Prices Soar for Key Chipmaking Metals as Trade War Intensifies

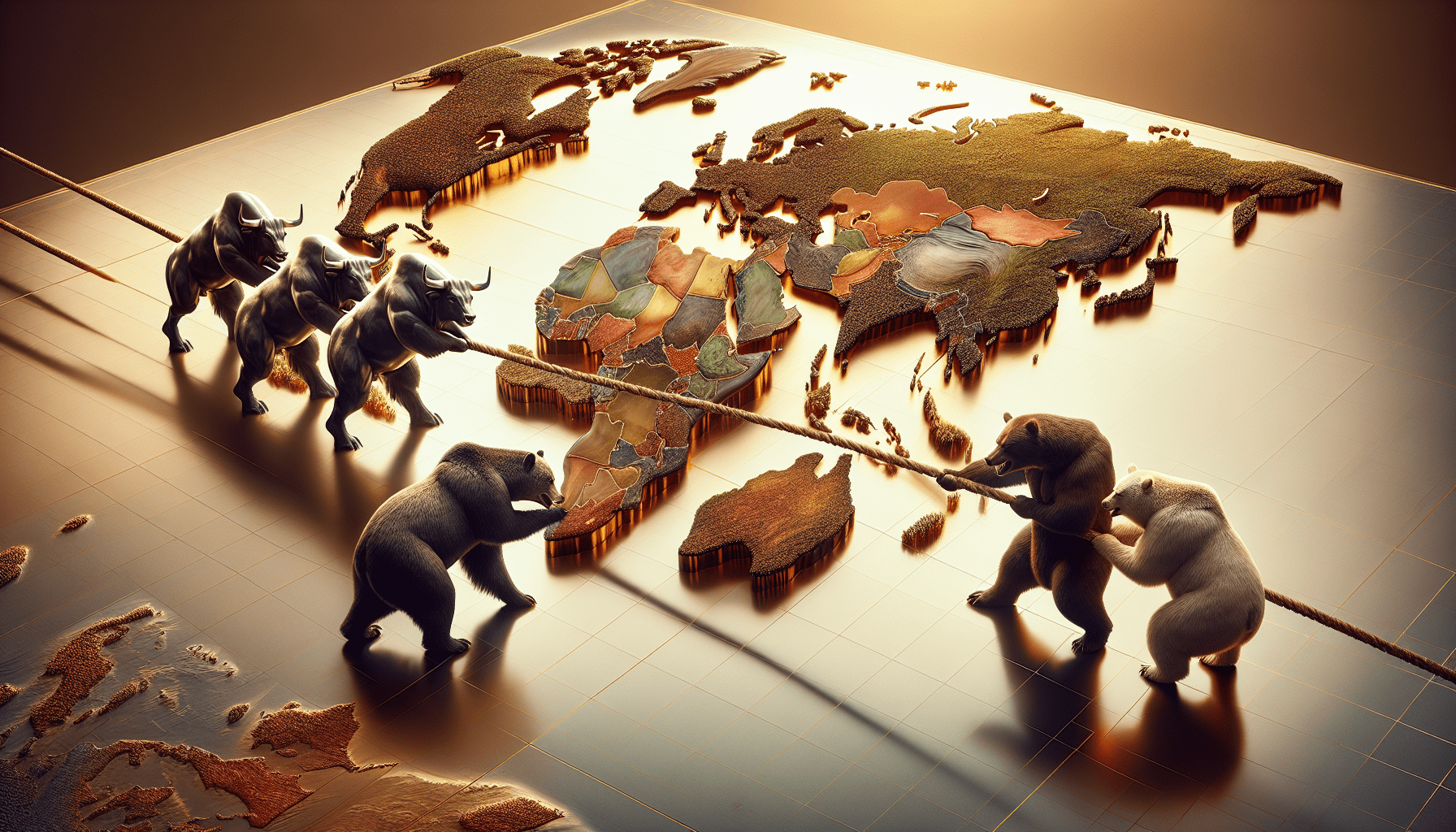

The ongoing U.S.-China trade war remains a significant risk for the weakening global economy

- The ongoing U.S.-China trade war has been quietly intensifying in 2024.

- In the latest escalation, China has curtailed exports of gallium and germanium, two critical metals for the global tech industry.

- The prices of both gallium and germanium have surged in 2024 because of the tightening availability of global supplies.

- Global producers of these critical metals, such as Teck Resources, could see significant benefits from this developing situation.

In financial markets, abrupt price movements often reflect broader shifts in the global economy.

