Brilliant but Overpriced?

Palantir's AI potential is hard to ignore, but its valuation is hard to swallow

- Palantir has grown impressively in recent quarters, fueled by its strong position in AI and a growing customer base.

- Despite those successes, the companys valuation is arguably overextended, raising concern about downside risk.

- Investors may want to weigh its long-term potential against the near-term risk.

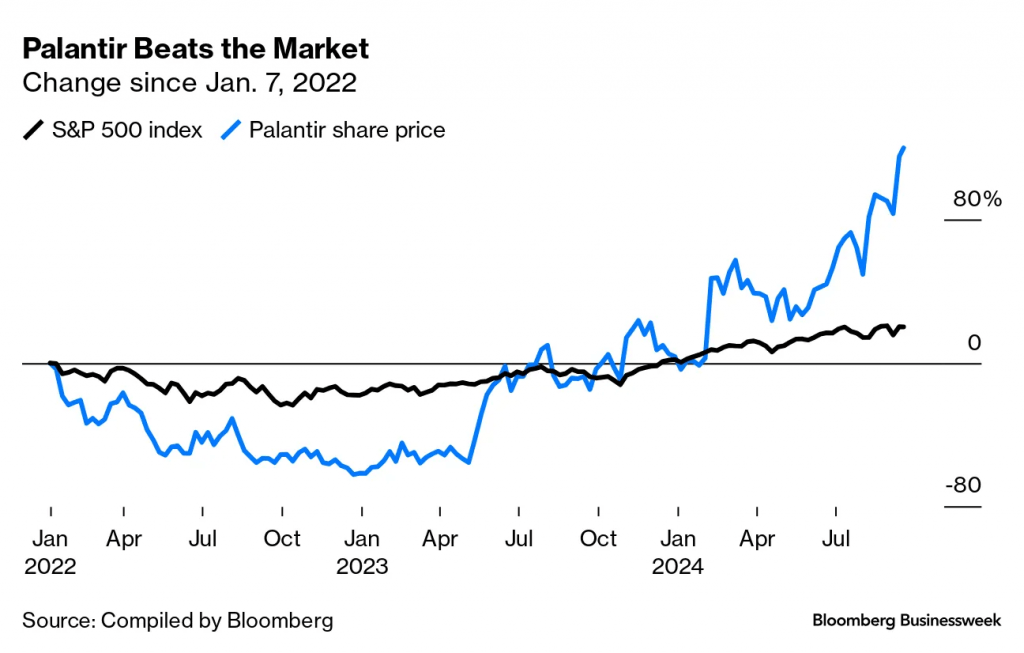

Soaring by more than 150% year-to-date, Palantir Technologies (PLTR) has become a focal point for investors. The company’s ascension last month to the S&P 500 further elevated its status, and it now ranks among the index’s top performers, trailing only Nvidia (NVDA) and Vistra (VST). But its meteoric rise raises questions about the sustainability of its valuation.

On one hand, Palantir has garnered widespread recognition for its cutting-edge technological capabilities, particularly in big data and artificial intelligence (AI). On the other hand, the company’s origins as a contractor for U.S. intelligence agencies—and its controversial ties to co-founder Peter Thiel, an outspoken supporter of former President Donald Trump—add layers of complexity to Palantir’s story.

These complexities inevitably shape how analysts and investors view Palantir, leading to both objective and subjective assessments of the company’s future. Some argue the company’s political associations put the business at risk. For example, Palantir’s reliance on government contracts raises concern about how a loss of Republican influence could affect its revenue stream.

Still, one could argue those subjective considerations aren’t necessarily relevant to an objective evaluation of the company’s true value. We’ll start by focusing on a fact-based analysis of Palantir’s financial performance and valuation to gain a clearer picture of its current position. After that, we’ll explore additional factors, including some that may introduce more subjective elements into the discussion.

Q2 earnings reflect positive momentum

Palantir’s Q2 2024 earnings report paints a picture of a company capitalizing on the growing demand for artificial intelligence technologies. With revenue reaching $678.13 million, representing a 27% year-over-year increase, Palantir exceeded expectations, largely driven by the success of its Artificial Intelligence Platform (AIP). This surge reflects the broader market trend of industries increasingly turning to AI to streamline operations. It’s positioning Palantir as a key player in this evolving scene.

