Meta Platforms: A ‘Strong Buy’ if TikTok Gets Banned

The company’s future looks great, no matter what happens with TikTok

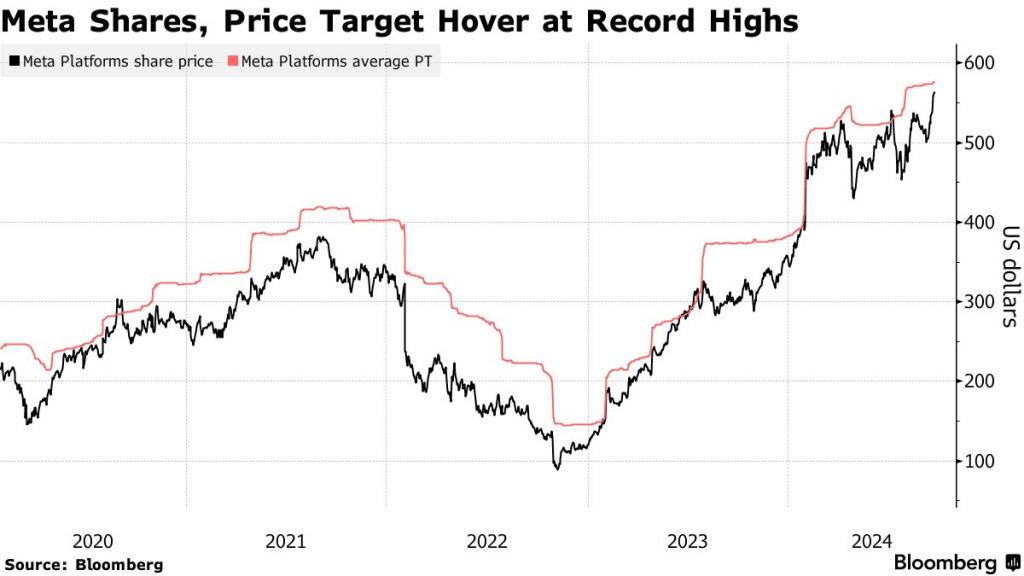

- Meta’s shares are up 80% year-to-date, a testament to its market dominance and its strategic pivot into AI, capturing investor attention and enthusiasm.

- Recent capital investments have positioned the company to benefit from a potential TikTok ban, which could add billions to its advertising revenue.

- Even without the ban, Meta’s scale, visionary approach and robust financials make it a compelling choice for long-term investors seeking exposure to the tech sector.

Meta Platforms (META), parent company of Facebook, continues to push the boundaries of the tech industry, leveraging its dominance in social media and digital advertising to expand into transformative technology. With social media that touches billions worldwide, Meta’s influence is unmatched, but its vision extends far beyond connecting people. The company has embraced artificial intelligence and immersive technology as the cornerstone of its next chapter, redefining how businesses engage audiences and users experience the digital world.

Financially, the Meta narrative is equally compelling. The company’s robust growth in earnings and premium valuation reflect investor confidence in its market leadership. And a looming TikTok ban could reshape the competitive landscape, positioning Meta to capture a significant share of displaced ad dollars and strengthen its already formidable advertising engine. Join us as we dive deeper into Meta’s evolving story—its earnings, its valuation and how it could benefit from a forthcoming ban of TikTok.

A market leader with room to grow

Meta Platforms stands as a cornerstone of the tech industry, dominating the social media sector. With its flagship platforms—Facebook, Instagram, WhatsApp and Messenger—Meta has attracted nearly 4 billion active monthly users, giving it unparalleled scale. At its core, Meta operates a two-pronged strategy: leveraging user engagement to create a sticky social digital ecosystem, while delivering high-precision advertising that drives measurable results for clients. Advertising accounts for over 96% of the company’s revenue, cementing its role as the primary engine of profitability.

In recent years, Meta has extended its vision beyond social media, positioning itself as a leader in artificial intelligence and immersive technology. CEO Mark Zuckerberg’s strategic shift toward AI-powered tools and open-source innovation is a pragmatic yet bold approach. Meta’s proprietary Llama large language model—offered as an open-source tool—exemplifies this ethos, fostering developer collaboration while enhancing network effects. Meanwhile, initiatives like the Meta AI assistant and AI-driven video recommendations are producing tangible gains in user engagement and advertiser satisfaction.