Consider, for example, the oil market’s dramatic response to violent conflicts in energy-producing regions, such as the escalation of hostilities in Eastern Europe during the spring of 2022. Today, a similar dynamic is playing out, but in a different niche.

The recent surge in the prices of gallium and germanium reflects the intensifying geopolitical tensions between the United States and China. This conflict, often dubbed the “chips war,” is a subset of the broader U.S.-China trade war.

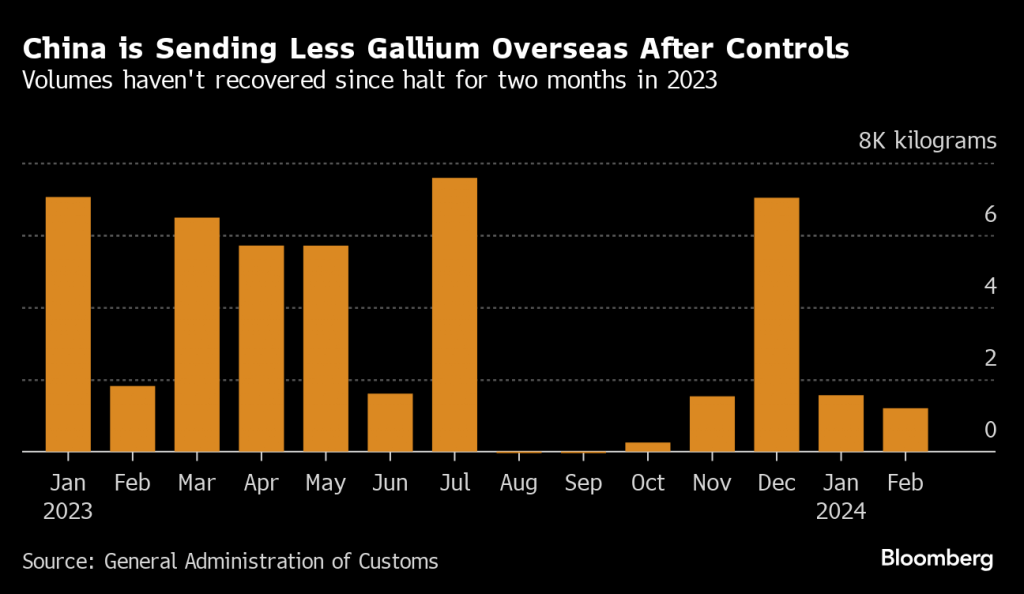

In July of last year, China imposed export controls on these two crucial metals, a clear response to the United States’ increasingly stringent trade policies. Gallium and germanium, while not household names, are both key raw materials for global chipmakers.

Since the beginning of 2024, the prices of both metals have been on a steep upward trajectory. Germanium prices recently hit a new all-time high, while gallium prices appear poised to follow suit. This surge is not merely a market anomaly, but a clear indicator of the broader strategic maneuvers in the ongoing U.S.-China economic rivalry.

