GameStop (GME): Anatomy of a Short Squeeze

An epic short squeeze in video game retailer GameStop (GME), fueled by collaborative retail investing, suggests the market could be in for quite the ride in 2021.

A jaw-dropping spike in the price of GameStop (GME) stock pushed the entire investment and trading universe to the edge of their collective seats this week. And the drama looks far from over.

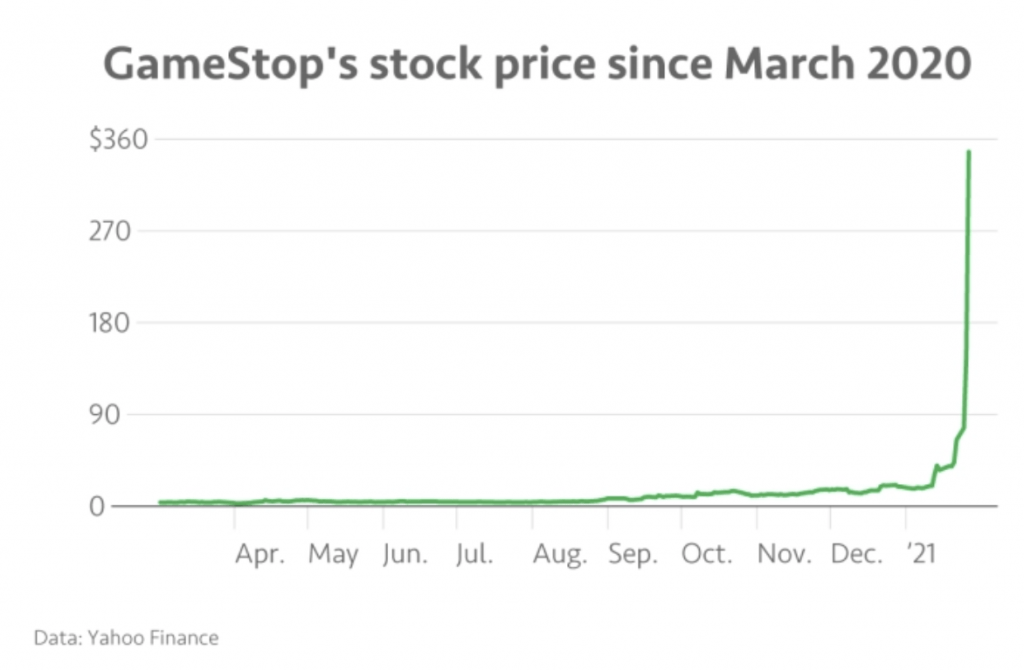

What’s known for certain at this time is that a stock worth less than $20 per share on January 12 traded up to nearly $500/share on January 28. And that interest in the stock appears to have originated in a market-focused internet group on Reddit, known as Wall Street Bets (r/WallStreetBets).

GameStop, like many other traditional retailers in the United States, has been under financial pressure since the onset of the pandemic. The company operates stores geared toward video games, consumer electronics, and related merchandise. Despite the increased popularity of gaming during the pandemic, GameStop—like most other brick-and-mortar retailers—has seen a significant drop in foot traffic in the last 12 months.

When GameStop reported Q3 earnings in December 2020, it revealed that sales were down 30% year-over-year. The stock, which had already tailed down below $10/share over the last couple of years, plumbed new depths in 2020—spending much of the summer under $5/share.

That all changed on Jan. 25, when the stock vaulted above $100/share. Only a few days later, on Jan. 28, it closed trading at nearly $400/share.

Based on those numbers, one would think the company had been acquired for an insane premium, or at least announced plans to develop an electric vehicle (EV)

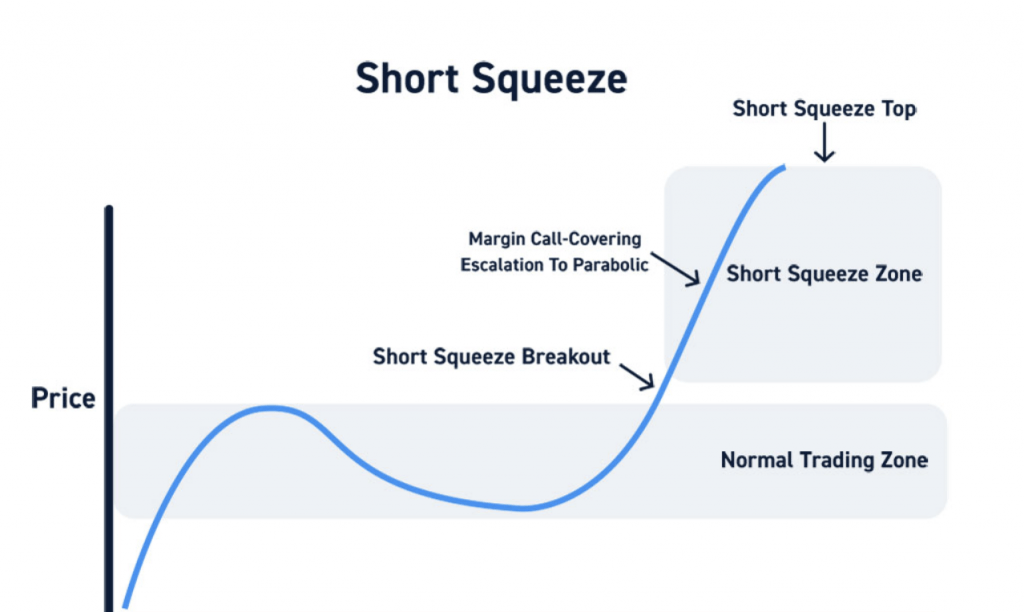

Instead, however, it appears the stock underwent a “short-squeeze”—a situation in which a stock’s price spikes dramatically because in addition to new buyers, the stock price is propelled by short players chasing the market higher to buy-in their positions.