Originally, Palantir’s AIP was been geared toward government clients for tasks like intelligence gathering and counterterrorism. However, the company later began leveraging its AI capabilities to fuel growth in the commercial sector. By incorporating generative AI into its product offerings, Palantir aims to meet the growing demand for AI-driven decision-making across a wide range of industries.

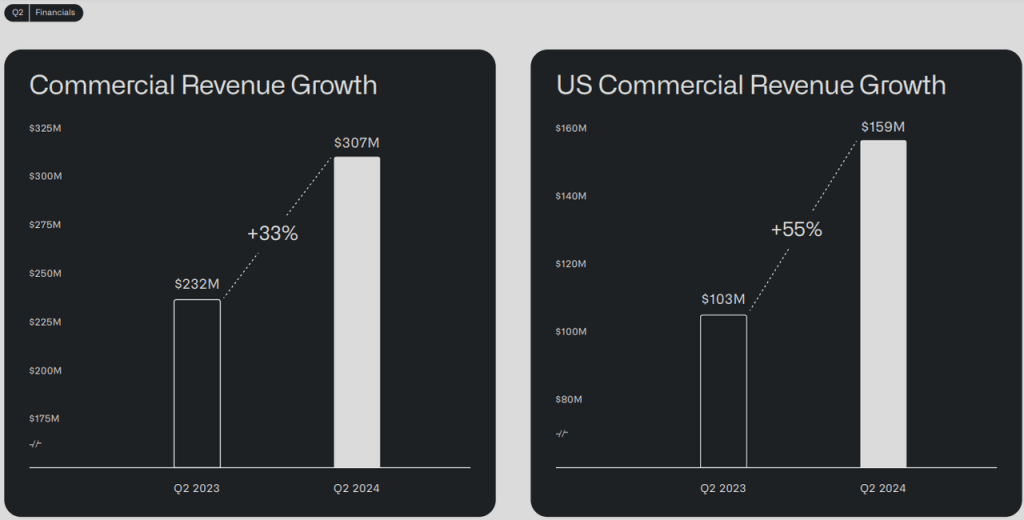

In Q2, commercial revenue grew by 33% globally, demonstrating Palantir’s success in securing new business from enterprise clients outside its initial pursuit of landing government contracts. And in the U.S. market, commercial growth was even stronger, rising by 55%. This acceleration highlights the company’s ability to establish a robust presence in its home market, particularly in sectors like healthcare, finance and manufacturing.

On the profitability front, Palantir posted net income of $134 million, while earnings per share (EPS) climbed to $0.06, up from the Q1 figures of $106 million and $0.04. Improved profitability, alongside increased demand for AI-powered products and services, suggests Palantir’s efforts to scale are bearing fruit.

On top of all that, management at Palantir remains optimistic about the company’s trajectory, increasing its full-year revenue guidance. Palanter now expects sales to lock it at around $2.75 billion in 2024, up from the previous range of $2.68 to $2.69 billion. CEO Alex Karp attributed this optimistic outlook to “unbridled demand” for Palantir’s software, particularly its AI capabilities.

Palantir is in a strong growth phase, improving both revenue and profitability while diversifying its revenue streams. The rapid expansion of the company’s commercial division is particularly significant, signaling success in solidifying the comany’s presence in the U.S. enterprise market.

Red flags emerge as valuation soars

While demand for AI has driven Palantir’s recent growth in earnings, its valuation tell a different story, suggesting that the stock may be significantly overvalued relative to both industry peers and historical norms.

Palantir’s price-to-earnings (P/E) ratio, based on trailing twelve months (TTM) GAAP earnings, stands at around 250, compared to an industry average of 30. This multiple, more than eight times the sector’s standard, raises serious concerns about whether Palantir’s growth can justify such a steep premium. Although the company has delivered 27% year-over-year revenue growth, a P/E ratio at this level suggests the market is pricing in extraordinary long-term growth—growth that may not be sustainable.

To put this in perspective, traditional growth-stock valuations have been considered high at 50x EPS. And even in the age of AI, when companies like Nvidia trade at higher multiples, Palantir’s valuation remains extreme. Nvidia, with a P/E ratio of around 65x, is also priced aggressively, but its market dominance and stronger revenue growth make that valuation more reasonable than Palantir’s.

