The Emerging “Harris Trade”—What Investors Need to Know

From solar power to affordable housing, a Kamala Harris victory could spark opportunities and challenges in the financial markets

- “The Harris trade” refers to how the vice president’s proposed policies could change markets if she’s elected president.

- Sustainability-focused sectors like renewable energy and grid modernization may thrive, but companies that deal fossil fuel could be hurt.

- Investors should monitor Harris’s evolving platform, as new insight into her policies may reveal fresh opportunities in the markets.

As the 2024 presidential election approaches, investors are beginning to think about how a Kamala Harris victory might affect the financial markets. While the results of a ”Trump trade” are fairly well known, the “Harris trade” remains less-defined.

Harris’s political priorities could cause a shift in market sentiment. Investors should consider how her positions on renewable energy, climate change, healthcare and affordable housing could create opportunities and pose challenges.

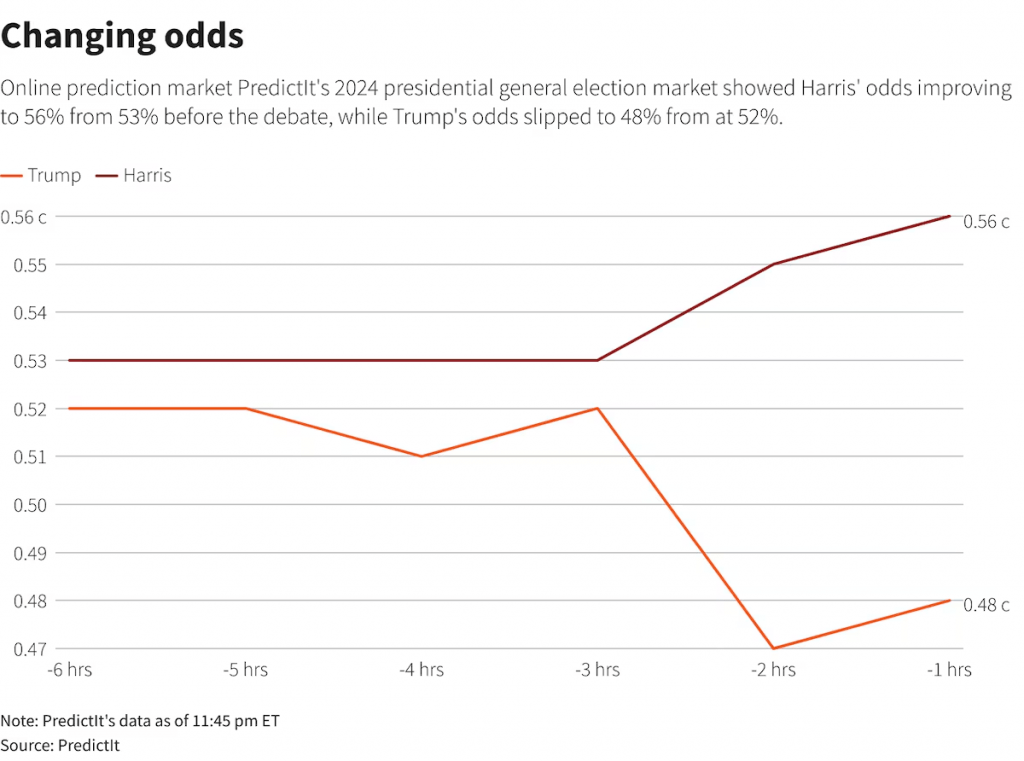

Following the Sept. 10 presidential debate, the markets responding swiftly, reflecting a noticeable shift in sentiment away from the so-called “Trump trade” and toward what could be described as the early stages of the “Harris trade.”

Let’s look at how the markets reflected the immediate aftermath of the televised matchup of the two candidates.

Winners in a Harris administration

Solar stocks provided one of the clearest signals of the markets’ shift from Trump policies to to Harris priorities after the vice president prevailed in the debate.

The next day, exchange-traded funds (ETFs) devoted to renewable energy surged. Invesco Solar ETF (TAN), for example, saw a sharp increase, reflecting optimism that a Harris presidency could usher in favorable policies for renewable energy. Shares of individual solar companies also saw significant gains. First Solar (FSLR), an industry leader, rose more than 15%, marking its biggest single-session gain since May.

The vice president also wants to reduce America’s reliance on fossil fuels. That could boost companies involved in renewable energy, grid modernization and other sustainability-driven technology, particularly if her administration pushes for increased subsidies and incentives to accelerate these transitions.

