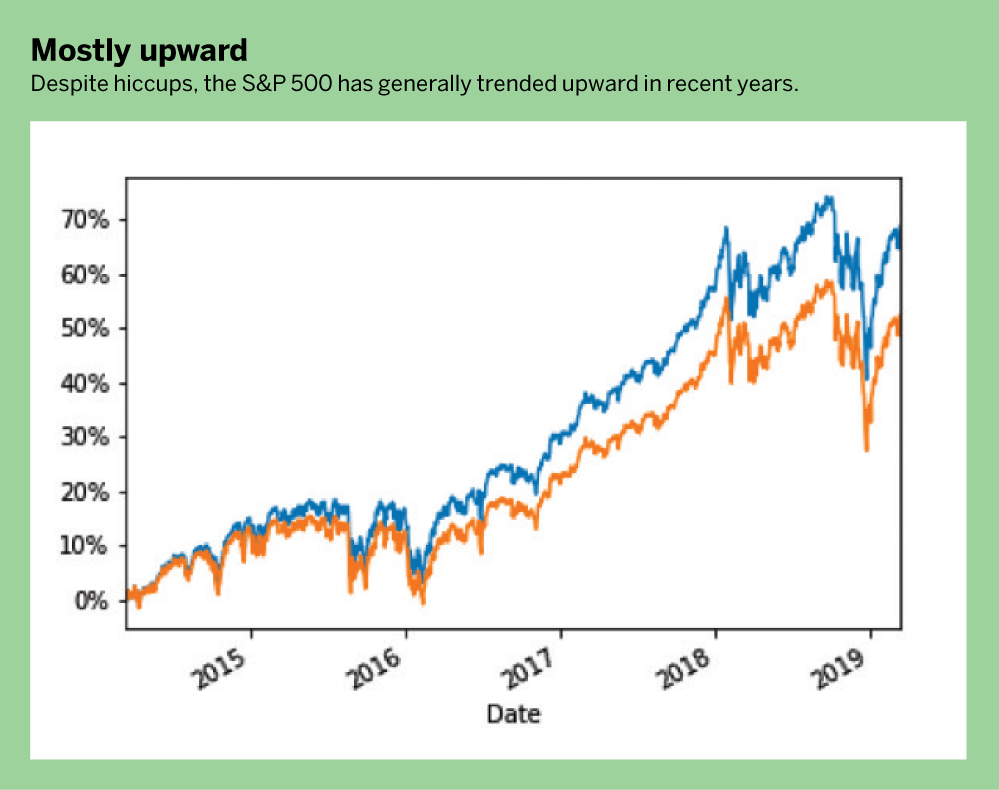

Generally, buying high-yield stocks has worked well. Look at the five-year performance of the S&P 500: It’s up 50%, and adding the dividends boosts it to a 70% increase! There’s a difference of 20% because of dividends — small dividends — which historically have had around 1% to 3% increase per year.

Buying high-yielding stocks is one of the first strategies new investors learn and, unfortunately, it’s sometimes all they learn

It’s that extra return over and above the gains in the stock price that makes the high dividend so attractive — but it doesn’t always pay off. It’s easy to become enamored of dividend yield. “If I like the stock with a 2% dividend yield, I’d love one with a 6% dividend yield,” some readers are thinking. But larger dividends don’t always lead to higher returns because high yields can make investors overlook risk. Anyone who assumes dividend investing is low risk and then buys a stock that moves up and down 20% month-to-month has made an inappropriate investment. Instead of dividend investing, they have unwittingly become “dividend speculators.” While the original appeal of dividends was less risk, inadvertent speculators have actually taken on more risk than they had wanted.

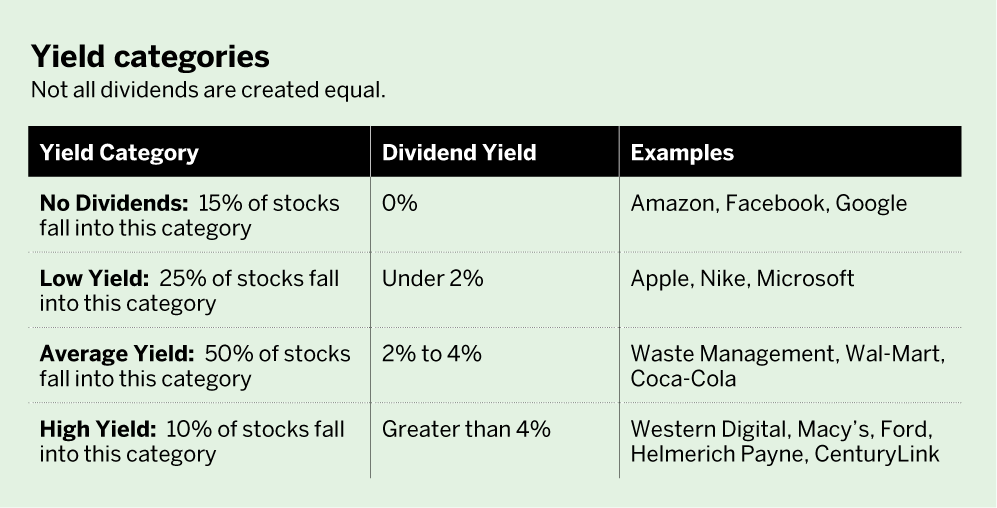

So, what exactly is the definition of a high- yield dividend stock? Investors can improve their understanding of the dividend landscape by exploring the 500 stocks in the S&P 500. About 90% of those stocks pay dividends of less than 4% a year. Examples include Apple (AAPL), which pays less than 2%, and Coca-Cola (KO), which pays 2% to 4%. Stocks with dividends of more than 4% a year are considered high-yield, and investors should handle them with caution. (See “Yield categories,” left.)