While AI integration strengthens Meta’s core business, its ventures into hardware and immersive experiences present both opportunities and challenges. Reality Labs, the hub for augmented and virtual reality innovation, posted 29% revenue growth over the past year, but remains unprofitable, with $4.4 billion in losses in Q3. Despite those headwinds, Meta’s foray into wearable technology, such as Ray-Ban Meta smart glasses, hints at the company’s potential in emerging markets.

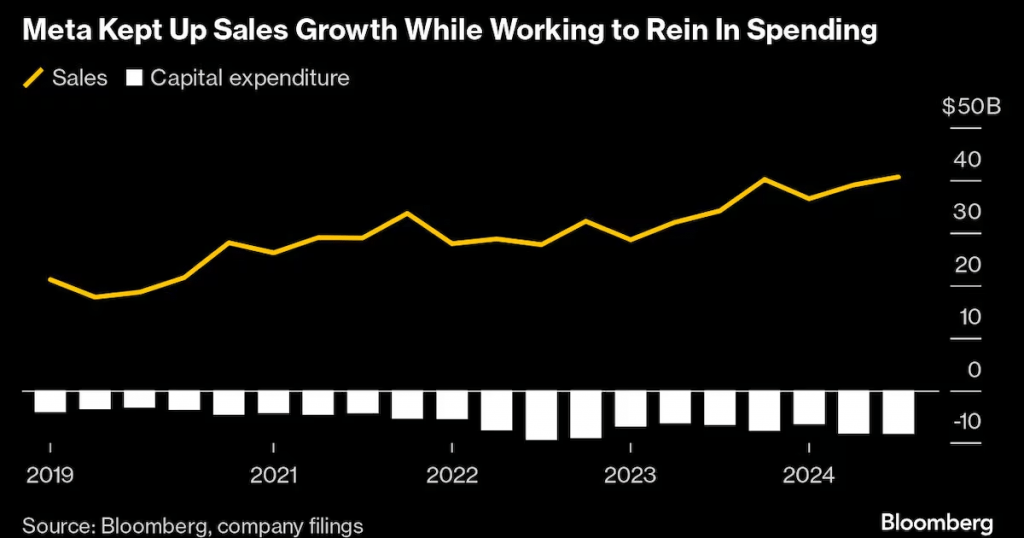

Strategically, Meta has maintained disciplined capital management, balancing pro-growth investments with operational efficiency. Moreover, the company’s recent cost-cutting initiatives haven’t throttled revenue growth (illustrated below) and have still allowed for critical expenditures on research and development. Meta’s 2024 gross profit margin of 81%-82% showcases its ability to scale effectively, while allocating resources to ambitious projects like global AI infrastructure and next-generation data centers.

The challenge for Meta lies in balancing these long-term investments with its primary profit engine—advertising. Growth rates in its core markets are maturing, with daily active people (DAP) up only 5% year-over-year in Q3 2024. Average Revenue Per Person (ARPP) rose 12%to $12.29, driven by enhanced ad-targeting capabilities and international market expansion. However, ad impression growth has slowed, and competition from TikTok, YouTube Shorts and other emerging platforms continues to intensify.

Overall, however, Meta’s market position is formidable. Its mission to enhance user experiences, integrate AI and diversify revenue streams signals a company poised for sustained growth, even amid industry challenges or an economic downturn. Meta’s narrative will hinge on whether these bold bets can deliver outsized returns, while maintaining its dominance in advertising.

Earnings momentum builds confidence

Meta Platforms has been a standout performer in 2024, with shares surging 80% year to date, reflecting investor enthusiasm for its return to strong growth and its ambitious foray into artificial intelligence and virtual reality. Once embattled by regulatory scrutiny and challenges to its ad-driven business model, the company has regained its footing with robust earnings and ambitious plans for the future. Meta’s Q3 earnings report provided the latest evidence of its upward trajectory, with the company delivering better-than-expected results for key financial metrics.

