From Africa to Asia: The Top-Performing Global Stock Markets in 2024

It’s not just Wall Street—global markets are delivering impressive gains in 2024

- While the U.S. stock market has seen significant gains in 2024, many foreign markets have also delivered impressive performances, presenting valuable opportunities for diversification.

- African markets, especially in South Africa, Egypt and Kenya, have emerged as unexpected leaders, with distinct economic and political developments sparking renewed interest among investors.

- In Egypt and Turkey, soaring inflation and severe currency devaluations have driven investors to equities for protection against economic instability.

If you thought the U.S. stock market was the only game in town in 2024, think again. While Wall Street has been busy grabbing headlines with the S&P 500 up an impressive 18% and the Nasdaq Composite flexing a muscular 21% increase, some unexpected players in the global markets are quietly making big gains of their own.

From the bustling markets of Mumbai to the tech-driven urban landscape of Tokyo, and even to the often-overlooked bourses of Cairo and Johannesburg, investors around the world have found plenty to celebrate this year. And it’s not just the usual heavyweights making noise—African nations, often under the radar for many global investors, are delivering some standout performances.

Take the case of VanEck Africa Index Exchnage-Traded Fund (AFK). It’s up nearly 17% through mid-August, nipping at the heels of the S&P 500. And there’s more to the story: Egypt, Kenya and South Africa have all seen their stock markets soar in 2024, buoyed by a surge in investor confidence and renewed economic optimism.

So, as we examine the international stock market standouts of 2024, prepare to be surprised by the diverse, and sometimes unexpected, corners of the globe driving this year’s gains. Here’s a closer look at who’s leading the charge:

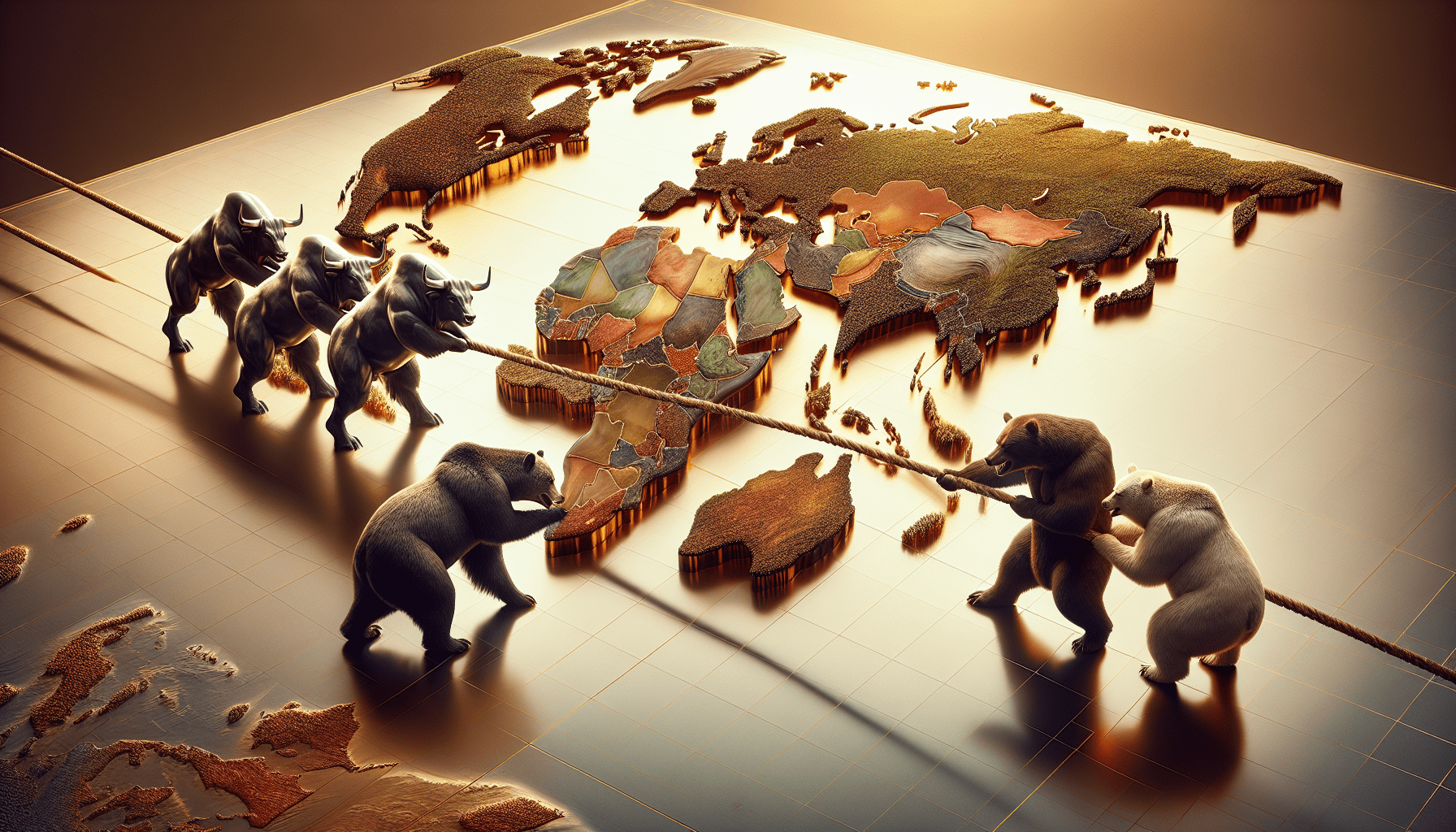

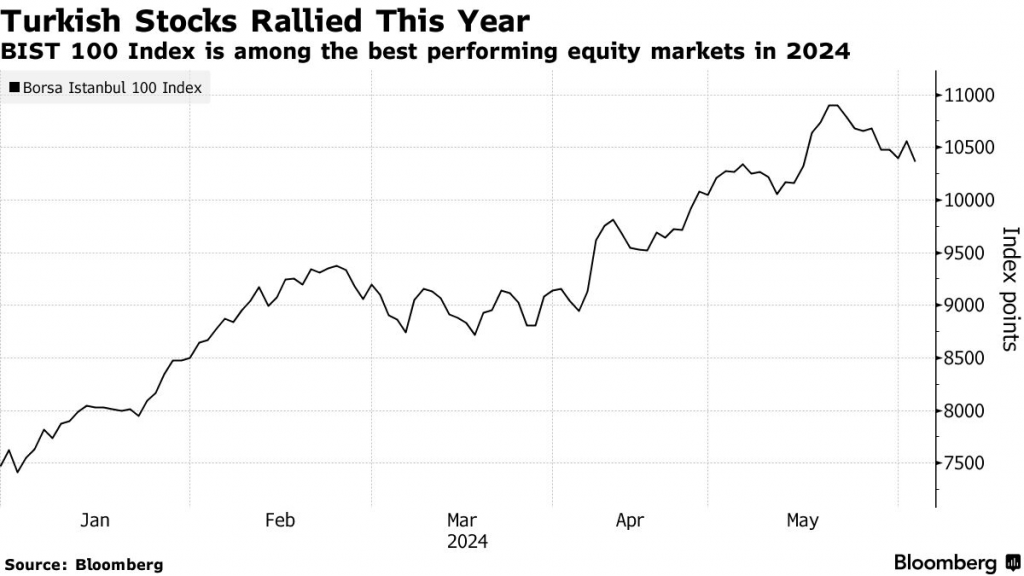

- Turkey, BIST 100 +32%

- USA, Nasdaq Composite +21%

- USA, S&P 500 +18%

- South Africa, FTSE/JSE Index +17%

- Netherlands, AEX +15%

- Egypt, EGX 30 +15%

- Japan, Nikkei 225 +14%

- India, SENSEX, +12%

- Canada, S&P/TSX Composite +11%

- Switzerland, SMI +10%

Some of those markets have been part of the mainstream for several years, while others, especially in Africa, are much fresher.

Take India, for instance. Its stock market has been a global standout for several years, driven by an economy that continues to expand at a remarkable pace. Japan, too, has consistently performed well, thanks to shifts in policy that have made Japanese equities increasingly attractive to domestic and international investors.

Egypt and Turkey face more complex situations. In those countries, the stock market isn’t just a place for growth—it’s a refuge. With both nations grappling with soaring inflation and steep currency depreciation, investors are turning to equities as a hedge against eroding purchasing power and potential capital losses. Here, the market serves not just as an investment opportunity but also as a critical defense against economic instability.

Meanwhile, positive developments are reshaping parts of Africa. Chief among them is the emergence of a new ruling coalition in South Africa. This political shift has injected a fresh wave of optimism into the country’s equity markets, signaling the potential for sustained economic improvement.