Stocks that pay big dividends tend to have low capitalization and lots of volatility

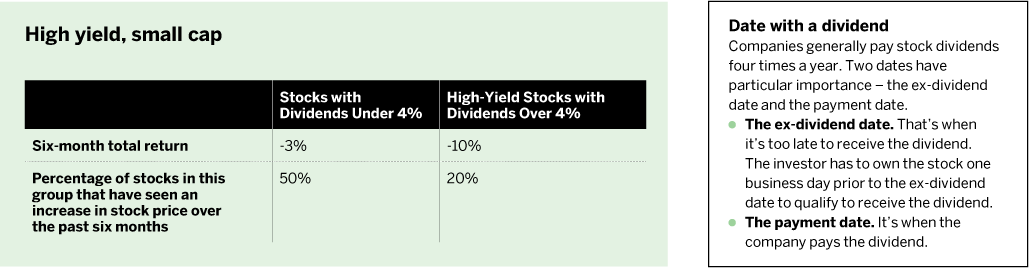

The problem with high-yield dividend stocks is two-fold for “safety seeking investors.” First, any gain from having a higher dividend has been lost during the past six months because of the declining stock price. (See “High yield, small cap,” below.) While stocks are down 3% over the past six months, high-dividend stocks are down 10%. Only 20% of high-yield stocks were up, compared with 50% of the rest of the stocks.

High-yield stocks tend to have small capitalizations (on average 10 billion smaller), which makes them more volatile and sensitive to shifts in the economy or changes in their industry. Think of what happens when a company begins having problems — it cuts the dividend. Today’s high yields may not exist tomorrow. Because dividends come from a company’s excess cash, they are often first on the chopping block. That can lead to a further decline in stock price because shareholders no longer have cash flows. Recent examples include CenturyLink (CTL) and Limited Brands (LB). They lost 9% and 20% respectively the day after management announced a dividend cut. Even GE, once one of the largest companies in the world, cut its dividend when it faced problems.

To further complicate things, as stocks decrease in price, the amount of the dividend might stay the same — at least for a while — but the yield will increase. The math is simple. Dividend yield equals the dividend amount divided by the stock price. Keep the dividend the same but drop the stock price, and yield goes up. A decrease of 50% in the price of the stock doubles the yield. But the company can rarely sustain that yield.

For example, in the financial crisis of 2008, the dividend yields spiked for a bit. But within a few months, more than 100 stocks in the S&P 500 cut dividends. So, while investors at the bottom might have gotten some deals, they didn’t have the yields they were expecting.

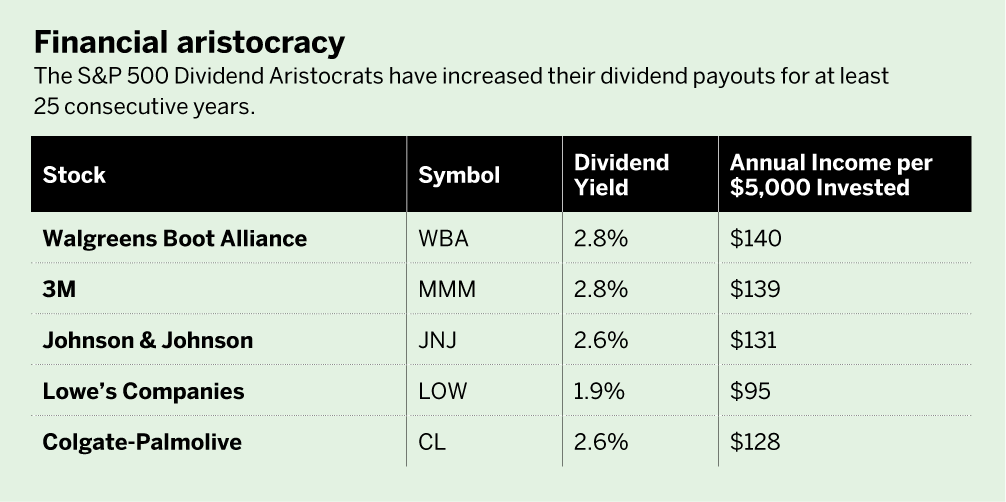

Many astute investors focus their attention on the S&P 500 Dividend Aristocrats. These stocks have increased their dividend payouts for 25 consecutive years or more. By focusing on the Aristocrats, investors limit their lists of potential dividend investments to historically stable companies. On average, the size of those companies is $75 billion — they’re large inter- national companies. They outperformed the overall market seven of the past 10 years. (See “Financial aristocracy,” below.)

In last month’s article, “The Case for Proactive Investing,” luckbox made the argument that covered calls help accentuate returns along with reducing overall risk. Investors can use that approach for stocks in the S&P 500 Dividend Aristocrats. It provides the best of both benefits – a consistent cash stream from the dividends, along with a cash flow from the covered calls.

Image: Ideas

Both ideas offer the advantage of gain- ing access to the dividend, while also having the potential to double or triple the income received every year. So, don’t stop with the simple stuff Wall Street promotes. With just a little more work and a little more knowledge, investors can turn dividend investing into the lower risk/higher return strategy they’ve been hoping for.

Michael Rechenthin, Ph.D., (aka “Dr. Data”) is head of research and data science at tastytrade