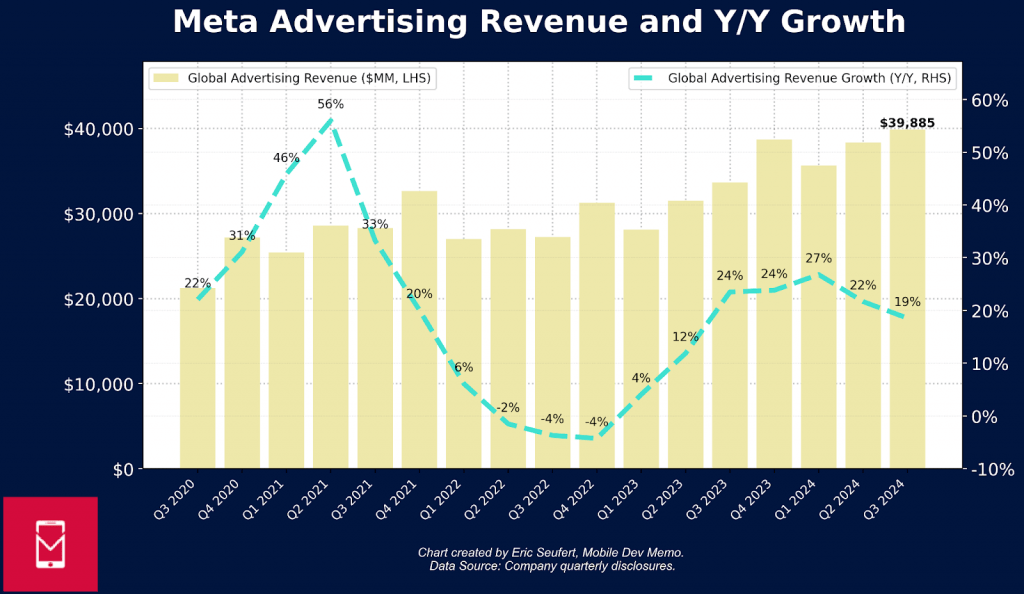

For the third quarter, Meta reported revenue of $40.59 billion, up 19% year-over-year, and earnings per share of $6.03, beating analyst expectations of $5.25. Net income grew 35% to $15.7 billion, driven by strong advertising revenue, which rose 19% to $39.9 billion and accounted for 98.3% of total revenue. These figures, paired with Meta’s upbeat guidance for Q4—forecasted revenue of $45 billion to $48 billion—have bolstered confidence in the company’s ability to navigate an uncertain economy, and build on momentum in its core business.

Quarter-over-quarter earnings trends for Meta have also been strong, though not as robust as the year-over-year figures. In Q2, the company posted a 22% year-over-year revenue increase, with net income soaring 73%—a striking recovery from previous years of stagnation. While Q3’s 19% revenue growth and 35% net income gains reflect some deceleration, they align with a maturing growth profile as Meta balances its core advertising strength with massive investment in emerging technologies. Quarter-over-quarter, revenue increased by 3.9%, a steady climb that also points to solid operational performance.

Overall, Meta’s recent earnings data reflects broader trends shaping the company’s evolution. Its cost-cutting measures, which began in late 2022, have yielded significant improvements in operating margins, which rose to 38% in Q2 and 39% in Q3. At the same time, Reality Labs—the division focused on metaverse and augmented reality initiatives—remains a costly bet, posting a $4.4 billion operating loss in Q3 despite 29% growth in revenue.

Valuation reflects dominance and opportunity

Meta Platforms’ financial performance and strategic positioning provide a robust foundation for its valuation. Trading at a TTM GAAP P/E ratio of 29—well above the industry average of 20—Meta commands a premium multiple that reflects its dominance in social media and the resilience of its core advertising business. This valuation also stems from a favorable future outlook. Revenue growth is expected to be strong in the fourth quarter, and the looming TikTok ban creates added gravity.

A TikTok ban, set to take effect on Jan. 19, 2025, could boost Meta’s prospects. Analysts estimate that the company could capture between 22.5% and 27.5% of TikTok’s U.S. ad revenue, translating to approximately $2 billion in 2025. This influx would reinforce Instagram Reels as a leading short-form video platform, deepen user engagement and further strengthen Meta’s already dominant position in social media. Such a development would not only validate Meta’s premium valuation, but is also likely extend it because it would demonstrate the company’s ability to capitalize upon disruptions in the market.

However, even without a TikTok ban, Meta’s core business remains a formidable force. With 4 billion monthly active users across its family of apps, Meta commands a scale and reach that few competitors can match. The company’s ad-targeting algorithms, powered by AI, have driven consistently strong increases in engagement and revenue, as evidenced by the 12% rise in average revenue per person, and an 11% increase in ad prices year-over-year in Q3 2024. International markets, particularly in regions like Asia and Africa, offer additional growth potential as expanding middle classes offer Meta a larger addressable audience.