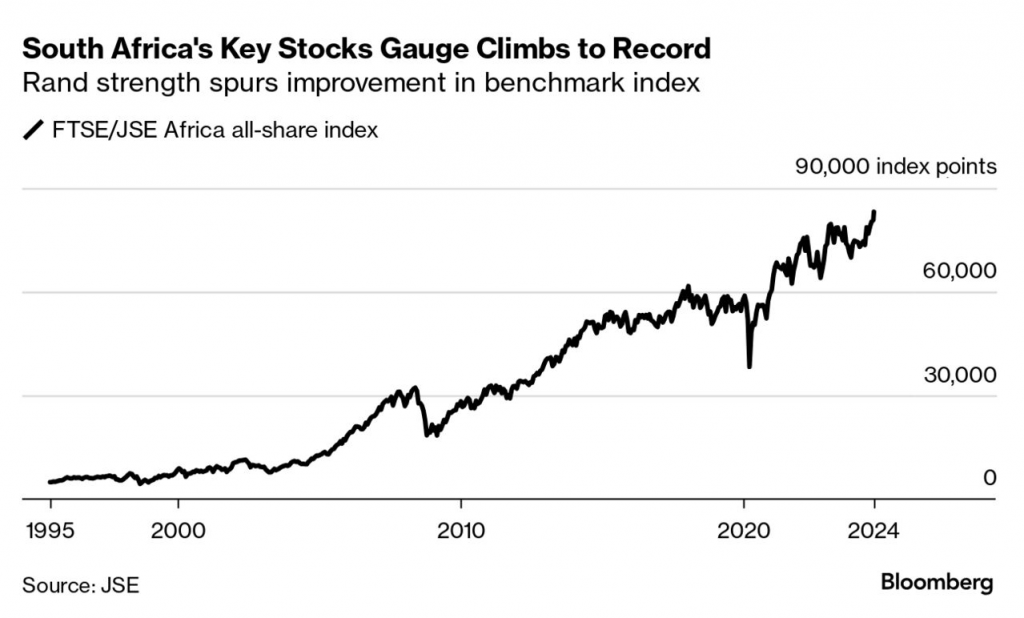

South African stocks post impressive gains in 2024

Among the many compelling stories in the international markets this year is the performance of the VanEck Africa Index Exchange-Traded Fund (AFK), which we mention eviously , climbed roughly 17%. While the fund is designed to capture the performance of stocks across the African continent, it’s heavily weighted toward South Africa, with 40% of its holdings originating there.

It’s no surprise, then, that a South Africa-focused exchange-traded fund, the iShares MSCI South Africa ETF (EZA), has mirrored this success. It’s also up about 16% year-to-date. But South Africa isn’t the only bright spot on the continent. The Egyptian stock market, as tracked by the EGX30, has surged nearly 15%, while Kenya’s NSE 20 has gained around 9%.

South Africa’s gains are particularly intriguing, driven by encouraging political developments that could pave the way for stronger-than-expected economic growth in the coming years.

One of the most pressing issues facing South Africa in recent years has been inconsistent access to electricity, a challenge that has forced many companies to scale back production—not because of o a lack of demand, but because of frequent power shortages.

However, there’s a growing sense of optimism that the new ruling coalition might finally address this critical issue. Early signs of progress have already fueled increased confidence in South Africa’s capital markets. If the government can deliver on these initiatives, South African stocks could be poised for further gains.

Unique circumstances propel further gains in Egyptian and Turkish stock markets

One of the most fascinating stories in global finance over the past few years has been the extraordinary rally in the Turkish stock market.

So far in 2024, the BIST 100—Turkey’s flagship stock index—has surged by an impressive 32%. But that’s just part of a much larger picture. Over the last five years, the BIST 100 has skyrocketed by a staggering 930%. To put that in perspective, the Nasdaq Composite, one of the top-performing indices globally, has risen by 130% over the same period.

However, the forces driving this meteoric rise in Turkish equities are far from conventional. Instead of deep value or robust corporate earnings, it’s a unique set of circumstances that’s pushing Turkish citizens into the stock market. With inflation running rampant and the Turkish lira in a tailspin—depreciating by roughly 83% against the U.S. dollar over the past five years—many Turks are seeking refuge in equities to protect their wealth.

Just five years ago, six Turkish lira would buy a U.S. dollar; today, it takes closer to 34. In response, Turkish citizens have poured their savings into the stock market, propelling the BIST 100 to fresh all-time highs. This year alone, the index is up over 30%.

Egypt’s situation mirrors Turkey’s in many unsettling ways. Since the beginning of 2022, the Egyptian pound has depreciated by about 65% against the dollar. The country’s economy has become so embattled that it now ranks as the second-largest borrower from the International Monetary Fund (IMF), trailing only Argentina.

Faced with similar economic turmoil, Egyptian investors have flocked to their stock market, using equities as a hedge against further erosion in the value of the Egyptian pound. Five years ago, 17 Egyptian pounds would fetch a dollar; today, it’s closer to 49—a 65% drop in the currency’s value.

This context paints a picture of stock markets in Egypt and Turkey as “lucky losers,” gaining from the broader chaos in their respective financial systems. However, this unusual dynamic suggests caution for global investors. If inflation is eventually brought under control—a theoretically positive development for these economies—it could paradoxically lead to a sell-off in their stock markets, as investors move to convert their gains back into cash.

Parting shots

While the U.S. stock market continues its steady climb, 2024 has also been a year of remarkable performance in several foreign markets, offering intriguing opportunities for those willing to look beyond American shores.

Given the impressive gains in markets like India and Japan, along with emerging stories in Africa, investors and traders may want to consider diversifying their portfolios internationally. These markets offer not just growth potential, but also the chance to tap into unique economic narratives that differ from those driving U.S. equities.

Diversifying into these regions can be particularly attractive for those whose investment strategies align with a more global perspective. The strong momentum in Indian and Japanese markets over the past few years highlights their staying power, while the burgeoning interest in African markets reflects the continent’s growing economic significance on the global stage.

In a world where markets are increasingly interconnected, looking beyond the familiar can open the door to fresh opportunities and help build a more resilient portfolio. As the stories in these diverse markets continue to unfold, they present not just alternatives to U.S. stocks, but potentially rewarding avenues for growth in 2024 and beyond.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.