Buy the Dip? Evaluating First Solar’s Post-Election Potential

It’s low valuation could be a rare opportunity—or in a less favorable scenario, a waiting game

- First Solar’s valuation seems attractive because the stock’s trading below the sector average despite robust demand for the company’s products and services.

- The company’s U.S.-made solar technology and a substantial order backlog are driving growth, but the election makes its future uncertain.

- Meanwhile, global demand for solar energy remains strong.

In the lead-up to the 2024 election, First Solar (FSLR) was widely viewed as a central player in the “Harris Trade,” positioned to benefit if Democrats maintained control of the White House because of the party’s support for renewable energy. With Republicans now securing the White House, the Senate and possibly the House, the dynamics have changed for First Solar and the solar industry as a whole.

But First Solar still stands out as a compelling, potentially undervalued investment, even under a Republican administration. The forces shaping First Solar’s future and how the company’s valuation could evolve in light redefined politics are especially pertinent with the company’s shares sliding more than 10% after the elections, offering investors a chance to “buy the dip.”

First Solar’s unusual position in the industry

In the sprawling global solar industry, First Solar stands apart. While most players rely on silicon-based panels, it has pioneered the use of cadmium telluride, a lower-cost material that performs well in hot, direct sunlight. This has established the company as a dominant U.S.-based manufacturer in a field crowded with low-priced foreign producers.

Beyond its technology, First Solar’s business model combines production of solar modules with the execution of large-scale solar projects. And unlike many manufacturers, the company offers a full-service suite of products and services for utility and commercial clients—including design, development, construction and maintenance—to ensure it captures revenue throughout the lifecycle of solar power projects.

First Solar has also benefitted from government policy. Tariffs on imported solar products reduce competition from foreign manufacturers, especially from China. Incentives like those in the Inflation Reduction Act (IRA) further enhance First Solar’s position by promoting domestic solar production and installation.

Robust earnings, but challenges in Q3

First Solar has reported consecutive quarters of solid earnings, reflecting strong demand for its products. In Q2, revenue surged 24% year-over-year, underscoring the company’s strong foothold in a favorable market. By Q3, however, growth began to slow, with revenue increasing just 11%—a sign of emerging pressures as economic and policy headwinds came into view. This slight softening tempered the company’s outlook, highlighting both the strengths of First Solar’s position and the challenges of navigating an increasingly volatile market.

Following strong performance earlier in the year, First Solar’s Q3 earnings brought some areas of concern into focus. Although net income rose 17% year-over-year to $313 million, earnings per share (EPS) fell short of expectations, partly because of a $50 million charge for product warranty reserves—a sign that quality control remains a priority for the company. Liquidity saw a sharp decline in Q3, with net cash dropping 42% to $700 million as a result of significant capital investments aimed at expanding the company’s U.S. manufacturing operations. These expenditures reflect First Solar’s strategic push to reduce reliance on foreign markets and bolster its competitive position against lower-priced producers, particularly from China.

Revenue trends indicate a gradual slowdown in growth, leading management to revise its full-year guidance downward to $4.1 billion to $4.2 billion, from the earlier range of $4.4 billion to $4.6 billion. Earnings projections were similarly adjusted to $13.00-$13.50 per share, reflecting a more cautious outlook. Despite the adjustments, First Solar’s strong order backlog—estimated at 15.6 gigawatts to 16.3 gigawatts for the year, with bookings extending through 2030—underscores the company’s impressive long-term growth potential.

In sum, First Solar’s recent earnings highlight a resilient growth path but reflect the realities of rising costs, quality control demands and a volatile market. Revenue and earnings remain on solid footing, but the company faces shifting policies, aggressive global pricing pressures and the capital-intensive nature of scaling its U.S.-based operations. As the company balances near-term financial goals with ambitious expansion plans, its ability to maintain attractive revenue and earnings growth will be a key determinant in its valuation.

Compelling earnings multiple

From a valuation perspective, First Solar appears attractively priced relative to the broader industry. With a market cap of around $21 billion and a current stock price around $195/share, the company trades at a trailing twelve-month (TTM) P/E ratio of 18, well below the sector median of 29. This lower P/E suggests that investors may be undervaluing First Solar’s earnings potential, especially if the company can sustain its growth trajectory.

First Solar’s below-average P/E ratio, compared to its sector peers, likely reflects the market’s cautious stance toward the company’s exposure to shifting policies and the heavy capital it has poured into U.S.-based manufacturing. These risks have put a damper on investor enthusiasm, yet they also carve out a place for First Solar in an industry crowded with lower-priced international players. Armed with proprietary CdTe thin-film technology and a deep backlog of orders, First Solar combines steady core operations with the potential for substantial gains if conditions remain favorable.

Yet, this undervaluation is tethered to the unpredictable winds of policy. The Inflation Reduction Act (IRA) has become a cornerstone ofhthe solar industry, providing critical support for domestic production. Should the IRA face rollbacks, First Solar’s earnings trajectory—and consequently, its valuation—could be deeply affected. Ultimately, the value in First Solar’s current price hinges on the resilience of renewable energy policy in Washington, and whether the industry’s momentum can hold steady through shifting political tides.