Overall, Meta’s valuation reflects its dual strengths: a dominant advertising business that consistently delivers strong results and a strategic vision aimed at capturing the next wave of technological transformation. Its $65 billion cash reserve and robust free cash flow provide a solid foundation for navigating risk and pursuing new opportunities. While the TikTok ban could offer a near-term catalyst, Meta’s broader resilience and industry leadership ensures it will remain a compelling investment regardless of TikTok’s fate in the U.S.

TikTok ban could reshape Meta’s future

The potential ban of TikTok in the United States (if its parent company ByteDance does not divest its U.S. operations) could dramatically reshape social media. For Meta Platforms, this could represent an unexpected opportunity to reclaim market share and momentum in the U.S. TikTok has been one of Meta’s most persistent competitors, particularly among younger audiences, where its short-form video format has redefined engagement. Meta has responded with Instagram Reels, which has steadily gained traction, but has been overshadowed by TikTok’s cultural influence and growth.

The road to a TikTok ban in the U.S. is as complex as it is contentious. While a federal appeals court has upheld the ban on national security grounds, ByteDance is preparing to take its case to the Supreme Court. With the Jan. 19 deadline fast approaching, the future of the app remains unclear, leaving both its users and the broader tech industry in a state of uncertainty.

Further complicating the situation is the stark divide within President-elect Donald Trump’s incoming administration, with Cabinet picks and advisors holding sharply contrasting views on the app. Some have championed an outright ban, citing national security concerns and its ties to the Chinese government, while others—some with considerable TikTok followings—oppose the ban. It’s not yet clear whether Trump himself favors or opposes the ban, at least in a definitive way.

If TikTok is ultimately banned, Meta is positioned to absorb a substantial portion of its displaced users and advertisers. Industry analysts estimate Meta could capture between 22.5% and 27.5% of TikTok’s U.S. ad revenue, adding around $2 billion to its bottom line in 2025. This would not only boost advertising revenue but also deepen user engagement across Meta’s platforms, strengthening its data-driven ad ecosystem. The migration of TikTok users to Instagram Reels, a platform already integrated into the broader Meta family of apps, would further enhance its appeal to advertisers seeking targeted reach and measurable outcomes.

From an operational standpoint, a TikTok ban would provide Meta competitive breathing room to consolidate its position in short-form video, while dedicating additional resources to other growth areas. It could also strengthen Meta’s foothold among younger demographics, addressing a key vulnerability in its user base. However, this potential windfall comes with challenges, including heightened scrutiny from regulators concerned about Meta’s growing dominance amid broader criticisms of U.S. tech monopolies. Additionally, rivals such as YouTube Shorts and Snapchat Spotlight will also vie for displaced users, presenting competitive pressure, even in TikTok’s absence.

In the near term, a potential TikTok ban could prove to be a transformative opportunity for Meta, offering a financial windfall and reinforcing its strategic position. From a valuation perspective, the increasing likelihood of a ban theoretically bolsters Meta’s investment case, and provides a compelling justification for its premium P/E ratio. Speaking to that potential, Citibank recently reiterated its “buy” rating on Meta shares, with a target of $705/share, and referred to the successful ban of TikTok as a “significant opportunity” for the company. Meta stock currently trades for about $625/share.

Meta’s outlook is promising, even if TikTok isn’t banned

Meta Platforms has built its legacy on reinvention, continuously evolving to meet new challenges and opportunities while solidifying its dominance in digital advertising and social media. With a $1.5 trillion valuation and a stock price near $625 per share, Meta’s ability to execute at scale remains unmatched. Its financial performance—characterized by rising engagement metrics, double-digit revenue growth, and forward-thinking investments in AI and the metaverse—has reinforced confidence across Wall Street.

Among the 69 analysts covering the stock, 58 rate it a “buy” or “overweight,” while only two analysts rate it a “sell” or “underweight.” The average price target of these 69 ratings is $655 per share, underscoring broad optimism over Meta’s ability to sustain, or even accelerate, its current growth trajectory.

Considering all of the above, we view Meta shares as a compelling choice for investors seeking exposure to a market leader with a proven track record of execution and an ambitious vision for the future. And if the TikTok ban is enacted, Meta’s earnings potential and competitive position should see a significant boost, thus elevating the stock to “strong buy” and potentially pushing shares toward $700 (or above).

But even without this positive catalyst, Meta’s dominance in digital advertising, unparalleled reach and steadfast commitment to innovation make it an appealing choice for long-term investors looking to capitalize on this segment of the technology industry.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.