Is Tesla Losing its Charge?

The market value of Tesla (TSLA) has plummeted by $280 billion this year, and may still fall

The market value of Tesla (TSLA) has plummeted by an astonishing $280 billion this year, but it was still worth approximately $510 billion at press time, comparable to the combined worth of industry giants McDonald’s (MCD), Disney (DIS) and Nike (NKE).

Shares in Tesla had cratered in March on expectations of disappointing first-quarter deliveries projections, vehicle price cuts, analyst downgrades and pessimism around the market for the EV giant’s long awaited next-generation offering.

Meanwhile, competition is fierce from China, the world’s largest EV market. Investors’ sentiment for the stock is likely to remain subdued until early April when the company reports its first-quarter delivery numbers.

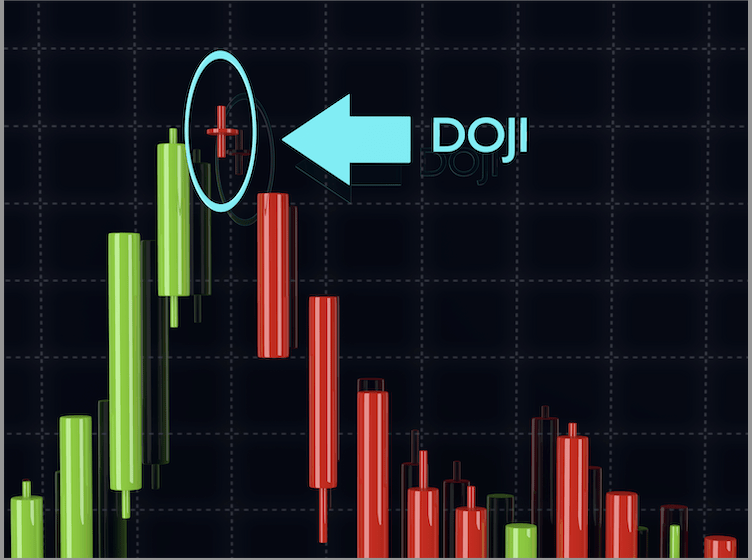

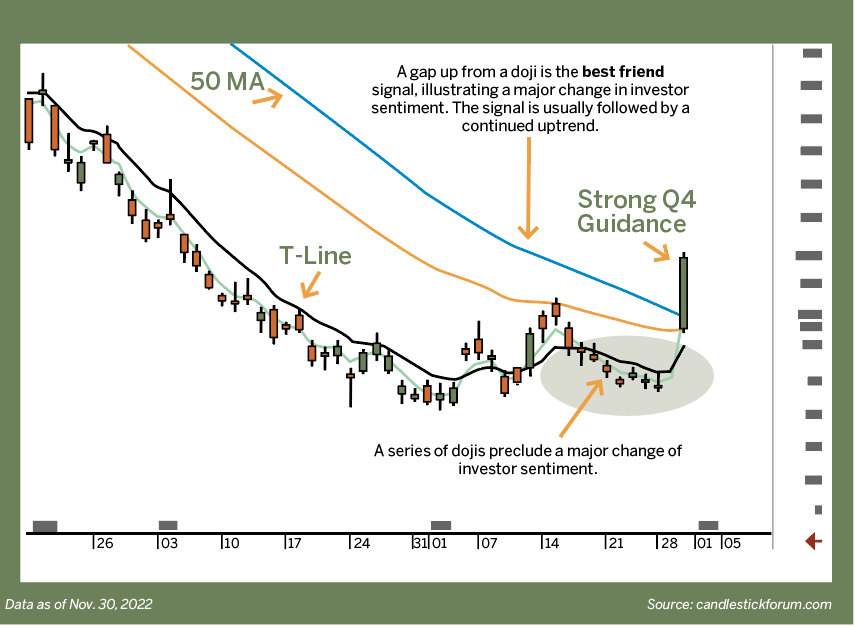

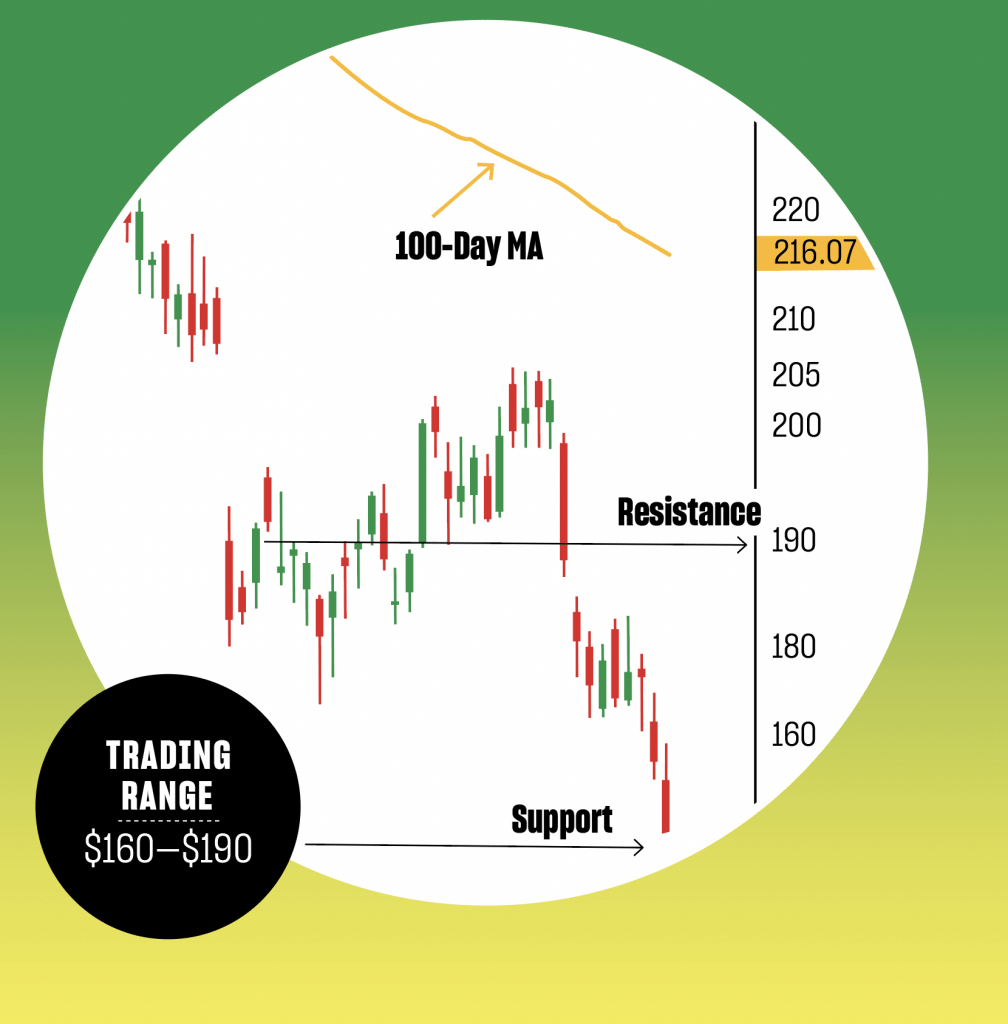

From here, bulls should be looking to push the price up to the two-week moving average (MA) of $190, where a continuation of buying activity could lead to a rally toward the 100-day MA of $216.