Near-term political headwinds

After the 2024 elections, First Solar faces challenges because it relies on the Inflation Reduction Act (IRA), which has directly enhanced its profits. The IRA has been instrumental in strengthening First Solar’s profit and sales outlook by creating a more favorable economic environment for U.S.-based solar manufacturers.

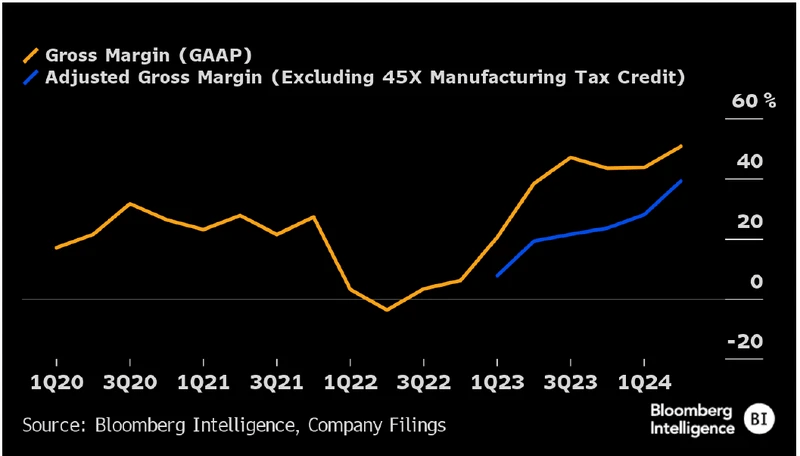

Provisions like tax credits under Section 45X, significantly reduce production costs for domestically manufactured solar components. This support has lowered First Solar’s cost structure, leading to a notable improvement in gross margins—from roughly 3% in 2022 to nearly 47% in H1 2024 (illustrated below). This margin expansion has enabled the company to remain competitive in a crowded market.

The IRA incentivizes utilities and developers to prioritize American-made products for large-scale solar installations, aligning with First Solar’s focus on utility-scale projects and strengthening its sales pipeline. This ensures solid revenue streams for years to come. Protective tariffs also shield First Solar from lower-cost foreign imports, helping it maintain favorable profit margins without facing aggressive pricing pressure from international competitors

With these advantages, the recent election results now cast a layer of uncertainty over First Solar’s future. The incoming Republican administration may seek to repeal or revise the act, given the party’s generally cautious stance on renewable energy incentives. However, any major policy rollback would require substantial legislative support—a challenging feat if Congressional margins remain tight.

Even if the IRA is revised, First Solar’s focus on high-efficiency, advanced modules and its strong U.S. market position suggest it could maintain a competitive edge. Gross margins are unlikely to fall below 25%, even “if the IRA is revoked or watered down,” according to Rob Barnett, a senior analyst at Bloomberg Intelligence. That would still be a solid margin, especially when you consider the fact that First Solar’s gross margins had dipped below 5% as recently as 2022.

Investment takeaways

As First Solar navigates the changing political landscape, its innovative CdTe technology, strong U.S. manufacturing base and substantial order backlog combine to make it a leading player in the renewable energy space. Despite some signs of slowing growth, First Solar’s ability to expand profit margins and insulate itself from international pricing pressures has helped it weather recent challenges.

Adding to this favorable setup, global demand for solar energy continues to soar. 2023 was a landmark year for the industry, with an estimated 87% increase in new solar capacity. Remarkably, 2024 is projected to surpass that record, with installations expected to reach 593 GW, a 29% increase over last year. This rapid expansion strengthens First Solar’s position in the U.S. market, where demand for reliable, American-made solar technology has been especially strong (illustrated below).

From a valuation standpoint, First Solar’s price-to-earnings (P/E) ratio of 18, well below the sector median of 29, indicates the company is underappreciated. This discount may reflect investors’ caution, but it also presents an opportunity: If the Inflation Reduction Act (IRA) remains untouched, First Solar could continue reaping the benefits of U.S.-centered incentives that fuel its growth and enhance its market position. In that scenario, the current valuation could look like a clear mispricing.

Still, a Republican administration could scale back renewable energy support. If that happens, First Solar’s valuation gap might narrow as it adjusts to altered policy. Yet even with that potential headwind, the company’s appeal endures. In a world leaning into green energy, First Solar presents a rare opportunity: nA investment that holds promise whether or not policy remains in its favor.

The appeal of First Solar’s current valuation is Wall Street’s consensus. According to The Wall Street Journal, 42 analysts cover First Solar, with 28 rating the stock a “buy,” five rating it “overweight ” and nine rating it a “hold.” Notably, none of the analysts rate the stock as a “sell” or “underweight.” Based on these ratings, the average price target for First Solar stands at approximately $280 per share—a significant upside compared to its current trading price of around $195 per share.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. He is a frequent contributor to Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.