Another telling metric is Palantir’s enterprise value-to-sales (EV/Sales) ratio, which stands at 37x—well beyond the norm for high-growth tech companies, which typically range between 5x and 15x. For comparison, Nvidia, one of the most valuable tech firms, trades at an EV/Sales ratio of 35x, still lower than Palantir’s despite Nvidia’s stronger growth trajectory.

At these valuation levels, Palantir is priced not just as a high-growth company, but as one whose future growth will far exceed its past performance. While Palantir’s 20% to 30% growth is impressive, it’s difficult to argue that this pace justifies such inflated multiples, especially when compared to peers with stronger earnings growth. Even with AI as a tailwind, these growth rates don’t match the explosive potential typically required to support such high valuations.

The reality is that at 250x GAAP earnings and 37x sales, Palantir’s $100 billion valuation reflects lofty expectations that may be hard to sustain. If the company fails to meet these aggressive expectations, the downside risks in the stock will intensify. If the market’s enthusiasm for AI cools, for example, or if competitors start to erode Palantir’s potential for growth, the disconnect between its valuation and fundamentals could become increasingly hard to defend, even by the company’s most bullish advocates.

Ultimately, while Palantir has showcased impressive operational performance and AI capabilities, its current valuation metrics indicate that the stock is priced for near-flawless execution. New investors in Palantir may therefore want to exercise caution because any misstep or failure to meet its ambitious growth expectations could result in a significant downward revaluation.

Diverging opinions raise concern

Wall Street analysts largely echo concerns about Palantir’s elevated valuation. While the stock currently trades around $43 per share, the average analyst price target is $28, highlighting a clear disconnect between market sentiment and analyst expectations. Among the 23 analysts covering the stock, only four rate it as a buy, with two assigning an overweight rating. The majority remain cautious, with nine recommending a hold, seven issuing sell ratings and one rating the stock as underweight.

This spread of opinions suggests many analysts view Palantir’s stock as overextended. And among that group, the consensus is the stock has limited upside unless Palantir significantly outperforms its aggressive expectations for growth.

Also be aware that insider trading activity suggests Palantir’s valuation may be on the higher end of its historical range. Over the past 12 months, insider selling has significantly outweighed buying, including notable liquidations by CEO Alex Karp, who sold over $300 million, and co-founder and Chairman Peter Thiel, who sold more than $1 billion worth of shares. These sales occurred in mid-September and early October.

Does that mean Palantir shares can’t climb higher in the near term? Not at all. The momentum behind AI stocks and the broader market euphoria could certainly push Palantir to new highs in the short term. While excitement can drive prices up, it’s the fundamentals that ultimately sustain them. For Palantir to justify its lofty valuation, the company will need to continue growing its revenue and earnings at a torrid pace. Without that, Palantir may be riding a wave that could eventually crest, leaving the stock vulnerable to a sharp pullback.

Private-sector opportunities

Palantir Technologies has long been recognized for its deep ties to government agencies, with platforms like Gotham serving as key drivers of its defense and intelligence contracts. However, the company has been steadily shifting its focus toward the commercial sector.

Today, government contracts account for approximately 55% of Palantir’s total revenue, while the commercial sector contributes 45%, a growing portion of its overall business. This transition reflects Palantir’s recognition of the substantial growth potential outside of government work.

At the center of Palantir’s commercial expansion is its Foundry division, which plays a crucial role in attracting and growing the company’s private-sector client base. While Gotham serves government and defense agencies, Foundry is specifically designed for commercial clients, offering a powerful data integration and analytics platform that helps businesses in industries such as healthcare, financial services, energy, manufacturing and logistics with their need to visualize, analyze and manage large datasets.

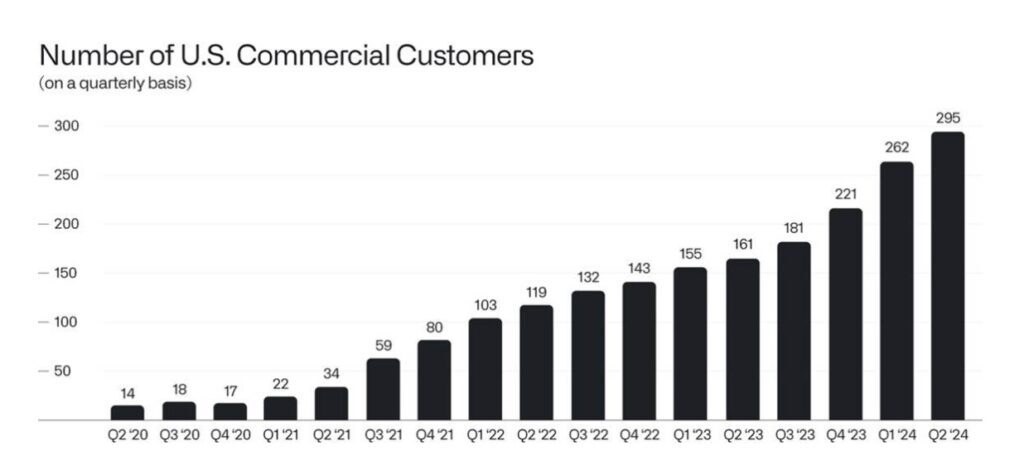

In its Q2 earnings report, Palantir said its U.S. commercial customer base grew by 83% year-over-year, rising from 161 customers in Q2 2023 to 295 customers in Q2 2024. Commercial clients now account for half of the company’s total customer base, underscoring the growing importance of this segment to Palantir’s long-term strategy. While government contracts remain a stable and reliable revenue source, the commercial sector represents a far larger addressable market with greater growth potential.

One key factor in Palantir’s success in commercial work is a highly effective onboarding process, known as “Bootcamp.” This program functions as a hands-on workshop where prospective clients are introduced to Palantir’s capabilities by in-house developers and engineers. Through this approach, Palantir helps potential customers quickly see the value of its offerings.

The Bootcamp process follows a tried-and-true software sales strategy of acquire, expand and scale. At these sessions, Palantir aims to hook clients with rapid-use cases that deliver quick wins. From there, the platform can be configured more deeply, enabling Palantir to associate more closely associate with the customer. And the approach appears to be working.

Similar to its government division, Palantir is delivering optimization and efficiency to its private sector clients. Based on impressive customer testimonials, high-profile clients such as Airbus, BP, Panasonic and Tyson Foods have benefited significantly from Palantir’s technology. One standout example is Tyson Foods, where Palantir’s work is credited with delivering significant cost savings. On its website, Palantir indicates that it “created $200M in savings over 24 months, including $40M in logistics optimization in 120 days” through its work with Tyson Foods.

All told, these successes showcase Palantir’s ability to translate its expertise in helping government agencies to the private sector, positioning itself for robust growth.

Investment takeaways

Palantir is in a strong position amid the AI boom. In recent times, the company has proven its ability to expand beyond its traditional government contracts, successfully pivoting its technological capabilities into the private sector.

Palantir’s 2024 financial performance highlights this transition, with the company delivering a handful of consecutive quarters of positive net income. However, the excitement surrounding AI seems to have inflated Palantir’s valuation to levels that are difficult to justify given its financial metrics. The stock’s earnings multiple suggests the market is pricing in extraordinary growth—growth that has yet to materialize at the scale needed to support such an elevated valuation.

It’s possible external factors are contributing to this premium valuation. Co-founder Thiel is a well-known supporter of former President Trump and a mentor to running mate Sen. JD Vance of Ohio. Some of the bullish exuberance in Planatir may therefore be linked to the so-called “Trump Trade.” While CEO Karp has endorsed Vice President Kamala Harris, a Trump victory in the upcoming election could lead to a wave of new government contracts, helping to justify Palantir’s current valuation. Conversely, a Trump loss could pressure the stock because it could lead to a less favorable outlook for securing future government business. But at the same time, Harris supports efforts to aid Ukraine in its struggle agains Russia and wants to maintian a strong NATO alliance, both of which could result in more contracts for Palantir. It all goes to show the future’s difficult to divine.

Plus, even under a Harris presidency, Palantir would likely maintain its competitive edge in securing government contracts, though its growth trajectory might not accelerate as quickly as it would under a second Trump administration. For now, cautious investors may prefer to wait for a more attractive entry point, particularly if the stock experiences a correction post-election.

All told, Palantir merits investor attention. Its recent addition to the S&P 500 and impressive year-to-date performance positions it as one of the more intriguing names on Wall Street. And regardless of the political landscape, Palantir’s long-term prospects suggest it could be one of the big winners in the AI revolution.

The next big test for Palantir is right around the corner—the company is scheduled to release its Q3 earnings report on Nov. 4. A blowout quarter could help quiet the skeptics, while an earnings letdown would almost certainly amplify concern about the company’s valuation.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. He is a frequent contributor to Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.