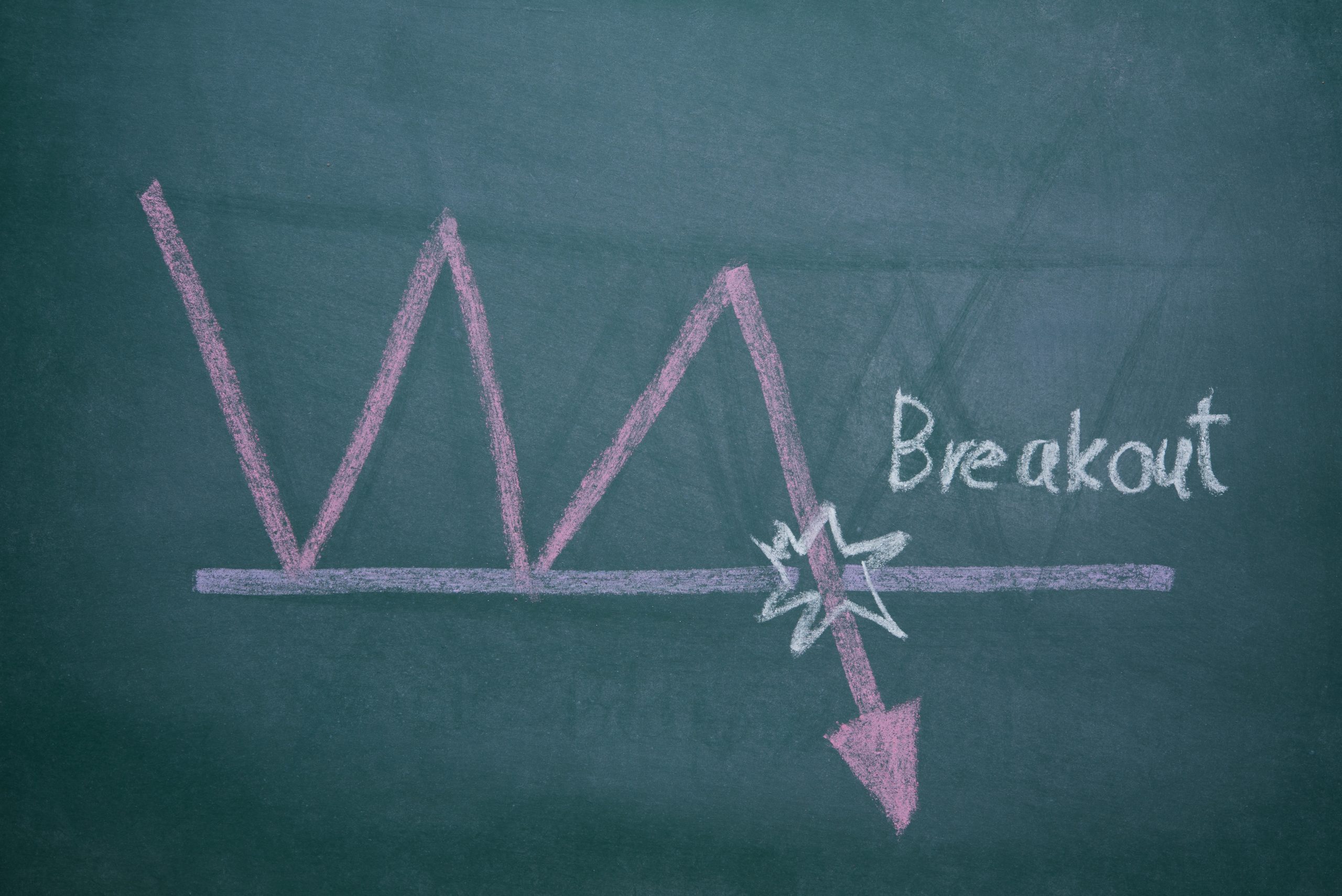

However, if the breach of the $160 support level is sustained, the price could fall to $152, where a further selling could send the stock lower into unchartered territory.

In light of the price breakdown at press time, the best advice is to fear the falling knife—step aside.

Jermal Chandler, is host of Engineering the Trade, a show that helps tastylive traders get a sense of the way the market is moving from an analytical point of view.