Companies working to modernize and optimize the use of energy in the U.S. could also gain advantages if Harris wins the presidency, according to Deutsche Bank. Eaton (ETN) and Hubbell (HUB)—two firms working to enhance electrical and utility infrastructure—stand to benefit from policies aimed at combating climate change. Both are heavily involved in bringing energy efficiency to the nation’s infrastructure.

Healthcare is another area that may take center stage in the Harris trade. She favors expanding access to affordable healthcare, which could benefit companies involved in preventive care, pharmaceuticals and health technology. Her administration might emphasize health equity, which could translate into growth opportunities for firms aligned with public health initiatives, especially those catering to underserved communities or working on advances in telemedicine.

Construction-related companies that could earn subsidies targeted to aid lower-income Americans may also see gains under a Harris administration. Increased investment in affordable housing could boost companies like Carrier Global (CARR), Lennox International (LII), Pentair (PNR), Stanley Black & Decker (SWK) and Trane Technologies (TT), Deutsche Bank notes. These companies specialize in housing infrastructure, HVAC systems and tools—all of which could see increased demand if housing policies shift toward greater support for low-income communities.

But a Harris policies would be a setback for some companies.

Losers in a Harris administration

Stocks linked to Trump-era policies, such as private prisons, could experience weakness under a potential Harris administration. Companies like Geo Group (GEO), which benefited from Trump’s stance on immigration and crime, saw their shares slide in the wake of the debate.

The same could be said for the fossil fuel sector, where energy stocks, which had enjoyed a strong run under the Trump administration, experienced a cooling off as market participants began to anticipate a more environmentally conscious policy approach under Harris. Crude oil prices have dipped toward their lowest levels of the year, and the Energy Select Sector SPDR Fund (XLE), which is heavily weighted toward fossil fuels, has dropped around 5% over the past 30 days.

Energy, which has already struggled this year relative to the broader S&P 500 (illustrated below), could face headwinds if Harris expands upon President Biden’s renewable energy agenda. In such a scenario, traditional energy companies, particularly those heavily exposed to fossil fuels, might experience heightened regulatory pressure, reduced subsidies and a push toward stricter emissions standards. Those factors could dampen growth prospects for these companies and undermine investor sentiment.

The financial sector could also suffer. It has historically benefited from deregulation under Republican administrations but could see a reversal as Harris pushes for policies promoting greater oversight. That could include a push for tougher capital requirements, more stringent lending practices and heightened scrutiny of financial products that disproportionately affect vulnerable populations. As a result, the financial sector may see slower growth and reduced investor enthusiasm.

As highlighted in the 2024 performance figures shown below, the energy sector has already been a laggard this year. But the financial sector has been one of the top-performers. If Harris wins the November election, that could catalyze a shift in sentiment during Q4, as market participants reposition according to the Harris agenda.

Year-to-Date Sector Performance (as of 10/9/24)

- Communication (XLC): +25%

- Utilities (XLU): +23%

- Technology (XL3): +22%

- Financials (XLF): +21%

- Industrials (XLI): +21%

- Consumer Discretionary (XLY): +12%

- Consumer Staples (XLP): +12%

- Basic Materials (XLB): +11%

- Health Care (XLV): +11%

- Energy (XLE): +8%

- Real Estate (XLRE): +7%

Accordingly, the Harris trade might become a strategy that’s not just about targeting potential winners like solar and health care but also about steering clear of sectors that progressive policies would challenge. Investors looking to balance their portfolios should therefore keep an eye on how different sectors react in the coming weeks, especially as Harris’s platform solidifies.

Takeaways

Though the specifics of the Harris trade are still taking shape, shifts in the financial markets suggest investors are already considering how a Harris victory might influence the investment landscape. One theme emerging from this speculation is the potential boost to the alternative energy and grid modernization sectors because her platform emphasizes sustainability and climate change mitigation.

Investors should continue to monitor Harris’s public statements and policy proposals. Her campaign messaging will offer insight into which areas of the financial markets could benefit from her priorities and which sectors could face increased scrutiny or regulatory challenges. As her platform becomes more-defined, the list of potential winners and losers should crystalize, opening up opportunities for vigilant market participants.

However, investors should keep in mind that the U.S. stock market has historically performed well under Democrats and Republicans, alike. The last eight years, in particular, have seen strong market returns regardless of which party held the White House. This suggests the U.S. capital markets will continue to produce positive returns over the long term, no matter who wins the election in November.

To learn more about the proposed economic policies of both candidates, readers can check out these posts from Luckbox:

- We’re Finding Plenty To Criticize in the Harris and Trump Economic Platforms

- Trump vs. Harris: The Stage is Set for a Corporate Tax Showdown

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. He is a frequent contributor to Luckbox Magazine.

Trade with a better broker,open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.