Trading a Breakdown in the VXX

Uncertainty in the VXX has risen significantly after the issuer in charge of the volatility ETN, Barclays, announced it was suspending new share sales.

Trading volatility using an approach that leverages the mean reversion philosophy isn’t rocket science.

Historical data shows that implied volatility over the long term is mean-reverting—historically high levels of implied volatility will revert downward toward their long-term mean, and historically low levels of implied volatility will revert upward toward their long-term mean.

That said, trading volatility products can be a different animal altogether, and in many ways it is rocket science.

Most active investors will recall the fate of the Daily Inverse VIX Short-Term ETN (XIV). The XIV essentially represented a short on market volatility—basically a short position in the CBOE Volatility Index (VIX). From roughly 2013 to 2017, investors in the XIV profited handsomely as complacency in the markets pushed the VIX lower and the XIV higher.

However, that all came to a screeching halt back in Q1 2018. On Feb. 5, the VIX made one of its biggest moves in history—rallying 116% in a single trading session.

Obviously, that spike in VIX was a disaster for pure short volatility positions—especially in inverse and leveraged ETFs and ETNs like the XIV. On Feb. 5, the XIV dropped by more than 80%—a move that ultimately resulted in a termination event for the product.

The XIV no longer exists, and owners of XIV shares probably haven’t forgotten those harrowing days. Unfortunately, it appears that trouble is now brewing in another well-known volatility product. This time it’s the iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX) that’s grabbed Wall Street’s attention, and where things go from here is anyone’s guess.

On Monday, March 14, the financial entity in charge of the VXX, Barclays, announced that it had indefinitely suspended share sales in VXX and that the creation of new shares in the product would also be halted.

A day later, the impact of those announcements was immediately felt in the market, as the VXX appeared to decouple from the VIX—the latter being the product that the VXX is supposed to track.

On Tuesday, March 15, the VIX declined steadily throughout the day while shares in the VXX inexplicably shot higher. At one point on March 15, the VXX was up more than 30%.

Considering that the VXX was designed to replicate the return of the VIX (by investing in VIX futures), that was indeed a peculiar development. However, when one considers the move in conjunction with the Barclays announcement, the behavior in VXX begins to make a little more sense.

In normal conditions, other actors in the market—banks, hedge funds, proprietary trading firms—typically step into the market when a product like VXX trades out of line with its indicative value. The indicative price is the value at which the security would be expected to trade based on the value of its underlying constituents.

However, without new shares in the market available for shorting, it’s believed that the VXX was effectively caught in a short squeeze, whereby the inability of short sellers to locate inventory effectively weakened their hand.

The VXX closed trading on March 15 substantially lower than its intraday high but still finished an estimated $1.58 higher than its indicative value.

Action in the VXX on March 15 takes on a new complexion when one considers that short interest in the ETN is roughly 90%. But that is mainly due to the way the product is constructed.

In order to achieve its mandate—which is to replicate short-term performance in the VIX—the VXX invests in near-term VIX futures contracts. But as those contracts expire, managers at the VXX need to buy the next month’s contract, theoretically in perpetuity.

That’s viewed by most market participants as a losing proposition because the term structure of volatility is such that out-month contracts in VIX futures are typically more expensive than near-month contracts. That’s due to the fact that uncertainty in the markets is generally believed to increase further out in time.

That means the VXX is constantly fighting an uphill battle, selling lower-priced futures contracts and buying higher-priced contracts—effectively selling low and buying high. That’s why short interest in the VXX is traditionally so high.

With short sellers now unable to locate inventory (i.e. new shares to sell short), it’s much harder to predict where the VXX might trade in the coming days and weeks. It’s entirely possible that a huge short squeeze pushes VXX dramatically higher.

However, one must also keep in mind that Barclays is expected to resume creating new units at some point in the future. When that comes to pass, the VXX will likely get pushed straight back toward its indicative value—wherever that might be.

In that sense, buyers of the VXX betting on a short squeeze probably need to tread cautiously. For example, if the VXX were to continue to rise well above its indicative value, the potential for a dramatic sell-off becomes increasingly more likely.

Some pundits have suggested that Barclays might have stepped back from the kitchen because they couldn’t take the heat, and that the firm was effectively de-risking by suspending sales of new inventory. That could be due to a lack of liquidity in the VIX futures market, a situation that would make effective management of the VXX increasingly difficult.

Investors and traders considering positions in the VXX should therefore analyze the situation comprehensively before taking action.

Like the XIV before it, the VXX may be poised to make some dramatic and unexpected moves in the coming days. And being on the wrong end of that action could result in catastrophic losses.

For context, it’s estimated that roughly $2 billion in shareholder capital was lost when the XIV got decimated in early 2018.

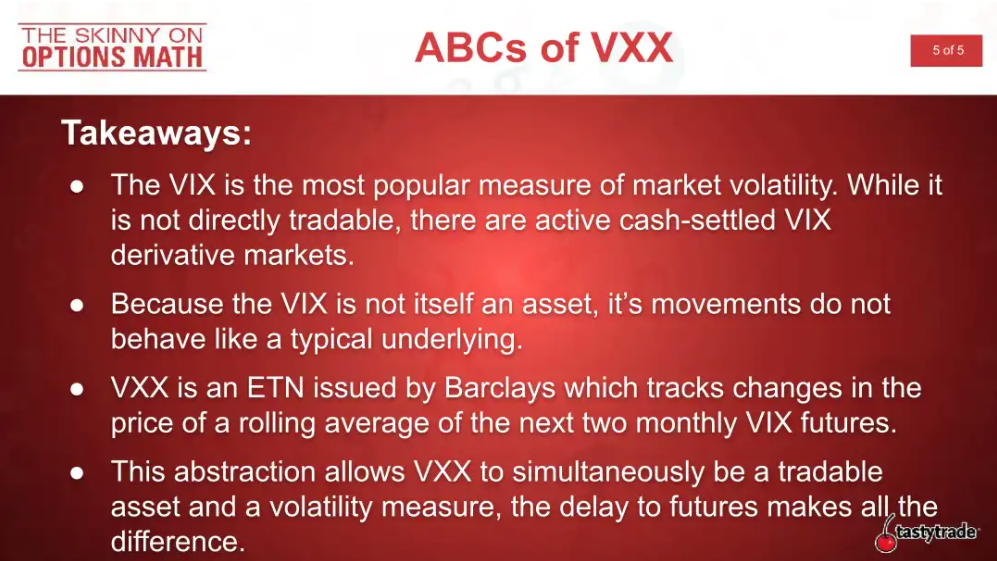

For more background on the VXX, readers are encouraged to review a recent episode of The Skinny on Options Math on the tastytrade financial network.

To follow everything moving the markets, readers can also tune into TASTYTRADE LIVE weekdays from 7 a.m. to 4 p.m. Central Time at their convenience.

Get Luckbox! Subscribe to receive 10-issues of Luckbox in print! See SUBSCRIBE or UPGRADE TO PRINT (upper right) for more info or visit getluckbox.com.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.