Tech and Communications Headline S&P 500’s Sector Losers in 2022

The S&P 500 is down roughly 16% so far this year, but the individual performance of the eleven primary sectors within the S&P 500 provides investors and traders with a lot more insight into 2022 trading activity.

On May 9, the stock market dropped another leg lower, with the S&P 500 slumping just over 3%. One of the world’s best-known gauges for U.S. stock performance is now down more than 16% during 2022.

But that high-level view doesn’t provide a lot of insight into the specific performance of different sectors within the broader market.

For a deeper look at the stock market’s performance (or underperformance) in 2022, it’s necessary to examine the S&P 500’s sector ETFs. The sector ETFs are eleven unique funds that divide up the S&P 500 by business category/focus.

The sector ETFs are a class of exchange-traded funds that invest in the stocks and securities of a specific sector, typically identified in the title of the fund. For example, the XLF is called the Financial Select SPDR ETF, and is comprised of 62 underlying symbols that operate in the financial sector and are represented in the S&P 500.

Listed below are the 11 primary sector ETFs that make up the S&P 500 and their respective performance so far in 2022:

- XLY – Consumer Discretionary, -28%

- XLC – Communication Services, -25%

- XLK – Technology, -23%

- XLRE – Real Estate, -17%

- XLF – Financials, -14%

- XLI – Industrials, -11%

- XLV – Health Care, -9%

- XLB – Materials, -8%

- XLP – Consumer Staples, -1%

- XLU – Utilities, +1%

- XLE – Energy, +33%

Certain corners of the U.S. stock market have suffered to a greater extent than others in 2022. Halfway through Q2, the consumer discretionary, communication services, technology and real estate sectors have been especially weak.

Surging prices for oil, natural gas and gasoline have been a plus for the energy sector, which likely explains why the Energy Select Sector SPDR Fund (XLE) has outperformed so far this year.

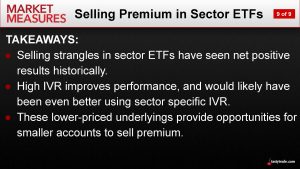

The existence of sector ETFs provides traders with additional choices when evaluating trades that may better express their view, as compared with the broader S&P 500.

For example, a trader looking to deploy risk related to the financial sector may feel that the SPDR S&P 500 ETF Trust (SPY) is too broad to express this view, while JPMorgan Chase & Co. (JPM, a single-stock) is too narrow, ultimately deciding that the Financial Select Sector SPDR Fund (XLF) best fits his or her needs.

Market participants aren’t limited to purely directional opportunities when it comes to the sector ETFs. These products also offer robust option markets, which means that options/volatility strategies can be easily deployed as well.

When selling options/volatility, ETFs can be particularly appealing because they reduce stock-specific risk. To an investor, stock specific risk is a hazard that applies only to a particular company.

ETFs reduce single-stock risks because they are typically comprised of many companies. As referenced previously, the sector ETFs are usually comprised of 30-60 individual companies. Consequently, if there is a blow-up in one company within an ETF, the effect on a short volatility position is minimized.

Looking at a specific example, imagine a short volatility trader that sold puts in Netflix (NFLX) during 2022, which is down 71% so far this year.

To learn more about the sector ETFs, review this previous installment of Market Measures on the tastytrade financial network. For more context on trading the sector ETFs, check out this episode of Options Jive.

For more on what’s moving the financial markets, tune into TASTYTRADE LIVE.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.