Hidden Pitfalls Trading Options After Earnings

In the wake of earnings, implied volatility typically declines, but research suggests that this phenomenon doesn’t necessarily equate to “cheap” options prices.

As Q2 earnings season winds down, investors and traders are no doubt looking forward to the fall. The transition from summer to fall in the markets is usually important, because historically, volatility tends to pick up during this period.

When it comes to options trading, an important dynamic to also keep in mind is the fact that implied volatility usually gets “crushed” in the wake of earnings.

This phenomenon happens because the passing of earnings removes some of the “event-risk” from the options market, and prices typically decline as a result—especially in near-term options.

However, does that decline in implied volatility represent a buying opportunity?

Like most things, the answer depends—especially on the exact strategy of the trader or investor in question, as well as his or her market outlook and risk profile.

However, research produced by tastytrade suggests that while implied volatility does decline after earnings, that doesn’t necessarily mean it’s “cheap.”

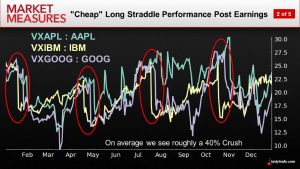

As illustrated in the chart below, implied volatility for single stocks has historically dropped around 40% in the wake of earnings, on average.

The graphic above shows us how implied volatility in AAPL, GOOG and IBM dropped precipitously after earnings. Market participants that sell volatility for earnings are hoping for this precise scenario, alongside little or no movement in the underlying.

While the earnings crush is well documented, the inquisitive mind may in turn wonder if buying such premium has historically produced a favorable result? Alternatively, “Does volatility get ‘too cheap’ after the earnings crush?”

In order to answer this question, market researchers at tastytrade designed a market study that looked back at post-earning volatility in five different stocks, and incorporated 12 years of historical trading data in those five names. Associated backtests were then used to evaluate the relative success of purchasing options premium after earnings.

As such, the market study incorporated the following parameters:

- Utilized 12 years of historical trading data in AMZN, IBM, GOOG, GS and AAPL

- Backtested purchasing straddles after earnings (45 DTE, held to expiration)

- Trade entry was always the end of the day (EOD) after the earnings release

- Market study encompassed 256 individual trades

The slide shown below summarizes the historical performance of this approach, in terms of average P/L and win rate.

As illustrated above, not one of the five symbols produced an average win rate above 50%.

And in four of five cases, the average P/L produced by this approach was either slightly above breakeven or deeply negative. AAPL did produce an overall profitable P/L using this approach, but the win rate still wasn’t attractive—only 46%.

Overall, the findings from this study indicate that purchasing options premium after earnings hasn’t historically produced attractive returns—despite the associated drop in implied volatility.

Obviously, one’s approach to post-earnings volatility will ultimately depend on his or her unique approach in the market. It’s entirely possible that traders who often maintain portfolios heavily biased toward short volatility might decide to reduce their exposures after earnings as a result of declining volatility levels.

On the other hand, traders that utilize a more balanced approach—involving both long and short volatility positions—might use that reduction in volatility after earnings to identify attractive long options positions to help balance the portfolio.

For others, the mere fact that implied volatility tends to increase between summer and fall, may also be a consideration in the coming weeks.

Readers seeking to learn more about this topic may want to review the aforementioned research on post-earnings volatility trading when timing allows. Along those lines, a new episode of Options Jive focusing on post-earnings trading behavior in the technology sector may also be of interest.

For updates on everything moving the markets, TASTYTRADE LIVE—weekdays from 7 a.m. to 4 p.m. CST—is also recommended.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.