The Trade Desk is Getting Cheap. Time to Jump In?

A 60% correction could be exactly what this ad-tech leader needed

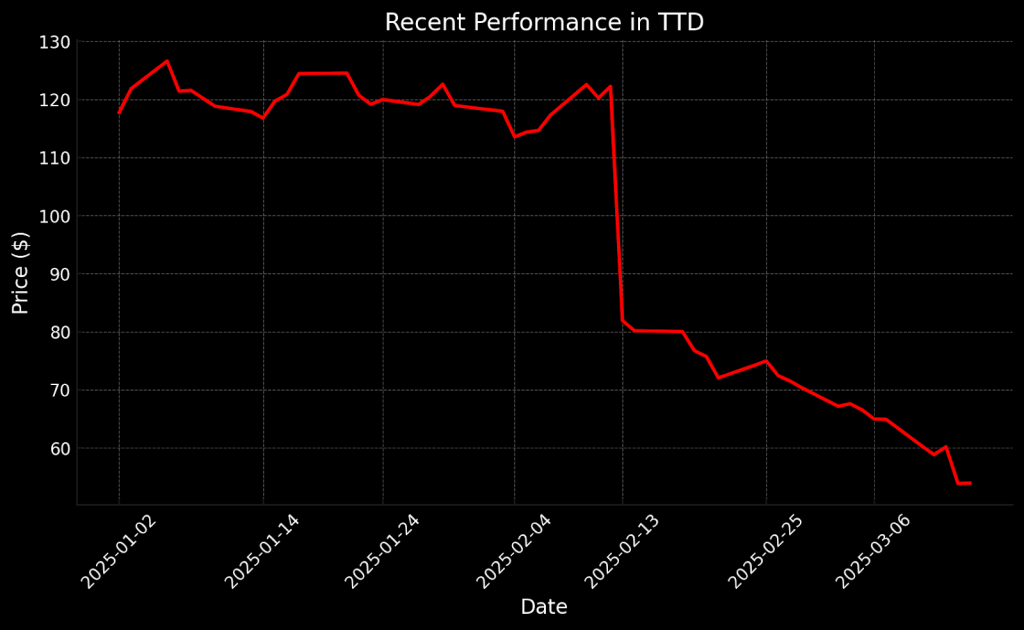

- The Trade Desk’s Q4 earnings report came up short of Wall Street expectations, leading to a sharp sell-off.

- While still trading above industry averages, the digital marketing company’s stock now presents a more balanced valuation, with most analyst price targets suggesting significant upside.

- One analyst who was previously bearish has now adopted a neutral stance, highlighting how the 60% drop has altered the stock’s valuation outlook.

Shares in The Trade Desk (TTD) have taken a sharp 60% dive but could be setting the stage for an exciting investment opportunity. The digital marketing company, once the darling of the ad-tech world, has posted impressive growth of revenue and demonstrated cutting-edge innovation in connected TV (CTV) and AI-driven advertising. These days, the stock is priced at a much more attractive level.

Despite recent struggles, The Trade Desk’s core strengths remain intact. With its industry-leading technology and dominant position in digital advertising, the company still has significant upside. Its strategic pivot toward AI and CTV positions it for long-term growth. So, is this drop an overreaction? Could it be the perfect time for a rebound? Let’s explore why the company might be on the brink of a comeback.

A critical role in the digital advertising revolution

The Trade Desk has become a key player in digital advertising, reshaping how businesses approach ads across the open internet. The company. founded in 2009 and operating from headquarters in California, offers a global technology platform that enables clients to manage and optimize their ad spend in real-time. Tne platform provides businesses with tools to make smarter, data-driven decisions and improve the effectiveness of ad campaigns.

Unlike most competitors, The Trade Desk operates on a demand-side platform (DSP) model, which gives advertisers the ability to purchase digital ad inventory on multiple channels, including display, video, audio and connected TV (CTV). This helps clients to target consumers with precision, using data-driven insight and automation to optimize ad performance and return on investment (ROI).

The Trade Desk excels in programmatic advertising, which automates buying digital ads through real-time auctions. This has become the gold standard in digital advertising, providing efficiency and transparency compared to traditional, more manual methods of ad buying. As digital advertising has evolved, the company has capitalized on the shift toward premium, scalable channels such as CTV, retail media and mobile. And by integrating AI and machine learning into its platform, the company is leading the next wave of innovation.

Recent developments show The Trade Desk’s commitment to expanding its capabilities. In 2024, the company made headlines with its first acquisition in nearly eight years, purchasing the ad tech intelligence platform Sincera. This acquisition, along with the company’s focus on identity technologies like Unified ID 2.0 and innovations in CTV through its new Ventura Operating System (OS), signals the company’s commitment to pioneering data-driven, digital advertising.

Despite these strategic successes, shares of The Trade Desk have been under considerable pressure since peaking in December. The latest earnings report revealed a series of execution missteps that resulted in a slight revenue miss, coupled with a more conservative outlook for 2025. In response, management is taking action, recalibrating its strategic approach and improving operations. The company is realigning its efforts to position itself for growth.