The strategic importance of gallium and germanium

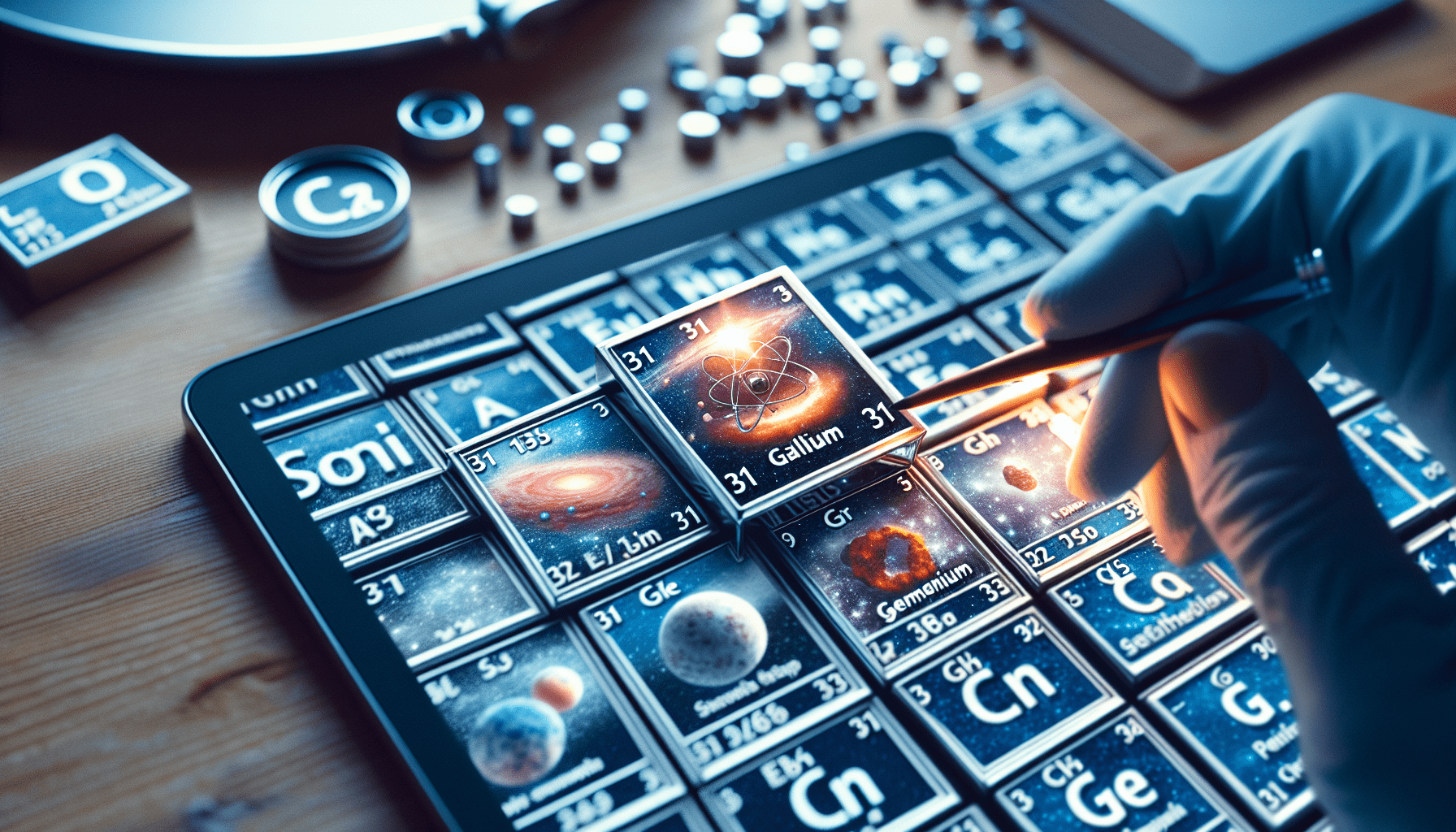

Gallium and germanium are critical elements in the global technology sector, as well as the electronics, telecommunications and renewable energy sectors. Gallium, a soft, silvery metal, is integral to high-speed semiconductors, LEDs and solar cells, while germanium, a lustrous yet brittle metalloid, is essential for semiconductors, fiber optics and infrared optics.

These metals are typically not mined independently. Instead, they are often recovered as byproducts of other commercial mining operations, such as those for aluminum, zinc and copper. Consequently, the production of gallium and germanium is concentrated in regions with substantial commercial mining activities, benefiting from economies of scale.

In China, the mining sector benefits from significant state support, including subsidies, enabling Chinese miners to manage the additional burden of separating and processing these key materials. In many other regions, this process is often considered too complex and costly to be economically viable.

Marina Zhang, an associate professor at the University of Technology Sydney, recently observed that “refining technologies and facilities for processing gallium and germanium cannot be built overnight, particularly considering the environmental implications of their extraction and mining.”