Short-interest in GameStop had gotten inordinately high during 2020, with some reports suggesting it was well above 200%.

Equity investors have two choices when it comes to investing in stocks—buy (i.e. go long) or sell (i.e. go short). Obviously, investors buy stocks when they are optimistic about the future prospects of a given company.

Alternatively, investors and traders can also choose to sell stock in a publicly-traded company. This is typically done when the investor or trader views the future prospects of a company negatively. Selling stock in the market is generally referred to as “shorting.”

In technical terms, investors and traders that short stock first need to borrow it.

That’s because an investor can’t technically sell something without a claim on it. Short-sellers, therefore, borrow the stock from their brokerage firm, which is ultimately lent by the party that actually owns the stock. That might be the investment company itself, or a client, or another financial institution.

Once the stock is borrowed, the stock can be sold, and the investor henceforth holds a position that profits if the stock drops below the level at which it was “shorted.” If the stock moves above the level in which it was sold, however, the investor starts suffering losses.

In the case of GameStop, the number of shorted shares was much higher than the actual number of shares trading in the market—by most accounts well over double that number. This occurs because of “naked short selling,” which is basically when a market participant shorts a stock he/she hasn’t borrowed.

Naked short selling has been illegal since 2008 but still occurs at times because of regulatory loopholes and problematic discrepancies between paper electronic trading systems.

It’s stocks with especially high short interest, like GameStop, that can be subject to dramatic short squeezes. Typically a short squeeze sees a sharp rise in the value of the underlying company.

Short squeezes usually materialize when something unexpected is announced by a company under pressure. For example, a company that is expected to file for bankruptcy suddenly announces a major positive, which altogether shifts the market’s view of the company’s ongoing prospects.

In such cases, when the stock experiences a turnaround, short-sellers are faced with a difficult decision.

Depending on the depth of their pockets, and their ongoing view of the underlying company, they might decide to hang onto all, or some, of the short position. Others might decide to close the position outright, by buying back the shares—often for a loss. Still others might even have their short position involuntarily closed by their broker, especially if they don’t maintain enough capital in their account.

In the case of GameStop, one of the major short sellers was believed to be Melvin Capital. It was further reported, amidst the short squeeze, that Melvin Capital received emergency funding from Citadel and Point72 (to the tune of $3 billion) to help the company hold its GameStop position. Ultimately, due to the intensity of the squeeze, it was forced to wave the white flag and exit the position.

Short squeezes happen frequently in the marketplace, and sometimes can occur marketwide. For example, the “flash crash” of May 10, 2010, saw the U.S. stock market plunge significantly mid-day, only to snap-back in profound fashion prior to market close that same day.

In late 2019, and going into 2020, it’s believed that Tesla’s (TSLA) dramatic 400% rise in share price was at least partially attributable to a short squeeze.

But short squeezes have existed for much longer. In 1923, the founder of Piggly Wiggly, Clarence Saunders, made headlines by purchasing up to 98% of the shares in his company to force a short squeeze. Shares in his company jumped from $40 to $120 in less than a month.

GameStop undoubtedly suffered a historic short squeeze during its meteoric rise this week. It’s all but certain a Harvard case study is currently being outlined to learn from this event.

But what’s maybe most interesting about this particular story, is the role of social media in the rise of GameStop. It’s believed that GameStop, aside from its potential turnaround prospects, was targeted by buy-side retail investors because of the ridiculously high short interest. And in this instance, smaller retail traders forced the hand of professional traders on Wall Street.

As a result of the positive outcome in GameStop, that same group appears to be targeting other such companies in hopes of producing a similar chain of events. Whether that will come to pass, and when, is anyone’s guess.

The frenzy in trading activity this week also highlights how legions of new investors and traders have joined the global financial markets during the pandemic. 2020 was the highest volume trading year in history, and 2021 is already breaking those records. More than 24 billion shares traded hands on Jan. 27 in the United States—a new record.

Moreover, 57 million options contracts traded hands that day, which surpassed the previous record of 49 million contracts, set on Jan. 15. Before that, the highest volume day was Feb. 28, 2020, when more than 48 million options contracts traded hands.

And while recent market activity is certainly exciting, investors and traders would be wise to remember that strong discipline, and close attention to risk management, usually win the day in the long run. Especially as compared to a knee-jerk, emotional approach.

For more context on recent activity in GameStop, readers are encouraged to listen to a new podcast featuring tastytrade co-founder Tom Sosnoff and long-time market pundit Dylan Ratigan: GameStop Won’t Stop.

To follow everything moving the markets in real time, readers can also tune into TASTYTRADE LIVE, weekdays from 7 a.m. to 4 p.m. Central Time.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about any of the topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.

Subscribe to Luckbox in print and get a FREE Luckbox T-shirt! See SUBSCRIBE or UPGRADE TO PRINT (upper right) for more info.