Q4 earnings miss: what went wrong?

The company’s latest earnings report showed solid growth but was met with disappointment on Wall Street. Q4, total revenue reached $741 million, a 22% year-over-year increase, while full-year revenue surpassed $2.4 billion, up 26%. These figures reflect the company’s scalability, yet the report fell short of investors’ expectations, triggering a sharp sell-off. The stock plummeted by more than 30% after the earnings release and is now down nearly 60% from its 52-week highs.

The negative market reaction was driven by the company’s revenue miss, which fell about $15 million short of the guidance provided in the previous quarter. This was the first time in 33 quarters that The Trade Desk failed to meet its own forecast, raising some eyebrows. The company also cited a series of small execution missteps, including a slower-than-expected rollout of its Kokai platform, which was designed to fuel long-term growth but negatively affected short-term performance. CEO Jeff Green acknowledged these issues and outlined corrective measures, including a major reorganization aimed at improving agility and leadership structure.

While the company remains profitable, posting over $1 billion in adjusted EBITDA for the year, and continues to generate strong free cash flow, these positive metrics were overshadowed by the shortfall in revenue and the accompanying concerns. The Trade Desk’s client retention remained strong, with a rate over 95%, and its investments in AI and supply chain optimization are positioned for long-term growth. However, in the near term, these structural changes and product rollouts failed to mitigate concern about the company’s performance.

Looking ahead, The Trade Desk has projected first-quarter 2025 revenue of at least $575 million, which represents 17% year-over-year growth but marks a noticeable deceleration from its recent growth trajectory. As the company continues its aggressive push into AI, media buying platforms, and its direct-to-publisher offerings, investors are left to assess whether these strategic initiatives will be enough to regain investor confidence and spark a recovery. With execution challenges still looming, one critical question is whether it can overcome these hurdles and regain momentum, or if it will continue to face struggles.

After 60% drop, the valuation looks more attractive

After a sharp 60% drop from its 52-week highs, The Trade Desk’s stock is starting to look like a tempting opportunity, even if it’s not quite “cheap” yet. The company’s valuation metrics, once considered sky-high, have come down dramatically, putting the stock in more appealing territory for investors willing to stomach the risk.

Despite the lofty price-to-earnings (P/E) ratio of 70, compared to the sector’s 20, and a price-to-sales (P/S) ratio of 11 that remains well above the industry median of 1.25, the stock is now trading at levels where investors might start to reconsider. The Trade Desk is still clearly priced for growth, but the recent correction has brought its valuation closer to a looking like a bargain—especially if the broader market can turn around.

Another positive development has been a shift in analyst sentiment. Of the 39 analysts covering the stock, 28 are still backing it with “buy” or “overweight” ratings, a vote of confidence that the company can bounce back. What’s more telling is one analyst who was once bearish has now softened their stance to neutral, signaling the stock’s lofty valuation is beginning to line up with reality.

Benchmark Research upgraded its outlook for The Trade Desk, moving from a “sell” to a “hold” rating, acknowledging the stock is now closer to its fair value. “The stock has retreated to within 10% of its fair value of $59, making it less risky for investors at this point,” said Pratyush Thakur of Benchmark. “We see potential for stabilization as the company recalibrates its strategy, but expect continued compression in its growth premium in 2025.” The shift from bearish to neutral illustrates how the company’s valuation has become more reasonable after the sell-off.

Another vote of confidence came from JMP Securities, which reiterated its “market outperform” rating, assigning a price target of $115 per share—substantially above the current price of about $55 per share. And if the broader market were to rebound, The Trade Desk looks well-positioned to benefit, particularly if digital ad spending resumes its upward trajectory.

The company’s core strengths—independence in the ad-tech ecosystem, focus on innovation like AI-powered forecasting and growing presence in Connected TV—could all fuel growth. While the stock’s valuation remains on the high side, the recent sell-off makes it a potential buying opportunity for those willing to look past short-term setbacks and focus on long-term growth.

Investment takeaways

The Trade Desk’s 60% correction has dramatically shifted its valuation, bringing the stock closer to a more reasonable price after a period of sky-high multiples. While still trading above industry averages, the stock now offers a much more attractive entry point—especially for investors looking to capitalize on a broader market recovery. Analysts remain cautiously optimistic, with 28 of the 39 covering the stock maintaining “buy” or “overweight” ratings, and price targets as high as $150 per share point to substantial upside potential.

While recent execution hiccups and a weaker-than-expected 2025 outlook have raised some concern, The Trade Desk’s long-term prospects remain strong. The company’s continuing investments in AI and focus on strengthening direct relationships with brands position it for growth. For investors with a longer-term perspective, this could be an ideal time to add the company to their watchlists and consider initiating new positions at these levels or below.

Andrew Prochnow, Luckbox analyst-at-large, has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader.