Trading Bitcoin Volatility Proxies

Cryptocurrency options markets are still in their nascency, but investors and traders can access volatility exposure through stocks, and associated options, that exhibit a strong historical correlation with digital currencies such as Bitcoin, Ethereum and Litecoin.

Bitcoin made headlines this spring when the underlying price of the world’s best-known cryptocurrency nosedived by nearly 50% over the course of about 30 days.

But beyond that sensational price move, there’s been plenty of other developments in the cryptocurrency sector that investors and traders should be aware of—particularly as it relates to volatility.

Interestingly, price volatility in the cryptocurrency space dropped off considerably in the wake of the April selloff. The fact that Bitcoin, and other digital coins, have been trading in range-bound fashion during the last couple of months, provides further confirmation of that reality.

For example, on May 24 of this year, Bitcoin was trading for around $38,000/coin. Fast-forwarding to August 3, Bitcoin is trading at the same level—$38,000/coin.

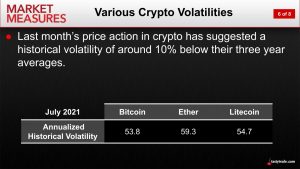

The first chart below illustrates how Bitcoin volatility, as of early August, has sunk toward the lower end of its 52-week range. The second chart highlights how the historical volatility of three of the most visible cryptocurrencies (Bitcoin, Ethereum, Litecoin) has dropped by about 10% as compared to their respective three-year averages.

As most traders and investors already know, implied volatility represents the current market price for volatility based on the market’s expectations for future movement in a given underlying. This value is “implied” by the dollar and cents value of options trading in the marketplace.

The problem with cryptocurrencies is that options markets on such assets aren’t yet fully developed. As a result, the implied volatility of a cryptocurrency such as Bitcoin can’t be easily, or accurately, derived.

However, historical volatility, or actual volatility, can be calculated easily using historical trading data. So while implied volatility may not be easily observed, historical volatility can at least be used as a point of reference. Realized volatility is defined as the actual movement that occurs in a given underlying over a set period of time.

The figures cited in the charts above refer to historical volatility, as opposed to implied volatility.

But there are other ways that market participants can monitor volatility in the cryptocurrency sector, as well.

For example, some public companies have incorporated blockchain technology—as well as direct investments into digital currencies—into their business models. And because these companies are exchange-traded, they also have associated options, which in turn means the implied volatility of such options can be tracked and traded.

It shouldn’t come as much of a surprise, therefore, that many of these crypto-focused companies have exhibited a strong positive correlation with bitcoin.

Featured in the slides below are several prominent companies that have historically exhibited a strong correlation with the price of bitcoin, including MicroStrategy Incorporated (MSTR), Paypal (PYPL) and Coinbase (COIN).

Considering the strong correlations highlighted above, one can see how it’s possible for investors and traders to access exposure to Bitcoin through the shares and options of crypto-focused companies. Such positions aren’t a pure play on bitcoin, but they do at least represent a close proxy.

In addition to the above, investors and traders focused on the cryptocurrency space may also want to add the following tickers to their watchlists: Riot Blockchain (RIOT), Canaan (CAN), SOS Limited (SOS), Ebang International (EBON), Grayscale Bitcoin Trust (GBTC), Bit Digital (BTBT), Marathon Digital Holdings (MARA) and Silvergate Capital (SI).

Previous research conducted by tastytrade suggests that volatility in the markets tends to decrease during the summer, before rising again in the fall. With cryptocurrency volatilities currently depressed, it will be interesting to observe whether volatility in this sector starts trending higher during the coming weeks.

To learn more about recent developments in the crypto sector, readers may want to review the following programming on the tastytrade financial network:

- Market Measures: What Happened to Bitcoin?

- Options Jive: Stocks Exhibiting Strong Correlations with Bitcoin

- Market Measures: Reviewing Volatilities in the Crypto Sector

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.