Trading Backwardation and Contango in Bitcoin Futures

Volatility in the cryptocurrency market has picked up in recent weeks, and the current term structure in bitcoin futures suggests more downside may lie ahead.

Cryptocurrencies have taken it on the chin in recent weeks, and data from the futures markets suggests more pain may lie ahead.

The key to this grim projection ties back to a concept known as “backwardation,” which hails from the futures universe.

When a futures market is in backwardation, that essentially means the price for shorter-dated futures contracts is higher than that of longer-dated contracts.

This is somewhat unusual because in “normal” futures markets it’s the reverse situation—referred to as “contango.” Contango exists in most markets because it’s expected that over time prices increase (ostensibly due to inflation and other market factors).

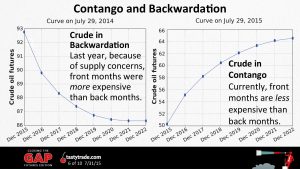

For example, the majority of the time, crude oil futures markets trade in contango—meaning the price is projected to increase the further one goes out on the time horizon. But as most investors and traders likely recall, crude oil futures traded negative for the first time in history amidst the onset of the COVID-19 pandemic in spring of 2020.

Interestingly, crude oil futures markets went into backwardation not long before that historic drop in prices. Looking back to January 2020, crude oil futures were already backwardized and didn’t move into contango until April of 2020 (after the huge drop in prices).

Between the months of January and April, the bottom fell out of the near-term futures contract because there was far too much supply, and far too little demand. With near-term futures contracts falling, and other parts of the time horizon holding more firm, the crude oil futures market moved back into “normal” contango.

But it’s important to keep in mind that every futures market—whether it be bitcoin, gold or oil—is somewhat unique, and therefore trades according to slightly different supply-demand dynamics.

For example, oil is a consumable good and one of civilization’s most important sources of energy. As a result, the price of oil can be affected by a wide range of factors across the term structure of prices. This may be due to a supply outage in the Middle East, a supply cut instituted by the Organization of Oil Exporting Countries (OPEC), or falling global demand.

For bitcoin, which is a digital asset, a backwardized term structure is considered bearish because many analysts attribute that situation to a drop in institutional demand.

Typically, longer-dated bitcoin futures contracts trade for as much as a 10% premium when compared to shorter-dated contracts—a situation that is believed to reflect the “high risk-free rate of opportunity cost in cryptocurrencies.”

Beyond that, bearish forecasters have also cited the fact that bitcoin’s market capitalization (as a percent of the total cryptocurrency universe) has also taken a hit in recent months. Some pundits have suggested that bitcoin’s percentage of the total cryptocurrency would need to rise back above 50% before the next bull run can unfold.

For bullish traders of bitcoin, the current downdraft in out-month futures contracts may represent an opportunity—depending on one’s market outlook, strategic approach and risk profile.

Regardless, the recent spike in cryptocurrency volatility should open up a plethora of new trading opportunities in the near term for investors and traders that closely follow these markets.

Traditionally, traders typically jump at the chance to deploy calendar spreads in futures markets when they expect a transition from backwardation back to contango.

To learn more about such opportunities, readers are encouraged to review a previous installment of Closing the Gap—Futures Edition on the tastytrade financial network when timing allows. More information on contango and backwardation is also available via this episode of Closing the Gap—Futures Edition.

For updates on everything moving the markets, readers can also tune into TASTYTRADE LIVE—weekdays from 7 a.m. to 4 p.m. CST.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.