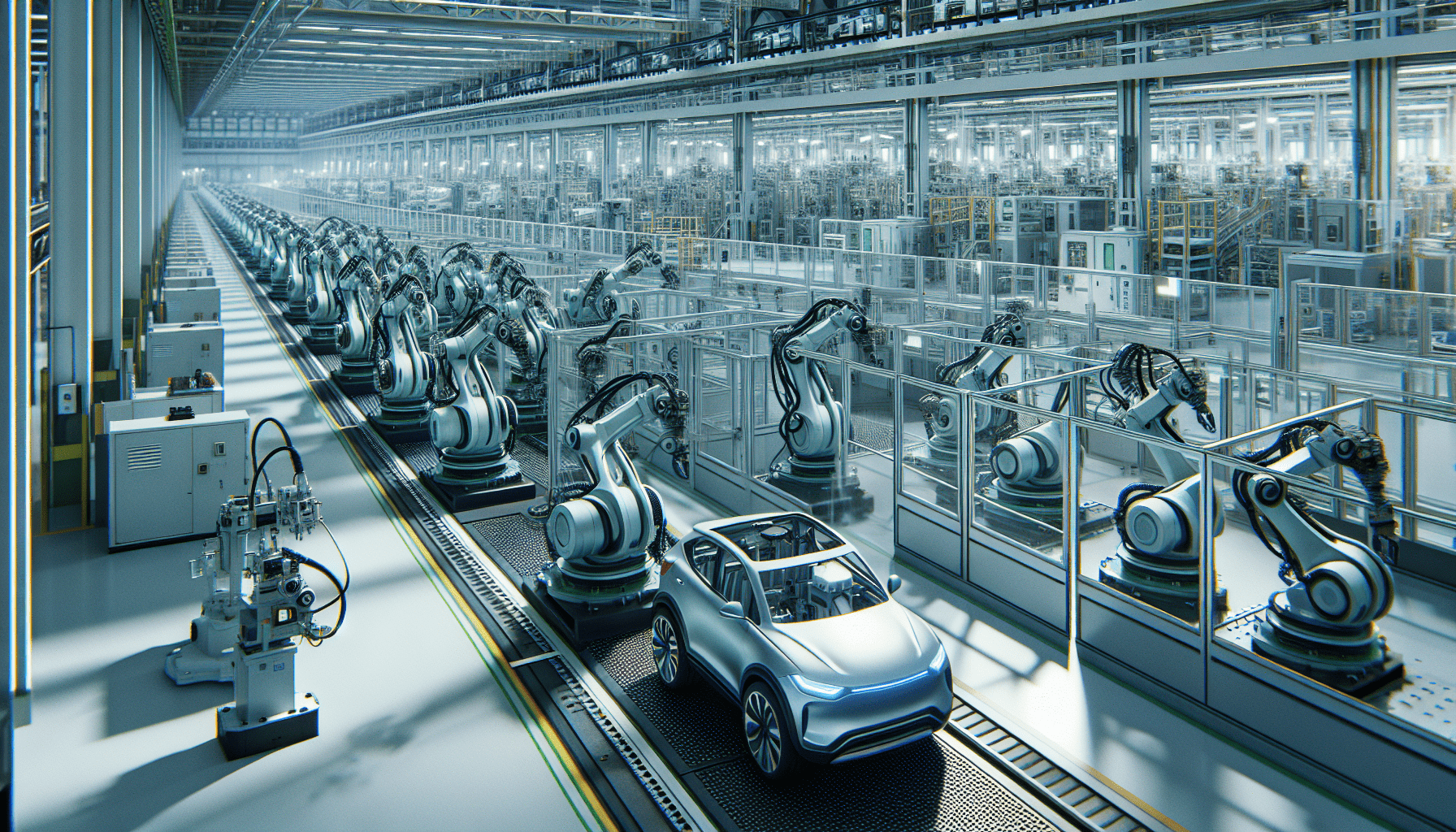

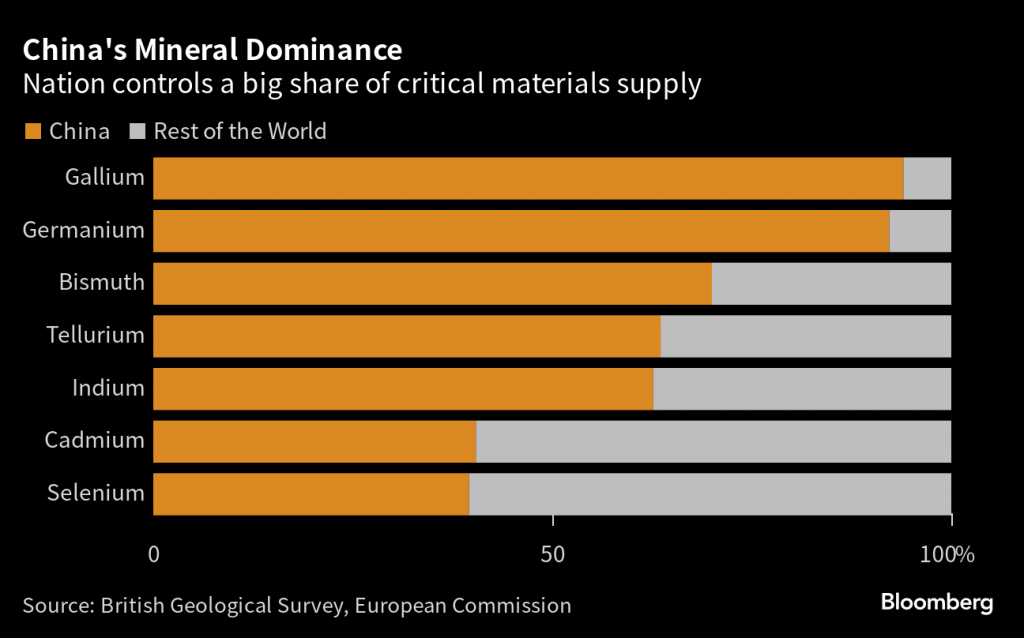

Critically, China controls a significant portion of both markets. China is responsible for roughly 98% of the world’s annual gallium production and about 68% of germanium production. Given these figures, the potential impact of reduced Chinese exports on the global market is considerable. As active investors are well aware, commodities prices are sensitive to prevailing supply and demand dynamics. And when supplies are limited, or under threat of reduction, prices typically rise.

The scarcity of gallium and germanium is of particular concern for the semiconductor industry. And that’s worrisome because modern chips—including CPUs and GPUs—have become so indispensable in the modern economy. As a result, disruptions to the chip manufacturing supply chain can have significant repercussions for the world economy.

Trade war implications amid rising tensions

The ongoing U.S.-China trade war is a significant factor behind China’s recent imposition of stricter export controls on gallium and germanium. While these two metals are not classified as rare earth elements, China has previously leveraged its dominance in rare earths as a strategic tool in geopolitical negotiations.

In this case, reduced exports of gallium and germanium appear to be a targeted response to recent U.S. efforts to restrict China’s access to key chipmaking technology. In October of last year, the White House enacted a series of restrictions that effectively banned Chinese companies from importing advanced chips and chipmaking equipment.

The U.S. also enlisted key allies, including Japan and the Netherlands, to impose similar export restrictions. In retaliation, China prohibited certain U.S. manufacturers, such as Micron (MU), from having access to the Chinese market.

This tit-for-tat over semiconductors is a facet of the broader U.S.-China trade war, which reignited in 2018 when then-President Trump imposed aggressive tariffs on Chinese imports. The efficacy of this approach is debatable, however, as most research indicates tariffs ultimately burden American businesses and consumers with higher prices. This strategy has likely contributed to the elevated rates of inflation in recent years.

Strategically, the U.S. has valid reasons to limit reliance on foreign manufacturers of chips and other key technology because overdependence could compromise national security. This concern underpinned the Biden administration’s promotion of the “CHIPS and Science Act,” aimed at enhancing America’s domestic chipmaking capacity.

Should China persist in restricting exports of gallium and germanium, the U.S. may be compelled to develop its own resources. However, such an endeavor comes with a substantial price tag. It would require around $20 billion to develop a robust gallium/germanium supply-chain that circumvents China.

Any intensification of the trade war, leading to further shortages of gallium and germanium, could severely disrupt the global tech sector. This would create significant supply chain bottlenecks and drive up costs for tech companies worldwide. The resulting strain on the semiconductor industry could have far-reaching consequences for the global economy, underscoring the profound impact that geopolitical tensions can have on technological advances and economic stability.

Investment takeaways

Active investors looking to gain exposure to gallium and germanium, could consider several strategic approaches. One option is to trade the futures of these metals, enabling them to speculate on price movements driven by geopolitical developments and supply-demand dynamics. However, it’s a niche market, so futures trading might not be as straightforward as it is for more common commodities.

Another approach is investing in companies with significant exposure to gallium and germanium production. Teck Resources (TECK) is a prominent example. As a major producer of germanium and a player in the global gallium market, the company stands to benefit directly from any price increases in these metals. Moreover, the company’s Trail smelter in British Columbia is a key site for germanium extraction, positioning Teck as a significant player in North America’s supply chain.

By investing in Teck Resources, investors can indirectly gain exposure to this critical materials market while also benefiting from the company’s diversified mining portfolio. This provides a lower-risk alternative to direct futures trading, leveraging Teck’s established operations and market position to capitalize on the increasing importance of gallium and germanium.

In addition to its exposure to gallium and germanium, Teck Resources also mines gold. With gold prices setting new all-time highs in 2024, Teck’s extensive mining portfolio offers considerable diversification, as well as exposure to other key commodities markets.

Teck Resources boasts a market capitalization of approximately $23 billion, and the company’s stock has appreciated by about 17% over the last six months. TECK currently trades for about $45/share, with an average analyst price target of closer to $55/share. For more insight into the latest spike in stock market volatility, readers can check out this installment of Market Measures on thetastylive financial network.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.